Will we see another Dot.com bubble? September 23, 2020

Nasdaq has experienced its best quarter since 1999, recording a 34% astonishing second quarter growth in 2020Q2. The previous best quarter was in 1999Q4 when a gain of 49% recorded. Nasdaq recorded a 500% growth for the years from 1995 to 2000. Comparing it to a similar 5-year period from Aug 2015 to July 2020, Nasdaq achieved 235% gain.

There is a continuous fund flow rotation between traditional value stocks and growth stocks where traditional sector managed to outperform Tech sector on some of the trading days or weeks since the low in March 2020. However, it is not hard to realise the widening disparity between Nasdaq and DJIA/S&P500 indices, where Nasdaq soared much more than the latter two indices. Seemingly, investors are avoiding traditional industries which are hit harder by the ongoing pandemic and treasure growth stocks more, as these stocks are deemed to be more relevant to the new norm, and new economy during the COVID-19 pandemic.

However, recent Tech meltdown from its all-time high put the tech rally into a halt. Given the speed of decline, it makes retail investors recall the dot.com bubble burst in 2000. If history would repeat itself, it is understandable that tech-heavy investors are anxious about the possibility of a tech crash. Similarity between the dot.com bubble and tech stock market in 2020 cannot be understated.

Similarities between 2000 bubble and 2020 rally:

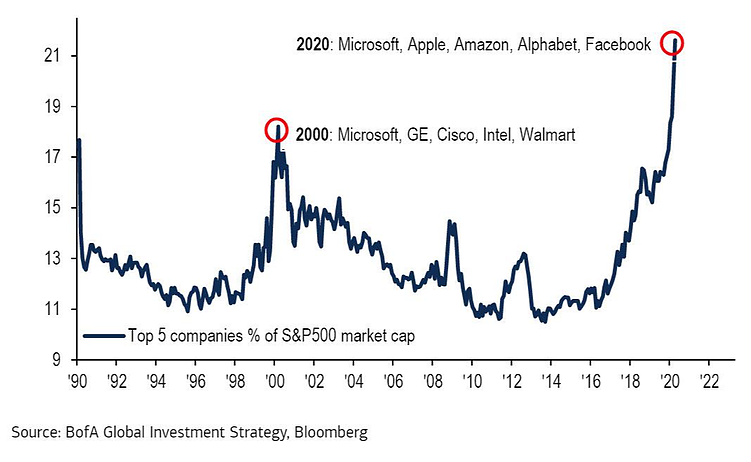

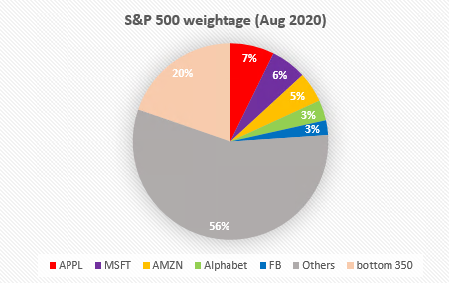

1. Over concentration across the big names – particularly the BIG 5 have been contributing record high allocation of fund since 2000, attributing to more than 20% of S&P 500 in 2020 compared to 18% in 2000 before the dot.com bubble burst. Astonishingly, the combined BIG 5 market capitalisation is larger than the bottom 350 companies in the S&P 500 index.

2. Widening disparity between Nasdaq and Dow Jones Industrial Average (DJIA) – Meanwhile if you look at the indices return since 1990, the stock market tends to succumb to a huge correction whenever there is a huge disparity between Nasdaq and DJIA return. This justifies that market sentiment realises tech’s future is not as rosy as perceived.

On top of that, the Nasdaq/DJIA ratio is at an agonising level, as it approaches the dot.com bubble level. This implies that funds are increasingly concentrating in the tech sector.

This can be described as the “narrowing” phenomenon, a situation where risk diversification is neglected. Over-concentration across the big names also caused deterioration of portfolio diversification in S&P 500, which derive its value based on market cap weightage. Historically, the “narrowing” phenomenon had preceded the Dot.com crash (2000) and Great Recession (2007-2009).

However, although the overvaluation trend in the tech stocks is inevitable, there are some hard facts in today’s Tech environment which could explain why some big names are able to justify its valuation.

