The Video Game Super Cycle August 26, 2021

Summary

- Sony announced the launch of the PS5 in the holiday season of 2020 and the next-generation console is expected to shake up the gaming industry

- The new console will benefit video game companies, related technological and consumer discretionary sectors

- The emphasis on a subscription-based business model will help increase the average revenue per user for console providers

- With advancements in 5G and cloud computing technology, cloud-based gaming could threaten and displace traditional console gaming platforms in the near future

- Nonetheless, there is tremendous growth potential in the E-Games industry and total revenue is expected to grow to US$196 billion by 2022

- Investors can gain exposure to the E-Games industry via ETFs like GAMR, ESPO, HERO, NERD and 9091.HK

Introduction

Sony (TSE: 6758) unveiled the PlayStation 5 (PS5) on 12 June 2020 and gave the world a glimpse of its flagship product. The reveal event had gamers around the world rubbing their hands in anticipation at the launch of this next generation gaming console in the holiday season of 2020.

The PS5 is a powerful and alluring machine – capable of delivering 8K video support and 360-degree audio for an immersive gaming experience. By incorporating a custom 825GB Solid State Drive (SSD) into its arsenal, the PS5 also promises faster loading speed for seamless in-game transitions.

Beneath the facade of a juiced-up hardware, the PS5 is expected to kick off a seismic shift in the gaming industry.

The Start of Another Video Game Super Cycle

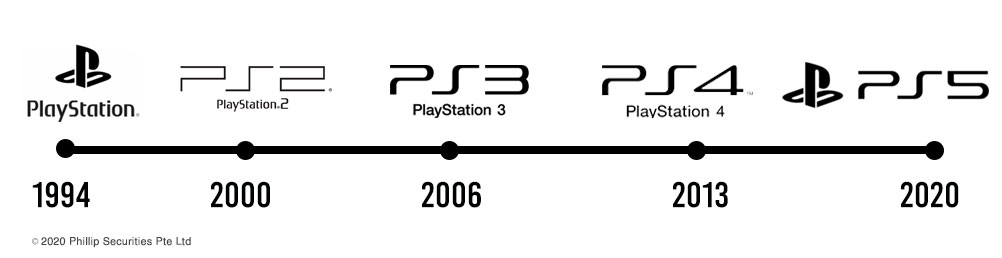

Sony’s original PlayStation first hit the shelves in 1994 and the product line has earned a Guinness World Record for being the best-selling home video game console brand ever. As of November 2019, Sony has sold more than 450 million units across the original PlayStation, PS2, PS3 and PS4.1

It is of little surprise that Sony’s Game and Network services is the top business unit under Sony’s diverse range of products and services since 2014.2

Each generation of Sony’s PlayStation has an average cycle of 6.4 years; with each new console outdoing its predecessor in terms of expectation and performance.

Sony’s direct competitors, Microsoft (NASDAQ: MSFT) and Nintendo (TSE: 7974), will not be sitting idly on the sideline and let Sony hogged the lion’s share of the console gaming pie. Microsoft’s new Xbox console, Xbox Series X, is scheduled for release in late 2020 to give the PS5 a run for its money.

The Nintendo Switch, which was launched in 2017, has proven to be immensely popular among the casual gamers. When several countries started implementing lockdown measures during the COVID-19 pandemic, the demand for Nintendo Switch was so high that there was a worldwide shortage of the console.3

The Biggest Gainers from the Video Game Super Cycle

Historically, the release of a new generation console has a positive spill over effects for game developers. The newly souped-up machine not only offers unparalleled gaming realism for gamers, it also provides a new platform for game developers to unleash their creativity and break through the bottleneck caused by the outdated hardware in the current ageing consoles.

Video games and video games consoles are perfect examples of complementary goods; the demand for either products will rise and fall in tandem. A new game console is a huge investment, typically costing in the range of US$400 to over US$500. Consumers will most likely want to get their money’s worth by buying new video games to keep themselves entertained for years.

