With the Downturn in the Economy, what should you invest in? November 30, 2022

At a glance:

- several exogenous events have shocked the stock market, resulting in major indices retreating well-off their 52-week highs

- the Fed, in its effort to tame inflation, may tilt the economy into a recession

- The labour market is still going strong, but appears to show signs of weakness, as seen during economic downturns

- two cases of recession: shallow vs deep, where the former may be more welcomed over the latter

- value over growth during a recession – evident from the slowdown in IPO and SPAC volumes

- POEMS offer trading in blue chip companies (listed on their respective exchanges) that are listed as unsponsored American Depositary Receipts (ADRs) in the Over-the-Counter (OTC) market

Consider the following events that have happened this year – the Russia-Ukraine war; runaway inflation; resurgence of COVID-19, with the ensuing lockdown in China; Pelosi’s controversial visit to Taiwan; UK’s political turmoil and many more.

There has been no lack of exogenous shocks dominating the headlines since the start of 2022. These macro events shocked the global economy and introduced renewed market volatility that has not been seen since the onset of the COVID-19 pandemic. This has resulted in the major indices falling well off their 52-week highs.

Below is a look at how far the broad based index, the S&P 500, retreating from its 52-week high; a total of -38% from its high on 4 January 2022 to its low on 13 October 2022.

The Federal Reserve – the biggest risk contributor?

More recently, the Fed’s aggressive rate hikes have led the market to a series of selloffs. Arguably, the biggest concern facing the current market is the ensuing fight to tame inflation. Potential risks include the Fed going too far and fast, which may tip the ‘still strong’ US economy into a recession.

Including the latest rate hike, the Fed has taken the federal funds rate to a range of 3.75-4%, with a total rate hike of 375 basis points Year-To-Date (YTD). This has been the most aggressive tightening so far, ever since the Fed started using interest rates as a policy tool.

The Fed took on a more aggressive stance, diverging from the conventional easy policy that has been in place since the pandemic (or arguably since the 08-09 financial crisis), to signify an important message: “the end of cheap money”. This has several repercussions, ranging from the valuation of growth stocks and the housing market mortgage rates to consumer spending.

Recent hawkish comments from two of the voting members (James Bullard and Mary Daly) on the Federal Open Market Committee (FOMC) reaffirmed the Fed’s commitment to bring down the record high inflation even at the cost of a recession. Although October’s CPI figure of 7.7% was welcomed, it was still a far cry from the target of 2%. Therefore, ‘more work’ needs to be done; such a statement is known to spook the market.

Labour market

There are whispers that the global economy is heading, or is already in a recession. In the US alone, the first half of 2022 was seen as a period of technical recession, going by the traditional definition of two consecutive quarters of negative GDP growth. However, the latest GDP read bucked the trend with an upside surprise of an annualised 2.6% growth.

The third quarter GDP number may be welcomed but this does not change the trajectory of the economy as evident from the layoffs and hiring freeze of many companies, including behemoths such as Meta Platforms (META.US) and Amazon (AMZN.US).

Companies freeze hiring in preparation for a downturn in the economy and to keep up with operating margins, especially when hampered by weak earnings, resulting in unemployment rates rising well into and after a recession.

Two cases of recession

The most famous recession indicator is the yield curve inversion, which has remained inverted throughout the majority of 2022. A yield curve inversion has always preceded an economic recession, which has been observed since the 1970s1 (though the reverse may not hold true). What remains to be seen is if the recession is a shallow or a deep downturn one.

A shallow recession is one where the economy contracts only marginally, for a limited time. This may not be a bad thing, especially with the current environment of persistent high inflation rates. A shallow recession helps revive expectations in the market, leading to moderate price increases, which can help tame runaway inflation.

A deep recession or worse, a depression, where GDP contracts more than 10%, similar to that of the Great Recession during the 2007-09 economic crisis, where a significant, widespread and prolonged downturn in economic activity was observed. This is usually followed by an especially long, but unusually slow recovery, which may take years or decades to recover.

In the absence of any further exogenous shocks, the probability is tilted towards a shallow recession, as evident by a still arguably robust labour market. A deep recession is typically characterised by an unemployment rate north of 10%, far from the current 3.7% rate. Interestingly amidst the jumbo rate hikes, the Fed still sees the possibility of a ‘soft landing’ of the economy, though admittedly, chances of it have narrowed2.

