US-China Trade War Timeline: A New Hope? September 29, 2020

This article is part of the US election series brought to you by POEMS. #USElection2020

What the report is about:

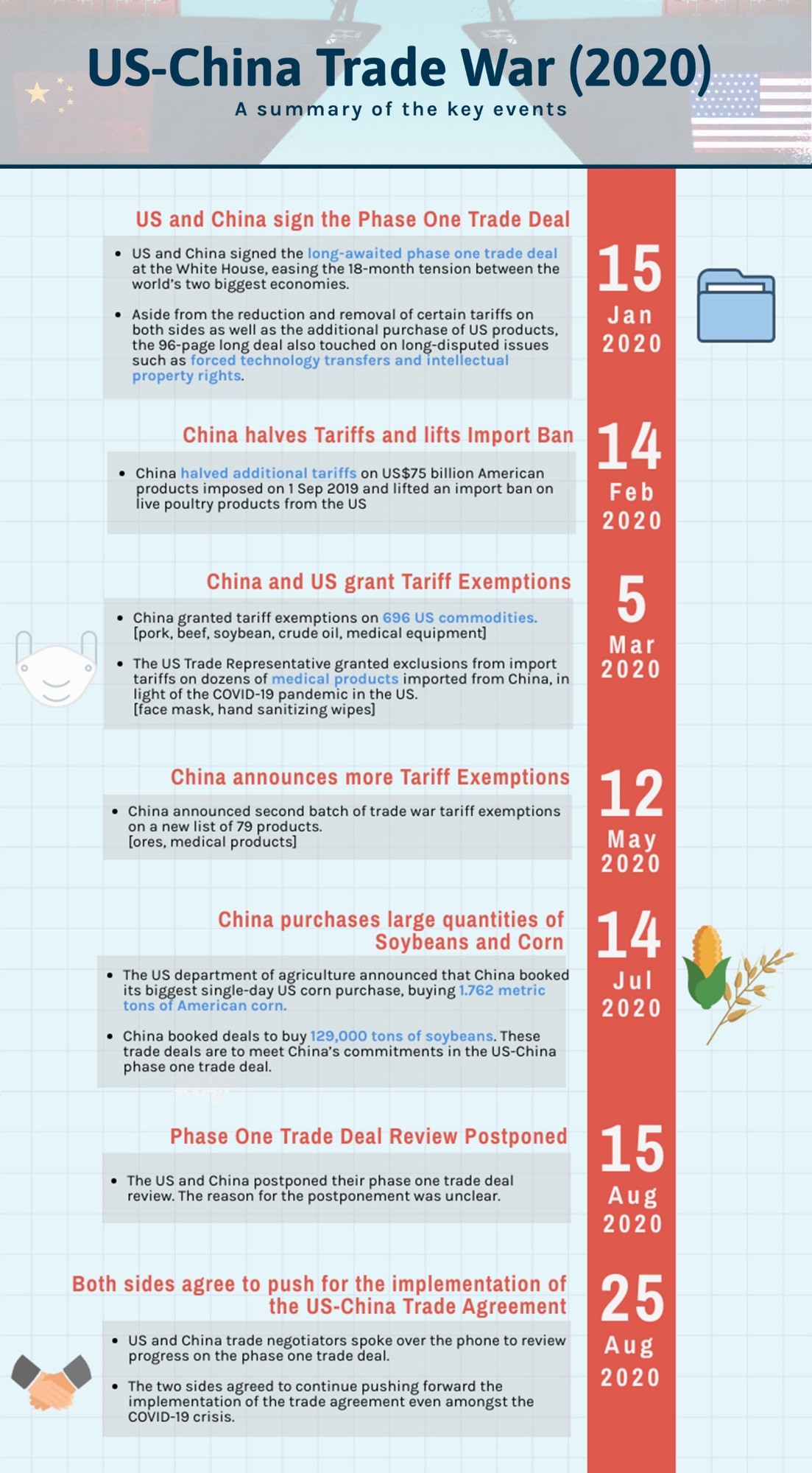

- Timeline of US-China trade developments from July 2019 to August 2020

- 2020 US-China outlook

- How to gain exposure to US and China markets

Phase 1 of the US-China trade deal was signed under the old normal, when additional tariffs could be absorbed by both sides. Since then, Covid-19 has turned the world topsy-turvy and overshadowed everything else. US-China relations have also deteriorated to below pre-trade-deal levels.

With US presidential elections round the corner, President Trump will likely ratchet up the heat on China to widen his appeal with his brand of populism. A Biden win, however, may well alter the course of relations. While the world watches in anticipation, check out our latest summary of trade developments from 2019 to 2020. Our article on trade developments from January 2018 to June 2019 can be found here.

2019 – silver lining at the end of the year

2020 – a new hope?

US-China outlook

The coming elections could be a crux for trade relations. If President Trump serves a second term, China is likely to face additional pressure, especially in the tech space. If Biden takes over, he would face the challenge of having to differentiate his China policy from Trump’s. Possible moves include getting rid of Trump’s policies to show goodwill, since the Democrats have long stood for stronger US-China relations. With further progress on trade talks unlikely due to the Covid situation, we can only wait and see.

What you can do

Investors can gain exposure to the upside and downside of markets, by hedging their positions with a wide range of World Indices Contracts For Differences (CFDs) which allows you to track and trade the underlying Index. These include the Wall Street Index CFD, China A50 Index CFD, US Tech 100 Index CFD and US SP 500 Index CFD. Alternatively, there is a whole range of equity CFDs under US Equity CFDs and China Equity CFDs. Speak to your Phillip Capital consultant today for details or drop us an email at cfd@phillip.com.sg.

Gain exposure to US & China markets with our new USD/CNH FX CFD pair!

Another way to gain exposure to both the US and China markets is via our recently launched USD/CNH FX CFD pair.

Forex CFDs or FX CFDs, allow you to participate in the price movements of an underlying forex (FX) pair. It is the exchange of one currency for another at a current quoted/market price where it is always traded in pairs.

The FX market is open 24 hours a day, five days a week. It is the world’s largest market in terms of daily transaction volumes, providing high liquidity for trading.

To understand more about the benefits of FX CFD trading, check out our articles, “What is FX CFD & Why You Should Trade Them” and “A Beginner’s Guide to Profit from FX Swap Points”.

Gain access to a wide variety of currency pairs and trades across 36 FX pairs in total.

Enjoy up to 20 times leverage, tight spreads and zero commissions when you trade FX CFDs with us!

Begin your FX CFD trading journey now!

Source:

1. https://www.china-briefing.com/

2. https://www.scmp.com/

3. https://markets.businessinsider.com/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Lester Chua

Dealer

Lester Chua graduated from Singapore Institute of Management (University of London) with a Bachelor's Degree in Accounting and Finance (FCH). He possesses over 5 years of trading and investing experience with in-depth knowledge in stocks and various investment products. In his free time, he researches on value investing, focusing on the fundamental analysis of companies.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  Playing Defence: Diversification in Forex Trading

Playing Defence: Diversification in Forex Trading  Demystifying Forex Trading – Technical Analysis

Demystifying Forex Trading – Technical Analysis