Episode 2 – Trading Made Simple May 10, 2022

“Trading” might seem difficult and not everyone perceives themselves as being “qualified” enough to be a trader or have sufficient knowledge to begin trading. Here, we break down the whats and hows of trading so you can gain a head start in your journey today!

Day trading is the act of buying and selling a financial instrument within the same day or even multiple times over the course of a day. Taking advantage of small price movements can be lucrative — if done correctly. However, for inexperienced individuals who might not have a well-thought-out strategy, the flipside is also true.

Here are 6 steps to simplify trading into a journey you can embark on:

Step 1: Setting aside funds

Before carrying out any trade, it is important to decide on the amount. Trading within your means will require you to acknowledge your comfort and risk levels. Going beyond them will only ignite unnecessary emotions we could do without.

A rule of thumb for budgeting that you may rely on is Elizabeth Warren’s 50/30/20 rule. This rule advocates segmenting your budget into three categories: needs, wants, and financial goals. With 20% of your income for financial goals which includes trading, you now have a starting point.

Step 2: Choosing the right market

This step is often overlooked. Unlike investing, trading requires constant monitoring of the market and execution of (buy and sell) trades. Hence, you will need to consider the trading hours of the exchange you would like to trade in.

For example, trading hours of United States’ exchanges is 9.30pm to 4am (Singapore) which means that you will need to stay up to monitor the market — not something many of us can afford especially with a day job.

Secondly, most people are aware of the stock market but there are other markets that can be used to carry out day trading as well, such as the futures, forex, and options market.

Step 3: Knowledge is power

Source: Lindsey Alimodian, 2018 [1]

Source: Lindsey Alimodian, 2018 [1]

Many do not recognise the potential of knowledge in this industry. On top of basic trading processes, traders will need to keep up with the latest news and events that will affect their investments. These include the Fed’s interest rate plans, economic outlooks and even companies’ earnings reports. Also, remember that it is easy to end up in the wrong place by getting brainwashed with hype. This is how you can often lose your way and ultimately your capital.

To begin, you may make a wish list of counters you would like to trade and regularly read up on those selected companies or markets. Learn to rely on credible financial sources and not be tempted by hype.

Step 4: Trading strategies

Before making your investment, you should devise a trading strategy that suits your needs and wants. Devising a suitable trading strategy will assist in your investment decisions over the long term.

There are many trading strategies and we will share the 4 basic strategies below:

Source: Valueofstocks, 2021 [2]

Source: Valueofstocks, 2021 [2]

Strategy 1: Value Investing

Value investors seek stocks they believe are undervalued. They look for stocks with prices they believe do not fully reflect the intrinsic value of the security. Value investing is predicated, in part, on the idea that some degree of irrationality exists in the market. This irrationality, in theory, presents opportunities to get a stock at a discounted price and make money from it.

Strategy 2: Growth Investing

Rather than look for low-cost deals, growth investors want investments that offer strong upside potential when it comes to the future earnings of stocks. It could be said that a growth investor is often looking for the “next big thing”. Growth investing, however, is not a reckless embrace of speculative investing. Rather, it involves evaluating a stock’s current health as well as its growth potential.

Strategy 3: Momentum Investing

Momentum investors ride the wave. They believe winners keep winning and losers keep losing. They look to buy stocks experiencing an uptrend. As they believe losers continue to drop, they may choose to short-sell those securities.

Strategy 4: Dollar-Cost Averaging

Dollar-cost averaging (DCA) is the practice of making regular investments in the market over time, and is not mutually exclusive to the other methods described above. Rather, it is a means of executing whatever strategy you choose. With DCA, you may choose to put $300 in an investment account every month. This disciplined approach becomes particularly powerful when you use automated features that invest for you. It’s easy to commit to a plan when the process requires almost no oversight.

Step 5: Review your strategies

After you start trading with your chosen trading strategy, you will still need to continue monitoring the market and the stock performance. A periodic review can be done every 6 months or whenever a major event occurs.