Sector performance and recession

The stock market tanked in 2022 after a record performance , with the restarting of the global economy in 2021, following the COVID-19 pandemic.

With the end of an era of easy money, investors should avoid stocks that are still loss-making businesses, such as growth start-ups. Exposure to these stocks follow trend investing, which looks at sectors that are expected to boom in the future.

Thanks to the era of easy money during the past two years, trend investing has paid off, unicorns (new privately-owned companies with more than $1 billion valuation) were able to thrive, with some even having valuations on par or exceeding traditional giants.

However, as the Fed tightened monetary policies, these companies had it the hardest with the abrupt cut off to access to cheap money as valuations were reset due to higher interest rates. This is evident in the IPO and SPAC spaces, where volumes have drastically reduced since the boom in 2020.

- SPAC liquidations top US$12 billion in 20223 – exponentially higher since 2020

- Global IPO volumes fell 44% YoY4

From the chart below, we can see that the IPO and SPAC indexes have been underperforming on the broad base index, the S&P500.

Outperformance of S&P 500 over SPACE and IPO indexes

Outperformance of S&P 500 over SPACE and IPO indexes

This stands in contrast to companies with tangible products that are still reporting earnings that beat forecasts, along with a rosy forward guidance. Please refer to the POEMS’ thematic page of ‘World Leaders’ in each industry for examples – both TSMC (TSM.US) and Walmart (WMT.US) gave stronger than expected guidance56.

Historically, defensive sectors such as healthcare, utilities, energy and consumer staples tend to fare better during a recession7. The logic is simple, during a recession, household discretionary spending decreases while spending on daily necessities stays constant therefore these sectors perform better amidst a market downturn.

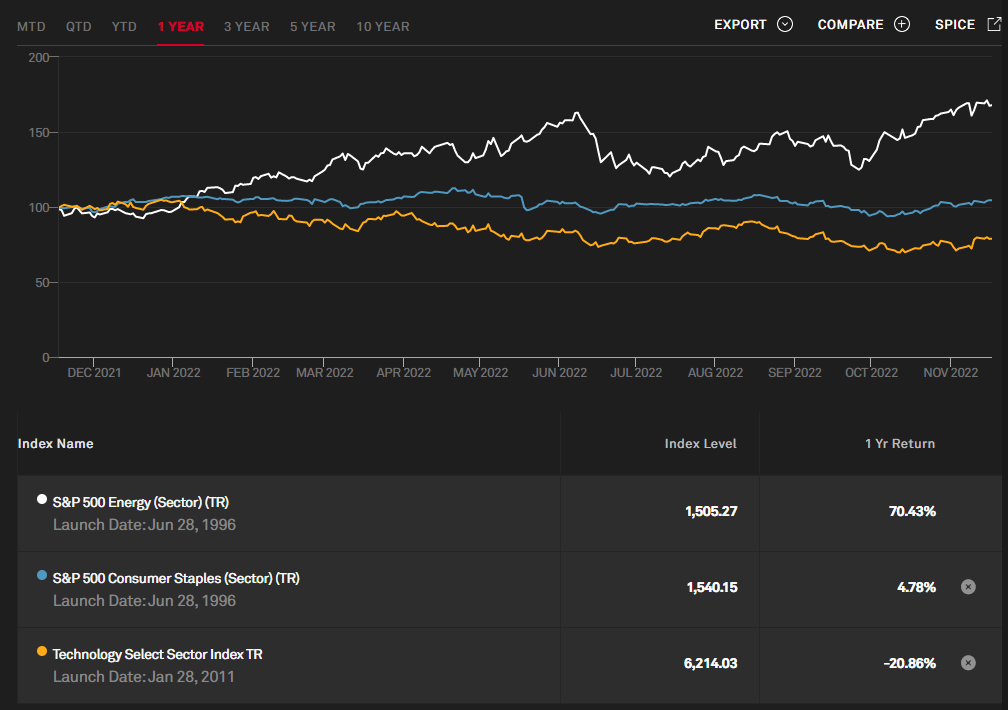

From the chart below, the cyclical technology sector underperformed, when compared to the consumer staples and energy sectors.

