Four Black Swans and one Grey Swan for 2022 (Revised June 2022) July 18, 2022

Summary

A black swan is an extremely rare event with severe consequences. It cannot be predicted, though many claim it should be anticipated1.

A grey swan is a term used to describe a potentially significant event which may be predicted beforehand with a small probability of occurrence2.

Here, we explore four potential black swan events and a positive grey swan event:

1. Inflation.

2. Oil

3. Afghanistan

4. Cyberterrorism

5. Grey Swan sighted! Possible all-time high for Chinese technology stocks

So far in 2022, while the world has barely gotten back on its feet after a prolonged stretch of the COVID-19 pandemic, the Russia-Ukraine3 conflict and fears of run-away inflation4 threatened to knock it back down.

While the two events may differ from the COVID-19 pandemic in how they affect the world in general, they are nonetheless of tremendous significance and should be addressed.

In this mid-year revision of the article, we will take another look at the four black swans and one grey swan events to determine how things may shape up for the rest of this year.

The fluidity of such events underline why it is important to prepare for black swan occurrences that cause market crashes due to their sudden, overwhelming and unpredictable nature.

Start trading on POEMS! Open a free account here!

1. Runaway all-time-high Inflation

According to Investopedia5, the highest year-over-year inflation rate was 29.78% in 1778. In the period of time since the introduction of the Consumer Price Index (CPI), the highest inflation rate observed was 19.66% in 1917. A black swan event will see the inflation rate surpass previous highs.

For this year (2022), the US consumer price index rose 8.6% in May, the highest increase since December 19816.

The Federal Reserve seeks to control inflation by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates to slow the economy and bring inflation down7.

The next question is how did we get to such high inflation?

While there may be several factors responsible, two standout events contributed to the current levels of inflation. Namely the Russia-Ukraine conflict and the massive COVID-19 pandemic quantitative easing.

After the start of the Russia-Ukraine conflict, the European Union’s leaders reached an agreement to ban most Russian crude imports by the end of the year8. As Russia is one of the biggest suppliers9 of crude oil to the world, it will inevitably affect the supply-demand balance.

While the Russia-Ukraine conflict affects the supply side of the oil equation (reducing supply), pent-up demand from the world yearning for travel after a prolonged lockdown affects the demand side (increasing demand). Oil prices are therefore looking to stay elevated for the foreseeable future.

Secondly, the US government responded to the major global shock of 2020 with unprecedented stimulus. The mismatch between government revenue and spending has now gone to a potentially reckless situation. The national debt is now approaching USD30 trillion, spirals out of control10.

The reality is, it is unlikely that the US will pay off its debt in a meaningful way. As interest rates rise, interest payments to service this debt will likely be unmanageable. National debt servicing was a record USD585 billion in 2019.

This record was when their debt was under USD24 trillion and interest rates averaged about 2%. Today, the US debt is about 25% higher, but with interest rates being lower, this mitigates the debt cost for now11.

If the Fed is forced to raise interest rates substantially to combat inflation, it risks raising the cost of the enormous debt burden, creating a debt trap. Rate hikes due to the financial crisis have had dramatically negative consequences, hammering equities markets and inhibiting growth.

The last thing the Fed could wish for today is repeating that mistake and having to court recession.

The key takeaway is that, while there will be interest rate increases in the near future, the main concern is whether the increases will be sufficient enough to combat inflation.

A potential worry is that inflation may spiral out of control as the Fed’s hands are tied as to how much interest rates can be raised.

You may wish to read our other related articles: 3 ways to invest during inflation article, Is inflation good or bad for stocks?, FOMC Meeting: What happens when interest rates rise?

2. USD200 oil per barrel

Petrol prices, this year, have hit another record high as oil and gas costs soar amid disruption fears from the Russia-Ukraine conflict. Oil prices jumped above USD130 a barrel at one point, the highest level seen in almost 14 years12.

While Electric vehicles (EV), clean energy and their adoption are all the rage (which are essentially oil-killers), they will not be widely adopted unless countries and companies have the necessary infrastructure in place.

For example, charging stations will need to be widely available for EV usage and solar panels need to be priced at a substantially lower cost for the general public to make use of them.

While in the long term, EV use, battery technology and clean energy will hurt the oil industry, these products are the next-decade trends.

Around 295,700 battery vehicles were sold in the US in 2020 according to statista13, with the value representing only around 2% of total US vehicles sales14.

Simply put, EV sales will need to grow 500% to 1,000% next year alone to cause any impact to oil demand. EV sales will grow eventually no doubt, but it will not happen soon.

In the interim, as the Russia-Ukraine conflict prolongs and affects global supply, oil prices will continue to be elevated.

This will lead to the next black swan event.

3. Geopolitical tensions: Afghanistan (+ Russia-Ukraine Conflict)

In August 2021, only days after the US military withdrew from Afghanistan, the Taliban took control of the country and stationed themselves in Kabul15.

Since regaining control, the Taliban have taken actions reminiscent of their brutal rule in the late 1990s. They have cracked down on protestors, reportedly detained and beaten journalists and generally threatened to set back Afghanistan, which had made progress after the US invasion.

International observers remain concerned that they will support terrorist organisations, posing a threat to regional and international security.

Afghanistan could again become a safe haven for terrorists capable of launching attacks against the US and its allies.

As reported by the Financial Times16, China and Russia – two of the US’ staunchest rivals – are both poised to move in to fill the void left behind by Washington in the region.

With the withdrawal of the US military presence from Afghanistan, we have indeed entered a new era of geopolitical uncertainty.

Adding fuel to fire, the Russia-Ukraine conflict this year17 has further increased geopolitical tensions.

While the world is distracted by the current Russia-Ukraine conflict and runaway inflation, terrorism will garner lesser attention and have even lesser resources accorded.

Additionally, as noted by some international observers, the Russia-Ukraine conflict likely emboldened certain countries such as Myanmar18 and China19 in their geopolitical stances.

This will only add on to the distraction.

In short, the environment for terrorism to breed could not be more ideal. Afghanistan could become the prefect breeding ground for a more radical, determined, better supported and funded terrorist leader to emerge.

Unlike the 2001 attacks which were conducted relatively in-silo by the al-Qaeda terrorists, the next terrorist attack could be a well-coordinated multipronged attack on the US by its rivals coming together.

Which brings us to the next possible black swan event.

4. Mother lode of cyberterrorism

Before Russia-Ukraine conflict began, western intelligence agencies had warned of potential cyberattacks that might severely cripple networks and further warned of “spillage” damage on global computer networks20.

Elsewhere, another example of a cyberattack saw disruptions to gasoline stations across Iran, which led to long lines outside gas stations21. In Tel Aviv, a well-known broadcaster was shocked to find intimate details of his sex life, and those of thousands stolen from an L.G.B.T.Q dating site and uploaded on social media22.

While we may chuckle while reading about these incidents that stem from a longstanding covert cyberwar between Israel and Iran, they do present very real dangers to all.

Unlike the 9/11 attacks on the US World Trade Center, cyberterrorism, or cyberattacks are not limited by geography. In other words, no one is truly safe from them.

In a Congressional testimony from the FBI in 2014, the FBI stated that virtually every national security threat and crime problem the agency has faced in recent times is either cyber-based or facilitated.

Its testimony titled “Worldwide Threats to the Homeland,” stated:

We face cyber threats from state-sponsored hackers, hackers for hire, global cyber syndicates, and terrorists. They seek our state secrets, our trade secrets, our technology, and our ideas – things of incredible value to all of us. They seek to strike our critical infrastructure and to harm our economy.

Given the scope of the cyber threat, agencies across the Federal government are making cybersecurity a top priority. The Department of Justice, including the FBI; the Department of Homeland Security; the National Security Agency; and other US Intelligence Community and law enforcement agencies have truly undertaken a whole-of-government effort to combat the cyber threat23.

