The Power of Leverage in CFD May 30, 2022

In this article we will explore the different uses of leverage through the use of Contract for Differences (CFDs) for both traders and long-term investors.

What is leverage?

How do traders use leverage to improve their returns?

How do long-term investors enhance their dividend portfolio with CFDs?

Contract for difference (CFD) is a financial product that is usually traded Over-The-Counter (OTC), CFD pays the difference in settlement price between the opening and closing of a trade. As such, CFD is a widely used by traders to establish long and short positions, as it utilises the inbuilt leverage and ability to gain exposure on a wide range of underlying assets from indices to commodities to their advantage.

Long-term investors can also use CFDs, by taking advantage of leverage and low financing costs to boost their dividend portfolio.

What is Leverage?

Leverage in trading is the use of borrowed capital to create positions and increase potential return on an investment [1].

The cost of using leverage is the financing charges, as the underlying financial instrument is the collateral.

In the event the levered position goes against the trader, the trader may get a margin call and the broker has the right to force the sale of the financial instrument in order to cover the borrowed capital.

Leverage can therefore, enhance potential gains but may amplify potential losses as well; as such, it is a double edged sword.

Leverage is inversely linked to the required margin, such that when required margins go up, the leverage ratio goes down as shown in the table below.

| Leverage Ratio | Required Margin |

| 20.00 | 5% | 10.00 | 10% |

| 5.00 | 20% |

| 3.33 | 30% |

| 2.00 | 50% |

| 1.67 | 60% |

| 1.43 | 70% |

The lower the required margin, the lower the amount of upfront capital is required to open the position. This is an important consideration for traders as many strategies are only worth doing if they have access to leverage.

Leverage tends to have a negative connotation associated with it and is constantly compared to high-risk reckless behavior. This is only true if market participants use leverage without proper planning and risk management.

Leverage when used properly gives market participants the ability to capture and sharpen their edge over other market participants.

How traders use leverage

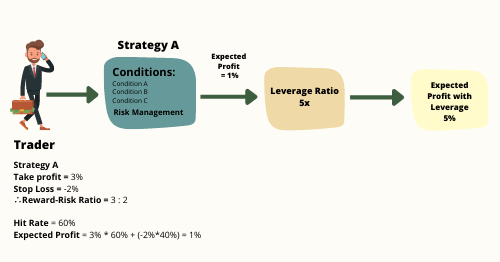

Successful traders tend to focus on strategies that rely on certain set-ups that have been back tested rigorously to ensure that they are robust and able to achieve the desired hit-rate (the ratio of money-making trades vs losing trades) with the target risk-reward ratio.

Traders, knowing that they have an edge will use leverage to boost their returns while having a risk management strategy in place.

Even small expected profits can be magnified with the use of leverage.

It is however, essential that traders have a strict risk management system in place to ensure that the strategy will only incur calculated losses.

How long-term investors can make use of leverage

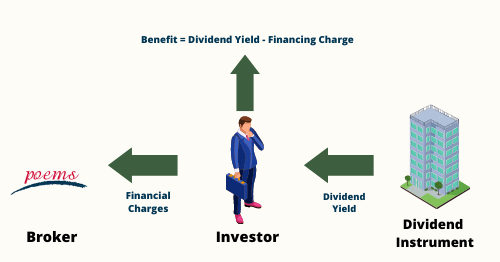

Having the ability to buy dividend stocks and ETFs through CFDs (which are a levered product), it is possible to perform a “carry trade” strategy and earn the difference between dividend yields and financing charges.

Carry trade is a strategy that consists of borrowing at a lower cost and investing in an instrument that generates a higher rate of return.

Traditional carry trade strategies consist of using FX pairs and different currencies that have widely different base interest rates. For example, the Japanese yen has a close to 0% interest rate, while the US dollar has interest rate of 1%. Therefore, if you borrow Japanese Yen to hold the US dollar, you will get the difference in interest rate (1%-0%)=1% [2].

As for CFDs, the cost is the financing charges while the returns will be the dividend yield post tax.

The following diagram is an example of using CFD in a “carry trade” strategy with a dividend instrument like dividend stocks, ETF and REITs.

It is possible to receive better benefit from buying and holding CFD compared to stocks, as long as the benefit from the CFD exceeds the base dividend yield on the instrument as shown in the equation above.

As finance charges do not fluctuate often, investors need to pay more attention to the leverage ratio and dividend yield.

To find out more about dividend, click here for a more in-depth dive into dividend investing.