Here are 3 reasons why it is important that we have a periodic review on our trading strategy:

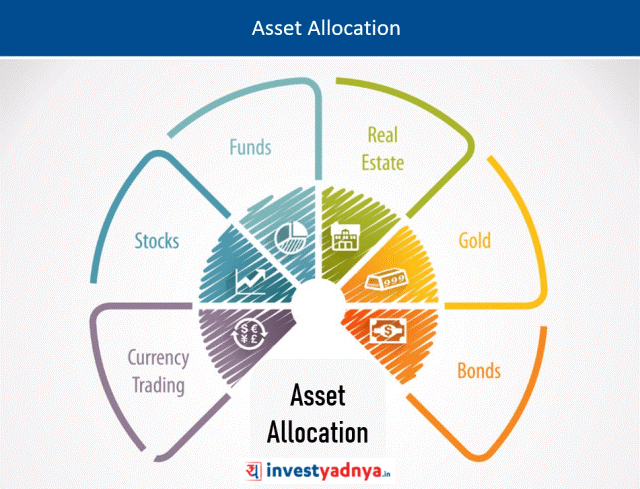

(A) It helps you to maintain the optimal asset allocation mix

Source: Yadnya Investment Academy [3]

Source: Yadnya Investment Academy [3]

Asset allocation is essentially the proportion in which you have allocated your total funds across different investments. For example, let’s say you wish to invest $100,000. Since you’re moderately risk tolerant, you decide to invest in equity and debt funds in a 50:50 ratio. Over the course of one year, the NAV of the funds will naturally fluctuate. And at the end of the year, say your portfolio’s asset allocation between debt and equity stands at 43:57. In that case, your original asset allocation no longer holds true. The equity component in your portfolio has increased.

(B) It helps you to align your investment portfolio with changing life goals

Typically, when you are younger, you may be open to taking more investment risks in favour of the possibility of earning higher returns. Over time, however, your risk tolerance could drop, particularly as you get closer to retirement. Similarly, your life goals may also change over the years. A new goal may appear on the horizon, and you may need to shuffle your investment portfolio accordingly.

(C) It allows you to take advantage of market movements

Reviewing your portfolio periodically also makes it possible for you to take advantage of market movements. For instance, if you expect the equity market to perform well in the foreseeable future, you could rebalance your portfolio to increase your equity funds weightage. Conversely, if you expect that the equity markets may enter a bearish phase, you could increase your investments in debt funds instead.

Step 6: Group trading

As market performance heavily relies on investors’ investment actions (Buyers and Sellers), we strongly believe that investment is not an individual activity. You can always discuss with your friends, family and refer to investment articles for investment ideas – there is no need to be alone in your trading journey.

“Trading is not for the dabblers, the dreamers, or the desperate. It requires, above all, one steadfast trait of dedication. So if you are going to trade, trade like you mean it”

– Rod Casilli

At PhillipCapital, we strive to enhance your trading journey by providing educational content (Market Journal, Podcasts and Webinars) that may provide insights to your investment decisions – so that you can trade like you mean it. Feel free to register and attend the webinars that POEMS has to offer!

Should you wish to begin your trading journey, you may open a POEMS account or chat with one of our licensed representatives to find out more! We welcome you to approach our Financial Adviser Representatives / Relationship Managers in Phillip Investor Centre who can partner you on your investment journey. For more information: you may contact ActiveTraders@phillip.com.sg.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

- [1]https://medium.com/clippings-autumn-2018/knowledge-is-power-ec1b8be2cdad

- [2]https://www.valueofstocks.com/2021/07/19/value-stocks-vs-growth-stocks/

- [3]https://www.google.com/url?sa=i&url=https%3A%2F%2Fblog.investyadnya.in%2Fasset-allocation-strategies-simplified%2F&psig=AOvVaw3ceL0MR9Q5VEtDc5B1ZBmt&ust=1651138150932000&source=images&cd=vfe&ved=0CAwQjRxqFwoTCLjW07_4s_cCFQAAAAAdAAAAABAD

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Jian You & Tan Yan Yi

Jian You graduated from Nanyang Technological University with a Bachelor's Degree in Banking and Finance, and joined Phillip Investor Centre as an Equity Specialist in 2019. He believes in making informed and educated investment, with the use of Fundamental and Technical Analysis.

Yan Yi graduated from Nanyang Technological University with a Bachelor's Degree in Banking and Finance. As an Equity Specialist, she strongly believes that all investors should make informed investment decisions. Thus, she is passionate in educating and guiding clients along their investment journey. Yan Yi also diligently equips herself with market analysis skills and stays updated with economic events.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?