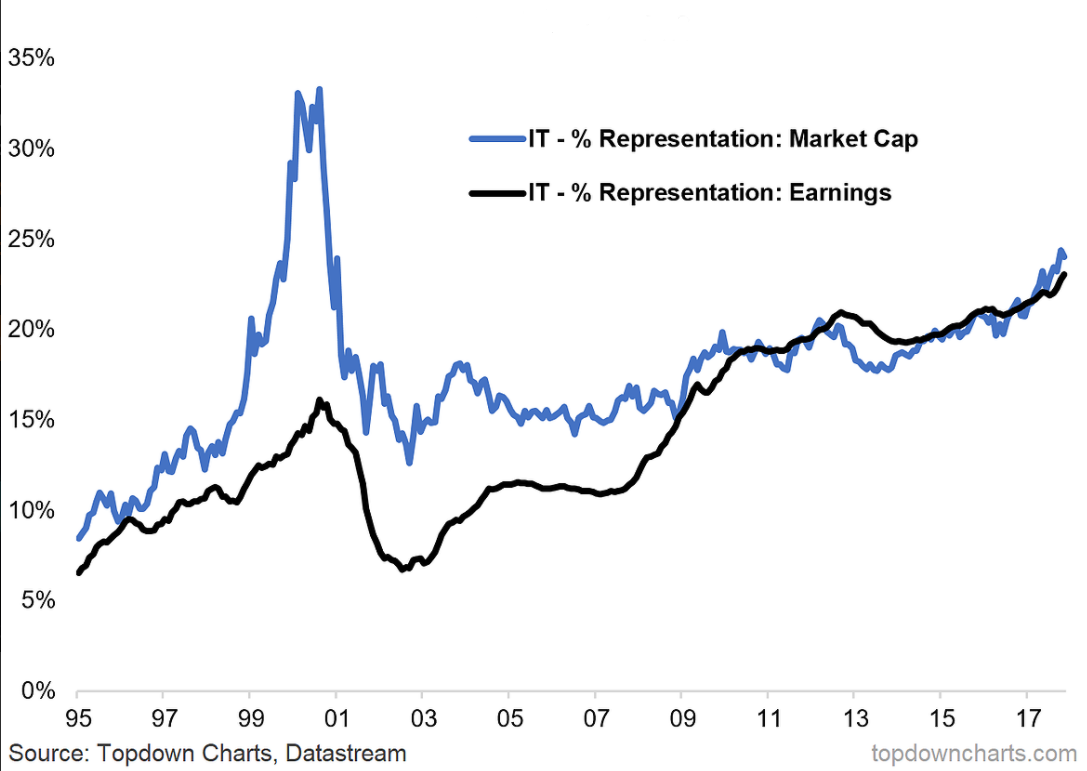

1. Proven track record in generating earnings – This is the era where the top few Tech giants’ products and services are deeply rooted in everyone’s daily life. From social media to e-commerce, Tech giants have dominated multiple billion-dollar-industries by either strengthening their own product development, diversifying into new business or by acquiring smaller entitles. As such, IT companies are able to achieve high CAGR in their earnings after the dot.com bubble while back then investors had flocked into the dot.com stock based on overhyped expectation instead of profitability only to find out most businesses in bubble. The chart below shows that Information Technology stock prices were much more aligned to its earnings compared to late 90’s, justifying their valuation and the trend of increasing allocation of funds into IT sector.

2. Market sentiment is not as euphoric as late 90’s – While some Tech stocks are benefiting from the COVID-19 pandemic and are not cheap today as a result of valuation boosted by monetary policy , they are not as overvalued as the Tech superstars in 1999. Back then, any IPOs with a counter name ending with “.com” or starting with “e-” had their share price multiplied within one IPO day. Investors were eager to invest at any valuation with mass media advertising on dot.com company. Tech executives allocated huge portion of operating costs on brand building and advertising instead of adding value to their technologies. Today, mega Techs invest in creating future values (e.g. Cloud computing, A.I, 5g and cryptocurrency) and are cash-ready to acquire smaller high-growth businesses. Investors are also more rational to avoid any tech companies that are unable to meet earning expectation (e.g: Alteryx) or lose out to their competitors (e.g. Intel).

3. Robust cash position to establish strong economic moat – With a high cash reserve in their balance sheet, these companies invest heavily in new technologies to ensure they will never run out of steam in exploring opportunities. Facebook (FB), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT); and Alphabet (GOOG) (formerly known as Google) (collectively known as FAAMG) spending hundred-millions a year on R&D, which makes it harder for startups or companies from other sectors to break through the barriers and join the competition. On the other hand, FAAMG had been known to exhibit almost a monopolistic competition nature in the industry and causing technology disruption to the traditional industry. Investors got no choice but to jump on the bandwagon, boosting the valuation higher.

4. Fourth industrial revolution – Historically, an industrial revolution not only changes how people communicate, live and work but also alters businesses. New jobs were created during the revolution while some were eliminated. Right now we are in the beginning of new industrial revolution. It is an ongoing revolution era leveraged on digital revolution, evolving human civilisation at an exponential pace. The technologies of this era consists of A.I, autonomous vehicles, robotics, quantum computing, cloud computing, biotechnology, just to name a few. These technologies are capable of blurring the lines between the physical, digital and biological spaces, causing massive disruption in the demand and supply structure, across all industries. Rising inequalities are expected among companies with Tech giants at the forefront runner in leading the revolution as the winners that take all.

Conclusion

Tech stocks are not as overvalued as they were during dot.com bubble, with FAANG’s business models being much more matured. They also established and acquired strong customer loyalty and brand recognition. In addition, Tech companies also spare no expense in investing in new technologies. Given a relatively high CAGR in 5G, cloud computing and A.I than traditional industry, I foresee that the “Tech trend” will continue.

All in all, the dot.com valuation given by investors in the late 90’s priced in information way too advanced into the future, which would have taken years and even decades to realise. While some of the emerging tech stocks tend to possess higher capital loss risk due to positive market sentiment on their growth potential, being selective in picking up tech stocks is one of the key to survive while beating average index returns. Nonetheless, you can diversify your risk by investing in a basket of technology stocks using Technology Exchange Traded Funds (ETFs).

Technology ETFs

| ETF | Ticker | Exchange | Top holdings | Expense ratio (%) |

| CSOP Hang Seng Tech Index | HK.3033 | HKEx | Alibaba,Tencent,Meituan | 0.99 |

| Nasdaq 100 TR USD | QQQ | Nasdaq | Apple,Microsoft,Amazon | 0.2 |

| Cloud Computing ETF | CLOU | Nasdaq | Twilio,Zoom Video,Zscaler | 0.68 |

Source:

1. https://www.macrotrends.net/2528/dow-jones-vs-NASDAQ-chart

2. https://www.capitalgroup.com/advisor/ca/en/insights/content/articles/tech-boom-no-dot-com-bubble.html

3. https://www.zerohedge.com/markets/market-now-just-5-stocks-sp-now-more-concentrated-top-5-names-then-ever

4. https://www.theatlantic.com/ideas/archive/2019/10/are-we-cusp-next-dot-com-bubble/600232/

5. https://www.weforum.org/agenda/2016/01/the-fourth-industrial-revolution-what-it-means-and-how-to-respond/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr. Choo Li Rui Hansel

Equities Specialist (Dealer), Phillip Securities Pte Ltd

Mr Choo Li Rui Hansel joined Phillip Securities as Equities Specialist (Dealer) and handles over 12,000 trading accounts. As an Equities Specialist, he handles trade execution and equity-related operation. He also provides market insights, corporate action, securities & portfolio advisory services. In addition, Li Rui also regularly conducts webinars to educate public with trading & financial knowledge. He acknowledges the importance of financial literacy in optimizing wealth growth, be it active trading or passive investing. Li Rui obtained Bachelor of Engineering Degree from Nanyang Technological University, majoring in Civil Engineering. Despite his academic background, Li Rui's interest lies in securities & derivatives market. His engineering academic background had equipped him with analytical skills which are the essential transferable skills in finance industry.

Back in Business: The Return of IPOs & Top Traded Counters in March 2024

Back in Business: The Return of IPOs & Top Traded Counters in March 2024  From $50 to $100: Unveiling the Impact of Inflation

From $50 to $100: Unveiling the Impact of Inflation  How to soar higher with Positive Carry!

How to soar higher with Positive Carry!  Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It

Why 2024 Offers A Small Window of Opportunity and How to Position Yourself to Capture It