- Home

- Phillip-China Universal MSCI China A 50 Connect ETF IOP

Why invest in China A-shares?

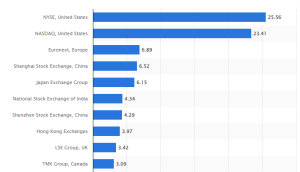

Over the past few decades, China has undergone unprecedented economic expansion and demonstrated a formidable track record of robust GDP and capital markets growth, establishing itself as a global economic powerhouse.

China’s implementation of market-oriented reforms and the opening up of its economy to foreign investments have been pivotal in fostering this growth. Its capital markets, including the Shanghai and Shenzhen stock exchanges, have seen remarkable development, attracting a diverse range of domestic and international investors. The government’s strategic focus on innovation, technology, and infrastructure development has further propelled the nation’s economic prowess. As a result, China has not only become the world’s second-largest economy but also significantly influenced global economic trends.

Global stock market valu by country (US$ trillions), Dec 2023

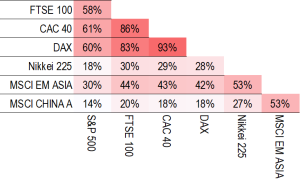

China’s A-shares, which represent shares of mainland Chinese companies listed on the Shanghai and Shenzhen stock exchanges, offer compelling opportunities for portfolio diversification. Incorporating A-shares into a portfolio provides exposure to a vast and dynamic market that is often less correlated with traditional global markets, such as those in the United States and Europe.

China’s growth and its transition towards a more consumption-driven economy contribute to the diversity of sectors available for investment, ranging from technology and e-commerce to healthcare and manufacturing. Additionally, the inclusion of A-shares allows investors to tap into the rising middle class and changing consumption patterns within the world’s most populous country. As China continues to open up its capital markets to foreign investors, A-shares can serve as a valuable component for investors seeking a well-rounded and diversified portfolio.

China’s equity index has low correlation with other main markets

In terms of capacity, China is well positioned to provide stimulus to boost economic growth. Notably, it boasts the largest foreign exchange reserves in the world, nearly three times larger than that of the second-largest holder.

In recent years, China had shown reluctance in providing massive economic stimulus, as policymakers were concerned about the potential risks associated with excessive debt and financial imbalances. The focus was on structural reforms, deleveraging, and maintaining financial stability. However, the stance has evolved, particularly in response to the economic challenges. China has shown an increasingly pro-growth policy stance to stimulate the economy, including fiscal and monetary policies aimed at boosting domestic consumption and investment. Notable recent measures include:

Monetary policy:

- Reductions in banks’ reserve requirement ratios

Fiscal policy:

- Proactive expansionary 2024 budget at 3% budget deficit

- 1 trillion yuan financing for affordable housing programs

Others:

- Tightening trading restrictions to limit short-selling

- Stock purchases by state-affiliated funds

Why invest in Phillip-CUAM MSCI China A50 ETF?