Additionally, the release of blockbusters video game titles will further drive up the demand of game consoles from the mass market consumers. The end result is a self-perpetuating cycle whereby the sales of both video games and video game consoles are sustained throughout the console’s life cycle. For example, Nintendo’s exclusive franchise gaming series, like Pokémon and Animal Crossing, are helping Nintendo compete for consumer dollars in the video game console war.

With the new super cycle heating up, video games companies have the potential to gain the most out of this cyclical event. Based on the previous video game boom in 2013, some video game stocks surged over 1,000% in just six years.4

Both EA (NASDAQ: EA) and Take-Two (NASDAQ: TTWO) have rose over 800% while Activision (NASDAQ: ATVI) has gained over 600% since 2013.

The announcements of console launches in the past have also provided a boost to video game stocks in the short term. According to Investment Bank Cowen, shares of Activision, Take-Two and Electronic Arts outperform the broad market index by an average of 26% during the 12 months preceding major console launches in 2000, 2005 and 2013.

The Gaming Ecosystem

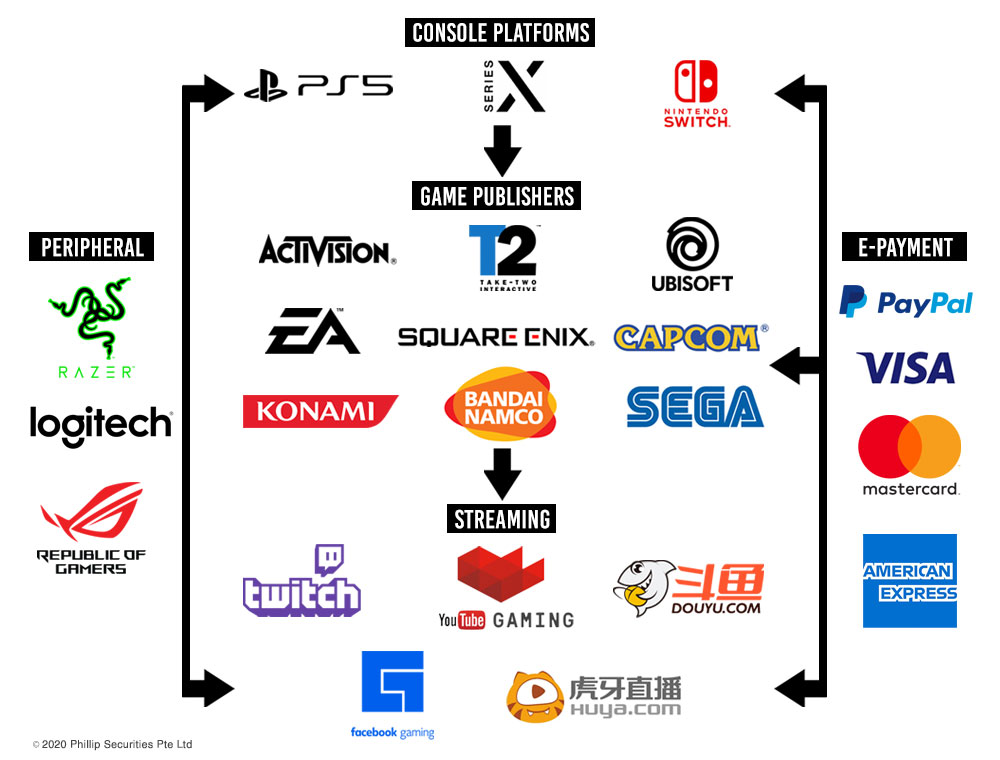

Besides benefitting video game companies, the next generation gaming consoles have a trickle-down effect on other technological and consumer discretionary sectors.

The flowchart below will give a brief description of how other companies can benefit from the new gaming consoles.

The Future of Console Gaming

A Subscription-Based Business Model

Sony will be releasing two versions of the PS5; the PS5 Standard Edition (with disk drive) and the PS5 Digital Edition (without disk drive). Whilst the elimination of an optical disk drive represents minimal manufacturing cost savings for Sony, it has the potential to generate substantial recurring income for the company through its PlayStation Network (PSN) and PlayStation Store.

The digitalisation process helps expedite the transition from a transaction-based to a subscription-based business model. Currently, consumers can buy or sell pre-owned physical game copies via traditional retailers like GameStop (NYSE: GME) or share their games with other users. As a result, a single physical game copy, which originated from a one-off transaction, may have multiple users and does not signify an efficient revenue stream for console providers and game developers.

Digital Edition users will have to purchase or stream digital game copies from PlayStation Store or PlayStation Now respectively. The digital game copies are tied to individual PSN accounts and are non-transferable. Hence, this business model has the capacity to increase video game sales dramatically.

For every game sold on the PlayStation Store, Sony retains about 12% in platform royalties. Furthermore, users must pay recurring fees to subscribe to PlayStation Plus and PlayStation Now to gain access to additional features like online multiplayer and cloud streaming functions, which can also be found on Microsoft’s Xbox Live Gold.

Contrary to popular belief, Sony and Microsoft do not reap huge profit margin from the sales of their gaming consoles. After factoring marketing, shipping and production cost, it is likely that the two companies incur losses for each console sold. Both companies adopt a loss-leading strategy with the intention of recouping their losses through recurring game and subscription sales.5

Through the subscription-based business model, game console providers are essentially squeezing out more revenue per gamer on their respective online platforms.

Cloud Gaming

Cloud gaming means that games are run from a remote server and streamed across multiple devices via a fast internet connection. These subscription-based cloud gaming services could be more attractive alternatives to Sony, Nintendo and Microsoft’s traditional gaming console platforms, which rely on customers buying both dedicated consoles and games.

The arrival of Google Stadia (NASDAQ: GOOGL), Apple Arcade (NASDAQ: AAPL), PlayStation Now, GeForce NOW (NASDAQ: NVDA) and Project xCloud have provided us with a sneak peek of a console-less future. They allow gamers to instantly play a variety of selected games and/or pre-owned games seamlessly across any laptop, desktop, tablet or mobile devices.

Owning a video game does not make economic sense when subscriptions can offer customers diversity and novelty via a library of games on the cloud platform – similar to what Netflix (NASDAQ: NFLX) is providing to its subscribers in terms of video content. The scalability and flexibility of this business model also allow subscribers to cancel their subscriptions whenever the needs arise.

Today, most graphically-intensive games require top of the line hardware to run. Video game consoles are expensive investment and high-end Graphic Processing Unit (GPU) for PC may cost upwards of US$1,000.

Cloud gaming lowers the entry cost for consumers by transforming a range of everyday devices into powerful gaming rig. With the advancement in 5G and cloud computing technology, cloud-based gaming could threaten and displace traditional console gaming in the near future.

Exchange Traded Funds

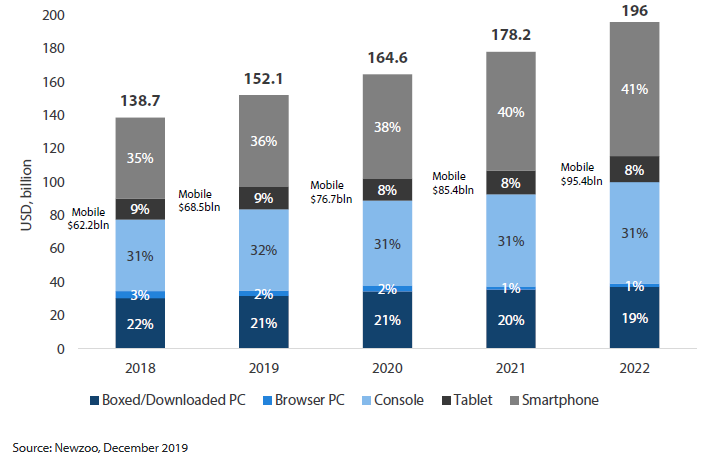

There is tremendous growth potential in the E-Games Industry. To illustrate, there are more than 2.5 billion gamers worldwide and the gamer base continues to grow across different age groups and genders. The industry total revenue of US$152.1 billion in 2019 surpassed the combined revenues of the movie and music industries. Growing at around 10% annually, it is estimated that revenue will reach US$196 billion in 2022.6

With four Gaming and E-Sports themed Exchange Traded Funds (ETFs) listed within the last three years, ETF issuers are racing to meet the growing demand for financial products with exposure to the industry.

To capture this growing market, Nikko Asset Management launched the first actively managed ETF in Asia on HKEx on June 16, 2020. The NikkoAM Active E-Games ETF has the flexibility to rebalance its underlying assets daily to adapt to the ever-changing landscape of the E-Games industry.7

These five Gaming and E-Sports themed ETFs will provide investors with a convenient investment vehicle to ride on the structural growth opportunity.

| ETF | Wedbush ETFMG Video Game Tech ETF | VanEck Vectors Video Gaming and eSports ETF | Global X Video Games and Esports ETF | Roundhill BITKRAFT Esports & Digital Entertainment ETF | NikkoAM Active E-Games ETF |

| Ticker | GAMR | ESPO | HERO | NERD | 9091.HK(USD)3091.HK(HKD) |

| Exchange | NYSE Arca | NASDAQ | NASDAQ | NYSE Arca | HKEx |

| AUM | USD 105.54 million | USD 700 million | USD 541.59 million | USD 79 million | USD 14.26 million |

| Expense Ratio | 0.75% | 0.55% | 0.50% | 0.50% | ~0.70% |

| Number of Holdings | 135 | 26 | 40 | 34 | 37 |

| Top 3 Holdings | – Unity Software Inc (NYSE: U)– KaKao Games Corp (KOSDAQ: 293490)– Pearl Abyss Corp (KOSDAQ: 263750) | – Advanced Micro Devices Inc (NASDAQ: AMD)– NVIDIA Corp (NASDAQ: NVDA)– SEA Ltd (NYSE: SE) | – SEA Ltd (NYSE: SE)– NVIDIA Corp (NASDAQ: NVDA)– Electronic Arts Inc (NASDAQ: EA) | – Modern Times Group (SS: MTGB)– Krafton Inc (KS: 259960)– Activision Blizzard Inc (NASDAQ: ATVI) | – Sony Group Corp (TSE: 6758)– Microsoft Corp (NASDAQ: MSFT) |

ETF information is accurate as of 23 August 2021

Conclusion

The next-generation gaming consoles will provide a near-term catalyst to the gaming industry. Game publishers and hardware producers will look to capitalise on the improved technology to develop complementary products for the new gaming consoles.

Secondly, game console providers are also looking towards building long-term relationships with their customers as they gradually shift towards a subscription-based business model to enhance the revenue generated from their consumer base on the console platforms.

However, the E-Games industry is driven by several key disruptive innovations that could threaten the profitability of the traditional console gaming industry. Just as smartphones disrupted the business model for portable entertainment devices, cloud gaming could have a similar impact on the gaming industry.

In conclusion, the advancement in 5G and cloud computing technology enable the conception of new business models that could help create the next structural shift in the gaming industry.

Reference:

- [1] https://www.cnet.com/news/sony-playstation-gets-guinness-world-record-for-best-selling-console-brand/

- [2] https://www.statista.com/statistics/297533/sony-sales-worldwide-by-business-segment/

- [3] https://www.forbes.com/sites/erikkain/2020/04/21/why-its-even-harder-to-find-a-nintendo-switch-than-toilet-paper-right-now/#25d5ed404473

- [4] https://www.forbes.com/sites/oliviergarret/2020/01/02/if-history-repeats-video-game-stocks-could-soar-690/#36fab327247c

- [5] https://www.fool.com/investing/2019/06/18/sony-microsoft-game-console-big-loss-leader.aspx

- [6] https://insights.nikkoam.com/articles/2020/05/egaming

- [7] https://www.theasset.com/asset-management/40784/nikko-am-lists-asias-first-active-equity-etf

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Joel Lim

ETF Specialist

Joel is the ETF Specialist from the ETF desk in Phillip Securities. He helps to provide sales support and trading ideas to retail investors, remisiers, in-house dealers, and fund managers. Joel also works closely with ETF issuers on new product and business development projects.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It