One year after these remarks from the FBI, at a 2015 technology conference, Admiral Michael Rogers, at the time director of the National Security Agency and the US Cyber Command, cited some of the cyber threats that concerned him the most from a national security perspective:

- Cyberattacks that do infrastructure damage – “It is only a matter of ‘when’ that someone uses cyber as a tool to do damage to the critical infrastructure of our nation,” Rogers said. By that, the admiral meant the electric grid, railroad switches, traffic control systems, nuclear power plants, and more.

- Data manipulation – “Historically, we’ve largely been focused on stopping the extraction of data and insights, whether for intellectual property for commercial or criminal advantage, but what happens when suddenly our data is manipulated and you no longer can believe what you’re physically seeing?” he said24

Last year’s cyber-attacks on the Colonial pipeline25 and the software contractor SolarWinds Corp26 prompted US President Joe Biden to host a cybersecurity meeting with the heads of some of the biggest technology, energy, and finance companies.

While there were commitments from some of the companies after the meeting, it must be noted that cybersecurity needs to be a collective effort by all involved.

The COVID-19 pandemic has fast-forwarded digital adoption that would otherwise have taken a longer time under normal circumstances27. The mandatary lockdowns and stay home requirements implemented by governments worldwide means that our reliance on technology to continue daily living and performance has never been higher.

This translates directly to a high opportunity for cyberterrorism or cyberattacks.

While we cannot be sure of when, what and how the next attack will be, it pays to remind ourselves that the mother lode of all cyberattacks may just be around the corner.

5. A grey swan: Chinese technology stocks make an all-time high.

Let us end the article with a grey swan event.

While several markets enjoyed mouthwatering gains the last year, namely, the US and cryptocurrency markets, one emerging sector saw a complete bloodbath.

Chinese technology stocks in particular crashed spectacularly last year but as explained below, this sector may be ripe for a reversal.

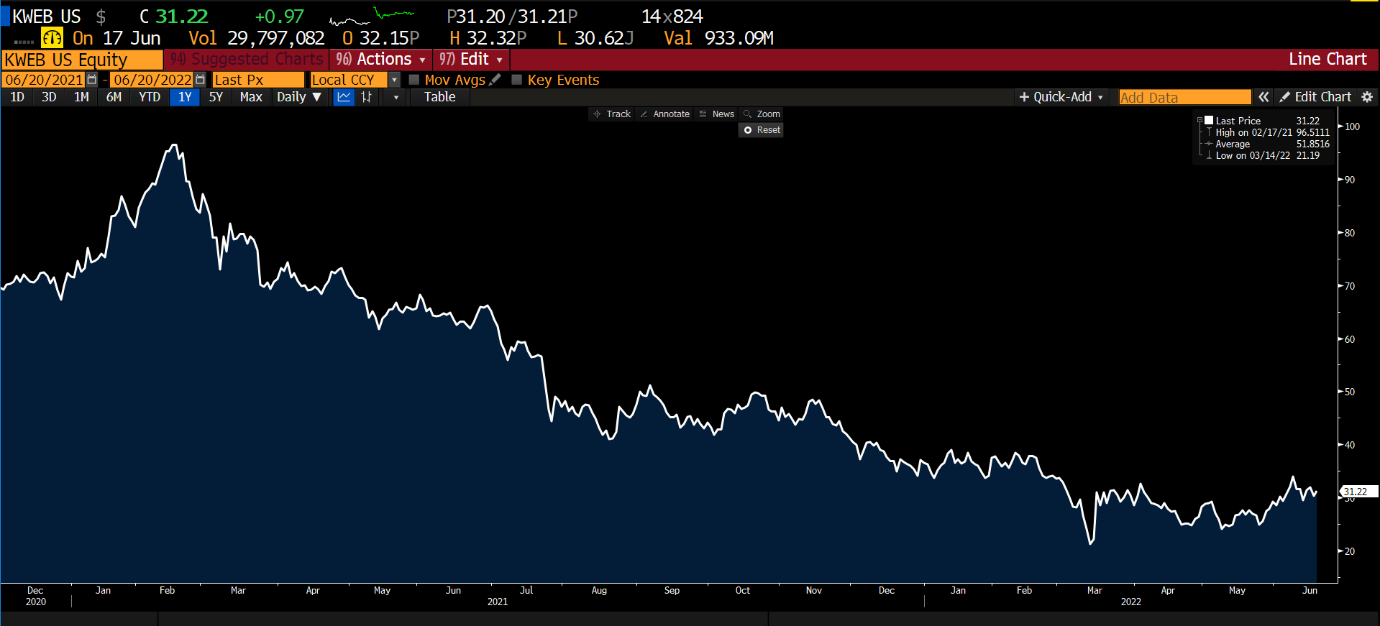

We can see this by looking at the KraneShares CSI China Internet Fund (NYSE: KWEB). This fund holds a basket of Chinese technology stocks, with the sector being down by more than 50% since peaking in February last year.

Source: Bloomberg dated 16 Jun 2022

Source: Bloomberg dated 16 Jun 2022

This decline happened due to a new wave of regulations from the Chinese government28.

Starting in November 2020 where Chinese regulators shut down Ant Group’s initial public offering at the last minute citing regulatory breaches28.

The regulators next investigated Alibaba (BABA) for monopoly-like behaviour and proceeded to slap the company with a USD2.8 billion fine – the country’s largest antitrust fine on record30.

In June 2021, a few days after DiDi Global (DIDIY) went public on the New York Stock Exchange, China’s cybersecurity arm banned new downloads of DiDi’s App in the country, accusing DiDi Global of improperly collecting and using data31.

That was not the end as Chinese regulators next took a hammer to the USD100 billion for-profit education-tech sector, banning these companies from making profits, raising capital, and going public.

The two largest companies in the space, New Oriental Education & Technology (EDU) and TAL Education (TAL), fell 54% and 71% respectively on the news. Today, both stocks are down roughly 90% from their February highs32.

When a foreign government exercises that kind of power over a group of major stocks, it frightens investors and has led many to stay away. The Chinese technology sector has become one of the most, if not, the most hated sector ever since.

There are, however, some subtle signs that this might be reversing:

- The Chinese regulators are concluding probes into DiDi Global and are preparing to allow the app back on domestic app stores this year33. Getting back on the App store is a sign that the worst of the sector’s regulatory problems are likely behind us.

- The recent move by DiDi Global to delist from the US bourses and to relist on the Hong Kong Stock Exchange34 shows its desire to get back and stay on the good side of the government.

- Another major fear in Chinese stocks has been the threat of mass delisting from the US exchanges because of the Holding Foreign Companies Accountable Act (“HFCAA”).