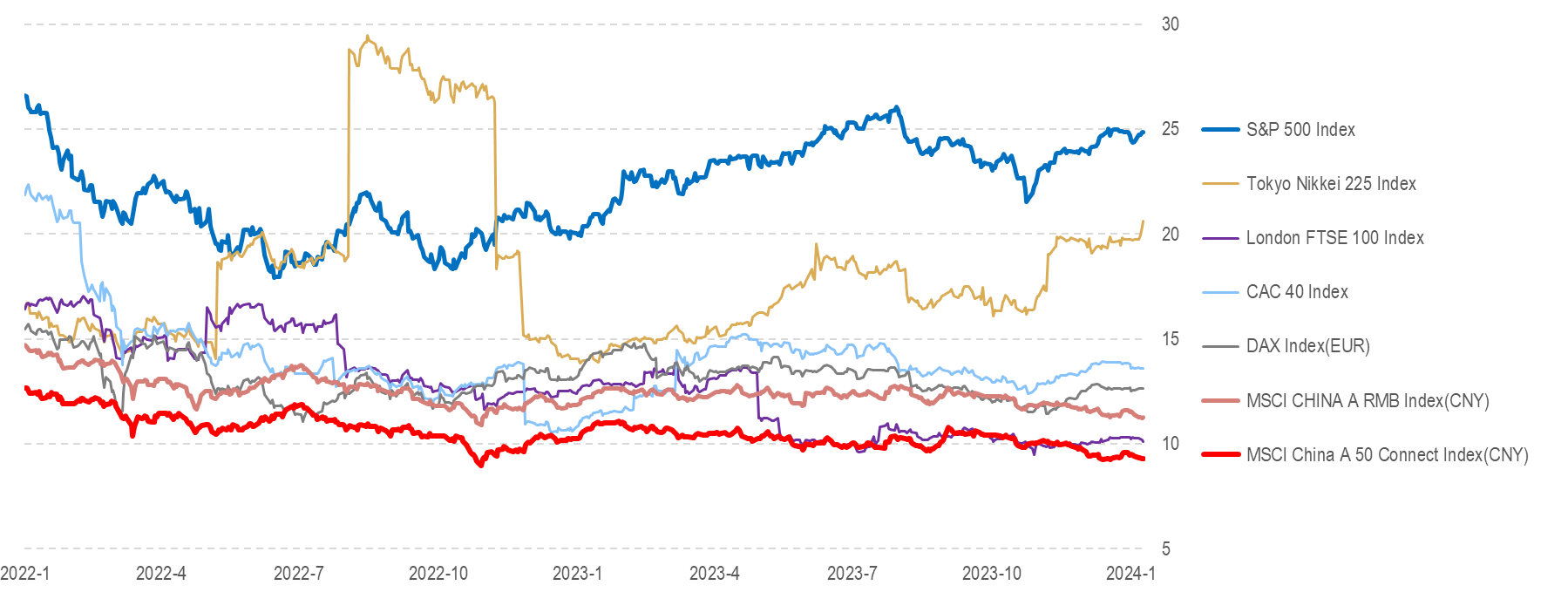

The ETF tracks the benchmark MSCI China A 50 Connect index, with exposure to equities of leading and well-established companies within the Chinese market. These companies are often considered as the pillars of China’s economic landscape and are characterised by strong fundamentals, stable performance, and significant market capitalisation.

The ETF is a Feeder Fund, and will primarily invest its Net Asset Value in the mainland-listed China Universal MSCI China A50 Connect ETF.

Investing in these stocks is commonly viewed as a strategy to capitalise on the long-term growth potential of the Chinese economy. The exposure is also reflective of the country’s ongoing transition toward a more consumption-driven and innovation-focused economy. Investors looking for stability and long-term growth in the Chinese market often consider including core China stocks in their portfolios.

Mainland A-shares have demonstrated a solid performance track record, compared to their counterparts – China stocks that are listed in foreign markets, such as Hong Kong or in the US. One contributing factor is that domestic companies are less exposed to regulatory interventions from Chinese authorities which focus on big-tech companies that are generally listed abroad.

Examples of top ETF constituents:

| Name | Sector | Remarks |

| Kweichow Moutai | Consumer Staples | Leader in liquor industry |

| CATL | Industrials | Leader in power equipment and new energy |

| Zijin Mining | Materials | Leader in mining & minerals |

| Wanhua Chemical | Materials | Leader in chemical industry |

| Luxshare Precision | Information Technology | Leader in electronics manufacturing |

| BYD | Consumer Discretionary | Leader in auto industry |

| Foxconn Industrial Internet | Information Technology | Leader in precision equipment |

| China Yangtze Power | Utilities | Leader in hydropower generation |

| China Merchants Bank | Financials | Leader in banks |

| LONGi Green Energy | Information Technology | Leader in photovoltaic industry |

Note the outperformance of the benchmark MSCI China A 50 Connect index versus other comparable China stock indices, particularly against broad China indices that incorporate offshore-listed China shares.

Returns of different China related indices 2014-2023

Many broad China stock indices are disproportionately weighted towards ‘old economy’ sectors due to historical economic structures and the dominance of traditional industries in the early stages of China’s economic development. While China has been actively transitioning towards a more technology-driven and consumer-oriented economy, the legacy of these older industries continues to influence the composition of stock indices.

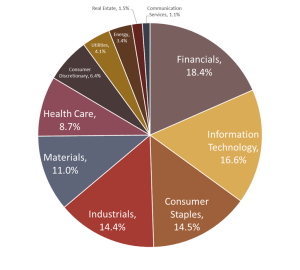

For the ETF and its tracking benchmark, the MSCI China A50 Connect Index, the largest sector weighting falls below 20% – much less than other products on the market. This balanced sector composition provides a more diversified exposure to China’s economy and prevents an overweight position in “old economy’ sectors, like financials and real estate, and averts an underweight position in the ‘new economy’ sectors, like technology and health care.

Balances sector exposure

The ETF has a very low management fee of 0.01%. Note that because it is a feeder into the mainland-listed master ETF (China Universal China A50 Connect ETF), the management fee of the master ETF (0.50%) should also be added to the total management fee that comprises the fund management expense to the investor.

This is the same approach as all other SGX-listed ETFs that utilise such feeder-master approach – essentially those ETFs that operate on the ETF link between Singapore and mainland China.

We believe by offering an extremely low management fee of 0.01% on the feeder level, we can essentially provide Singapore investors with costs comparable to what a mainland investor would incur when investing directly into the master ETF in mainland China.

Who is suitable for this ETF?

