Things to Know About Airbnb’s IPO December 9, 2020

What to note:

- 6 key strengths of Airbnb: unique host community, engaged guest community, global brand, global network, custom-built platform, design-driven approach.

- 3 key risks: still loss-making, COVID-19 or similar disruptions, laws and regulations.

- Though struck by COVID-19 earlier in the year, Airbnb has rebounded to pre-pandemic levels as people sought unique experiences in short get-aways from home.

Airbnb, yet another successful start-up platform, has finally kicked off its blockbuster IPO. It is expected to list on the Nasdaq (NASD) in December 2020, under the ticker “ABNB”. IPO price has yet to be confirmed but the company is looking to raise US$3bn. This values it at over US$30bn, according to one source[2].

Who is Airbnb?

Without owning a single property, Airbnb is the world’s largest accommodation provider.

It is in the same league as Uber and Alibaba, the largest cab provider that does not own any vehicle and the world’s largest retailer without inventories. All these companies connect vendors/sellers to users/buyers by leveraging their own technology platforms.

Airbnb started in 2007 when founders, Brian and Joe, were looking for ways to cover their apartment’s rental. They seized the opportunity to rent accommodation in their apartment – airbeds – to foreigners coming to town for an international design conference. Their first successful hosting of a group of designers during the conference laid the foundation for Airbnb. The trust and connection developed between the two founders and their guests rendered a whole new level of travel experience.

Nate, a software engineer, came on board a year later to improvise a platform design. The platform was designed around the core value of creating trust between hosts and guests by including their profiles, two-way reviews, messaging and secure payment. Thereafter, Airbnb built up its hosting business using its own technology platform. It has since provided a different kind of experience to travellers and hosts, one that is built around human connection.

Before this idea became widely embraced, travel was conceived as leisure stays in hotels and visiting popular landmarks and attractions. Travellers often leave the country they visit without experiencing how the local people live. Through hosting, Airbnb offers another type of travel experience. Travellers stay in the neighbourhood where their hosts live, spend time with their hosts and have deeper connections with the places they visit.

Airbnb has grown into a network of more than four million hosts listing private rooms, apartments and villas for rent, from one night to extended stays, in more than 220 countries and territories around the world. Since its launch, Airbnb hosts have made over 825 million bookings and have cumulatively earned over $110bn, the company said in its SEC filing.

Today, you can find accommodation in every imaginable style on the Airbnb platform. Some hosts share their spare rooms while others offer their spare houses. Some have even built themed properties to provide one-of-a-kind experiences to their guests.

Let’s explore the numbers

Airbnb charges both guests and hosts service fees for providing a reliable platform to connect both parties.

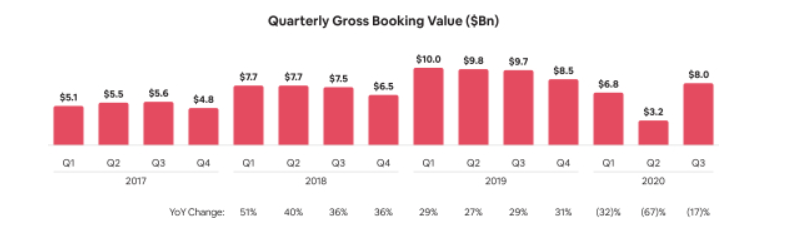

Investors and analysts typically look at transacted values rather than profits for companies like Airbnb because they are still not profitable in their growth stage. Transacted values are a key indication of the chances a business can grow big enough to turn profitable at some point, when it attains scale. Gross Merchandise Value (GMV) is the performance metric commonly used for e-commerce platforms like JD.com while Gross Booking Value (GBV) is used for ride-hailing platforms such as Lyft.

Table 1: Airbnb’s financial figures.

| 2018 (US$) | 2019 (US$) | 2020* (US$) | |

| Gross Booking Value | 29.4bn | 38bn | 18bn |

| Revenue | 3.7bn | 4.8bn | 2.5bn |

| Net Income | (16.9)mn | (674.3)mn | (696.9)mn |

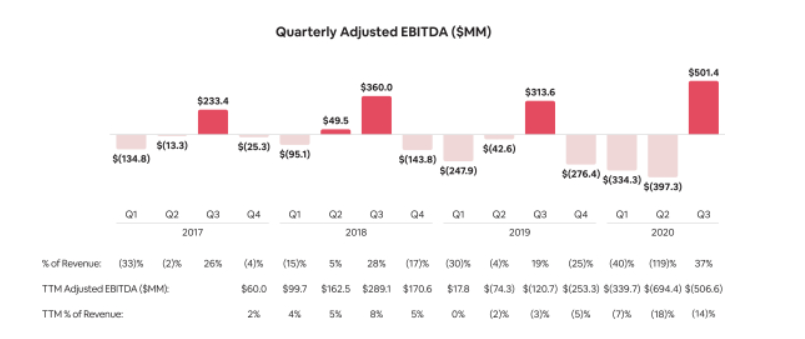

| Adjusted EBITDA | (170.6)mn | (253.3)mn | (230.2)mn |

*Figures comprise only data for the first nine months ended 30 September 2020

Source: Airbnb’s IPO prospectus

Airbnb’s GBV was US$38bn in 2019. This was a 29% increase from the US$29.4bn in 2018. Revenue also grew 32% to US$4.8bn in 2019 from US$3.7bn in 2018. However, due to the COVID-19 pandemic, GBV only hit US$18bn in the first nine months of 2020. Revenue was US$2.5bn. The two were down 39% and 32% yoy respectively.