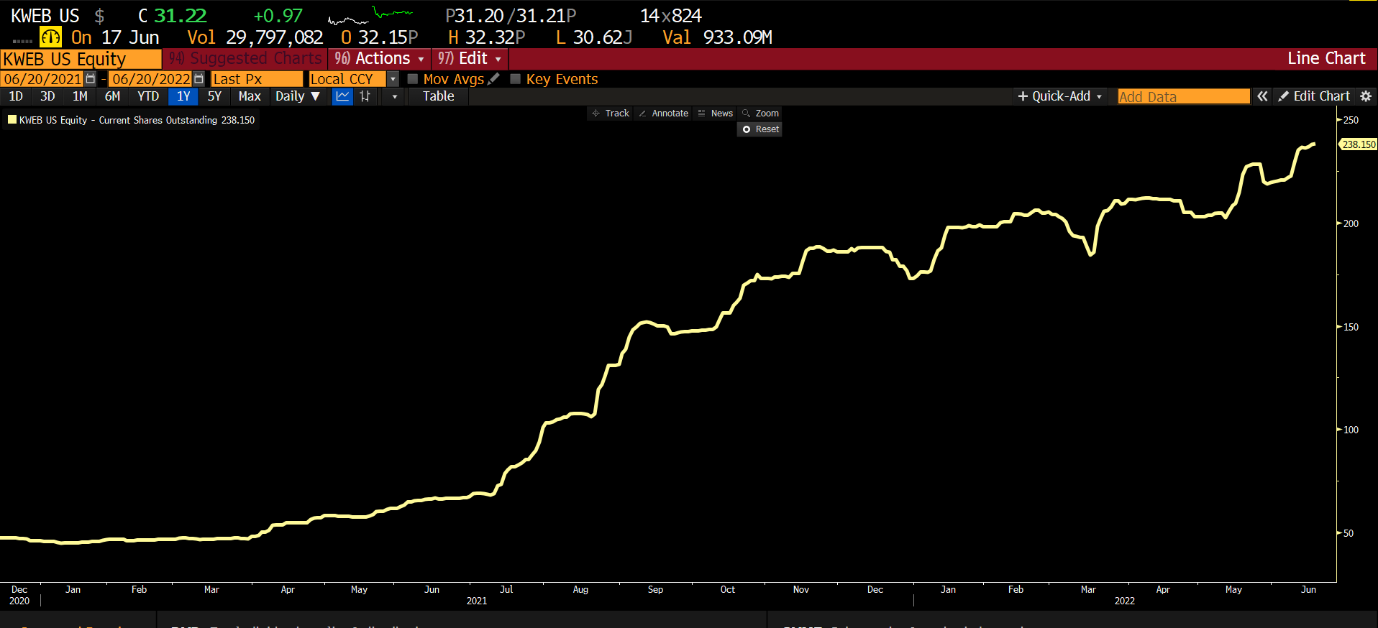

Under this act, US-listed Chinese companies require US oversight on audits. While there has been no a concrete solution as of yet, the two countries have said they are actively working on a solution35 which is widely seen as positive. - Lastly, as shown in the chart below, shares outstanding for the KWEB ETF have increased significantly. The share outstanding count for an ETF is a good indicator of investor interest. When investors are excited about an ETF, they will buy into the fund, which causes the share outstanding count to increase, indicating that investors are pouring money into the fund at a record pace36.

Source: Bloomberg 16 Jun 2022

Source: Bloomberg 16 Jun 2022

If the Chinese government does continue on this course of action for the regulation of its technology companies, investor interest will return and prices will likely rise.

What can you do to protect yourself from a black swan event?

Consider protection against black swan events like buying fire insurance for a property. You do not know when you will need it, but when you do, you will be glad you have it. You can practise regular investing by using the POEMS Share Builder Plan or Recurring Plan.

In addition, whenever there were black swan events such as a war or financial crisis in the past, gold and precious metals came to the rescue as defensive assets. Not forgetting the traditional defensive sectors, which may also help you hedge your portfolios!

To round up

Despite the uncertain macro environment, most of the management team of the companies featured in this article are optimistic of the near future. However, the Federal Reserve committee does not share the same sentiment and is greatly concerned with inflation as can be seen from the latest meeting.

Explore a myriad of useful features including TradingView chartings to conduct technical analysis with over 100 technical indicators available!

Take this opportunity to expand your trading portfolio with our wide range of products including Stocks, CFDs, ETFs, Unit Trusts and more across 15 global exchanges available for you anytime and anywhere to elevate you as a better trader using our POEMS Mobile 3 App!

Reference:

- [1] https://www.investopedia.com/terms/b/blackswan.asp

- [2] https://www.investopedia.com/terms/g/grey-swan.asp#:~:text=Grey%20swan%20is%20a%20term,low%20perceived%20likelihood%20of%20happening

- [3] https://www.cbsnews.com/live-updates/russia-ukraine-invasion-donbas-troops/

- [4] https://www.bloomberg.com/news/articles/2022-06-15/powell-sets-path-to-restrain-economy-and-stop-runaway-inflation

- [5] https://www.investopedia.com/ask/answers/112714/whats-highest-yearoveryear-inflation-rate-history-us.asp

- [6] https://www.cnbc.com/2022/06/10/consumer-price-index-may-2022.html

- [7] https://www.clevelandfed.org/our-research/center-for-inflation-research/inflation-101/why-does-the-fed-care-get-started.aspx#:~:text=The%20Federal%20Reserve%20seeks%20to,economy%20and%20bring%20inflation%20down

- [8] https://www.cnbc.com/2022/05/31/oil-prices-eu-russian-crude.html

- [9] https://www.iea.org/reports/russian-supplies-to-global-energy-markets/oil-market-and-russian-supply-2