The ETF is well-suited for investors seeking:

- An investment whose performance closely corresponds to the MSCI China A 50 Connect index

- Exposure to core China A-shares, with a well-balanced sector exposure

- The transparency and rules-based approach of ETFs for investing in emerging markets

- High liquidity and easy diversification across the Mmainland China’s stock market

- Ability to invest in China’s domestic market without the complexity of directly purchasing individual stocks

- Gain access to 50 leading companies in various industries in China’s A-shares through a single transaction

- ETFs that offer a lower expense ratio, enhancing cost-efficiency

Subscribe to Phillip-China Universal MSCI China A 50 Connect ETF during the Initial Offering Period (IOP) via POEMS 2.0

- Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form

- Select the IPO that you wish to subscribe to

- Read and agree to the prospectus, terms and conditions before subscribing to the financial product

- Application closes on 13 March 2024, Wednesday at 5pm

- Ensure sufficient cash is present in your POEMS account to complete the application process (inclusive of subscription amount, transfer fee and GST) by the settlement date on 13 March 2024, Wednesday at 5pm

| Subscription Period: | 4 March – 13 March 2024 |

| Listing Date: | 20 March 2024 |

| Subscription price: | SGD 1.00 |

| Minimum Quantity: | 1,000 unit |

| Commission Fees: | Zero Commission |

| Transfer Fees: | SGD 10.00 (Subject to GST) for Cash Management Account. Transfer fees will be waived for subscription of 5000 units and above. Other Phillip Investment Account Types will not be subject to transfer fee charge |

| Settlement Currency: | SGD |

| Trading Currency: | SGD, USD |

| Allotment | Full Allotment |

| Name | Phillip-China Universal MSCI China A 50 Connect ETF |

| Investment Objective | To replicate as closely as possible, before fees and expenses, the performance of the MSCI China A 50 Connect Index |

| Benchmark Index | MSCI China A 50 Connect Index |

| Index Methodology | The index aims to reflect the overall performance of the 50 leading companies in various industries in China’s A-shares (within the scope of Stock Connect). |

| Underlying Exposure | China mainland A shares market |

| ETF Replication Method | Physical Replication. The ETF is a Feeder Fund, and will primarily invest its Net Asset Value in the mainland-listed China Universal MSCI China A50 Connect ETF |

| Exchange Listing | Singapore Exchange Limited (SGX) |

| Base Currency | SGD |

| Trading Currency | Primary : SGD Secondary : USD |

| Launch price | S$ 1.000 per unit |

| Investment Product Type | Excluded Investment Product (EIP) |

| Board lot size | 1 unit |

| Management Fee | Management Fee 0.01% p.a. (master ETF management fee 0.50% p.a.) |

| Manager | Phillip Capital Management (S) Ltd |

| Investment Advisor | China Universal Asset Management (Hong Kong) |

| Designated Market Makers | Phillip Securities Pte Ltd |

| Participating Dealer | Phillip Securities Others TBC |

| Custodian and Administrator | BNP Paribas, acting through its Singapore Branch |

Contact your trading representative or visit your nearest Phillip Investor Centre for further assistance.

Alternatively, you can email us at etf@phillip.com.sg to find out how you can participate in this initial offer.

For more information on how to transfer funds to your POEMS account, please visit https://www.poems.com.sg/payment/

For more information about ETFs, please visit https://www.poems.com.sg/products/etf/

Past Events

Unlock China's Market Potential: Why This ETF Outshines Its Competitors

精准出击, 投资中国50高手

| Date/Time | Title | Venue |

|---|---|---|

| 5 Mar, Tue 07:00pm-08:00pm |

Strike with Precision, Invest in China’s 50 Leading Companies Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

Raffles City Tower, 250 North Bridge Road Raffles City Tower #06-00 Singapore, 179101 |

| 5 Mar, Tue 07:00pm-08:00pm |

Strike with Precision, Invest in China’s 50 Leading Companies Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

Webinar |

| 7 Mar, Thu 01:00pm-02:00pm |

乐无穹 | 基金经理 | 汇添富基金 & 姜昕宏 | 业务拓展 | 辉立资金管理有限公司 |

Webinar |

| 8 Mar, Fri 07:00 PM – 08:00 PM |

Strike the precision, Investing in China’s 50 leading companies Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

SGX Auditorium, Level 2, SGX Centre 1, 2 Shenton Way, Singapore 068804 |

| 11 Mar, Mon 01:00pm-02:00pm |

Strike the precision, Investing in China’s 50 leading companies Mr Tan Teck Leng | Deputy Chief Investment Officer | Phillip Capital Management |

Webinar |

Terms and Conditions

- The subscription period for this ETF is from 4 March 2024, Monday at 9am to 13 March 2024, Wednesday at 5pm

- The online subscription will close on 13 March 2024 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Six types of accounts namely, Cash Plus, Cash Management (KC), Prepaid (CC), Custodian (C), Margin (M) and Share Financing (V) accounts are eligible to subscribe for this ETF.

- An additional transfer fee charge of SGD 10 (subject to GST) per application for Cash Management Accounts will be applicable. The transfer fees will be waived for subscription of 5,000 units and above.

- Cash Trading Accounts (T) are not eligible to participate in this subscription.

- Only one application is allowed per account.

- Each ETF unit is priced at SGD1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in SGD. The settlement currency will be in SGD.

- Sufficient funds (including transfer fee and GST) must be present in the client’s trading account by 13 March 2024 at 5pm

- Applications will be rejected if the account does not have or reflect sufficient funds after 13 March 2024 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 20 March 2024.

- Clients will receive the full allotment of the number of ETF units that they subscribe to.

- Clients can start trading the ETF units when the ETF is listed on SGX on 20 March 2024 at 9am.