- Home

- Option Trading

Options Trading

Why Trade Options

Generating Income Regardless of Whether the

Markets Are Bullish or Bearish

Bullish on a particular stock? Buy a call option and earn when the stock prices grow.

What about when you feel bearish on a particular stock? Buy a put option and earn when stock prices fall.

Diversify Your Portfolio with Options

We are all too familiar with the ‘don’t put all your eggs in one basket’ term. With options, you have access to more sectors and a more diverse spread and exposure for a smaller amount of capital, even within your preferred sector.

In addition, diversifying your exposure will also assist in hedging against losses mentioned in the above stated scenarios.

Position Hedging to Minimise Potential Downside Risk and Limit Potential Losses on Other Open Positions

For example, if you own some stocks in your POEMS Account and are concerned about the fluctuation in pricing of this particular stock, or if the markets will turn bearish, you can consider using options to hedge.

In this scenario, buying a put option, with the strike price near the stock entry price covers some losses(or stock current trading price to protect the gains), while risking the cost of buying the put option only.

Limited Risk

When you buy options, you limit your risk to just the premium that you pay, which is a fraction of the cost of the underlying stock. Furthermore, it also helps to reduce the cost of holding a stock by allowing you to sell higher call options to earn premium.

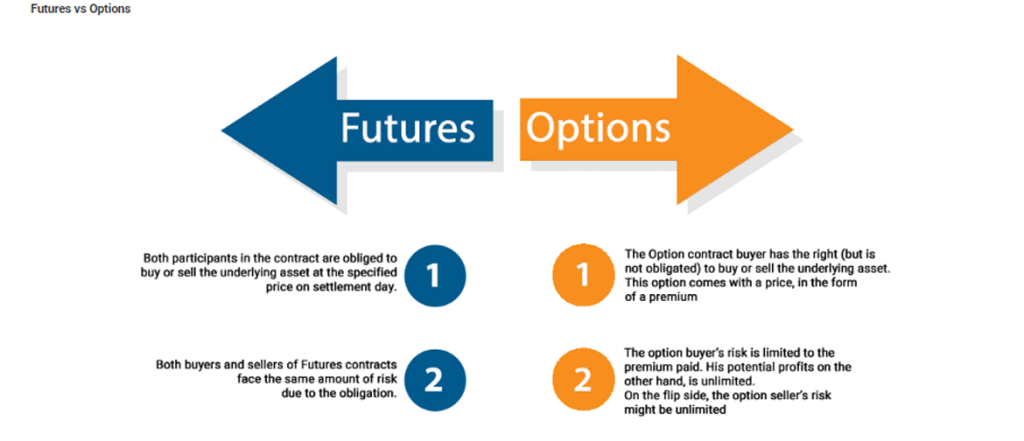

What is an Option?

When you buy options, you limit your risk to just the premium that you pay, which is a fraction of the cost of the underlying stock. Furthermore, it also helps to reduce the cost of holding a stock by allowing you to sell higher call options to earn premium.

The buyer of the option has the right but not the obligation to buy or sell the underlying asset within the specified time.

The seller of an option does not have such rights and can only assume the obligation as stipulated in the contract.

An Example

When purchasing a new car, you would have to purchase precautionary insurance plans before driving in it.

When you purchase an insurance policy — be it an automobile, health, life or homeowner’s insurance — you will need to pay a premium for the protection it provides.

This mimics that of an option buyer.

However, just like what we experience in life, we end up not putting the insurance to use, resulting in the profiting of the Insurance firm,

This mimics that of an Option Seller

Basic Options Strategies

- The stock falls below the strike price of the call and the call option expire worthless.

- The stock trade above the strike price and either

- exercise the option and buy the stock at the strike price and profit from the higher current market

- close out the long call position in a profit.

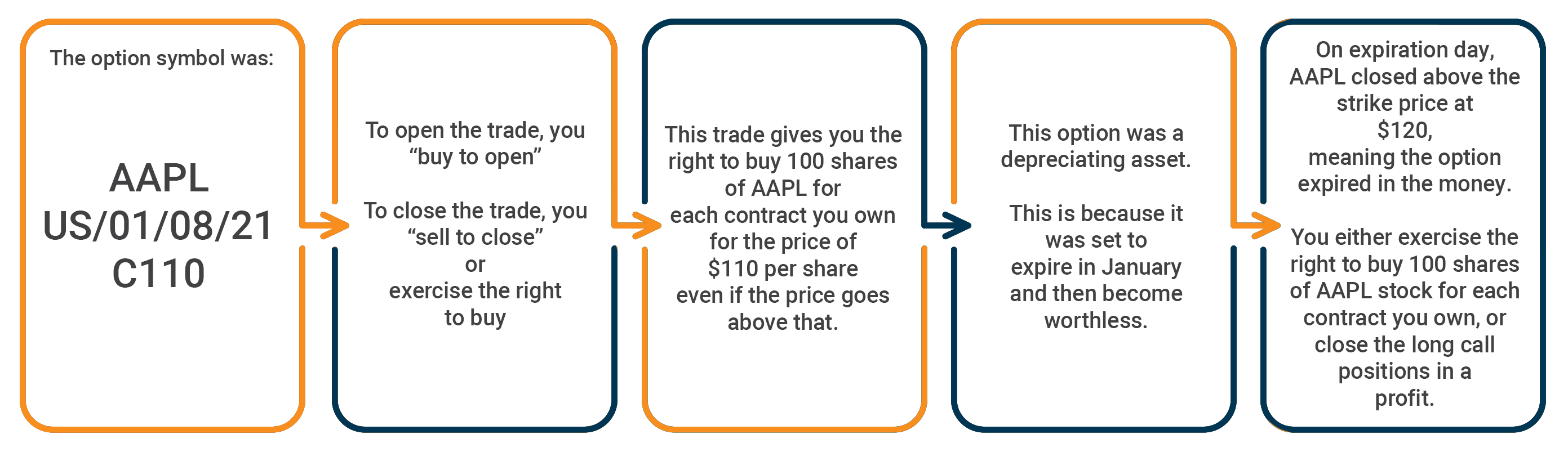

Long Call Trade Example

The trade was the Apple (AAPL) January 8th $110 Long Call (AAPL US 01/08/21 C110). You paid $139 ($1.39 x 100 shares) when you long the call and, at expiration, the option was in the money. The seller is obligated to sell the stock to us on Jan. 8, 2021, or you may close the long call position in a profit. Below are the details of the trade broken down step-by-step.

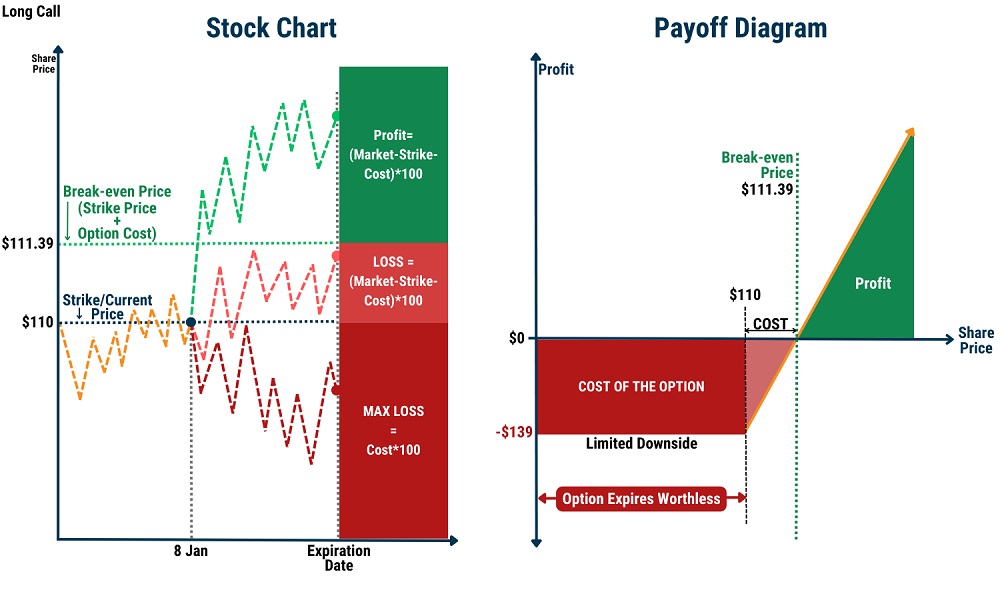

Long Call Stock Chart and Payoff Diagram

The Calls below can be employed with a Long Call Strategy:

The Calls below can be employed with a Long Call Strategy:

- Deep OTM Call

- The option will be cheap as it is deeply OTM. The investor may employ this low cost strategy to profit when the option moves ITM.

- The risk that the option will expire worthless is great but therein lies the potential for a large return.

- Deep ITM Call

- This is an alternative to buying the shares outright while profiting from the same underlying stock price movement.

- A Call that is deep ITM has delta value that is close to 1, which means it will mimic the price movement of the underlying closely i.e. if the price of the underlying moves by $1, this will result in a very similar price movement in the option value as well.

- The investor may employ this strategy to benefit from the leveraging nature of options, you may also see LEAPS below.

- The stock trades above the strike price of the put and the put option expire worthless.

- The stock fall below the strike price and

- exercise the option and sell the stock at the strike price and profit from the lower current market

- close out the long put position in a profit.

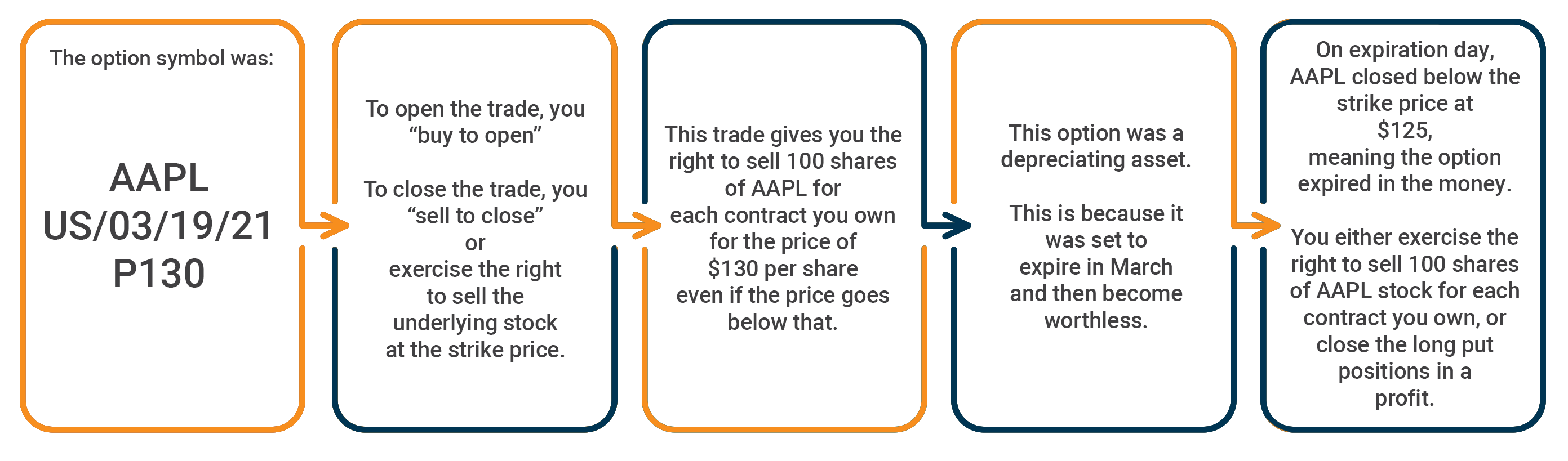

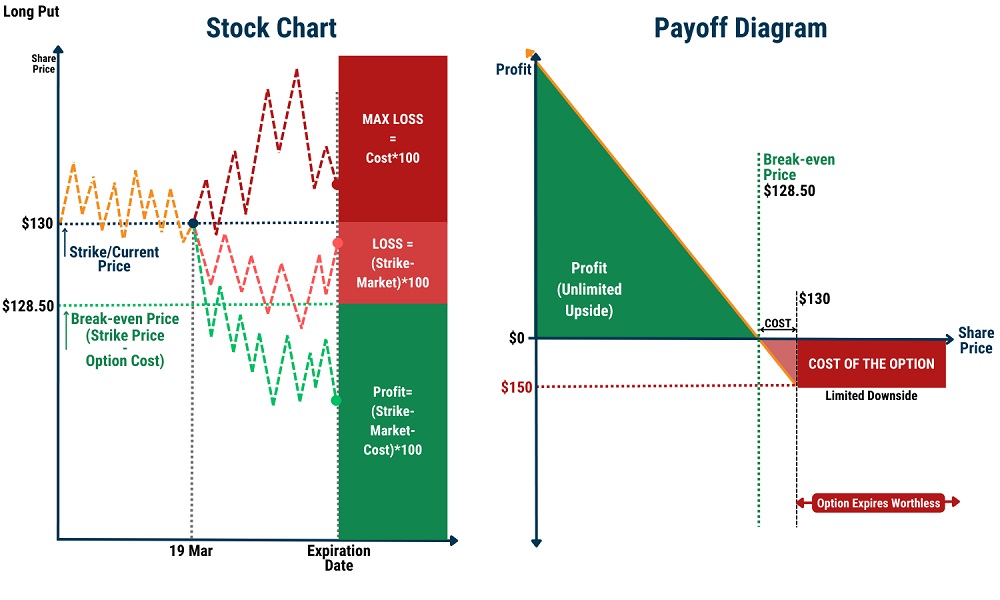

Long Put Trade Example

The trade was the Apple (AAPL) March 19th $130 Long Put (AAPL US 03/19/21 P130). You paid $150 ($1.50 x 100 shares) when you long the put and at expiration, the option was in the money. The seller is obligated to buy the stock from us on Mar. 19, 2021, or you may close the long put position in a profit. Below are the details of the trade broken down step-by-step.

Long Put Stock Chart and Payoff Diagram

A long put can be combined with a stock purchased previously to form a Protective Put.

This is a form of insurance against a decline in stock price which may result from events such as poor Earning Release or short-term bearish sentiment on the stock.

Protective Put Trade Example

Trade: Apple (AAPL), 19 March, $130 Long Put (AAPL US 03/19/21) bought and combined with the underlying stock holding of 100 shares of AAPL trading at $130. Near-term volatility or bearish sentiment may cause AAPL stock price to decline below $130 and cause a loss in the investment of the AAPL stock.

This decline however, will result in the AAPL Long Put to be more valuable and ITM hence offsetting the loss. Investors may close out the long put position in profit or “put” 100 shares of AAPL to the obligated seller at the exercise price of $130.

A covered call strategy involves selling an option to collect premium as income. For this strategy you will need to have the underlying stock before executing the strategy. Selling a call obligates you to sell 100 shares of a stock, which would be a bad idea if you don’t already own the stock. After all, you’d have to go out and buy 100 shares on the open market and then sell them back to the option buyer. But if you already own shares of the underlying stock, you wouldn’t have to buy shares to sell to the call buyer.

The shares you already own would “cover” the call you sold, hence the term “covered call.” Covered calls are ideal for generating income on stocks you already own. Rather than letting the stocks sit idle in your equity account, it can be used to generate extra income by doing covered calls on top of also profiting from the increase in price of the underlying stocks.

Stocks with high volatility (such as Tesla, Alibaba,) are great with generating more income due to the volatility priced into the option premium. This strategy can be utilise to generate constant income by rolling forward on the covered call contracts (ie. Extending the expiry date). Do take note if the covered calls expired ITM, the underlying needs to be delivered at the exercise price.

There are two potential outcomes when selling a call option:

- The stock rises past the strike price and the call seller is obligated to sell 100 shares of the stock for the strike price.

- The stock does not rise past the strike price and the call expires worthless, allowing the seller to keep the entire premium. Most of the time, we will buy back a call write that is out of the money and has lost most of its value.

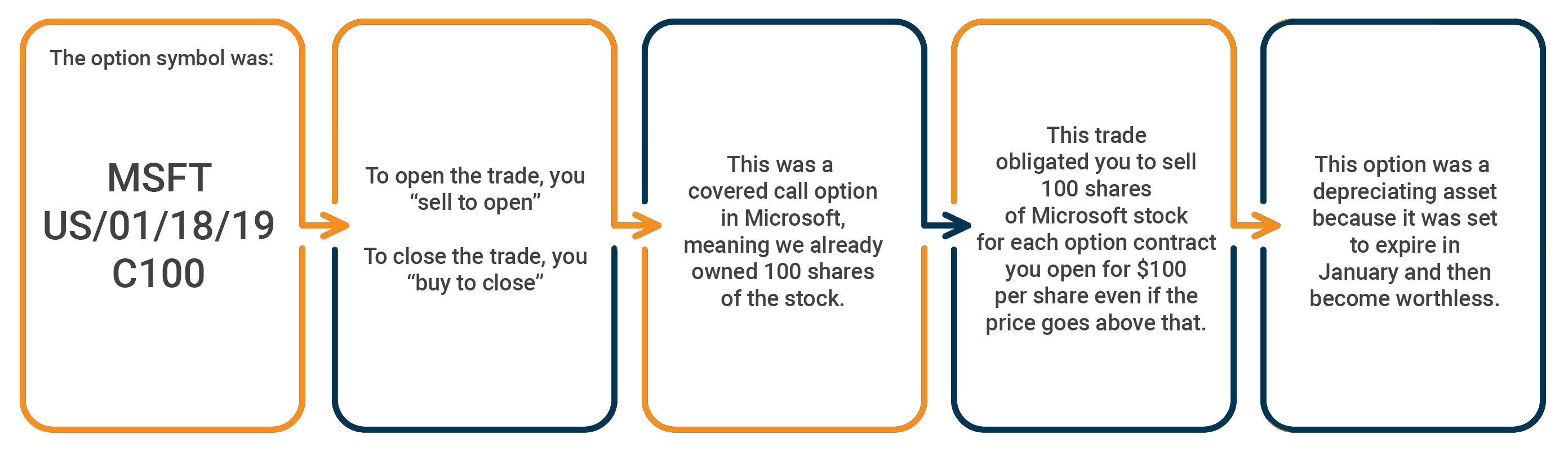

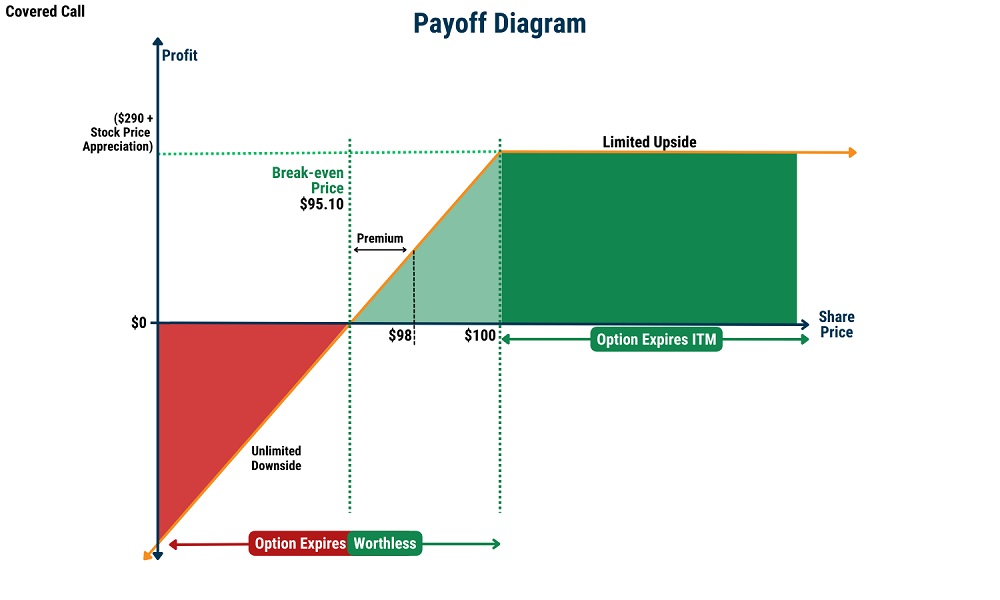

Covered Call Trade Example

(1)The trade was the Microsoft (MSFT) January 18th $100 Covered Call while your average cost for MSFT stock is at $98. You earned ($2.90×100 shares) when we sold the covered call and, at expiration, the call expire worthless if MSFT trade below $100.

Below are the details of the trade broken down step-by-step. The trade was a covered call trade in Microsoft with an expiration date of Jan. 18, 2019. We expected the stock stay below $100 through expiration.

(2) The trade was the Microsoft (MSFT) January 18th $100 Call Write while your average cost for MSFT stock is at $98. You earned ($2.90×100 shares) when you sold the covered call and, at expiration, the option was in the money.

The buyer call the stock from us on Jan. 18, 2019, but we still got to keep the $290 in premium we received for selling the option.

Below are the details of the trade broken down step-by-step.

Covered Call Payoff Diagram

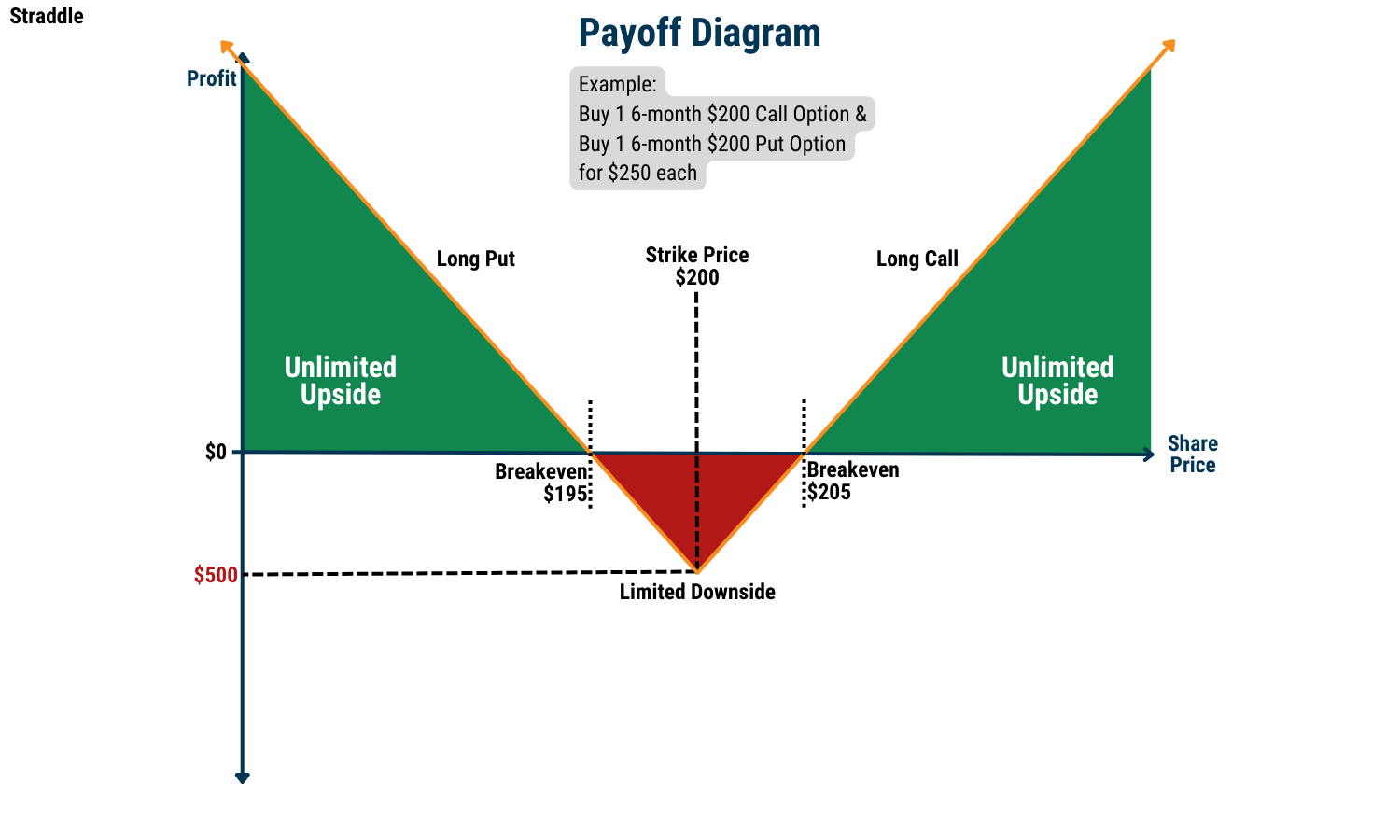

Straddle

A long straddle strategy involves both a Long Put and Call on the same underlying same strike price with the same expiration date.

The primary motivation behind this strategy is to profit from drastic movement (in either direction) of the stock price. This can take place during Earnings Announcements, where results might be unpredictable, potentially resulting in a huge impact on the stock price, causing it to deviate greatly.

Straddle Trade Example

Trade: Tesla (TSLA), 28 April, Long Call (TSLA US 04/28/23 C200) and Long Put (TSLA US 04/21/23 P200) bought with the underlying stock price of TSLA trading at around $200. On 27 April, TSLA announced a better (or worse) than expected Earnings results, causing TSLA stock price to move drastically.

This movement caused the Long Call (or Put) to be deep ITM, the position can be closed out in profit. Due to the drastic changes in price, the position that was deep ITM will cover for the initial investment in both Long Call and Put.

*Do note that volatility spikes that take place prior to earnings announcements will mean that the cost of options are usually more expensive and the resultant volatility post-announcement may result in a loss even though the options position moved ITM.

Straddle Payoff Diagram

Straddle Variants

There are multiple variants to the Straddle Strategy:

Strangle

Buy both Long Call and Long Put, with the strike price of the Call HIGHER than that of the Put. This will result in a lower premium paid (OTM options are cheaper than ATM/ITM options). The drawback to this would be that the price movement would have to be even more drastic for the position to be profitable.

Strip

Buy both a Long Call and Long Put with the quantity of the Put HIGHER than that of the Call (e.g. Long 1 Call and 2 Puts). This strategy relies on drastic stock price movement(s), biased towards a decrease in stock price.

Strap

Buy both a Long Call and Long Put with the quantity of the Put LOWER than that of the Call (e.g. Long 2 Calls and 1 Put). This strategy relies on drastic stock price movement(s), biased towards an increase in stock price.

LEAPS – Long-term Equity Anticipation Securities

LEAPS are long-term options that are still at least a year from expiration. They behave identical to that of other options, only difference being the longer expiration date. Besides the longer shelf life, LEAPS will also be deep ITM with a delta value of 0.80 or higher (-0.80 for Puts) at the chosen strike price. The high delta value essentially allows the LEAPS option to behave similarly to a stock in terms of price movement, for example a 0.80 delta option will move $0.80 for a $1 move of the underlying stock.An Example of LEAPS

AMZN stock is currently trading at $100, a LEAP option will be one where the expiry date is a year or more away and the option strike price chosen has a delta of 0.8 or more. For example, if today is 10 February 2023, the chosen AMZN call option has an expiry at 10 December 2025, a strike price of $50, delta value at 0.93 and currently trades at $60. Whenever the stock price moves $1, the option will move $0.93 or more depending on the delta. We see that the option price moves with a 93% similarity to the stock itself and investors using much less capital for the position.Brokerage

Commission and Brokerage Charges

| Commission | $0.88 per contract subjected to minimum $2.88 per order |

|---|---|

| Securities and Exchange Commission (SEC) Fee | 0.0008% (sell trades only) |

| Trading Activity Fee | Applicable only sale of an option at $0.00279 per contract. Applicable only for sell trades at $0.000166 per share, subject to maximum of $8.30 (for Assigned calls/ Exercised Puts on the underlying) |

| Option Regulatory fee (ORF) | $0.02685 per contract |

| OCC Clearing Fees | $0.02 per contract, subject to maximum of $55 per trade |

| Exercise/Assignment Fee | $2.00 per exercise/assignment. |

Note: Goods & Services Tax (GST) will be applied to commission charges and pass through fees. Commission and exchange fees may be subject to change without prior notice.

Trading Details

Minimum trade size: 1 contract which generally covers 100 underlying shares

| Action | Requirement |

|---|---|

| Long Call | Option premium |

| Long Put | Option premium |

| Short Call | Underlying asset |

For positions that are unable to meet the obligation of the Option contracts (including auto-exercise) with the exposure risk deemed as excessive, one of the below scenarios will happen. Any proceeds will be credited/debited to the client prior to the expiry of the Option.

⦁ Liquidate Options prior to expiration date

⦁ Allow the Options to lapse

⦁ Allow delivery and liquidate the underlying shares

PSPL does not allow exercising of Options. All open positions should roll forward prior to the expiry of the contract else it will be subjected to one of the above stated handling. Force liquidations related to expiration typically commence two hours before the market close, although we reserve the right to initiate this process earlier or later based on prevailing conditions.

The US Stock Option tab will only reflect positions and balance relating to US Stock Option(s). All trades are denominated in USD.

Order details

| Order Placement | Via 1) POEMS 2.0 Web 2) POEMS Mobile 3 |

|---|---|

| Trading lot(Minimum trade size) | 1 contract which generally covers 100 underlying shares |

| Live price | Via POEMS Mobile 3 or Poems Web (live Option price quote) |

| Order Type | Limit Order only |

| Minimum bid size | 0.01 (some subject to 0.05 increment bid) |

Trading Hours

| Singapore Time | 09:30pm – 04:00am (Daylight Savings Time) |

|---|---|

| 10:30pm – 05:00am (Non-Daylight Savings Time) | |

| US(Eastern) Time | 09:30am – 04:00pm |

*Order placement are allowed only during regular trading hours. Orders submitted outside of regular trading hours will be rejected, these includes orders in ETFs that trades an additional 15 minutes after regular close.

Settlement

| Option Settlement Date 1 | T+1 market days |

|---|---|

| Underlying Settlement Date 1 | T+2 market days |

| Order Amalgamation | No |

| Settlement Currency | USD only |

1. Should the due date coincide with Singapore public holiday/s – The due date will follow the traded market’s due date

Transfer Timeline

|

Stock to Option |

|

|

Cash transfer |

Same day processing if request is made before 10am SGT, else T+1 |

|

Stock transfer |

Same day processing if request is made before 3pm SGT, else T+1 |

|

Option to Stock |

|

|

Cash transfer |

T+1 processing if request is made before 10am SGT, else T+2 |

|

Stock transfer |

T+2 processing if request is made before 3pm SGT, else T+3 |

US Options Live Prices

US Options Live Price feed is available for subscription FOR FREE on the web portal if you are a non-professional investor. Each subscription will go on for 12 months, and is not auto-renewed. After a 12-month subscription period, your US Options Live Price Feed will expire. Users will have to re-subscribe if they want to continue enjoying the US Options Live Price Feed for the next 12 months (at no additional cost).

For professional investors, you can subscribe to our US Options Live Price feed at SGD $45 monthly.

Please note: if you do not subscribe to the Live Price Feed, Option prices displayed are delayed by 15-30 minutes.

Only Option prices are live. In order to have accurate IV/Delta/Gamma, investors are advised to subscribe to both US Equities and Options live prices.

Options Price Increments

There may be instances where your Option order has invalid price increments.

Below is a summary of how Option price increments are determined.

In general, most Options trade in either nickel or dime increments depending on the price of the option.

| Nickel and Dime Increments Options | |

|---|---|

| Options Price | Price Increment |

| Below US$3 | US$0.05 |

| Above US$3 | US$0.10 |

However, there are some options that trade in increments of a penny or a nickel depending on the price of the option.

| Penny Program Pricing Increments | |

|---|---|

| Options Price | Increment |

| Below $3 | $0.01 |

| Above $3 | $0.05 |

The Options Clearing Corporation (OCC) maintains a list of equity options that are part of the Penny Program.

The list can be downloaded from the OCC website here.

How to start?

How to activate stock options account (POEMS MOBILE 3 )

Video Guide

Screenshot Guide

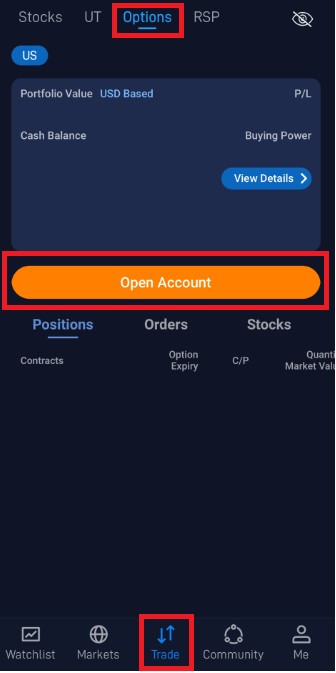

Step 1:

Navigate to (1)Trade > (2)Options and click on (3)Open Account

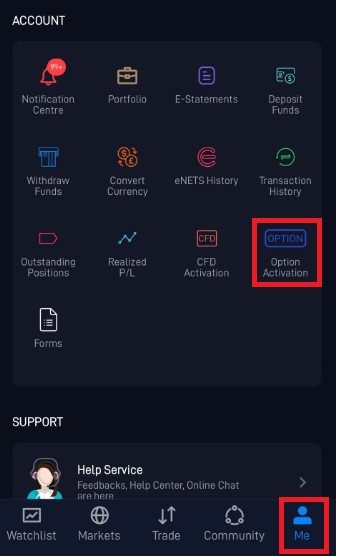

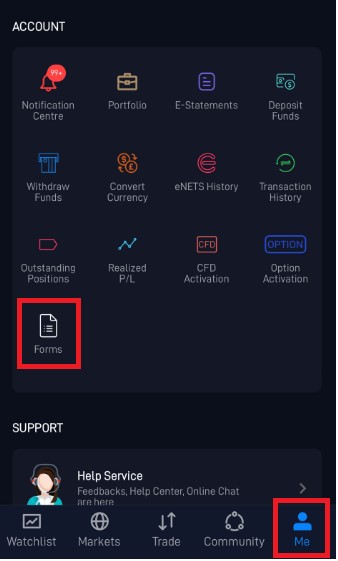

VYou can also navigate to (1)Me > (2)Option Activation to open Stock Option account

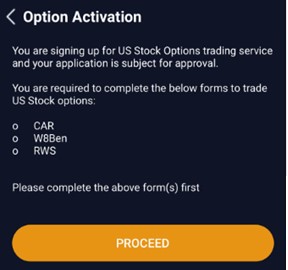

Step 2(inactive CAR/W8Ben/RWS):

Validation page for CAR/W8Ben/RWS. Click (1)Proceed to being filling up the respective forms

On click of respective forms, you will be redirected to fill up the forms.

*Do note CAR form can only be completed online on POEMS Web.

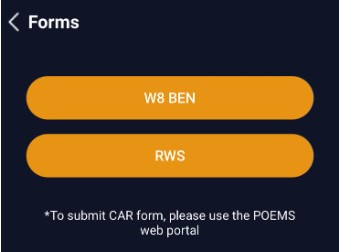

You may also submit W8Ben and Risk Warning Statement(RWS) under (1)Me > (2)Forms

Step 3(active CAR/W8Ben/RWS):

Redirect to acknowledge Option’s Risk Declaration Statement under ‘Option Activation’

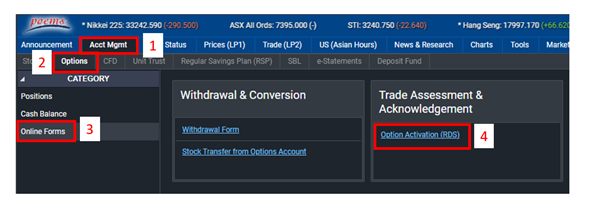

How to activate stock options account (POEMS WEB)

Screenshot Guide

Step 1: Acct Mgmt > Options > Online Forms > Options Activation (RDS)

Step 2: Upon clicking Options Activation (RDS) you will be prompt to acknowledge the risk disclosure for Options

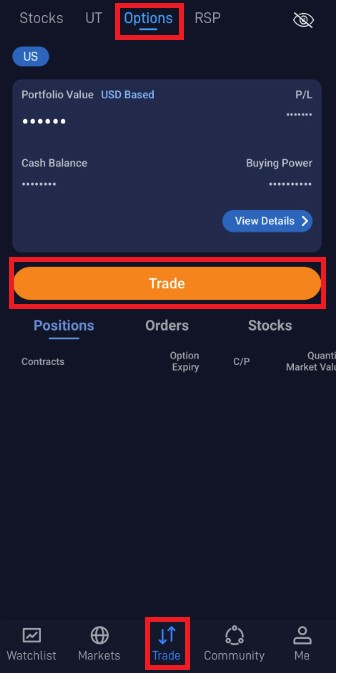

How do I place a trade? (POEMS MOBILE 3)

Video Guide

Screenshot Guide

Step 1:

To place a trade, navigate to (1)Trade > (2)Option > (3)Trade

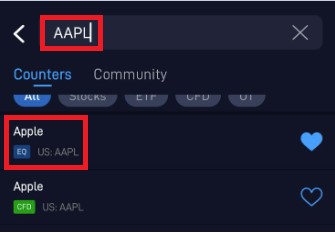

In the search bar, (1)search for the underlying counter > (2)Select the specific counter under EQ – Equity or ETF – Exchange Traded Funds respectively

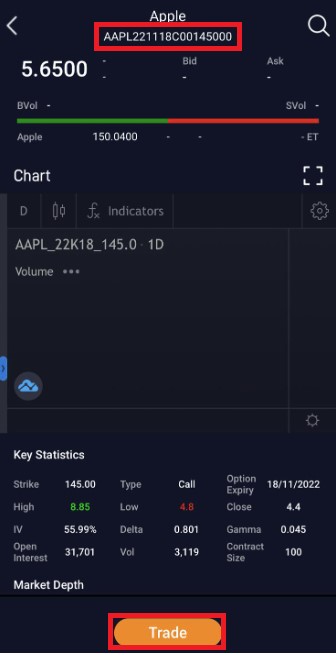

Select (1)Option and under the option page, you may choose for the (2)Options types ie. Call or Put to displayed separately or All to be displayed together. (3)Select the expiry date and the (4)Strike price respectively

(1)Show the option symbol and click on (2)Trade

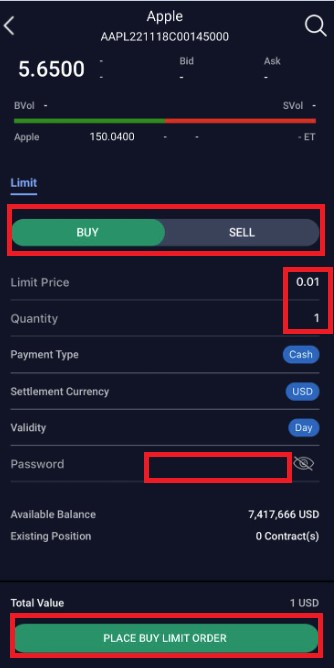

Select (1)Buy or Sell > (2)Input the limit price and quantity respectively > (3)Key in password > (4)Click on place order to submit order

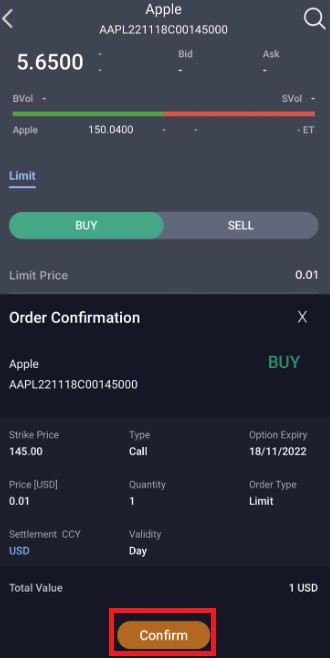

Order confirmation shown here, (1)Click on confirm to submit order

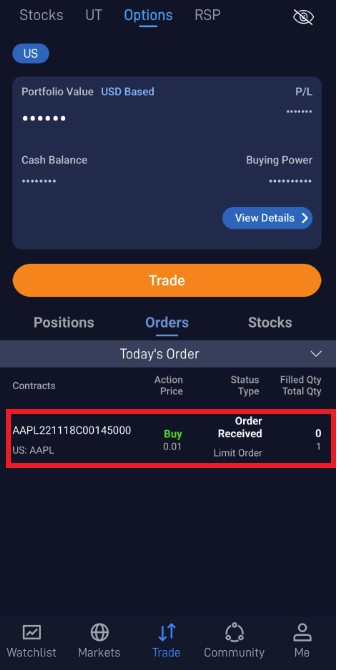

(1)Submitted order will be reflected under today’s order

How do I place a trade? (POEMS WEB)

Screenshot Guide

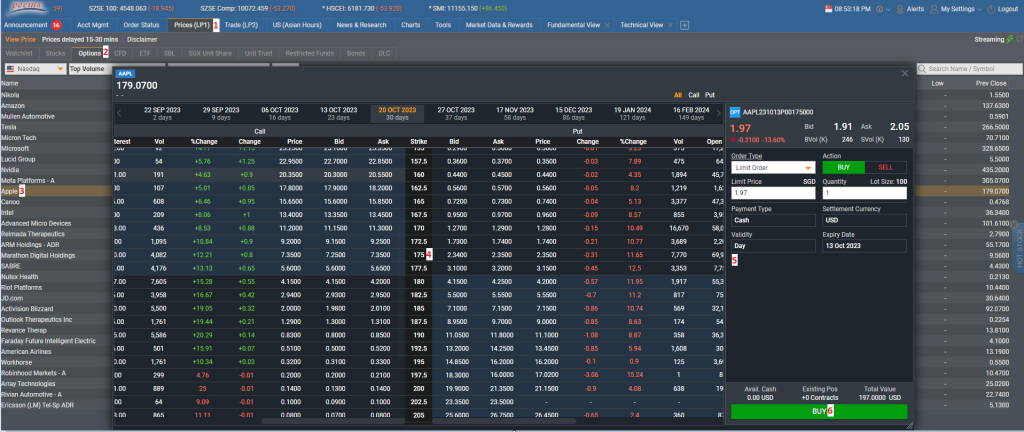

Step 1: Prices > Options > Select stock to launch Option Chain > Select contract to launch Trade Ticket > Fill in order details > Submit order

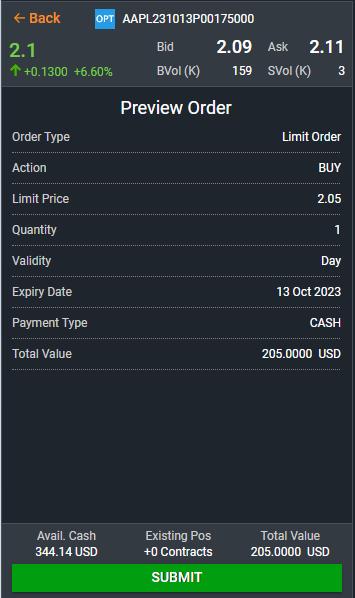

Step 2: Review order details and submit order

Corporate Actions

Special Cash Dividend

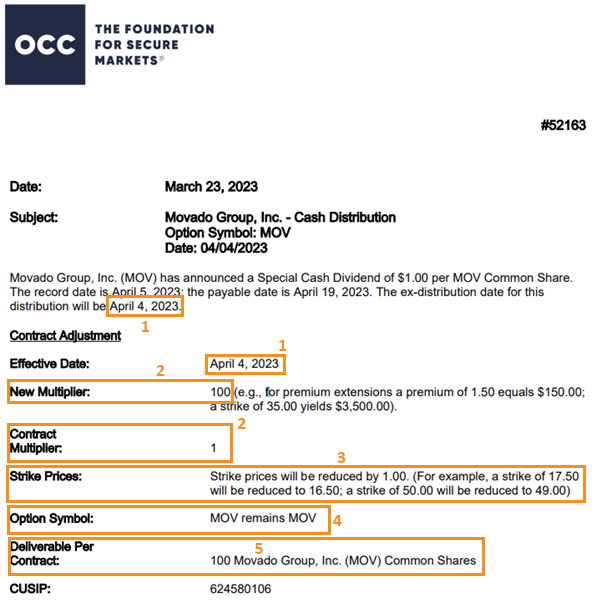

When a special cash dividend is issued, there are normally two scenarios.

Scenario A

The strike price of the options contract decreases accordingly.

The memo from OCC on MOV.US is explaining the following:

1. Options opened before 4 April 2023 will be adjusted

2. Multipliers remain unchanged

3. Strike price will all be reduced by $1.00

4. Option symbol remains unchanged

5. Deliverable remains unchanged

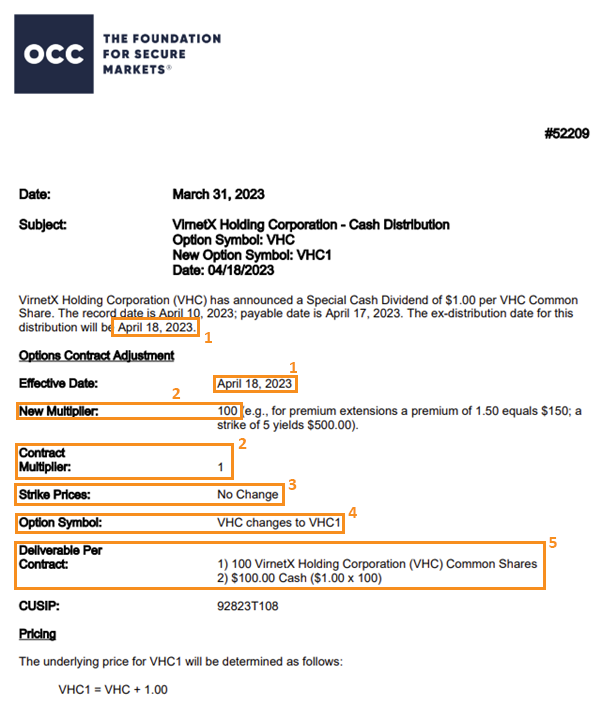

Scenario B

Strike price will remain unchanged with a change in option symbol and an additional deliverable of the cash distribution.

The memo from OCC on VHC.US is explaining the following:

1. Options opened before 18 April 2023 will be adjusted

2. Multipliers remain unchanged

3. Strike price will remain unchanged

4. Option symbol change from VHC to VHC1

5. Contract deliverable per contract will consist of:

a. 100 VHC.US common shares

b. $100 cash per contract.

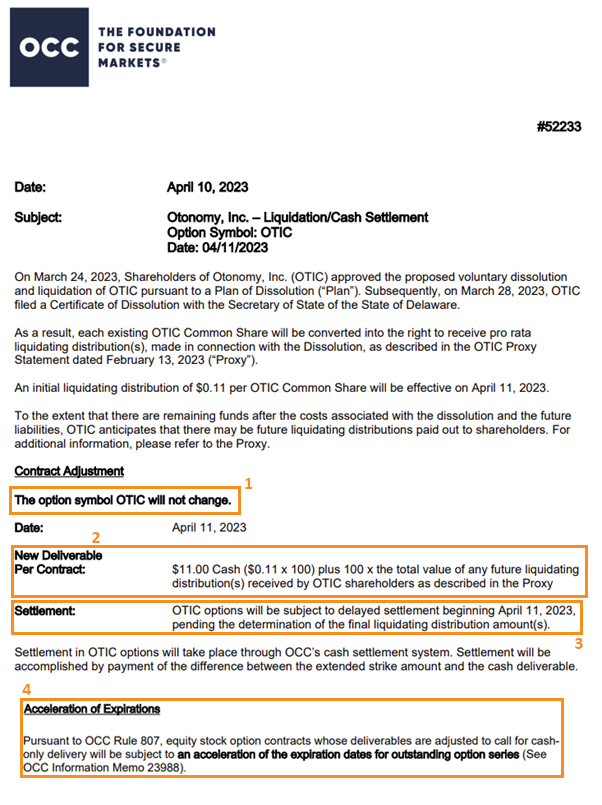

Liquidation

When the underlying stock liquidates and ceases trading in the market, the shares that make up the contract will turn into the cash-per-share amount the company allocates. Thus, the contract will be valued 100 times more than the company’s chosen pay out for each share.

Both the Symbol and Strike price will not change, but the Options Clearing Corporation (OCC) will bring forward the expiration date for the contract.

The memo from OCC on OTIC.US is explaining the following:

1. Option symbol will remain unchanged

2. Contract deliverable per contract will be $11.00 ($0.11 x 100) plus any future liquidating distributions.

3. There will be a delay in settlement from 11 April 2023

4. The expiry date of the option will be brought forward

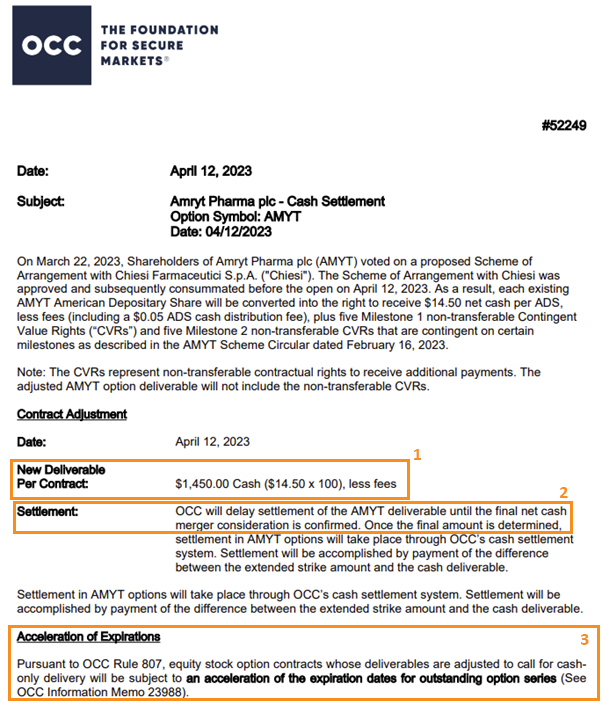

Acquisition

When the underlying stock gets acquired and ceases trading in the market, the expiration will be accelerated with the shares that make up the contract, turning into the cash-per-share amount that the company allocates.

The memo from OCC on AMYT.US is explaining the following:

1. Contract deliverable per contract will be $1,450.00 ($14.50 x 100) less fees

2. Settlement will be delayed until the final net cash merger consideration is confirmed

3. The expiry date of the option will be brought forward

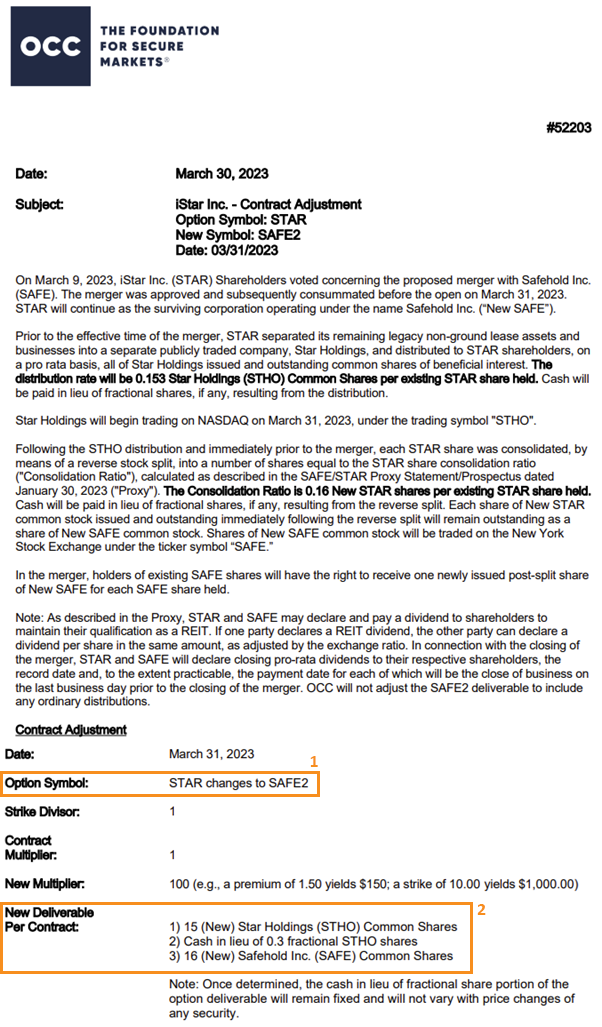

Cash and Stock Merger

In the event of a cash and stock merger, please note that the ticker of the options contract will change. The number of shares in the contract will also vary based on the merger conditions and deliverables that may include shares along with cash. Both the Strike price and Expiration date will however remain the same.

The memo from OCC on STAR.US is explaining the following:

1. Option symbol will change to SAFE2

2. Contract deliverable per contract will be:

a. 15 STHO.US common shares

b. Cash in lieu of 0.3 fractional STHO.US common shares

c. 16 SAFE.US common shares

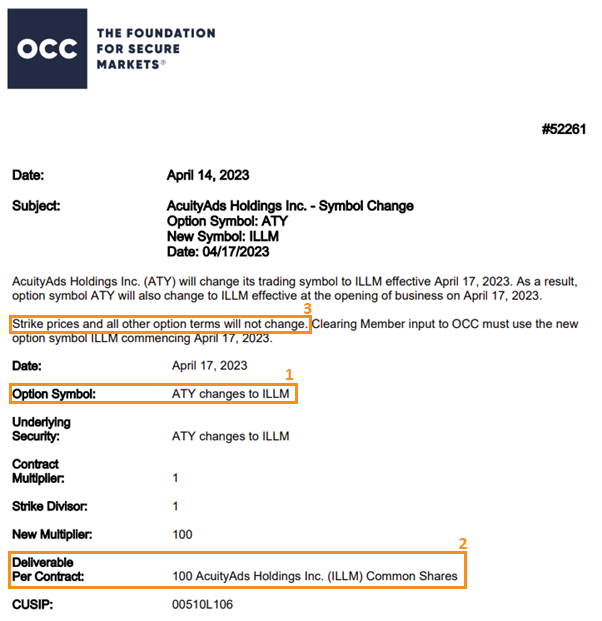

Ticker Change

During a ticker change, the Options contract will change to reflect the new ticker of the underlying stock. Both the Strike price and Expiration date will however, remain unchanged.

The memo from OCC on ATY.US is explaining the following:

1. Option symbol will change to ILLM

2. Contract deliverable per contract will be 100 ILLM.US shares

3. Strike price and other options terms will remain.

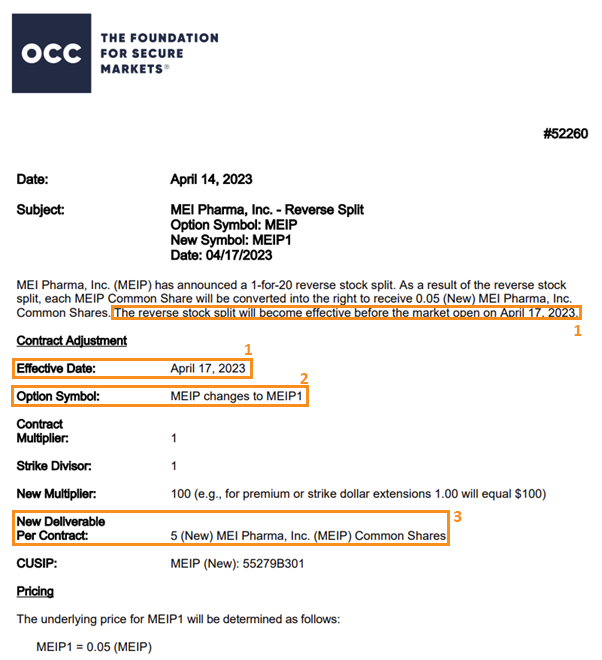

Reverse Split

During a reverse split, there will be a number that is added to the ticker of the Options contract. The number of shares in the contract will decrease based on the conditions of the reverse split. Both the Strike price and Expiration date will however, remain unchanged.

The memo from OCC on MEIP.US is explaining the following:

1. Options opened before 17 April 2023 will be adjusted

2. Option symbol will change to MEIP1

3. Contract deliverable per contract will be 5 (new) MEIP.US shares

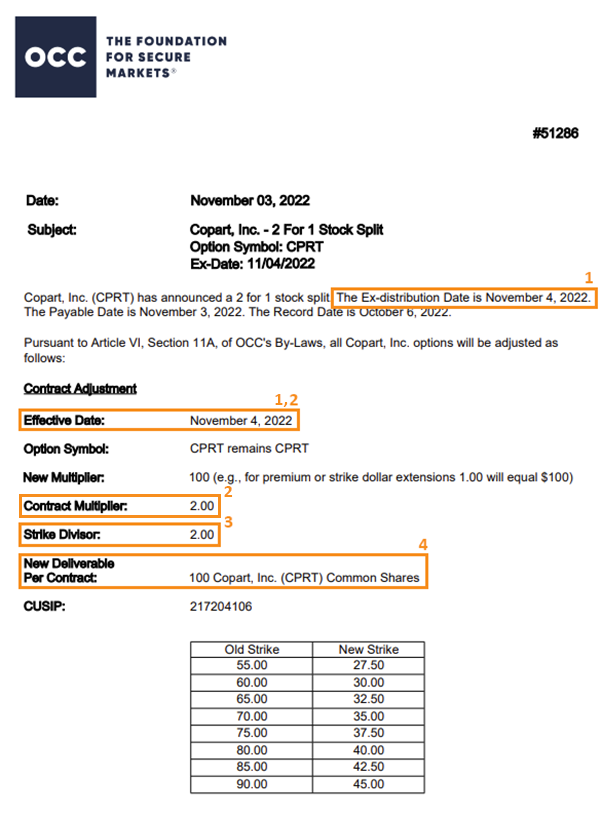

Forward Split

Forward splits are the division of the outstanding shares of a company into a larger number of shares. When a forward split occurs, there are normally two types of possible scenarios:

Scenario A

When the forward split results in a round number. (e.g. 2 for 1, 5 for 1, 10 for 1)

⦁ The ticker and expiration date will remain the same if you have Options on a stock that undergoes a forward split. The Strike price however, will be divided by the forward split multiplier.

The memo from OCC on CPRT.US is explaining the following:

1. Options opened before 4 Nov 2022 will be adjusted

2. Holders of the contract before 4 Nov 2022 will hold double the number of option contract

3. Strike price will be divided by 2. E.g. the old options contract with a strike price of $55 is adjusted to $27.50 ($55/2)

4. Contract deliverable per contract will still be 100 CPRT.US shares

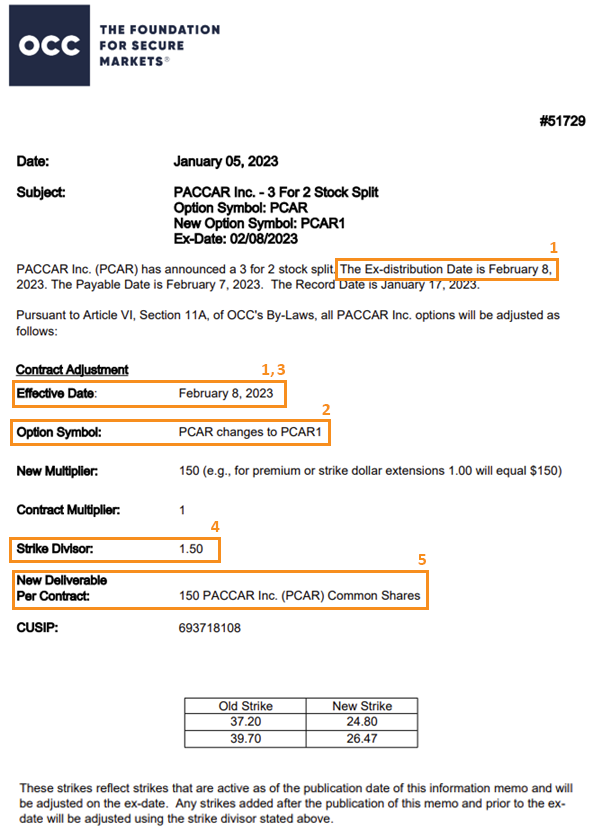

Scenario B

When the forward split does not result in a round number (5 for 4, or 3 for 2):

⦁ There is a change in symbol

⦁ Number of contracts remain the same but the deliverable of the contracts increase according to the forward split multiplier

⦁ Strike price decreases by the strike divisor

The memo from OCC on PCAR.US is explaining the following:

1. Options opened before 8 Feb 2023 will be adjusted

2. The option symbol is changed to PCAR1

3. Holders of the contract before 8 Feb 2022 will hold same number of option contract

4. Strike price will be divided by 1.5. E.g. the old options contract with a strike price of $37.2 is adjusted to $24.80 ($37.2/1.5)

5. Contract deliverable per contract will increase to 150 PCAR.US shares

Stock Dividend

When the firm pays a stock dividend, the Option’s strike price will lower and the number of deliverable shares in the contract will increase by the amount of the dividend. There will be a number that is added to the ticker of the Options contract if the firm of the underlying stock is issued a stock dividend.

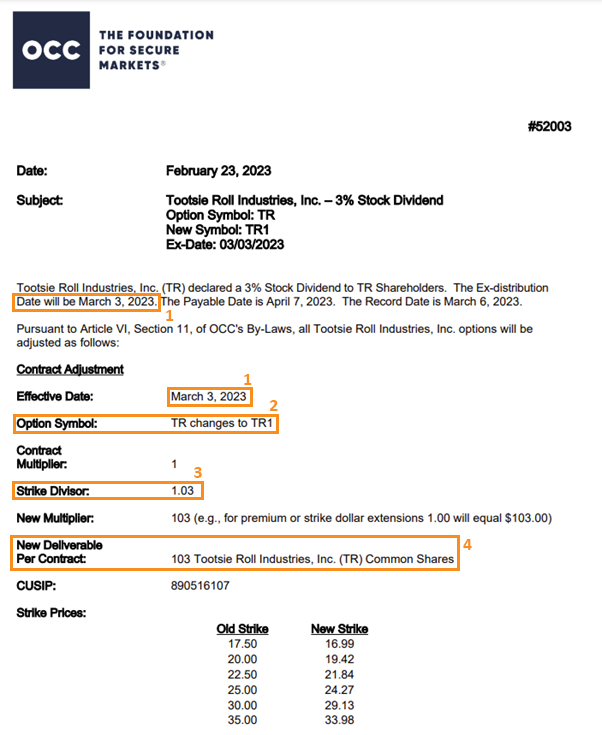

The memo from OCC on TR.US is explaining the following:

1. Options opened before 3 Mar 2023 will be adjusted

2..The option symbol is changed to TR1

3. Strike price will be divided by 1.03. E.g. the old options contract with a strike price of $17.50 is adjusted to $16.99 ($17.50/1.03)

4. Contract deliverable per contract will increase to 103 TR.US shares

Spinoff

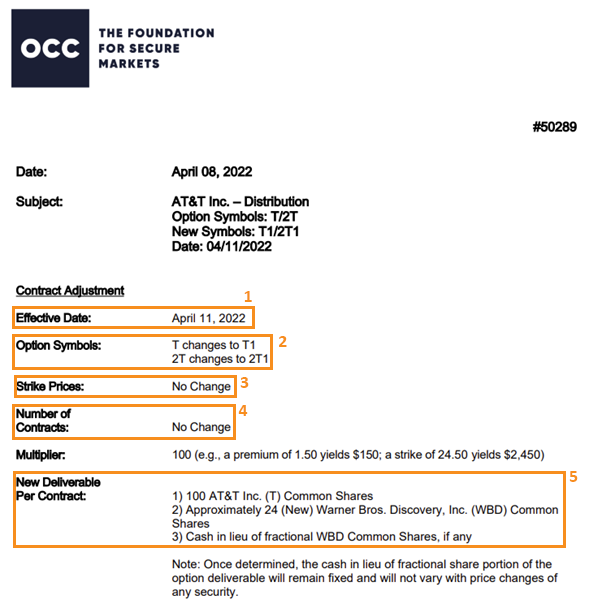

When the firm of the underlying stock executes a spinoff, the number of shares in the contract will remain the same. In addition to the existing shares, the new shares paid out by the issuing firm will be included in your contract. During a spinoff, there will be a number that is added to the ticker of the options contract.

The memo from OCC on T.US is explaining the following:

1. Options opened before 11 Apr 2022 will be adjusted

2. The option symbol is changed to T1 and 2T1

3. Strike price remain unchanged

4. Number of contracts remain unchanged

5. Contract deliverable per contract will consist of;

a. 100 T.US shares

b. 24 WBD.US shares

c. Cash in lieu

Frequently Asked Questions

Options 101

How are options classified?

Options are broadly classified into ‘Call’ and ‘Put’

Call: Is a contract that allows the option buyer (after paying an option premium) to have the right but not the obligation to buy the underlying asset (typically 100 shares) at the strike price within a specified time. The seller of the option (after receiving an option premium) is obligated to sell the underlying asset to the buyer at the exercise price if the buyer exercises his right.

Put: Is a contract that allows the option buyer (after paying an option premium) to have the right but not the obligation to sell the underlying asset (typically 100 shares) at the strike price within a specified time. The seller of the option (after receiving an option premium) is obligated to buy the underlying asset from the buyer at the exercise price if the buyer exercises his right.

How do I make sense of an option symbol?

AAPL211903P00120000

or

AAPL US 03/19/21 P120

- AAPL US: the symbol of the underlying asset (Ordinary APPLE shares)

- 03: month of expiration

- 19: day of expiration

- 21: year of expiration

- P:Put (C if it is Call)

- 120: strike price of the contract

What are the moneyness of options?

ITM: In-the-money options are those options that have intrinsic value if exercise

- Calls with strikes below where the underlying is currently trading

- eg. Call strike: 100, Current underlying price: 120 (Call < Underlying)

- Puts with strikes above where the underlying is currently trading

- eg. Put strike: 100, Current underlying price: 80 (Put > Underlying)

ATM: At-the-money options are those options that have a strike price closest to where the underlying asset is currently trading at

- Call/Put with strikes roughly the same where the underlying asset is currently trading at

OTM: Out-of-money options are those options that have no intrinsic value if exercise

- Calls with strikes above where the underlying is currently trading at

- eg. Call strike: 120, Current underlying price: 100 (Call > Underlying)

- Puts with strikes below where the underlying is currently trading at

- eg. Put strike: 80, Current underlying price: 100 (Put < Underlying)

What are the Greeks in option trading?

Delta: measure the change in the price of an option with a $1 change in the price of the stock. Delta for call range between 0 to 1 while for put range between 0 to -1.

- E.g. Delta of 0.5 means if the underlying stock increase in price by $1, the option price will rise by $0.5.

Gamma: reflects the rate of change in the delta in response to a $1 change of the underlying stock price.

- E.g. Gamma of 0.1 means if the underlying stock price increasse by $1, the option delta will increase by a corresponding 10%.

Vega: measure the price sensitivity of an option to changes in the volatility of the underlying stock.

- E.g. Vega of 0.2 means if the implied volatility of the option increase by 1%, the option price will increase by a corresponding $0.2.

Theta: also known as time value of option measure the rate of decline in the value of an option due to the passage of time.

- E.g. Theta of 0.9 means the option price will decrease by $0.9 per day till expiration.

Rho: measure the rate at which the price of an option changes relative to a change in the risk-free rate of interest i.e. U.S Treasury bill’s risk-free rate.

- E.g. Rho of 0.2 means the option price will increase by 0.2 for 1% increase in the risk-free rate.

Greeks are dynamic and will change throughout up till expiration of the option.

What are the risks involved in trading options?

The risks from buying Options (if you decide not to sell them before expiration) are that they will expire worthless, assuming they are out-of-the-money. On expiry, if the Option is ITM by 0.01 or more, it will be auto-exercised by the OCC. Post auto-exercise, the underlying stock price may have drastic price movement(s) during the extended hours trading hours, which in normal circumstances warrant the position to be OTM. As such, for positions that are delivered/taken, delivery may experience a loss instead (even if the auto-exercise was ITM).

Aside from buying Options, many investors get excited about selling Options because they get paid upfront for their trades.

Investors that sell short puts and covered calls are taking on specific risks. In the case of a cash secured put write, you risk being put stock, which we have mentioned above. Let’s look at the Microsoft (MSFT) 21 December 2022 US$110 Put Write, which expired in-the-money, again.

If we sold one contract, we would be required to purchase 100 shares for US$110 per share at expiration, costing US$11,000. Every put write carries the risk of exercise. However, this is unlikely to happen, hence selling too many options that expire in the money can be costly.

In the case of a covered call strategy, the risk lies with the possibility of the buyer calling your stock away.

Assuming you bought 100 shares of Microsoft for US$110 per share, your invested capital is US$11,000. You decided to engage in a covered call strategy. If your covered call expires in-the-money, you would have been required to sell your 100 shares for US$100. The buyer would have paid US$10,000, resulting in loss in money on our trade although the premium from the selling of the call option will still belong to you.

When selling covered calls, you risk losing money from your stock position at times.

What happens after I've entered into an options position?

Exiting of an Option position

There are two ways to close out an open option:

⦁ Let the option lapse (for options that are not ITM of US$0.01 or more which are subjected to auto-exercise by the OCC)

⦁ Enter into an opposing option to net off the position

Example:

⦁ Short a call with the same underlying asset and expiration date to exit an open position in a long call

⦁ Long a put with the same underlying asset and expiration date to exit an open position in a short put

Assignment

The Options Clearing Corporation (OCC) randomly assigns the exercise notices it receives to the open interests of its clearing members as part of their processing sequence. The clearing member then randomly assigns these exercise notices (via an automated assignment algorithm) to those short positions of that particular notice. Seller of Options have no control over the assignment and will have to fulfil the obligation as per the Option contract.

Auto-exercise

Positions expiring in the current month that are ITM as per below threshold, will be subjected to auto-exercise by the OCC without the need for any explicit instructions. Auto-exercise happen only on option expiration only. Intention to avoid the auto-exercise by the OCC for the Options held must have the position closed off prior to expiry.

⦁ Stock Options that are $0.01 or more ITM

Stock prices may experience huge price movement(s) during extended trading hours which may warrant the Option auto-exercised to be OTM in normal circumstances.

(PSPL will close off any ITM option positions prior to auto-exercise – refer to ‘Trading Details for more info)

Corporate action

Any change to an Option caused by a corporate action will be handled by the OCC and will be published on the company’s website. All affected Options will be automatically adjusted based on the notification from OCC.

Stock Options Account Matters

Are there any forms required prior to trading Options?

- Active W8Ben

- Acknowledged Risk Warning Statement (RWS)

- Passed Customer Account Review (CAR)

- Acknowledged Option Risk Disclosure Statement (Option RDS)

What are the eligible account types to trade Options?

The eligible account types are Cash Management (KC), Margin/Cash Plus (M), Prepaid (CC), and Custodian (CU) accounts.

Joint accounts are excluded.

Additionally, the trading account should also be opted in for e-statement.

How long is the approval process for Option Activation?

If acknowledgement of Options RDS is done before 6.15pm SGT, the option sub-account will be activated the next business day (T+1) by 4.00pm SGT, otherwise it will take up to 2 business days (T+2), excluding any SG/US holidays.

How do I read the Option Portfolio balance?

· Portfolio Value: Total portfolio valuation which is the aggregate of all positions and cash balance

· Buying Power: Amount available for trading. It is calculated as Allowance +(Sell added only upon fill) OR -(Buy deducted upon order placement and fill) premiums for option trades.

· P/L: Intraday P/L for all options positions. It is calculated based on bid(for long)/ask(for short) quotes with previous close as reference price.

· Cash Flow(P3)/Balance Used (Poems Web): Intraday total cash flow from option trades. It is calculated as negative for buy trades and positive for sell trades.

· Avail Balance/Buying Power: Amount available for trading. It is calculated as Allowance +(Sell added upon fill) OR -(Buy deducted upon order placement) premiums for option trades.

· Maintain Margin: Margin requirement for option positions

· Allowance(P3)/SOD+Allowance(Poems Web): Start of Day trading limit.

· P/L: Intraday P/L for all options positions. It is calculated based on bid(for long)/ask(for short) quotes with previous close as reference price.

· Stock Value: Market value of stock positions

Why are Exercise/Assignment activities not shown on the same day of the e-statements?

As exercise/assignment activities are processed after the market has closed, it will only be shown on the e-statements on T+2.

Do note however, portfolio balances and positions are updated accordingly prior to market open on T+1.

What are some of the common reasons for order rejection?

-Insufficient buying power: The Buy open gross amount should be higher than the available balance.

– Not allowed to sell Naked positions: Sell to Open positions will be rejected if not covered by the underlying stock i.e. Covered Call.

– Order mismarked: Closing and Opening of positions have to be done separately.

E.g. Long 1 AAPL Call position with 100 AAPL shares in account

Incorrect placement:

Sell 2 AAPL Call – to close 1 Long Call and open 1 Covered Call positions

Correct placement:

Sell 1 AAPL Call – to close 1 Long Call position

Sell 1 AAPL Call – to open 1 Covered Call position

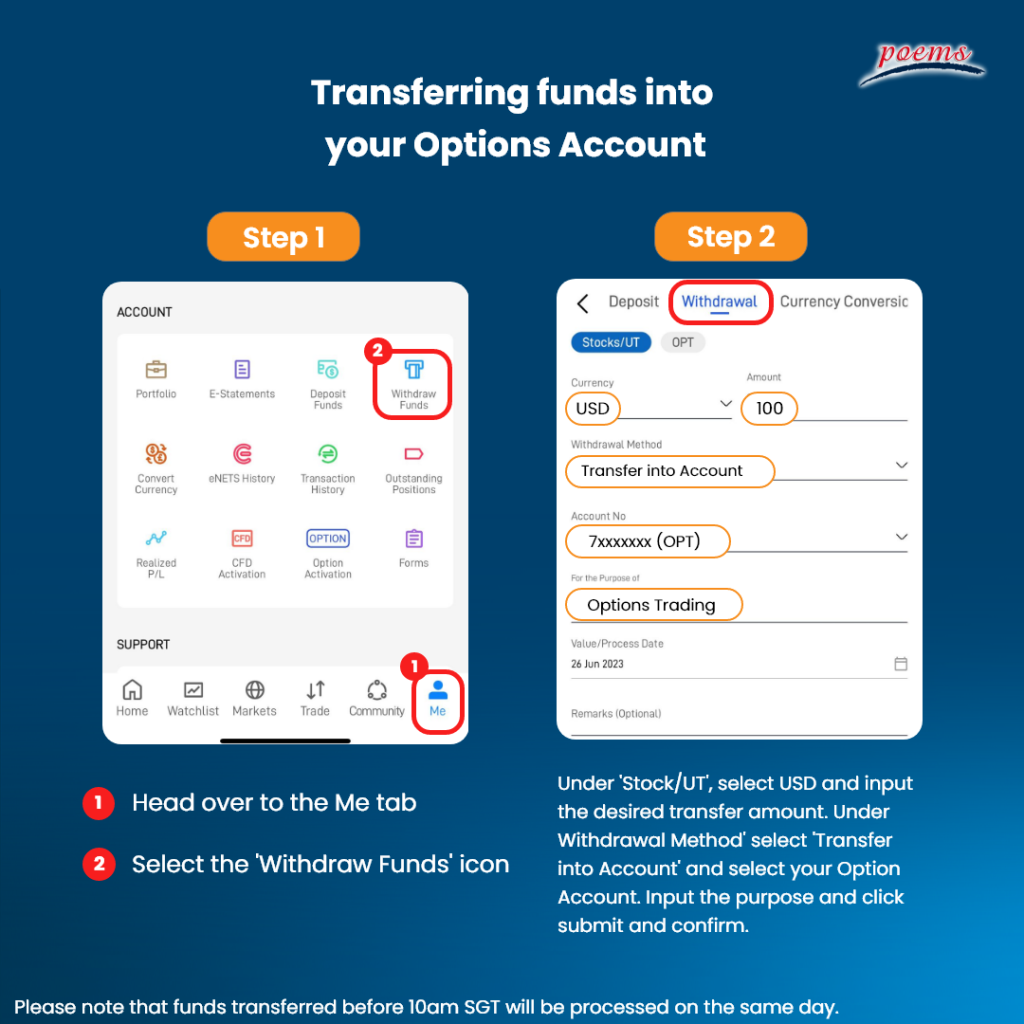

How do I transfer funds into my Options Account?

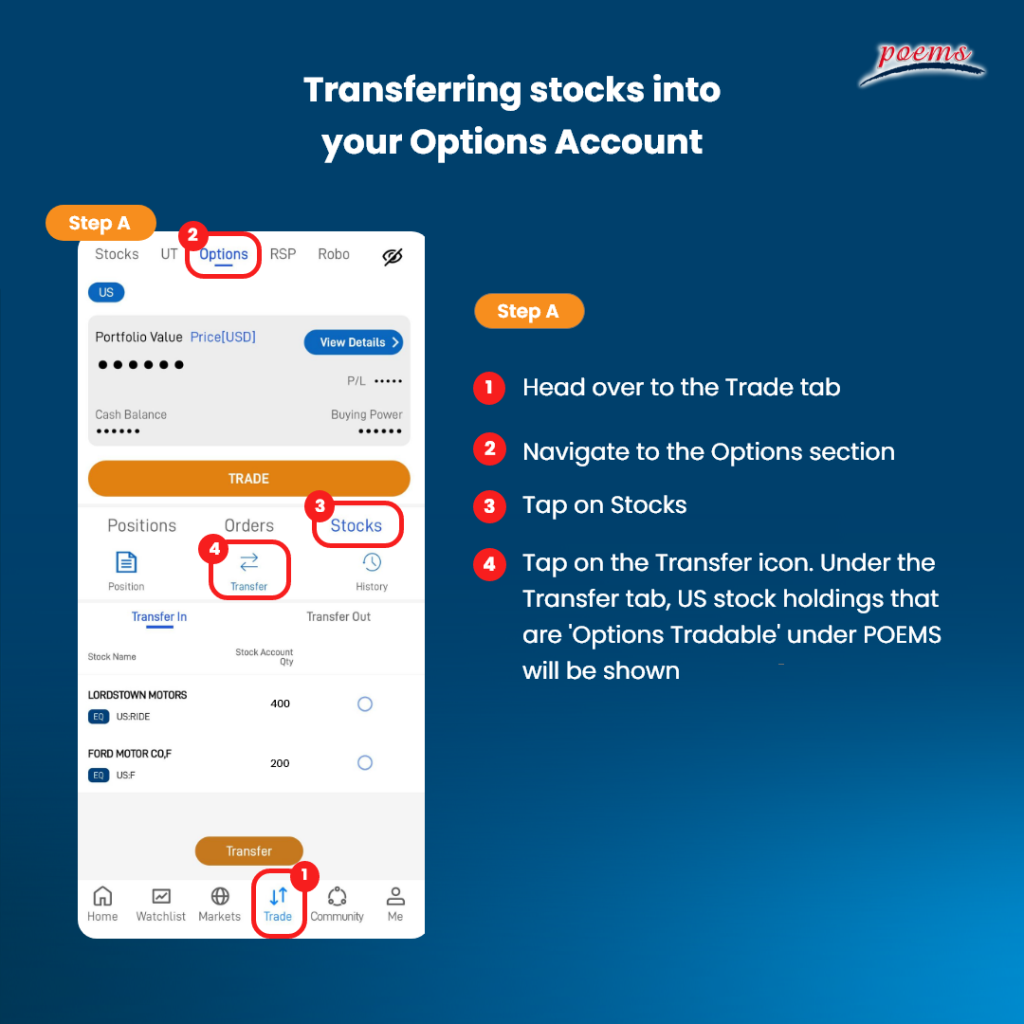

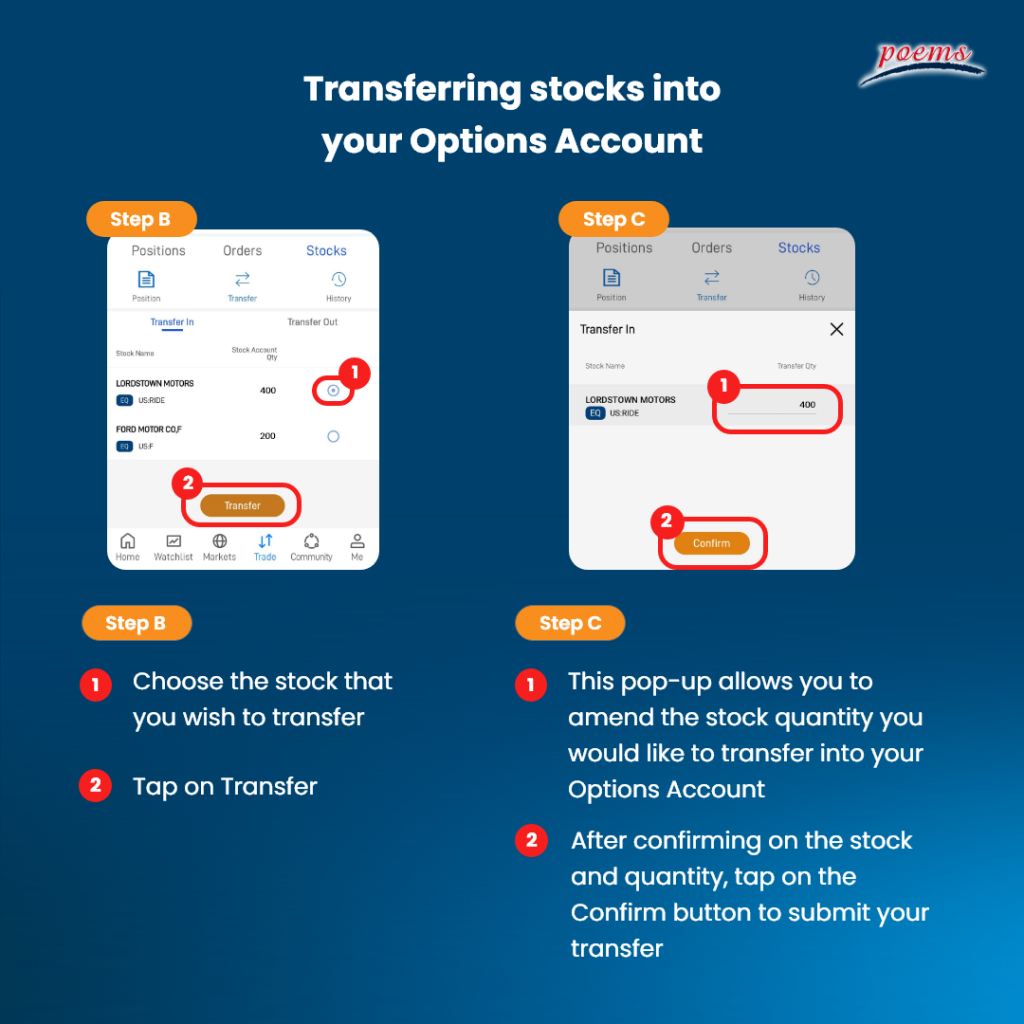

How do I transfer stocks into my Options Account?

Transfers can be done via the POEMS Mobile 3 App and there will be no applicable changes for transfers between these accounts.

For detailed steps, please refer to the image below:

Why is there a need to transfer funds/stocks prior to trading options?

Option ledger is kept separately from the main Poems equity account ledger, as such option sub-account will only have activities related to options only. Any liquidation of shares in the option sub-account will need to be transferred back to the main Poems equity account.

Others

Does POEMS support option strategies?

POEMS currently does not support the combination of option strategies i.e. Spreads.

All strategies have to be executed separately.

What are the supported platforms?

Options trading will only be supported on the POEMS Mobile 3 App and POEMS web.

It is not available on POEMS Mobile 2 and POEMS Pro.

Is there US Pre-market Trading for options?

US Pre-Market Trading is only available for Equities trading.

The trading hours for Options are from 9.30pm to 4.00am (SGT) during daylight savings and 10.30pm to 5.00am (SGT) during non-daylight savings.

What are the tradable counters available for options?

The counters in the constituents of S&P 500, S&P ADR, Nasdaq 100, and Russell 3000 are included in our list of supported counters.

Currently, popular ETF options ( SPY, QQQ, IWM ) and index options ( SPX, NDX, VIX ) are unavailable.

What happens if the underlying share is delisted onto OTC?

POEMS will only allow manual closing of the related option positions when the underlying shares are delisted onto OTC markets. You may place the order via the Night Desk by calling 6531 1225.

Glossary

General

Ask – The price at which a seller is offering to sell an option or stock. When a quote is obtained, the ask is always the higher nuber (on the right-hand side).

Bid – The price at which a buyer is willing to buy a security (buy it from you). Whenever a quote is obtained, the bid is always the lower number (on the left-hand side).

Chicago Board Options Exchange (CBOE) – The Chicago Board Options Exchange; the first national exchange to trade listed stock options.

Long – The buying of a security such as a stock or option with the expectation that the asset will rise in value.

Market Maker – A company or person who is ready to buy or sell securities at all times.

Options Clearing Corporation (OCC) – The issuer of all listed option contracts that are trading on the national option exchanges. It acts as the central counterparty clearing and settlement for equity derivaties for numerous exchanges.

Short – The selling of a security such as a stock or option with the expectation that the asset will fall in value.

Volatility – A measure of the fluctuation in the market price of the underlying security. Mathematically, volatility is the annualised standard deviation of returns.

Volume – The number of shares or contract that is traded in any given period of time within a security or an entire market.

Basic

Assignment – Refers to the process by which the seller (writer) of an option contract is required to fulfill their obligation to buy or sell the underlying asset. When you’re ‘assigned’ a call options, you sell the underlying asset (at the agreed-upon strike price). When you’re ‘assigned’ a put option, you buy the underlying asset at the predetermined strke price.

At-the-Money (ATM) – An option is at the money if the strike price of the option is roughly equivalent to the market price of the underlying security.

Exercise – Refer to the process by which the buyer (holder) of an option contract exercise their right to buy or sell the underlying asset. When you “exercise” a call options, you “trade in” your options for the actual asset (at the agreed-upon strike price). When you “”exercise”” a put option, you force the sale of asset you own at the predetermined strike price.

Exercise/Strike Price – Sometimes called the “strike price” is the price at which the option holder has the right either to purchase or to sell the underlying stock. The option writer is obligated to delivered (Call) or received (Put) the underlying at the strike price.

Expiration date – The day on which an option contract becomes void. The expiration date for listed stock options is the Saturday after the third Friday of the expiration month, so for most trading purposes it is the third Friday of each month. With the introduction of weekly option contracts, there is expiration date which now falls on every Fridays for weekly options.”

Extrinsic (Time) Value – The difference between an option’s price and the intrinsic value, also known as “time” value is the amount that the option buyer is willing to pay for any potential future movement of the underlying asset’s price. Extrinsic value is made up of several important variables: the number of days left until expiration, volatility, prevailing interest rates and dividends.

Implied Volatility – Is the volatility that is expected to happen in the future to an option. It is a mathematical formula based on an option pricing model.

In-the-Money (ITM) – For a call option, when the option’s strike price is below the market price of the underlying stock. For a put option, when the strike price is above the market price of the underlying stock.

Intrinsic Value – Intrinsic value represents the minimum value of the option contract, based on the current price of the underlying asset. It is the difference between the current trading price of the underlying and the strike price of the option contract.

Moneyness – Used in options trading to describe the relationship between the current price of the underlying asset and the strike price of the options. See ITM, ATM, OTM for more details.

Open Interest – Is the number of outstanding option contracts in the exchange market.

Option – A security sold by one party to another that offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security at an agreed-upon price during a certain period of time on or before a specific date.

Option Chain – A way of quoting option prices through a list of all the options (calls and puts) for a given security.

Option Greeks – Options Greeks are a set of measures used to assess the risk and potential reward of options trading strategies. They are dynamic and will change throughout up till expiration of the option and are based on mathematical models and calculations that take into account various factors affecting the price of an option contract. The five primary options Greeks are:

Delta: measure the change in the price of an option with a $1 change in the price of the stock. Delta for call range between 0 to 1 while for put range between 0 to -1. E.g. Delta of 0.5 means if the underlying stock increase in price by $1, the option price will rise by $0.5.

Gamma: reflects the rate of change in the delta in response to a $1 change of the underlying stock price. E.g. Gamma of 0.1 means if the underlying stock price increasse by $1, the option delta will increase by a corresponding 10%.

Vega: measure the price sensitivity of an option to changes in the volatility of the underlying stock. E.g. Vega of 0.2 means if the implied volatility of the option increase by 1%, the option price will increase by a corresponding $0.2.

Theta: also known as time value of option measure the rate of decline in the value of an option due to the passage of time. E.g. Theta of 0.9 means the option price will decrease by $0.9 per day till expiration.

Rho: measure the rate at which the price of an option changes relative to a change in the risk-free rate of interest i.e. U.S Treasury bill’s risk-free rate. E.g. Rho of 0.2 means the option price will increase by 0.2 for 1% increase in the risk-free rate.

Option Holder – The person who buys the right conveyed by the option.

Option series – Is the expiration month and strike price of an option. In MSFT July 30 Calls, the options series would be July and 30.

Option writer – The person who is the seller of the option right.

Options contract – Denotes the deliverable quantity of goods; options are traded in contract units. Each option contract represents 100 shares of the underlying stock. Hence, it’s necessary to multiply any option premium quote by 100 to get the true cost to the option buyer (or seller). An option quoted for $1.20 really costs $120 for each contract.

Out-of-the-Money (OTM) – For a call, when an option’s strike price is higher than the market price of the underlying stock. For a put, when the strike price is below the market price of the underlying stock.

Premium – The total cost of an option. The premium of an option is basically the sum of the option’s intrinsic and extrinsic (time) value. It’s the price that the holder of an option pays and the writer of an option receives.

Put Option – A put option gives the option buyer the right, but not the obligation, to SELL a stock (or “put” it to someone else) at a specified price, over a specified period of time

Style of option – The style of an option refers to when that option is exercisable. American-style options can be exercised at any time prior to its expiration while European-style options are exercised only at expiration. Majority of the listed equity options traded in the U.S. are American style.

Time Decay – The amount of change in the option price, which will decrease over time as the option gets closer to expiration. Since options are a wasting asset, they lose value over time, this loss increases the closer it gets to expiration.

Underlying Asset (Option class) – This is the underlying security the option is written on. In MSFT July 30 Calls, the underlying asset would be Microsoft.

Bear Call Spread – For most options on equity securities, it is 100 shares.

Wasting Asset – An asset that declines in value over time. An option is an example because it is only valuable until expiration; after that, it becomes worthless.

Intermediate

Bear Call Spread – This strategy involves selling a call option with a lower strike price and simultaneously buying a call option with a higher strike price on the same underlying asset with the same expiration date. The idea behind a bear call spread is to limit potential losses while still allowing for potential profits in a bearish market.

Bear Put Spread – This strategy involves buying a put option with a higher strike price and simultaneously selling a put option with a lower strike price on the same underlying asset with the same expiration date. The idea behind a bear put spread is to limit potential losses while still allowing for potential profits in a bearish market.

Bull Call Spread – This strategy involves buying a call option with a lower strike price and selling a call option with a higher strike price on the same underlying asset, with the same expiration date. The idea behind this strategy is to limit the trader’s potential losses while still allowing for potential profits in a bullish market.

Bull Put Spread – This strategy involves selling a put option with a higher strike price and simultaneously buying a put option with a lower strike price on the same underlying asset, with the same expiration date. The idea behind this strategy is to limit the trader’s potential losses while still allowing for potential profits in a bullish market.

Combination trades – When you take a position in both the call and put options at the same time for the same underlying security.

Covered Call – Having a long position in an asset (stock), combined with a short position in a call option on the same underlying asset. The covered call option strategy is one of the most widely used by investors.

Credit Spread – A credit spread is an options trading strategy that involves selling an option at a higher premium and simultaneously buying an option at a lower premium, with both options having the same expiration date and underlying asset. The goal of the strategy is to generate income by collecting a net credit when entering the trade.

LEAPS – Long-term Equity Anticipation Securities, which are long-term options contracts that have an expiration date of more than one year. LEAPS options are similar to traditional options contracts but with a much longer time horizon, allowing traders and investors to take a longer-term view on the underlying asset.

Long Straddle – This strategy involves buying a call option and a put option at same strike prices and expiration dates on the same underlying asset. The buyer of a long straddle is expecting a significant price movement in the underlying asset but is uncertain about the direction of the movement. Used by traders during the economic announcement or earnings seasons.

Long Strangle – This strategy involves buying a call option and a put option at different strike prices (Call strike > Put Strike) and expiration dates on the same underlying asset. The buyer of a long strangle is expecting a significant price movement in the underlying asset but is uncertain about the direction of the movement. Used by traders during the economic announcement or earnings seasons.

Protective Put – Having a long position in an asset (stock), combined with a long position in a put option on the same underlying asset. The protective options strategy is a basic hedging strategy.

Short Straddle – This strategy involves selling a call option and a put option at the same strike price and expiration date on the same underlying asset. The goal of a short straddle is to profit from the premium received from selling both the call and put options, which will be retained if the underlying asset stays within a certain range until expiration. The maximum profit is limited to the net premium received from selling the options. However, the risk is unlimited if the underlying asset price moves significantly beyond the strike price in either direction, as the trader may be required to buy or sell the underlying asset at the strike price.

Short Strangle – This strategy involves selling a call option and a put option at the different strike price (Call strike > Put Strike) and expiration date on the same underlying asset. The goal of a short strangle is to profit from the premium received from selling both the call and put options, which will be retained if the underlying asset stays within a certain range until expiration. The maximum profit is limited to the net premium received from selling the options. However, the risk is unlimited if the underlying asset price moves significantly beyond the strike price in either direction, as the trader may be required to buy or sell the underlying asset at the strike price.

Advanced

Black-Scholes Model – A mathematical formula used to estimate the theoretical value of financial derivatives, particularly options contracts. It was developed in 1973 by Fischer Black, Robert Merton, and Myron Scholes and is still widely used in finance today. This model is used widely by traders and investors to price options and understand the potential risks and rewards of investing in these instruments.

Butterfly Spread – A butterfly spread is a neutral options strategy that involves buying and selling multiple options at three different strike prices. The goal of this strategy is to profit from the time decay of the options while keeping a limited risk and a limited profit potential.

Call Ratio Back Spread – A Call Ratio Back Spread is an options trading strategy that involves selling a higher number of out-of-the-money call options and buying a smaller number of in-the-money call options. The strategy is used when the trader expects the underlying asset’s price to rise significantly, but wants to limit their potential losses.

Christmas Tree Spread – “It is constructed by buying one long call option at a lower strike price, selling two call options at a higher strike price, and buying one more call option at an even higher strike price. The options must all have the same expiration date. The result is a trade that looks like a Christmas tree when the options are graphed. The strategy has a limited profit potential and a limited risk, making it a popular choice for traders who want to speculate on a moderate rise in the underlying stock’s price while also hedging against significant losses.

Collar Spread – A collar spread, also known as a hedge wrapper, is a trading strategy that involves holding a long position in underlying and simultaneously buying a protective put option while selling a call option against the stock.

Diagonal Spread – A diagonal spread is an options trading strategy that involves buying and selling options with different strike prices and expiration dates. To set up a diagonal spread, an options trader would buy a longer-term option with a higher strike price and sell a shorter-term option with a lower strike price. The options are usually of the same type (either both calls or both puts) and are opened at the same time.

Iron Condor – An advanced options trading strategy that involves the use of two credit spreads, one bear call spread and one bull put spread, on the same underlying asset, with the same expiration date but with different strike prices. The goal of an Iron Condor is to profit from the premium received from selling both the bear call spread and the bull put spread, which will be retained if the underlying asset stays within a certain range until expiration.

Max Pain Theory – “Max pain theory is a concept used in options trading to predict where the price of an underlying asset is likely to settle on expiration day based on the open interest of the options contracts. The theory assumes that market makers will try to minimize their losses by manipulating the price of the underlying asset so that the greatest number of options contracts expire worthless. This theory suggests that the price of the underlying asset will settle at the price at which most options contracts expire out of the money, causing the holders of those options to lose money. By pushing the price of the underlying asset towards this point, market makers can reduce their overall losses.

PCR Ratio – PCR ratio, also known as Put-Call Ratio, is a commonly used technical analysis indicator in the stock market. It is calculated by dividing the total number of traded put options by the total number of traded call options for a particular stock or index over a specified time period, usually a day or a week. The Put-Call Ratio provides insights into market sentiment, as it measures the ratio of bearish to bullish trades. A high PCR ratio indicates that investors are purchasing more puts than calls, suggesting that they are bearish about the market or a particular stock. On the other hand, a low PCR ratio indicates a bullish sentiment, with more investors buying calls than puts.

Synthetic Long Stock – A trader can buy a call option on the stock and simultaneously sell a put option on the same stock with the same expiration date and strike price. This combination of options will result in a payoff that is similar to owning the underlying stock.