- [10] https://www.forbes.com/sites/johnmauldin/2020/04/02/federal-budget-deficits-to-30t-and-beyond/?sh=4ca1ed6e5508

- [11] https://en.wikipedia.org/wiki/National_debt_of_the_United_States

- [12] https://www.wsj.com/articles/why-gas-prices-expensive-11646767172

- [13] https://www.statista.com/statistics/976005/battery-electric-vehicles-sales-americas/

- [14] https://www.statista.com/statistics/199983/us-vehicle-sales-since-1951/#:~:text=In%202020%2C%20the%20auto%20industry,11%20million%20light%20truck%20units

- [15] https://www.wsj.com/articles/afghanistans-taliban-seize-jalalabad-as-panic-grips-kabul-11629005282

- [16] https://www.ft.com/content/7ceb9e3b-bd6e-43fe-bb86-80353249e6ac

- [17] https://www.reuters.com/world/europe/events-leading-up-russias-invasion-ukraine-2022-02-28/

- [18] https://www.bbc.com/news/world-asia-60144957

- [19] https://www.bloomberg.com/opinion/articles/2022-04-21/russia-ukraine-war-putin-s-struggles-may-embolden-xi-s-china-on-taiwan#xj4y7vzkg

- [20] https://www.reuters.com/world/europe/factbox-the-cyber-war-between-ukraine-russia-2022-05-10/

- [21] https://www.nytimes.com/2021/10/26/world/middleeast/iran-gas-station-hack.html

- [22] https://www.nytimes.com/2021/11/27/world/middleeast/iran-israel-cyber-hack.html?campaign_id=7&emc=edit_mbae_20211129&instance_id=46487&nl=morning-briefing%3A-asia-pacific-edition®i_id=91764076&segment_id=75561&te=1&user_id=23464947dc7bad915334f0d681684e60

- [23] https://www.dni.gov/files/documents/Intelligence%20Reports/2014%20WWTA%20%20SFR_SSCI_29_Jan.pdf

- [24] https://fortune.com/2015/05/12/rogers-cyber-attacks-us-response/

- [25] https://www.bloomberg.com/news/articles/2021-06-04/hackers-breached-colonial-pipeline-using-compromised-password

- [26] https://www.straitstimes.com/world/united-states/solarwinds-hack-was-largest-and-most-sophisticated-attack-ever-microsoft

- [27] https://www.forbes.com/sites/bernardmarr/2020/03/17/how-the-covid-19-pandemic-is-fast-tracking-digital-transformation-in-companies/?sh=180531dba8ee

- [28] https://www.bloomberg.com/news/articles/2021-10-20/chinese-tech-companies-adjust-to-xi-beijing-s-common-prosperity

- [29] https://www.wsj.com/articles/china-president-xi-jinping-halted-jack-ma-ant-ipo-11605203556

- [30] https://www.bloomberg.com/news/articles/2021-04-10/china-fines-alibaba-group-2-8-billion-in-monopoly-probe

- [31] https://www.bloomberg.com/news/articles/2021-07-22/china-is-said-to-weigh-unprecedented-penalty-for-didi-after-ipo

- [32] https://www.nytimes.com/2021/07/26/business/china-private-education.html

- [33] https://www.reuters.com/world/china/china-conclude-didi-cybersecurity-probe-lift-ban-new-users-wsj-2022-06-06/

- [34] https://www.bloomberg.com/news/articles/2021-11-26/china-is-said-to-ask-didi-to-delist-from-u-s-on-security-fears

- [35] https://global.chinadaily.com.cn/a/202203/16/WS62317edaa310fd2b29e51403.html

- [36] https://etfdb.com/china-insights-channel/as-china-internet-stocks-recover-kweb-sees-inflows/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Roger Chan

Roger holds a Business Degree in Electronic Commerce from the Monash University and is also the recipient of the Golden Key Scholarship Award for outstanding academic performance. He currently heads the Global Markets Night Trading team assisting clients with the US and European markets.

Prior to the night desk, he was a bond trader at the Debt Capital Markets desk and brings with him a wealth of equity and debt market knowledge.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile