Top 10 Traded US Stocks on POEMS in November 2020 December 11, 2020

Takeaways:

- All three US major indices hit their all-time highs in late November, before taking a breather as markets consolidated.

- Electronic vehicle (EV) makers continued to dominate as investors bet on their future. .

- Finally, some positive news on the vaccine front from Pfizer and Moderna, which announced better-than-expected drug efficacies.

Here are November’s top 10 traded US stocks on Phillip’s Online Electronic Mart System (POEMS), based on gross market value traded.

All three US major indices – Dow Jones, S&P 500 and Nasdaq Composite – made their new all-time highs in November. The Dow closed above 30,000 points for the first time, at 30,046.24 on 24 November 2020. S&P 500 traded at its 3,600 range while Nasdaq traded above 12,000.

Markets began early November fixated on US elections and Ant’s IPO. Ant’s IPO was, unfortunately, called off while the transition of power in the US was stonewalled by a defiant Trump, who refused to concede election loss. In a surprising turn in mid-month, markets became buoyed by news of COVID-19 vaccines’ Phase 3 results. Both Pfizer and Moderna said their vaccines’ effectiveness was above 90%. This hit tech stocks in general as investors rotated out of defensive and stay-at-home stocks to cyclical counters that may benefit from industry re-opening.

Starting from the 10th position:

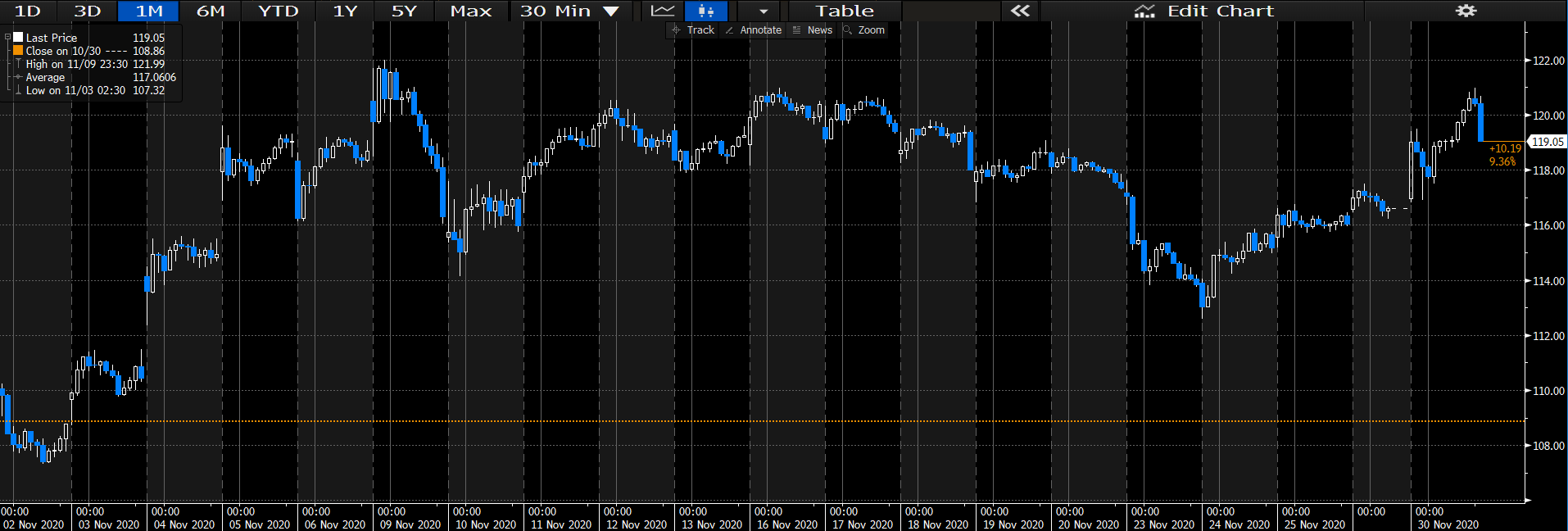

10th: Apple Inc. (NASDAQ: AAPL)

Apple came in at the last spot in November. For the most part of the month, it tracked its performance in October, flip-flopping between US$110 and US$120.

During its “One More Thing” event on 10 November, Apple rolled out its first in-house chip, M1. This has been built into its latest laptops and desktops. With this, Apple will officially shift away from Intel chips for all its products. Apple claims that its new MacBook Air, MacBook Pro and Mac Mini have better performance and battery lives with its M1 chips.[1]

9th: Moderna Inc. (NASDAQ: MRNA)

Besides making a comeback to our top traded list, Moderna had one of its best months in November. Its share price skyrocketed from below US$70 all the way above US$150, chalking up more than a 100% gain in the month.

On 16 November, Moderna said that its preliminary Phase 3 trial data showed more than 94% efficacy, one week after Pfizer announced its results.[2] The positive news from the two major vaccine players reignited optimism in the market. On 30 November, Moderna announced final results of its trial, which confirmed a 94% efficacy. Moderna filed for emergency-use authorisation of its vaccine, on the heels of Pfizer’s filing on 20 November.[3] Once the FDA grants approval, distribution could start as early as mid-December 2020.

8th: Li Auto Inc. (NASDAQ: LI)

Chinese EV maker, Li Auto, made its first appearance on our list on the coattails of the red-hot EV industry. Almost all EV stocks enjoyed similar rallies in November. Li Auto’s share price doubled from US$22 to a high of US$47.70 in the first three weeks, before dipping back to US$36 in the last week of November.

Li Auto announced better-than-expected earnings on 13 November, beating analysts’ estimations with revenue of RMB2.5bn. Although the jump in revenue did not narrow its loss, its share price gained 25% in pre-market/post-announcement trading on the back of bullish sales guidance.[4] Towards the end of November, its share price came under pressure from profit-taking after its recent run.

7th: Palantir Technologies Inc. (NASDAQ: PLTR)

Despite its short listing history of two months, Palantir Technologies has been in the limelight of investors. It debuted on 30 September 2020 at US$10 per share and traded at US$9-10 throughout October. After reporting 52% revenue growth in its first earnings announcement since going public, its share price made its way right up to US$33.50. While revenue beat estimates, bottom-line loss also widened to US$0.94 per share from US$0.24 the previous year. A week after its earnings announcement, Soros Fund Management, the fund founded by George Soros, disclosed plans to offload its stake in Palantir. It claimed that the business practices of Palantir are not in line with the fund’s requirements.[5] Still, Palantir’s share price marched above US$30.

6th: Zoom Video Communication (NASDAQ: ZM)

Zoom further slipped one spot from its 5th position in October as investors pulled funds out of stocks that had benefitted from COVID-19 lockdowns. This was on the back of a raft of positive vaccine news. Zoom’s share price fell to US$370 before it recouped losses to trade above US$450.

As Phase 3 drug results were announced, Zoom and other “stay-at-home” stocks got abandoned by investors who rotated out to traditional industries. Although Zoom posted stunning sales growth of more than 350% for the second consecutive quarter, its share price gave up 5% in post-market trading after results announcement on 30 November.[6]

5th: Xpeng Inc. (NYSE: XPEV)

A newcomer to the list, this Chinese EV company is no stranger to EV investors. Together with its Chinese EV competitor, Nio, its share price skyrocketed in November to a 52-week high of US$74 on 24 November.

Backed by breakneck expansion, Xpeng delievred 8,578 vehicles in the latest quarter. This was a leap of 266% YoY and 166% QoQ[7]. Analysts maintained their ‘buy’ ratings on the company with the prediction that declining battery costs would expand its profit margins . The company’s Zhaoqing factory, with an annual production capacity of 250,000 vehicles, is also set to be ready in December[8]. This will help it roll out vehicles to meet demand and sustain growth.

Xpeng’s share price gained 39% in November alone, making it one of the best performers in the month.

4th: Square Inc. (NYSE: SQ)

Square Inc. came in fourth in our November list of top 10 traded stocks. The company’s share price surged for the entire month to break the US$200 level, attaining a 52-week high of US$215 on 27 November.

Riding its hugely popular CashApp peer-to-peer payment service, Square crushed analysts’ estimates with a US$0.34 EPS vs. consensus of US$0.16. Revenue was US$3.03bn, a 140% increase. The company’s share price added close to 14% following its earnings beat.[9]

Square joined other fintechs’ move into the crypto market two years ago. Its clientele reportedly accounted for 40% of all new bitcoins traded in the market in the recent two years. PayPal’s recent entry into the crypto space has fuelled demand for bitcoins.[10]

3rd: Alibaba Group Holding Ltd (NYSE: BABA)

Alibaba shot up from the 10th position in October to the top 3 in November.

This Chinese tech giant’s share price had declined steadily from its near 52-week high of US$317 on 27 October to around US$250 on 18 November, a level not seen since early August.