Figure 1: Gross Booking Value

Source: Airbnb’s IPO prospectus

Figure 2: Adjusted EBITDA

Source: Airbnb’s IPO prospectus

On top of commonly reported figures, Airbnb uses Nights and Experiences Booked to measure the scale of its platform. This number is the sum of the total number of nights booked for stay, total number of seats booked for experiences, net of cancellations and alterations in a financial period.

Figure 3: Nights and Experiences Booked

Source: Airbnb’s IPO prospectus

Though initially hit by the pandemic, Airbnb’s business bounced back when people got tired of staying at home. Still cautious about avoiding crowded hotels or touristy places, many sought to travel domestically off the beaten track, preferably to places that offer unique experiences. In Q3 2020, Airbnb’s GBV rebounded to US$8bn, with Nights and Experiences Booked returning to 61.8mn. These were both pre-pandemic levels.

Forward strategy

According to Airbnb’s prospectus, the company will use net proceeds from its IPO for working capital and other expenditures. A portion will be used for opportunistic acquisitions or investments in businesses, products, offerings and technologies that can deepen its current strengths.

What are its current strengths?

Management highlighted six key strengths that have given Airbnb an upper hand in the industry. These are its unique host community, engaged guest community, global brand, global network, custom-built platform and design-driven approach.

With the money from its IPO, Airbnb wants to unlock more hosting and expand its global network. It believes it has just scratched the surface of this newly-created sub-sector in tourism. Worldwide, the Total Available Market (TAM) is estimated to be US$3.4tn. Against this, the Serviceable Available Market (SAM) is estimated to be US$1.5tn *. The difference between TAM and SAM is US$1.9tn. This means Airbnb has the potential to grow its SAM by 100%.

*TAM is the total market demand for a product or service. SAM is the segment of the TAM targeted by a company for its products and services, within its core competencies.

The company’s next two strategies are to invest in its brand and continue to engage its guest community. Don’t forget, Airbnb’s accommodation experience is unlike the traditional offering of hotels. It intends to leverage its Unique Selling Point (USP) to expand its guest community, by marketing to existing guests as well as bringing in new guests. It will continue to evolve new travel and living experiences.

Innovating its last two strengths of platform and in-person experiences will make Airbnb more accessible and appealing to new hosts and guests while increasing its engagement with its existing community.

Challenges

Airbnb is not immune to challenges.

Since its official launch in 2008, Airbnb has had to wrestle with new regulations all over the globe, as affected parties like hotel operators and landlords lobbied for stricter regulation of short-term rental and home-sharing. Countries like Japan, Thailand and Spain have restricted hosting via Airbnb. Airbnb is in fact banned in Singapore where homeowners stare at fines of up to S$20,000 for hosting guests on short-term stay. Even in the US which is Airbnb’s biggest market, homes are not allowed to be rented out for holiday stay in New York City [3].

COVID-19 is the latest salvo fired at the airline, hotel and travel industries. Worldwide lockdowns practically felled all travel in the second quarter of 2020. Airbnb was not able to escape but fortunately, its bookings rebounded in the third quarter when people sought relief from the confines of their homes in unique travel experiences in the domestic market. (There was no national lockdown in the US while by the third quarter, most countries had relaxed their domestic movement restrictions). Airbnb today has become one of the top choices in travel and accommodation booking. Having said that, a worsening of the pandemic could still affect its operations.

Ease of technology transfer and replication can also make Airbnb vulnerable. Though Airbnb does not yet have direct competitors with the exact same business models, it does face some pretty stiff competition from online travel agencies like Expedia, Booking.com, Qunar and Meituan. Some other online platforms like Tripadvisor, Klook and KKDay also continue to innovate and expand to challenge Airbnb’s market share. The battle of cash-burning in multiple regions continues, leaving Airbnb at risk.

How to invest in Airbnb’s IPO?

As Phillip Capital does not offer subscriptions of US IPOs, the most direct way for retail investors to participate is to trade over the counter after listing. Investors can place orders on the listing day itself when the stock starts trading or place limit orders before the stock starts to trade.

Investors who do not want to limit their exposure to a single company may look at ETFs that invest in newly-listed companies. Their options include First Trust US Equity Opportunities ETF (FPX.US) and Renaissance IPO ETF (IPO.US).

Do you have any trading views on the US market? Join our global investment community.

Telegram group and share your thoughts with us!

*Information accurate as of 5 December 2020.

Sources:

1. Airbnb’s IPO prospectus https://www.sec.gov/Archives/edgar/data/1559720/000119312520294801/d81668ds1.htm

2. https://www.cnbc.com/2020/10/02/airbnb-seeks-to-raise-roughly-3-billion-in-ipo.html

3. https://www.passiveairbnb.com/top-cities-and-countries-where-airbnb-is-illegal-or-restricted/

About the author

Allen Tan

Senior Dealer

Allen graduated from Nanyang Technological University with a Bachelor’s Degree, majoring in Economics with a minor in Business. He joined Phillip Securities in 2016 as an Equity Dealer in the Global Markets Team. He specialises in the US and Canada market and also supports the UK and Europe market.

Predicting Trend Reversals with Candlestick Patterns for Beginners

Predicting Trend Reversals with Candlestick Patterns for Beginners  Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap