Markets Offered

US Asian Hours

What is “US Asian Hours”?

Singapore’s first trading platform launched by Phillip Securities to provide trading of specific US equities during Asian market opening hours.

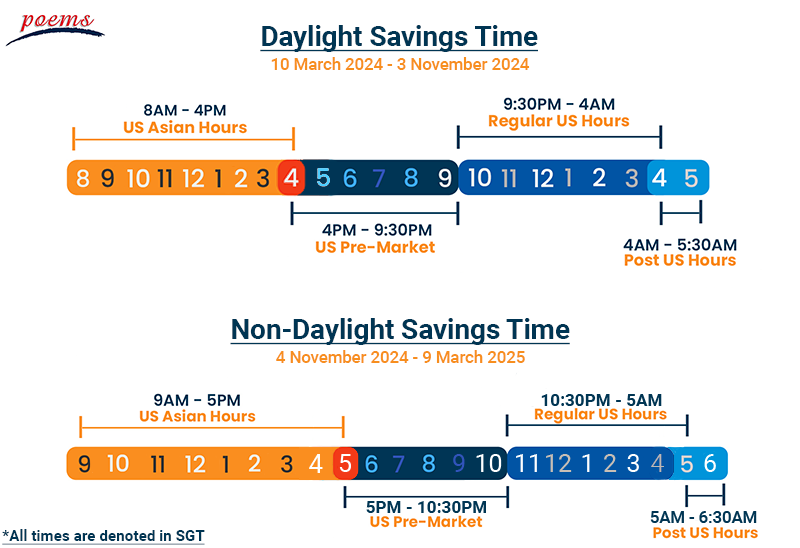

Currently, our US Pre-Market hours offer trading from 4pm – 9.30pm SGT (5pm – 10.30pm non-DST). With the launch of “US Asian Hours”, investors can trade even earlier from 8am – 4pm SGT.

This will give investors greater flexibility and convenience when trading in the US equities. They will have access to an extra 8 hours of US trading, which is not offered by any other broker! Investors can leverage this capability and take action on any market moving events that are outside of the extended hours and realise the first mover advantage that is exclusive only to POEMS clients. Furthermore, it allows for more trading opportunities via POEMS from the start of US Asian hours (8am SGT) till the end of Regular Trading Hours (4am SGT). To facilitate this, clients will be transacting with Phillip Securities as the principal and the US Asian Hours will quote bid-offers via the POEMS trading platform, so that clients can make transactions with confidence in price security.

Promotional rate is applicable to all account types including CashPlus.

CashPlus rates are not applicable for US Asian Hours

T&Cs Apply

Introduction of USAH by Lee Yong Heng from Phillip Global Markets Desk:

Alternatively, you can learn more about US Asian Hours from our Market Journal here!| Singapore Time (SGT) | 08:00am – 04:00pm (Non-DST) 09:00am – 05:00pm (DST) |

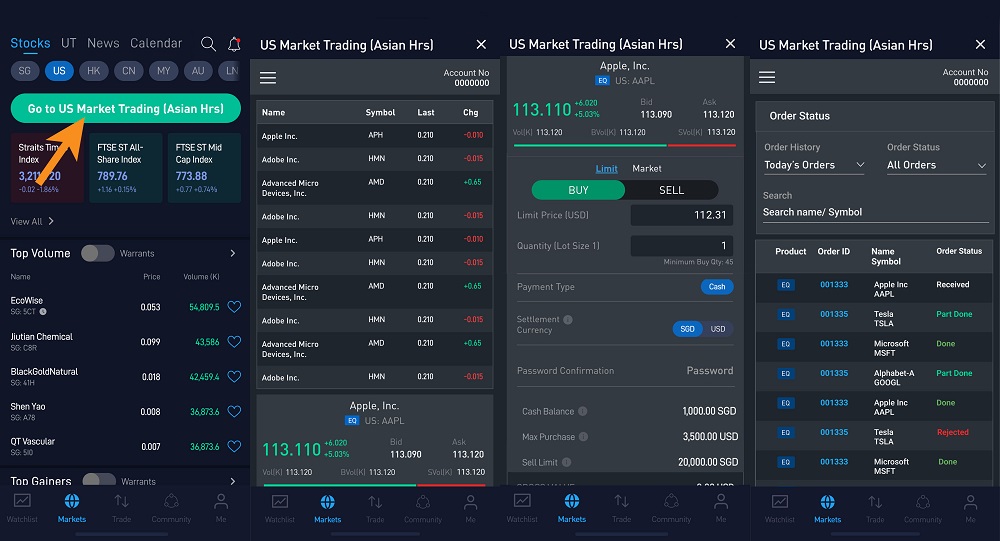

| Order Placement | Via 1) POEMS 2.0 Web 2) POEMS Mobile 3 |

| Lot Size | 1 Share |

| Minimum Order Size | USD 10 |

| Order Type1 | Limit Order, Market Order |

Trading on POEMS Mobile 3:

You can download the POEMS Mobile 3 App for iOS and Android here.

Promotional rate is applicable to all account types. CashPlus rates are not applicable for US Asian Hours.

T&Cs Apply

| Securities and Exchange Commission (SEC) Fee | 0.0008%^(sell trades) |

| Trading Activity Fee (TAF) | Applicable only for sell trades at USD 0.000166 per share, subject to maximum of USD 8.30 |

| American Depository Receipt (ADR) / Depository Receipt (DR) fee | Varies for each counter |

Custody Fees

Cash Plus Account| Starter | Premier | Privilege | |

| Foreign Share Custody Charges | Waived1 | Waived1 | Waived |

Cash Management Account

| Foreign Share Custody Charges | S$2 per counter per month (subject to max S$150 per quarter)

Waiver Condition:

|

| Settlement Date | T+2 market days |

| Settlement Currency | USD or SGD |

| Month | Day | Date | Holidays | Settlement | Trading Day |

| January | Monday | 1 January | New Year’s Day | No | No |

| Monday | 15 January | Martin L. King Day | No | No | |

| February | Monday | 19 February | Presidents’ Day | No | No |

| March | Friday | 29 March | Good Friday | No | No |

| May | Monday | 27 May | Memorial Day | No | No |

| June | Wednesday | 19 June | Juneteenth | No | No |

| July | Wednesday | 3 July | Indep. Day Early Close | Yes | Partial |

| Thursday | 4 July | Independence Day | No | No | |

| September | Monday | 2 September | Labor Day | No | No |

| October | Monday | 14 October | Columbus Day | No | Full |

| November | Monday | 11 November | Veterans’ Day | No | Full |

| Thursday | 28 November | Thanksgiving | No | No | |

| Friday | 29 November | Day After Thanksgiving | Yes | Partial | |

| December | Tuesday | 24 December | Day Before Christmas | Yes | Partial |

| Wednesday | 25 December | Christmas Day | No | No |

- W8Ben – US tax declaration form

- Risk Warning Statement (RWS) – Acknowledgement of trading in foreign listed shares

- Customer Account Review (CAR)* – To qualify for transacting in listed Specified Investment Products (SIPs) *Required for trading in ETFs

- Risk Disclosure Statement – Acknowledgement of risks trading in US (Asian Hours)

The order is less than USD 10

Minimum order size (where order size = Quantity x Bid or Ask price) must be above the gross value of USD 10. The order will be rejected if order size is below the threshold.Insufficient liquidity for this counter

Price and volume may vary at any point in time during the market making process, leading to instantaneous liquidity fluctuations during US Asian Trading Hours (8am – 4pm). Hence, market orders may get rejected due to insufficient liquidity at time of order placement.Lower liquidity

There might potentially be less trading volume, resulting in more difficulty when executing some trades.Higher Volatility

Prices can be more volatile than usual in US Asian Hours. Limited volume can make prices rise and fall more rapidly and steeply than usual. For stocks with limited trading activity, price fluctuations may be greater than during regular trading hours (RTH).Wider Spreads

Lower liquidity and higher volatility in US Asian Hours may result in wider than normal spreads.Not reflective of RTH (Regular Trading Hours) activities

US Asian hours may not be reflective of the actual trading trends/momentum of RTH trading activities due to the limited liquidity and greater volatility. There is a chance that the market may go the opposite direction when it opens.Risk of Overtrading

Bid/Ask quotes shown on US Asian Hours are dynamic, there may be a risk of overtrading. Indicative gross value shown on order confirmation page may be larger/smaller than the actual gross value done due to deviation from quoted Bid/Ask while order is placed. You can read more on the risk here Risk Disclosure Statement| Ex Date | Split Ratio | Closing Price on 01/06 | Opening Price on 02/06 on US Asian Hours | Closing quantity held on 01/06 | Opening quantity held on 02/06 during US Asian Hours |

|---|---|---|---|---|---|

| 02/06 | 10:1 | 1000 | 100 | 2 | 20 |

Dividends

Counters that go ex-dividend will not have the closing price adjusted downwards by the full amount of the dividend on ex-date.- US Asian Hours 0.08% with No Minimum Commission promotion is applicable for all POEMS account types including CashPlus account.

- The duration of the promotion will be from 19 July 2022 to 28 June 2024./li>

- This promotion is only applicable for ONLINE trades traded through POEMS suite of platforms.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and / or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, Customer acknowledges that he/she has read and consented to these Terms & Conditions.