Underperformance of technology vs Energy and Consumer staples

Underperformance of technology vs Energy and Consumer staples

Thus it would be wise to position your portfolio defensively and pick quality companies during a downturn in the economy. Companies with quality balance sheets are better insulated from exogenous shocks to the economy, especially during a downturn.

POEMS Foreign Blue Chip companies is US (Unsponsored ADR)

Did you know that POEMS offers trading in blue chip companies that are traded on the US OTC market as unsponsored ADRs? When a company is termed blue chip, it means that it has a national reputation for quality, reliability and the ability to operate profitably in both good and bad times. The list of companies that POEMS offer are market leaders in their respective sectors and are also listed on their local exchanges. With the exception of FNMA.US and FMCC.US, these companies have a market capitalisation of over US$100 billion, which we term as large cap stocks.

Below is the list of counters available for trading.

| Stock Name | Symbol | Market Cap(USD ‘bil) | Share price(USD) |

| FANNIE MAE | FNMA.US | 2.8 | 0.48 |

| FREDDIC MAC | FMCC.US | 1.5 | 0.47 |

| TENCENT HOLDINGS LTD-UNS ADR | TCHEY.US | 374.8 | 39.12 |

| NESTLE SA-SPONS ADR | NSRGY.US | 317.2 | 115.33 |

| MEITUAN-UNSP ADR | MPNGY.US | 111.8 | 40.57 |

| NIPPON TELEGRAPH & TELE-ADR | NTTYY.US | 97.3 | 26.85 |

| IND & COMM BK OF UNSPON ADR | IDCBY.US | 199.1 | 9.48 |

| BANK OF CHINA-UNSPN ADR | BACHY.US | 118.5 | 8.5 |

| PING AN INSURANCE ADR | PNGAY.US | 106.3 | 11.32 |

*Data as of 17th November 2022

Many of the counters from the list are unsponsored ADRs. Predominantly, the difference between an unsponsored ADR and a sponsored ADR such as BABA.US, is that the latter is issued in collaboration with a foreign company while the former is established without the company’s cooperation.

Benefits of trading these counters:

- take advantage of trading before earnings release the next day

- access to stocks listed in markets that retail clients may not have easy access to

- lower trading cost in the US vs the primary listing market

- Ability to invest in 1 ADR vs 1 trade lot such as 100 shares in the primary market

Even without a company’s cooperation, a depository entity can issue ADRs (termed unsponsored ADRs) when there is a demand for ownership in a company from abroad. These depository entities are typically large investment banks that own common stocks in the foreign company. That being said, regardless of whether they are being sponsored or not, all ADRs must still be registered with the Securities and Exchange Commission.

Additionally, since there is no consent from the foreign company when issuing the unsponsored ADRs, there could be several issues for the foreign company. The POEMS’ list only offers the most liquid ones for ease of trading.

Do note shareholder benefits and voting rights may not be extended to the holders of these unsponsored ADRs. Furthermore, ADR fees may still be charged by the depository bank to cover the cost of issuing an ADR.

POEMS is looking to expand the list of tradable US OTC counters in the future.

Reference:

- [1] https://www.chicagofed.org/publications/chicago-fed-letter/2018/404

- [2] https://www.reuters.com/markets/us/feds-powell-soft-landing-chances-have-narrowed-2022-11-02/

- [3] https://www.cnbc.com/2022/10/19/spac-liquidations-top-12-billion-this-year-as-sponsors-grapple-with-tough-market-new-buyback-tax.html

- [4] https://www.ey.com/en_gl/news/2022/09/global-ipo-market-continues-to-plummet-as-q3-draws-to-a-close

- [5] https://www.cnbc.com/2022/07/14/tsmc-q2-2022-chipmaker-posts-record-profit-and-strong-guidance.html

- [6] https://www.cnbc.com/2022/11/15/walmart-wmt-earnings-q3-2023.html

- [7] https://www.forbes.com/sites/qai/2022/08/12/what-industries-do-well-in-an-l-shaped-recession/?sh=68d2703e404e

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Lee Yong Heng

Assistant Manager

Yong Heng joined Phillip Securities in June 2020 as an Equity Dealer in the Global Markets Team. He specializes in the US and Canada markets assisting clients and supports the UK and Europe markets. Yong Heng graduated with First Class Honours from Singapore Institute of Management, University of London (SIM-GE) in 2015 with a bachelor’s degree in Economics & Finance. He also completed his CFA studies in 2019.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile