Trade SGX-listed ETFs with no minimum commission

We are happy to announce that customers can enjoy trading SGX-listed ETFs with no minimum commissions.

With the reduction of SGX-listed ETFs lot size to 1 with effect from 17 Jan 2022, you can start your ETF investment from as little as 1 unit with no minimum commission.

Example 1: Customer invests $3000 in an ETF that has a price of $1.00 per share.

| Before 03/02/2022 | Now | |

| SGX-listed ETF traded price: | S$1.00 | S$1.00 |

| Quantity Purchased: | 3,000 units | 3,000 units |

| Gross Amount: | S$3,000 | S$3,000 |

| Commission : | S$25 (Fees calculated at 0.28% or minimum S$25, for Cash Management Account with contract value below SGD50k) | S$8.40 (0.28% x $3,000)(Fees calculated at 0.28%, for Cash Management Account with contract value below SGD50k) |

| Commission Saved:: | ||

Example 2: Customer invests $300 in an ETF that has a price of $2.50 per share.

| Before 03/02/2022 | Now | |

| SGX listed ETF traded price: | S$2.50 | S$2.50 |

| Quantity Purchased: | 120 units | 120 units |

| Gross Amount: | S$300 | S$300 |

| Commission : | S$25 (Fees calculated at 0.28% or minimum S$25, for Cash Management Account with contract value below SGD50k) | S$0.84 (0.28% x $300) (Fees calculated at 0.28%, for Cash Management Account with contract value below SGD50k) |

| Commission Saved:: | ||

Note: The above examples does not include Exchange Fee and GST.

What does this mean for you as an investor?

- Lower cost of trading

With the removal of the minimum commission, you can now maximise your investment dollars and invest them into more than 30 ETFs listed on SGX. Use our POEMS ETF Screener to locate the ETFs best suited to your investment needs. - Make full use of Dollar Cost Averaging (DCA)

With a lower cost of trading, you can now incorporate Dollar Cost Averaging (DCA) where you spread out the purchases over time instead of a lump sum purchase. You can read about the benefits of DCA here. Over at POEMS, we made it even easier for you with our Recurring Plan; plan your regular investments in a highly flexible manner such as choosing the frequency (daily, weekly, monthly and so on). - More on the Recurring Plan

On the POEMs app/ POEMs desktop, open the Recurring Plan widget. There are 2 ways you can create a Recurring Plan.

Method 1 (Step 1):

Search for your desired counter that you wish to set a Recurring Plan for. Right click on the selected counter and select “Set as Recurring Plan”

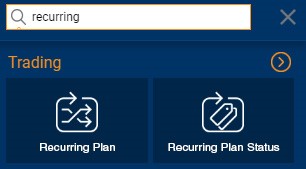

Method 2 (Step 1):

Create a new widget and search for “recurring”. Select the “Recurring Plan” and search for the counter using the search bar.

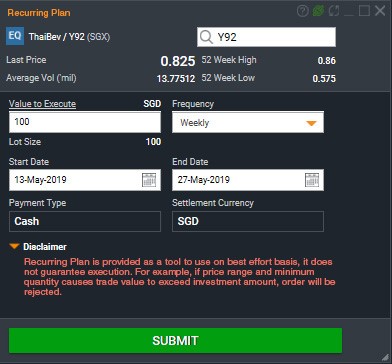

Step 2:

Key in the value, frequency, start date and end date of the Recurring Plan that you wish to place. Key in your password and submit.

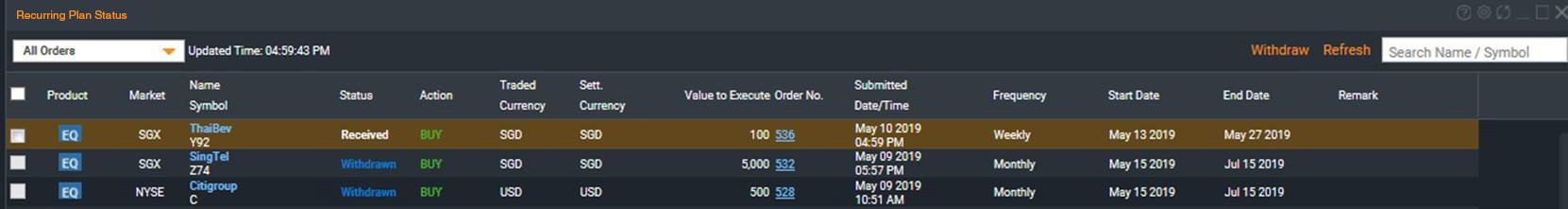

Step 3:

Check the order status under the “Recurring Plan Status” widget to ensure that the details are correct

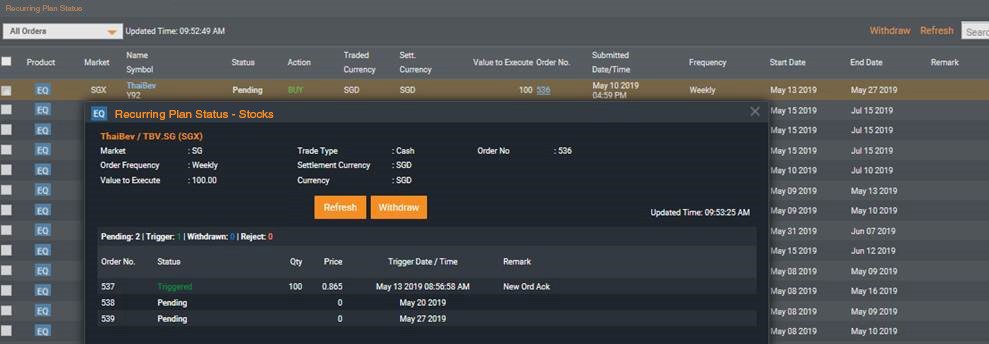

Step 4:

Click on the Parent Order number to view details of the Child Order status. The Child Order status will indicate “Triggered” if the order has been successfully sent to the market on the actual trigger date.

Step 5:

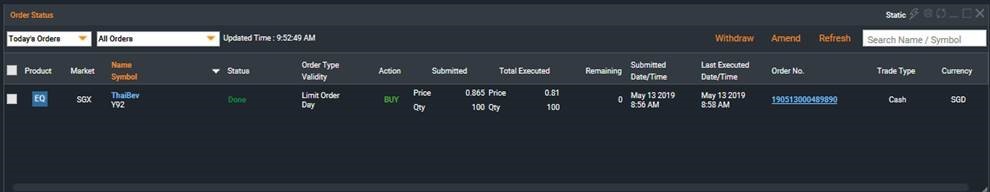

Open the Order Status widget to view the quantity and actual price executed for the Child Order. The contract will be created the next day, and you will be able to view it under the Account Management Widget.

If you have further enquiries, please contact your trading representative or make an appointment to visit the nearest Phillip Investor Centres near you.

Alternatively, you can email us at etf@phillip.com.sg or visit our ETF page.

Terms and Conditions for “No minimum commission for SGX listed Exchange Traded Funds (“ETFs”)” Promotion:

- No minimum commission rates for SGX-listed ETFs are applicable for all POEMS Trading Accounts from 3 Feb 2022 onwards. For standard rates, please refer to the respective account pricing.

- This promotion is only applicable for ONLINE trades traded through POEMS suite of platforms available on SGX listed ETFs.

- Applicable for Cash, CPF and SRS trades.

-

The following persons are not eligible to participate in those promotions unless approved by the management of Phillip Securities Pte Ltd (“PSPL”):

- PSPL institutional Customers and corporate Customers

- PSPL Account holders whose Accounts have been suspended, cancelled or terminated

- All employees of PSPL and its associated entities; PSPL and all its subsidiaries

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and / or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and / or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, Customer acknowledges that he/she has read and consented to these Terms & Conditions.