Top 10 Traded US Stocks on POEMS in February 2021 March 17, 2021

At a glance:

- All three US major indices had a volatile month in February, closing lower after hitting record highs.

- Amid concerns about rising bond yields which may hurt high-growth tech stocks the most, the Nasdaq Composite underperformed, with an 8% correction from its 14,000 high.

- Investors rotated from high-growth tech stocks to cyclical sectors which are sensitive to economic re-opening.

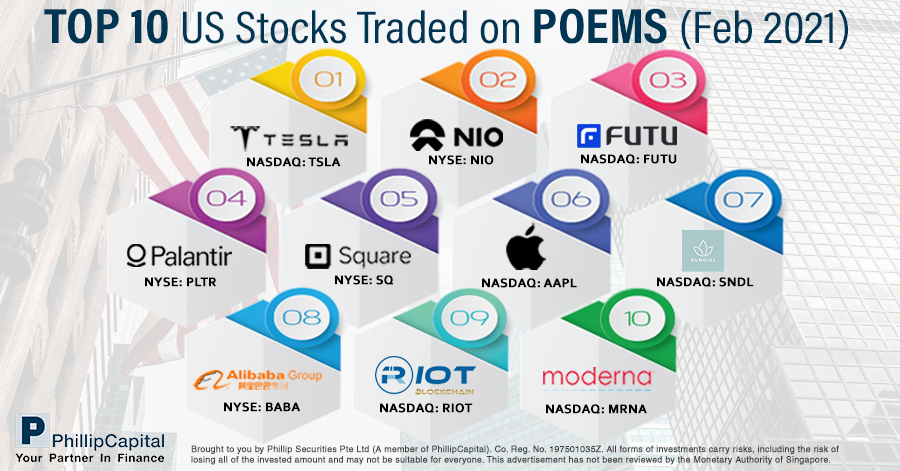

Here are February’s top 10 traded US stocks on Phillip’s Online Electronic Mart System (POEMS), based on gross market value traded.

All three US major indices – Dow Jones, S&P 500 and Nasdaq Composite – scaled new heights in mid-to-late February, before closing sharply lower at the end of the month. The Dow and S&P 500 broke new records of 32,000 and 3,900 points respectively, before retracing lower. They still closed higher than January levels of slightly below 31,000 and 3,800 points. The Nasdaq Composite hit a record 14,100 points in mid-February but corrected more than 8% to close slightly lower than its January close of 13,000 points.

With the Reddit trading frenzy slowly subsiding and trading activities returning to normal, investors shifted their focus back to earnings. Rising bond yields spooked many as they questioned the Fed’s commitment to low rates amid the economic recovery. This prompted a flight from high-growth stocks as valuations came into question in the middle of uncertainties over easy monetary policies.

We have included technical charts for all of the top 10 counters. These are based on 4-hourly time frames over 30/40 days. The charts are for your information only and support and resistance levels discussed are solely based on our dealers’ views. The technical charts should not be constituted as buy or sell recommendations and investors/traders are advised to do their own due diligence before making any trade.

Starting from the 10th position:

10th: Moderna Inc (NASDAQ: MRNA)

After dropping out of the top 10 list in January, Moderna clawed back its 10th spot in February. The COVID-19 vaccine maker struck an all-time high of US$187.50 on 9 February before losing more than 23% to end the month at a low of US$143.62 on 23 February.

With Moderna’s vaccine shot appearing more effective than rivals – which recently reported data against new strains of COVID-191, the vaccine maker hopes to produce more than 700 million doses in 2021, with the potential for as many as 1 billion doses2. The company is also expecting US$18.4bn in vaccine sales this year, putting it on track for its first profit since its founding in 20103.

Rival AstraZeneca has just cashed out of its stake in Moderna, raking in US$1bn. This came after Moderna’s meteoric rise in the past year4. With this disclosure, investors might have been spooked into taking profit, as Moderna went public at US$23 a share vs its February close of US$154.81 – which represented more than a 600% increase!

Technical Analysis:

Status: Technical Sell

Support: around US$121.12 (recent low)

Resistance: around US$140 (20-period moving average)

Moving average cross-down indicates a likely downtrend.

9th: Riot Blockchain Inc (NASDAQ: RIOT)

A newcomer to our list, Riot is a digital-currency company that invests in cryptocurrency and block chain entities. Its share price closely mimics the extreme volatility of many cryptocurrencies.

From a February opening price of US$18.81, it catapulted to US$77.90 on 18 February, more than a 400% increment. This paralleled the movements of the largest cryptocurrency, bitcoin, which smashed a record of US$58,000 around the same time. However, the cryptocurrency company’s share price subsequently plummeted by more than 40% to close at US$43.74 at end-February.

Investments in such companies are slowly gaining popularity as investors look to gain exposure to cryptocurrencies. This explains the recent surges in Riot’s share price and trading volumes. Further volatility can be expected, as cryptocurrencies remain highly speculative.

Technical Analysis:

Status: Neutral

Support: US$35-40 (recent low)

Resistance: around US$48 (20- and 50-period moving averages)

Moving averages appear to be sloping downwards. 20-period MA looking to cross below 50-period MA. May indicate a downtrend.

8th: Alibaba Group Holding Ltd – ADR (NYSE: BABA)

Dropping two ranks, Alibaba came in 8th in February. Share price rallied around 8% initially to this year’s high of US$273.85 before selling pressure kicked in, causing it to correct by 13%. It closed at US$237.73 in February.

The company started the month in good standing with its US$5mn bond sale attracting more than US$38bn orders5. This demonstrated investors’ confidence in the e-commerce giant as they shrugged off antitrust fears and look to the future of China’s e-commerce and cloud industries.

However, nearing the end of the month, the Bill and Melinda Gates Foundation disclosed its entire exit from Alibaba at a US$232.73 price for a total of US$128.56mn6. This re-introduced selling pressure even as the Chinese giant continues to be plagued by regulatory and antitrust threats.

Technical Analysis:

Status: Technical Sell

Support: US$228.34 (recent low)

Resistance: US$238-240 (20-period moving average)

Moving average cross-down indicates a likely downtrend.

7th: Sundial Growers (NASDAQ: SNDL)

Sundial Growers, another newcomer to our top 10 and one of the stocks recently embroiled in the Reddit mania, is a target of retail investors’ extreme speculation. Share price vaulted more than 300% from its January close of US$0.815 to a month-high of US$3.35 on 11 February. It then crashed 160% to a February close of US$1.33 right after.

Besides speculation, certain fundamentals might have improved the company’s reputation. There is growing optimism that the US Congress may lift some restrictions on cannabis. This is positive for the company’s cannabis-related business. Sundial grows a range of cannabis strains and sells a variety of cannabis-derivative products. The company also recently closed out stock and cash investments in edible producer, Indiva, another licensed Canadian cannabis producer. It is set to put this capital to work on growth7.

While cannabis investing is picking up, extreme volatility makes this stock unsuitable for risk-averse investors.

Technical Analysis:

Status: Technical Sell

Support: US$1 (recent low)

Resistance: US$1.30 (20-period moving average)

Moving average cross-down indicates a likely downtrend.

6th: Apple Inc (NASDAQ: AAPL)

A staple in our top 10, Apple slipped from No. 3 in January to No. 6 in February. Despite a stellar set of quarterly results, the tech giant underperformed the broader market as investors rotate from high growth tech companies to value / cyclical companies. Its share price retraced from a month-high of US$137.39 on 4 February to US$121.26, down more than 11%.

The recent correction may offer an opportunity to buy into one of the largest companies with record earnings to boot. What’s more, Apple is diversifying away from the iPhone to augmented reality. AR has the potential to become the next big thing in tech.

Technical Analysis:

Status: Technical Sell

Support: around US$118 (recent low)

Resistance: around US$125 (downtrend line)

Downtrend line formed.

5th: Square Inc (NYSE: SQ)

Square retained its fifth spot in February. It further skyrocketed to a new record of US$281.09 on 16 February, before succumbing to the broader market selloff towards the end of the month. It closed 18% off its high at US$230.

Even though Square announced a stronger-than-expected quarterly EPS of US$0.32 vs the Street’s US$0.24, its shares slumped after it announced a new purchase of bitcoins. The company had snapped up another 3,318 bitcoins for US$170mn. The cryptocurrency now represents about 5% of Square’s 2020 cash holdings8.

Investors didn’t seem to stomach Square’s appetite for cryptocurrencies well, even though Square sees a need for the Internet to have a native currency9.

Technical Analysis:

Status: Neutral

Support: around US$200 (recent low)

Resistance: around US$230 (20-period moving average)

US$200 supporting well at the moment. 20 MA cross-down below 50 MA may indicate a downtrend. Take note of support level at US$200. A breakdown and close below this level could indicate further downside.

4th: Palantir Technologies Inc (NYSE: PLTR)

Palantir retained its 4th spot in the month. After breaking a record at the end of January, Palantir retreated a little before testing a month-high of US$38.39 in February. It then gave up 38% to close the month at US$23.90.

Recent weakness may be attributed to its earnings shortfall. EPS came in at -US$0.08 vs the Street’s estimate of US$0.0210.

The data analytics company is projecting more than 30% YoY growth for 202111. This underscores its optimism on the usability of its software for enabling data integration and modularity. However, the company is a government IT provider, with revenue from the government accounting for more than 60% of its total. This means Palantir heavily relies on its government business for its success. The company may need to diversify its revenue stream further to prevent the adverse scenario of termination of government contracts which will heavily affect the company’s business.

Technical Analysis:

Status: Neutral

Support: around US$22 (recent low)

Resistance: around US$25 (20-period moving average)

US$22 supporting well at the moment. 20 MA cross-down below 50 MA may indicate a downtrend. Take note of support level at US$22. A breakdown and close below this level could indicate further downside.

3rd: Futu Holdings Ltd (NASDAQ: FUTU)

Yet another newcomer to our top 10 list is Futu Holdings, one of the most disruptive companies in the brokerage and wealth-management circle. Known as the Robinhood of China, it muscled its way to the top 3 in February. Like its US counterpart, Futu’s introduction of no commission trading and fractional share ownership helped to create an explosion in retail trading and speculation in call options in China.

Futu’s share price has been on a tear since the start of the year, rising close to 300% to a high of US$191 on 16 February. After that, it corrected by about 20% to close at US$152.79 towards month-end.

The explosion in its share price may be attributed to a few factors. One is the mushrooming of retail trading that is happening across the globe, particularly benefitting the stockbroking and trading industry. Two, unlike many early-stage tech start-ups, Futu is already a profitable company on the back of the recent eruption in retail trading. However, as with many high-growth companies, caution is warranted, as volatility in such companies is likely to persist due to increased speculation.

Technical Analysis:

Status: Technical Sell

Support: US$95-100 (recent low/psychological level)

Resistance: around US$150 (20-period moving average)

20 MA cross-down below 50 MA may indicate a downtrend.

2nd: Nio Inc (NYSE: NIO)

A staple in our list, this Chinese EV maker defended its second position for the third straight month. Nio soared to another record high of US$62.84 on 10 February. However, it crashed right after to close at US$45.78, more than a 28% drop.

Its initial rise could be credited to record monthly deliveries of 7,225 vehicles, up 352% YoY12. Unfortunately, despite its record deliveries, earnings missed analysts’ estimates. Nio’s loss came in at RMB1.49bn vs expectations of RMB757mn. This renewed questions about the profitability of the EV industry, especially with so many companies vying for a share of the pie. On a brighter note, Nio’s revenue has crossed the billion-dollar mark for the first time. In order to be profitable, the company would need to control costs and improve margins.

Technical Analysis:

Status: Technical Sell

Support: US$32 (recent low)

Resistance: around US$42.50 (20-period moving average)

20 MA cross-down below 50 MA may indicate a downtrend. Take note of oversold conditions on RSI.

1st: Tesla Motors Inc (NASDAQ: TSLA)

Ruling the list yet again is the king of EVs, Tesla. Though its share price was on a downtrend for the entire month of February, it still had secured the top spot for three consecutive months. Share price dropped from a near-record high of US$873 at the beginning of the month to close at US$675 towards month-end, down 30%. Its performance turned negative for the first time after a historic run since its inclusion in the S&P 500. It briefly went below the price it was trading at when it was inducted into the S&P 500, after its biggest intraday drop of more than 12% to US$627 on 23 February. This came after a decline of 8.6% the previous day.

Tesla’s recent weakness may have been caused by its recent US$1.5bn investment in Bitcoin. This was followed by comments from CEO Elon Musk that cryptocurrency prices did seem high13. The sharp decline in Tesla tracked the tumble seen in the price of Bitcoin around the same period.

Though selling pressure was strong, popular fund manager, Cathie Wood, snapped up more shares of the EV maker during its 12% dip. She bought 240,548 shares and mentioned in passing that the shakeout was a healthy one common in all bull markets14. That aside, Tesla’s share price may be in for further wild swings as investors closely watch its investments in Bitcoin.

Technical Analysis:

Status: Technical Sell

Support: around US$540 (recent low)

Resistance: around US$650 (20-period moving average)

20 MA cross-down below 50 MA may indicate a downtrend. Take note of oversold conditions on RSI.

Check out our full series on ‘Top 10 Traded US Stocks on POEMS’ here!

Have a view on the above? Join our global investment community on Telegram and share your thoughts and views with us today!.

References:

1. https://www.forbes.com/sites/greatspeculations/2021/02/10/why-has-moderna-stock-already-rallied-75-in-2021/?sh=6416772449f2

2. https://www.channelnewsasia.com/news/business/moderna-sees-us-18-4-billion-in-sales-from-covid-19-vaccine-in-2021-14281456

3. https://www.channelnewsasia.com/news/business/astrazeneca-sells-stake-in-vaccine-maker-moderna-for-nearly-us-1-billion-14304732

4. https://www.channelnewsasia.com/news/business/astrazeneca-sells-stake-in-vaccine-maker-moderna-for-nearly-us-1-billion-14304732

5. https://www.straitstimes.com/business/companies-markets/investors-flock-to-us5b-alibaba-bond-deal-shrug-off-regulatory-woes

7. https://www.fool.com/investing/2021/02/25/why-sundial-growers-stock-jumped-then-dropped-toda/

8. https://www.thestreet.com/investing/square-drops-despite-quarterly-beats-buys-more-bitcoin

9. https://www.cnbc.com/2021/02/23/square-buys-170-million-worth-of-bitcoin.html

10. https://www.fxstreet.com/news/breaking-palantir-results-miss-earnings-per-share-loss-but-revenue-beats-202102161210

11. https://investors.palantir.com/news-details/2021/Palantir-Reports-Revenue-Growth-of-47-for-Full-Year-2020-Expects-Q1-2021-Revenue-Growth-of-45

12. https://www.nasdaq.com/articles/is-nio-stock-a-buy-after-its-january-delivery-numbers-2021-02-01

13. https://www.businesstimes.com.sg/transport/tesla-sinks-below-the-price-at-which-it-entered-sp-500

14. https://fortune.com/2021/02/24/cathie-woods-arkk-tesla-tech/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng (Dealer) and Chuang Ming Jun (Senior Dealer)

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Ming Jun graduated from RMIT with a Bachelor’s Degree in Business Management. He joined Phillip Securities in 2016 as an Equity Dealer and is currently with the Global Markets Night Trading Team, specialising in the UK and Europe markets, as well as supporting the US and Canada markets. . He has provided regular market commentaries across various media channels such as Morning Express Channel 8, 95.8FM Live Radio, and 联合早报.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!