It started November on a rough note, as it rode a spate of bad news such as the abrupt suspension of the highly-anticipated IPO of its fintech arm, Ant Group. This IPO was supposed to have been the largest in history. Upended by increased antitrust scrutiny of online platforms and China’s crackdown on digital banking practices, investors became concerned about the regulatory impact on the future of the Alibaba Group. Hence, even though the company delivered blowout Singles Day sales and better-than-expected quarterly EPS of US$2.65 vs. estimates of US$2.12, its share price declined 9%.[11]

Towards the end of November, the coast cleared for Alibaba, which steadily made its way back from its month-low of US$255. Its recent weakness may have coaxed some investors into picking up the stock more affordably as against its 52-week high following the hype of Ant’s IPO.

2nd: Tesla Inc. (NASDAQ: TSLA)

For the first time in five months, market darling Tesla was dethroned from its top spot. After muted movements, Tesla briefly flirted around US$400 before shooting up more than 10% following news of its inclusion in the S&P 500. Its share price has never looked back since. It broke US$600 on 30 November, before closing at US$567.60.

Its inclusion in the S&P 500 provided vindication after an earlier snub by the S&P in September. With its inclusion, many index-tracking ETFs will need to rebalance their portfolios to reflect its addition. This created another round of buying frenzy. The stock was given another boost by Joe Biden’s presidential win as he promises to champion a green environment. This will benefit companies in the EV space.

1st: Nio Inc. (NYSE: NIO)

The ‘Tesla of China’ has finally unseated the real McCoy (TSLA.US)! It topped the list in November, after breaking a 52-week high of US$57.20 on 24 November.

On 2 November, the company announced it delivered a new monthly record of 5,055 cars in October. It was the first and only premium Chinese car maker to deliver over 5,000 vehicles in a month[12]. This represented 100.1% YoY growth and marked its eighth consecutive month of YoY growth. Its share price added 14% after the news.

Quarterly reports released on 18 November showed a narrower quarterly loss than expected, of -12 cents per share vs. analysts’ estimate of -20 cents. Gross margins, however, were 12.9% vs. analysts’ estimate of 14.9% [13]. Its share price captured this, retreating 8.8% in intraday trading. But that did not stop investors from piling back to the stock soon after.

Investors seem to be expecting that Nio will continue to benefit from the trend of cleaner energy adoption. Whether the company’s future sales and production can sustain its parabolic share-price movements, only time will tell.

1. https://www.apple.com/sg/newsroom/2020/11/apple-unleashes-m1/

2. https://www.cnbc.com/2020/11/16/moderna-says-its-coronavirus-vaccine-is-more-than-94percent-effective.html?&qsearchterm=moderna

3. https://www.theguardian.com/world/2020/nov/30/moderna-covid-vaccine-has-94-efficacy-final-results-confirm

4. https://www.theguardian.com/world/2020/nov/30/moderna-covid-vaccine-has-94-efficacy-final-results-confirm

5. https://www.cnbc.com/2020/11/19/george-soros-is-offloading-palantir-shares-due-to-business-practices.html?&qsearchterm=palantir

6. https://www.marketwatch.com/story/zoom-sales-more-than-quadruple-again-but-stock-still-drops-11606771205

7. https://www.fool.com/investing/2020/11/12/why-shares-of-xpeng-are-surging-today/

8. https://investorplace.com/2020/11/xpev-stock-xpeng-looks-like-a-winner/

9. https://www.cnbc.com/2020/11/06/square-stock-soars-after-massive-earnings-beat-helped-by-cash-app-.html?&qsearchterm=square

10. https://www.cnbc.com/2020/11/24/square-and-paypal-emerge-as-whales-in-the-crypto-market-.html?&qsearchterm=square

11. https://markets.businessinsider.com/news/stocks/alibaba-stock-price-regulatory-pressure-overshadows-singles-day-blowout-2020-11-1029788690

12. https://cntechpost.com/2020/11/02/nio-delivers-5055-vehicles-in-october-up-100-1-year-on-year/

12. https://www.msn.com/en-us/money/topstocks/nio-s-quarterly-loss-narrows-more-than-expected-but-stock-swings-to-losses/ar-BB1b6vC1?ocid=FinanceShimLayer

About the author

Allen Tan & Lee Yong Heng

Senior Dealer & Dealer

Allen graduated from Nanyang Technological University with a Bachelor’s Degree, majoring in Economics with a minor in Business. He joined Phillip Securities in 2016 as an Equity Dealer in the Global Markets Team. He specialises in the US and Canada market and also supports the UK and Europe market.

Yong Heng joined Phillip Securities in June 2020 this year as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and also supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a Bachelor’s Degree in Economics & Finance. He also completed his CFA studies last year.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?