“Instant” dividend

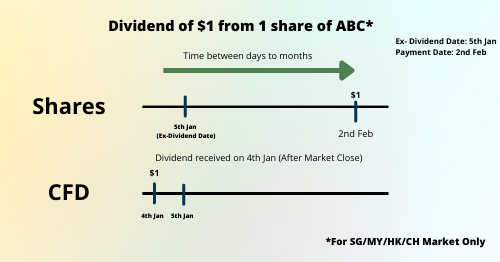

Another feature of using CFDs for dividend investing is to instantly receive dividend adjustment on ex-dividend day -1 (after the market closes) till ex-dividend day +1 for world indices (For more information, click here).

Normally a stock paying a dividend will have an ex-dividend date (the date where buyers of the stock on or after this date are not entitled to the dividend payment) and a payment date (when the dividend is paid out).

The period between the ex-dividend date and payment date ranges from a few days to 3-4 weeks. However, if you are using a CFD of the stock, the dividend adjustment will be credited much faster. The reduction of the time delay between the payment date and ex-dividend date can be taken advantage by investors.

Investors who have quicker access to the dividend are able to have the flexibility to re-invest, spend and even create a possible arbitrage opportunities if the conditions are right.

The diagram below showcases the difference between owning a share vs owning a CFD contract when dealing with dividend.

Risks

Using CFDs for dividend investing has certain risks that investors need to take note of, such as in scenarios where the underlying dividend instrument reduces dividend payout and therefore decreasing the dividend yield.

As dividend given by underlying instruments may vary, the attractiveness of using CFDs will vary accordingly as well.

Decrease in price of the dividend instrument

A decrease in the price of the dividend instrument may trigger a margin call while using CFDs. So, it is advised to have a safety buffer to weather the volatility of the markets.

This will however, affect the effective leverage ratio as a safety buffer will lower the maximum leverage potential.

Financing Charges

With central banks all over the world starting to raise their base interest rates, there is a potential increase in financing charges for CFD products.

This will affect the difference between the cost of using CFDs and the dividend yield, thus affecting the overall effectiveness of the strategy.

Leverage Ratio

Changes in margin requirements seldom occur, unless there is a change in the risk profile of the invested instrument.

For example, the Singapore index component counters enjoy a higher leverage ratio (low margin requirement of 10-20%), but Singapore non-index counters have a lower leverage ratio (higher margin requirement of 20% and above).

Key Takeaway

In conclusion, CFD is a product for investors and traders who have a higher risk tolerance and are keen to explore additional ways to maximise their portfolios.

By having access to leverage through CFDs, traders are able to amplify their expected returns and long-term investors are able increase their dividend yields if the conditions are met.

However, market participants need to consider all the risks involved with CFDs as leverage is a “double-edged sword” that can amplify losses as well.

After weighing the risks and benefits, CFDs still create unique and valuable opportunities for market participants when used strategically.

A CFD is traded on margin, which means you would need only to put up a fraction of the full value of your trade upfront. It is ideal for people with less capital who wish to capitalise on the growth potential of certain industries. And it is also for those who wish to take advantage of the latest market movements regardless of direction.

Both potential profits and losses are amplified when you trade a CFD. Hence, a CFD may not be suitable for investors whose investment objectives revolve around capital preservation and/or whose risk tolerance is lower.

To understand more, refer to our article on “Understanding Contracts for Differences”.

If you want to open a POEMS account, check out this link or scan the QR code below.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

For enquiries, please email us at cfd@phillip.com.sg. If you are interested in active discussions, you can also join our Telegram community here.

Reference:

- [1]https://www.investopedia.com/terms/l/leverage.asp

- [2]https://www.avatrade.com/education/market-terms/what-is-carry-trade

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Sam Hei Tung

Dealing

Sam graduated from National University of Singapore with a Master of Science in Finance. He personally manages his own investment portfolio and does equity and economic research in his free time. Sam believes that education and information is essential to making good financial decisions.

Unveiling Opportunity: Exploring the Potential of European Equities

Unveiling Opportunity: Exploring the Potential of European Equities  Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading

Mastering Stop-Loss Placement: A Guide to Profitability in Forex Trading  Crude Realities: Understanding oil prices and how to trade them

Crude Realities: Understanding oil prices and how to trade them  Gold at All-Time Highs: What’s Fuelling the 2025 Rally?

Gold at All-Time Highs: What’s Fuelling the 2025 Rally?