Ways to deal with Stagflation May 30, 2022

There has been growing concern in recent days over the possibility of stagflation making an reappearance. Stagflation can result from a combination of various factors such as lacklustre or negative economic growth, high unemployment rates and high inflation.

One of these has already made its presence felt – the US inflation rate for February 2022, measured by the Consumer Price Index, increased by a whopping 7.9% on a year on year basis, which is a 40-year record.

There are indications that inflation will continue to remain elevated due to the Russia-Ukraine conflict and President Joe Biden’s ban on energy imports from Russia, which drove prices of fuel up.

Many experts have also predicted that the other two factors will soon come into play. Hence, the US economy could soon see high rates of unemployment and weak economic growth as inflation continues to remain high.

However, there is little consensus over this, as some analysts are confident that the economy is in a strong position and will not enter a period of stagnation.

With this being the case, it would be prudent to analyse some of the potential causes of stagflation and break down the series of events that occurred during previous instances of stagflation.

Reasons for Stagflation

While there is debate among economists over the exact reasons for stagflation, they can be largely explained by either supply shocks or monetary policy, or a combination of both.

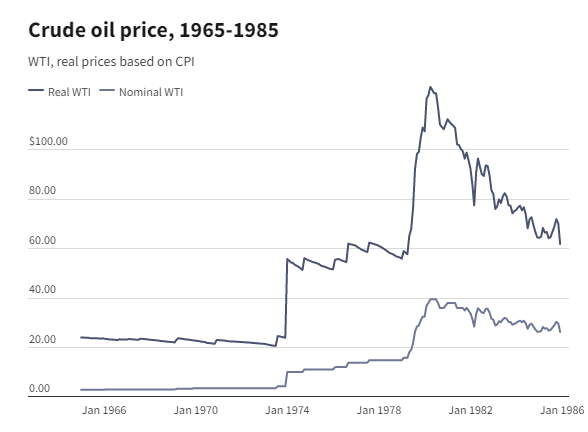

Supply shocks are characterised as a sudden and unexpected event that has a serious impact on supply, and consequently, the price of a product or commodity, such as crude oil. Both Brent crude and West Texas Intermediate (WTI) crude futures traded above US$100 per barrel on 24 February 2022, the first day of Russia’s invasion of Ukraine.

It was the first time that crude oil prices surpassed USD100 per barrel since August 2014 for Brent crude and July 2014 for WTI. Prices have stayed elevated above USD100 per barrel since then with some brief respite.

However, it is also crucial to note that Russian oil today makes up approximately 10% of the global oil supply, while OPEC, or the Organisation for Petroleum Exporting Countries, controlled around 60% of global oil supply in the 1970s.

The 1973 Organization of Arab Petroleum Exporting Countries (OAPEC) embargo on the US caused oil prices to rise almost four folds, from USD2.90 per barrel (in 1973) pre-embargo to USD11.65 per barrel (in 1974).

The other often cited cause of stagflation is the introduction of a monetary policy.

During the two previous periods of stagflation in the 1970s and early 1980s, the Federal Reserve had implemented contractionary monetary policies, which can be seen through an increasing Federal Funds Rate.

Contractionary monetary policy is used by the Federal Reserve to bring rising inflation under control. This was the case with the interest rate increase in March. Future interest rate increases are likely to be announced by Federal Reserve chairman Jerome Powell later this year.

However, typically after the Federal Reserve implements a contractionary monetary policy by hiking the Federal Funds Rate, there is time lag before economic indicators such as inflation, unemployment and Gross Domestic Product growth to respond.

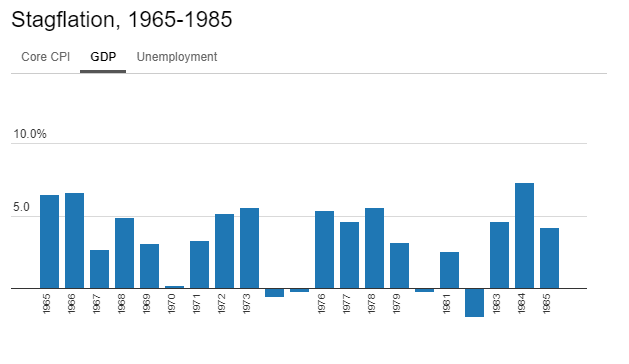

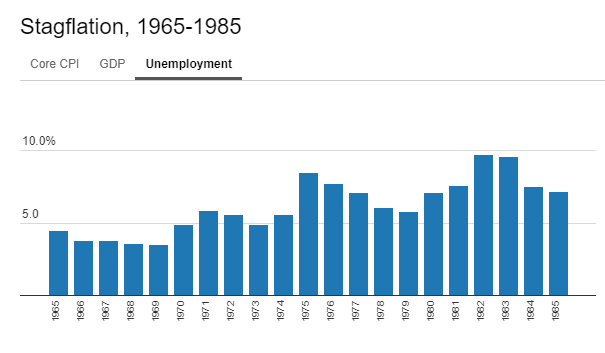

During the two previous periods of stagflation, inflation started to decline only around three years after interest rates were increased, on average. However, unemployment and GDP growth reacted more quickly, at around two years on average after the Federal Reserve increased interest rates. When the Federal Reserve changed its course and hiked interest rates in 1973, this resulted in rising unemployment and negative economic growth over 1974-75. However, inflation remained high, at an average of 10.1%.

Hence, the time lag from the interest rate hike in 1973 and the time it took to impact unemployment, economic growth and inflation resulted in stagflation over 1974-75.

Will we see Stagflation?

Some experts have argued that we are not in danger of stagflation due to strong economic growth and a positive employment outlook, with 431,000 jobs added in March 2022 and unemployment rate falling to 3.6%.

US GDP growth for the fourth quarter of 2021 came in at 6.9%, with growth for 2021 coming in at 5.7%, which is the fastest rate of increase since 1984. Hence it seems unlikely that we will see slow or negative growth and high rates of unemployment in the US economy in the near future.

Whether stagflation will occur will depend largely on how quickly inflation goes down in response to the latest round of contractionary monetary policy versus the time it will take for unemployment and economic growth to be affected by the interest rate hikes that have been and will be implemented for the rest of this year.

In the event that stagflation happens, investors should shield their portfolios by moving out of growth stocks, which tend to perform badly in times of high inflation and rising interest rates, and by increasing their exposure to value stocks, that are regarded as trading at a level below what they are really worth, and cyclical stocks, whose value follows economic cycles very closely.

Some examples of cyclical stocks are automobile manufacturers and retailers of luxury goods, while value stocks have a low price to book ratio, low price to earnings ratio and high dividend yield.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

- [1]https://www.cnbc.com/2022/04/11/oil-drops-brent-crude-falls-below-100-as-china-lockdowns-spark-demand-fears.html

- [2]https://www.cnbc.com/2022/02/24/oil-prices-jump-as-russia-launches-attack-on-ukraine.html

- [3]https://www.forbes.com/sites/phillipbraun/2022/03/22/why-stagflation-is-not-a-concern-but-there-are-other-things-to-worry-about/?sh=4fd35b3d650b

- [4]https://www.investopedia.com/terms/s/supplyshock.asp

- [5]https://seekingalpha.com/article/4462851-stagflation

- [6]https://time.com/6160043/ukraine-oil-1970s-stagflation/

- [7]https://www.federalreservehistory.org/essays/oil-shock-of-1973-74

- [8]https://www.nytimes.com/2022/04/05/business/economy/recession-economy.html

- [9]https://www.cnbc.com/2022/01/27/gdp-grew-at-a-6point9percent-pace-to-close-out-2021-stronger-than-expected-despite-omicron-spread.html

- [10]https://www.nasdaq.com/articles/the-stagflation-threat-and-the-one-strategy-that-will-beat-it

- [11]https://www.cnbc.com/2021/11/12/how-to-invest-around-stagflation-inflation-risks-says-analysts.html

- [12]https://www.investopedia.com/articles/00/082800.asp#:~:text=Cyclical%20stocks%20represent%20companies%20that,clothing%20retailers%2C%20and%20automobile%20manufacturers

- [13]https://www.investopedia.com/terms/v/valuestock.asp

- [14]https://www.investopedia.com/articles/economics/08/1970-stagflation.asp

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Ming Jie

Investment Specialist

Phillip Investor Centre (Holland Drive)

Ming Jie is an Investment Specialist at Phillip Investor Centre (Holland Drive) and specialises in providing investment advisory services to retail clients, with a focus on helping clients to build and manage unit trust portfolios that can help to achieve their investment objectives. He joined Phillip Securities in 2017 and graduated from University of London with an external honours degree in Economics and Finance.

From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  What Makes Forex Trading Attractive?

What Makes Forex Trading Attractive?  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!