DAILY MORNING NOTE | 11 March 2025

Recent Podcasts:

OCBC – Earnings miss from higher allowances and expenses

UOB Ltd – Higher allowances hurt earnings

Singapore Airlines – Better than expected 3Q25 performance

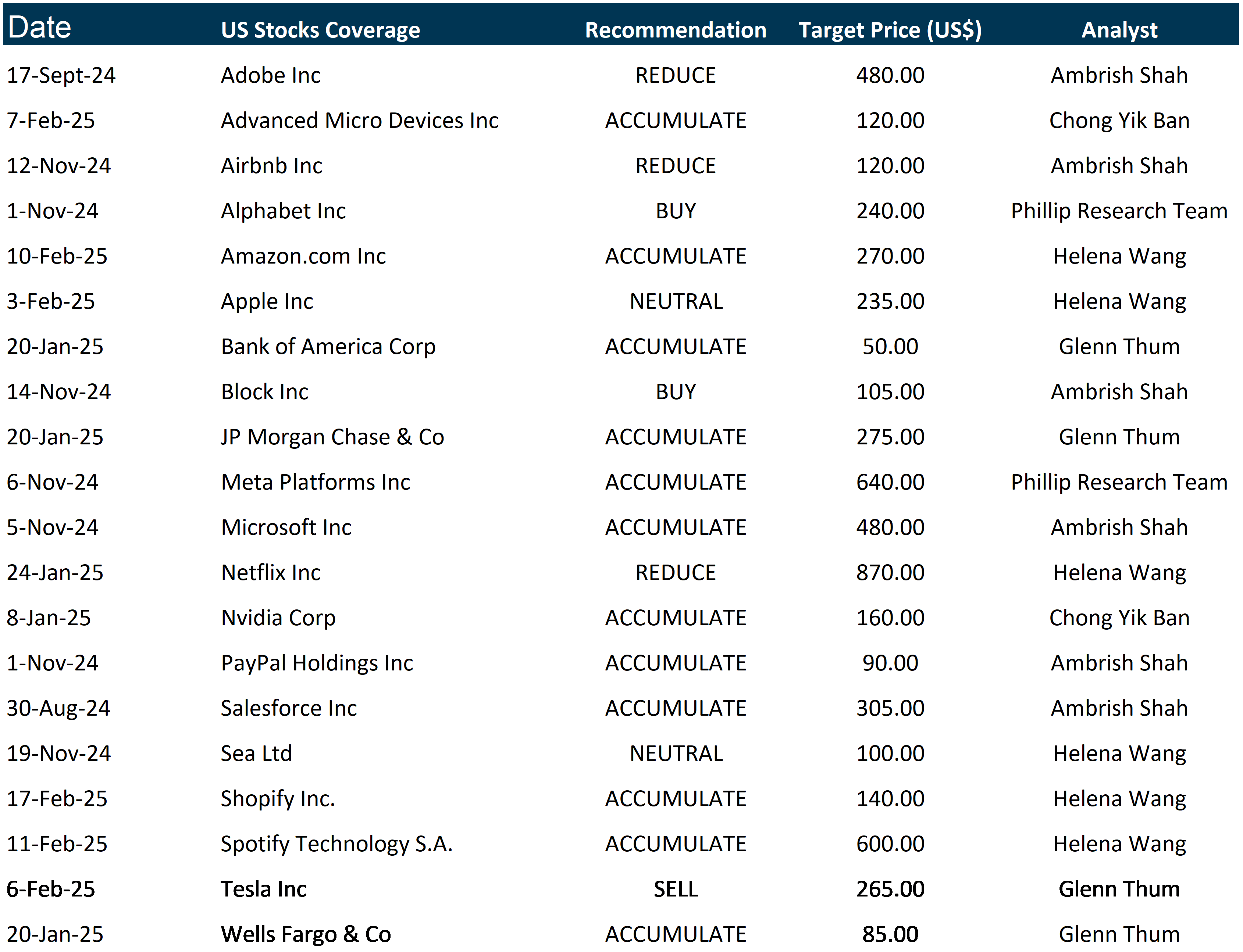

Trades Initiated in Past Week

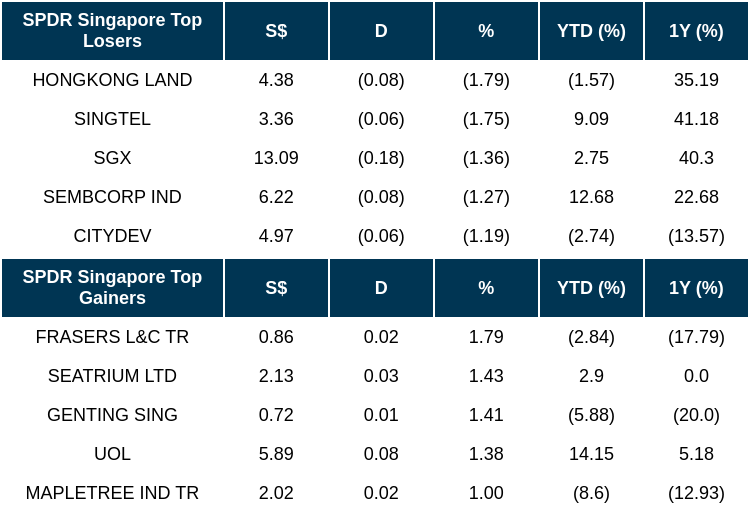

Shares on the Singapore bourse closed the first trading day of the week in the red amid mixed performance among regional markets. Shares fell 0.4 per cent or 15.41 points to 3,899.07 on Monday (Mar 10). The biggest decliner was property developer Hongkong Land. The counter slid 1.8 per cent or US$0.08 to US$4.38. The top gainer was real estate investment trust Frasers Logistics & Commercial Trust, climbing 1.8 per cent or S$0.015 to S$0.855. Resort and casino operator Genting Singapore was the most actively traded counter by volume, with 38.9 million shares worth S$27.8 million traded. The counter rose 1.4 per cent or S$0.01 to S$0.72. Across the broader market, losers beat gainers 320 to 195, after 1.4 billion securities worth S$1.3 billion were traded.

Wall Street stocks plummeted on Monday as investors fretted that uncertainty over President Donald Trump’s tariff policy could tip the world’s biggest economy into a recession. The moves came after Trump refused to rule out the possibility of a 2025 recession, saying there would be “a period of transition, because what we’re doing is very big – we’re bringing wealth back to America.” Tech stocks led the slump, with the tech-focused Nasdaq Composite Index marking its largest one-day loss since 2022.

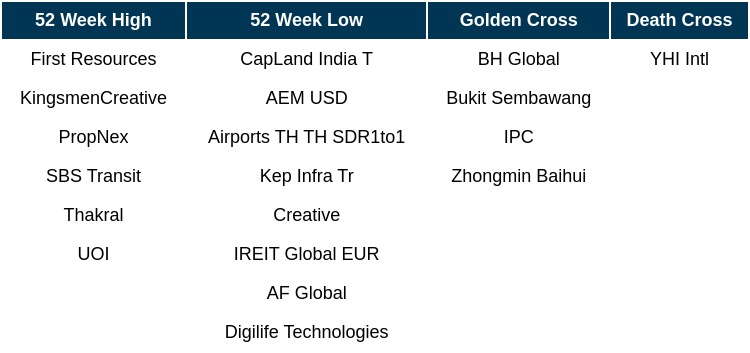

Singapore Technical Highlights

TOP 5 GAINERS & LOSERS

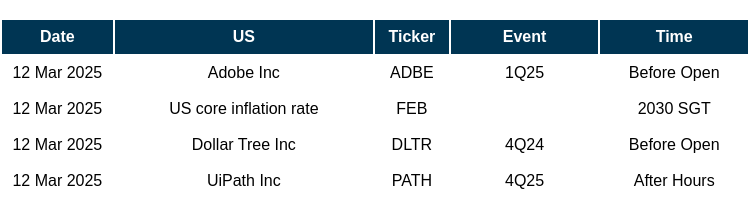

Events Of The Week

SG

SIA Group’s low-cost carrier (LCC) Scoot will focus on driving traffic and revenue in “high-potential” areas of South-east Asia and India, with Embraer jets helping it to mitigate delays in Airbus and Boeing deliveries. The airline aims to maintain its strong performance in passenger numbers over the past two years by expanding and optimising routes, in the face of falling yields caused by competitors adding capacity.

The Singapore Exchange (SGX) said on Monday (Mar 10) that it was teaming up with Brazilian exchange operator B3 to launch real futures contracts later this year, a move aimed at helping investors manage exposure to the currency during Asia trading. If the Brazilian real futures contracts receive regulatory approval, it would be SGX’s first time venturing into emerging markets currencies out of Asia.

The Singapore Exchange (SGX) plans to list Bitcoin perpetual futures as traditional exchanges push deeper into crypto derivative markets. It intends to launch the contracts in the second half of 2025.

Hong Kong-based conglomerate Jardine Matheson Holdings on Monday (Mar 10) logged an 11.4 per cent decrease in underlying profit to US$1.5 billion for its full year ended Dec 31, 2024, from US$1.7 billion in the previous corresponding period. This comes as full-year revenue fell some 0.7 per cent to US$35.8 billion from US$36 billion in the year-ago period.

Supermarket and retail store operator DFI Retail Group posted a 29.7 per cent rise in underlying profit to US$200.6 million for its full year ended Dec 31, 2024, from US$154.7 million in the previous corresponding period. This comes even as full-year revenue fell 3.3 per cent to US$8.9 billion from US$9.2 billion in the year-ago period. DFI attributed profit growth to an improved showing in its food and convenience sector, supported by growth in digital channels.

Grab signed new memoranda of understanding (MOUs) with four autonomous technology companies to explore the impact and role of autonomous vehicles (AVs) in South-east Asia, the company said on Monday (Mar 10). The technology company will work with Autonomous A2Z, Motional, WeRide and Zelos to assess technologies for delivery and mobility, such as shuttles, buses, cars and bots. Grab said that it will assess how AVs can improve safety and reduce road accidents. It will also evaluate opportunities.

The global asset manager Keppel on Monday announced that its private investment vehicle Keppel Infrastructure Fund (KIF) and its co-investor have acquired a 100 per cent stake in the UK-headquartered Global Marine Group (GMG), from investment affiliates of J F Lehman and Company. GMG is a subsea cable solutions provider and this acquisition marks the first investment by KIF.

Majority of Wee Hur Holdings’ shareholders have voted in favour for the sale of its seven purpose-build student accommodation (PBSA) in Australia in its extraordinary general meeting (EGM) held on Feb 28. The group first proposed to sell its Australian PBSA segment to GS Australia Student Venture I Mid Trust for a net consideration of A$355 million ($319.8 million) on Dec 16, 2024.

Southern Alliance Mining has guided for a gross loss for 1HFY2025 ended Jan 31, 2025, compared to a gross profit reported in the same period a year ago. The group is also expecting to report a higher net loss for 1HFY2025, mainly due to a decrease in average realised selling price for iron ore concentrate, crushed iron or iron ore tailing for the reporting period, which was influenced by the slowdown in demand from China’s steel industry.

US

Beijing’s tariffs on certain US agricultural goods in retaliation for President Donald Trump’s latest hike on Chinese imports came into force on Monday, as trade tensions mount between the world’s two leading economies. After imposing a blanket 10 per cent tariff on all Chinese goods in early February, Trump hiked the rate to 20 per cent last week. Beijing reacted quickly, its finance ministry accusing Washington of “undermining” the multilateral trading system and announcing fresh measures of its own. Those tariffs come into effect on Monday and see levies of 10 and 15 per cent imposed on several US farm products. Chicken, wheat, corn and cotton from the United States will now be subject to the higher charge.

Apple is preparing one of the most dramatic software overhauls in the company’s history, aiming to transform the interface of the iPhone, iPad and Mac for a new generation of users. The revamp – due later this year – will fundamentally change the look of the operating systems and make Apple’s various software platforms more consistent, according to sources familiar with the effort. That includes updating the style of icons, menus, apps, windows and system buttons.

Apple and Meta Platforms are set to face modest fines for allegedly breaching landmark rules aimed at reining in their power, people with direct knowledge of the matter said on Monday. Both companies have been in the European Commission’s crosshairs since last year for potential breaches of the Digital Markets Act which could cost companies as much as 10 per cent of their global annual sales.

Oil prices were down 1 per cent on Monday on fears that US tariffs on Canada, Mexico and China would slow economies around the world and slash energy demand while Opec+ ramps up its supply. Brent crude oil futures futures settled at US$69.28 a barrel, down US$1.08, or 1.5 per cent. US West Texas Intermediate futures settled at US$66.03 a barrel, shedding US$1.01, 1.5 per cent. Last week marked WTI’s seventh consecutive weekly decline, the longest losing streak since November 2023, while Brent fell for a third consecutive week.

Oracle reported a surge in bookings and gave a revenue forecast for the fiscal year beginning in June that topped estimates, fuelling confidence that the company is gaining large customers for its cloud infrastructure business. Oracle has now signed cloud agreements with several world leading technology companies including OpenAI, xAI, Meta, Nvidia and AMD. It expect that the huge US$130 billion sales backlog will help drive a 15 per cent increase in Oracle’s overall revenue in our next fiscal year.

Tesla shares plunged to their worst day in more than four years, extending a slide in 2025 amid growing concerns on Wall Street about demand for the company’s electric cars.

ServiceNow is nearing a deal to buy artificial intelligence (AI) firm Moveworks, sources familiar with the matter said, in what would be its largest acquisition to date. The software company is putting the final touches on a deal for Mountain View, California-based Moveworks that could be announced as soon as the coming days. The purchase could value Moveworks at close to US$3 billion.

Star Entertainment said on Monday that it had received a proposal from US-based casino operator Bally’s Corp to inject A$250 million (S$209.3 million) of funding into the Australian firm. The proposal comes at a time when the embattled Australian firm is seeking critical funding to stabilise its finances and serves as a last-minute effort to take control of the casino group. Under the terms of Bally’s offer, the US company would provide a capital raise of A$250 million, leading to Star issuing convertible notes to its existing senior lenders.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

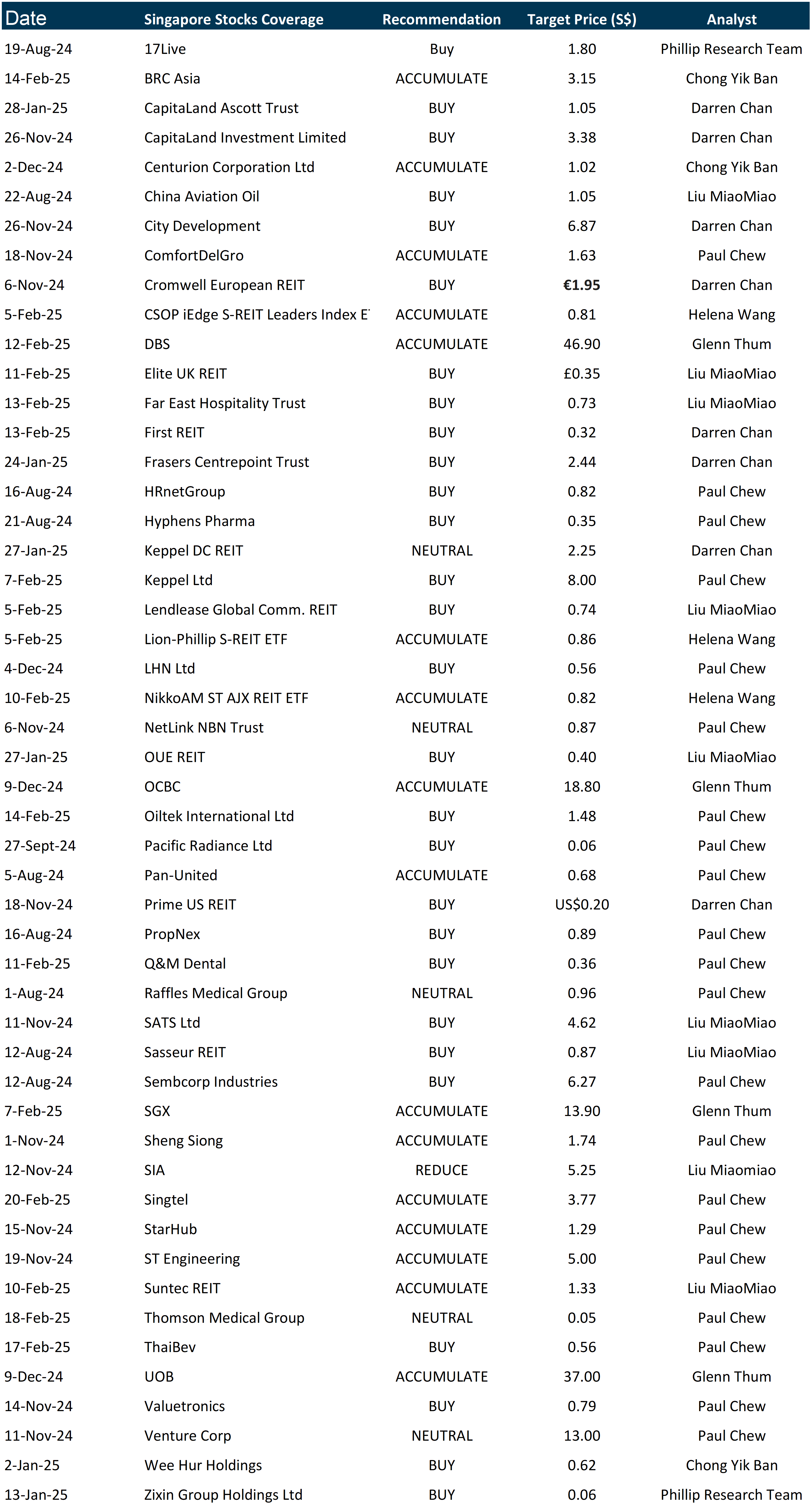

RESEARCH REPORTS

Oiltek International Ltd – Working with the giants

Recommendation: BUY; TP S$1.48; Last close: S$1.2200; Analyst Paul Chew

- On 26 February, Oiltek announced a heads of agreement with Indonesian state oil company Pertamina to enter a joint venture to develop a pre-treatment unit (PTU) and supply feedstock. There are potentially three revenue streams – constructing the PTU plant and recurrent revenue from partial ownership of the PTU and sourcing feedstock for the PTU.

- On 3 March, Oiltek proposed a 2 for 1 bonus issue. It is subject to shareholders’ approval during the upcoming annual general meeting. The company is also proposing to transfer its listing from the Catalist Board to the SGX Mainboard.

- We maintain our BUY recommendation and FY25e earnings. The target price of S$1.48 is based on industry 20x PE FY25e, in line with peers. The conclusion of the agreement will be a major driver to earnings and re-rating of the business model from project-based earnings to a higher proportion of recurrent earnings. Oiltek is a global leader in palm oil process technology, including refining, fractionation, and phytonutrient extraction. The thematic growth drivers include increased palm oil acreage in Africa and South America, increased downstream activities, higher biodiesel capacity in Indonesia and Malaysia, and expansion into sustainable aviation fuel (SAF).

Wee Hur Holdings Ltd – More visibility from PBSA sale

Recommendation: BUY; TP S$0.62; Last close: S$0.4450; Analyst Yik Ban Chong (Ben)

- FY24 revenue/adj. PATMI fell below our expectations, at 86%/78% of our FY24e estimates. Building construction (~32% of FY24 revenue) segment’s 2H24 revenue/operating profits fell 67%/19% YoY, as tenders remain competitive. Order book fell by 21% from June 2024.

- The net proceeds from the sale of a 37.1% stake of the WH PBSA Master Trust is estimated to be received by May 2025. Given net proceeds are received, we believe ~20% of net proceeds (~S$0.065 per share) could be distributed as special dividends before 1H25e results. The ~S$300mn net proceeds, ~76% of Wee Hur’s market capitalisation, would bring Wee Hur to a S$126mn net cash post-dividends distribution (FY24: net debt S$114mn).

- We maintain BUY with an unchanged target price of S$0.62. We lowered PBSA Fund I’s discount to RNAV to 20% (prev. 40%) to reflect the increased visibility of PBSA sale. We lowered the building construction segment’s P/S to 0.3x (prev. 0.4x) to reflect competitive tenders. We increased WACC of workers’ dormitory segment to 13.7% (prev. 6.3%) to reflect potential delays in the commencement of Pioneer Lodge operations.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by TeleChoice

Date & Time: 11 March 25 | 12PM-1PM

Register: poems-20250311-112959

Corporate Insights by ESR REIT [NEW]

Date & Time: 21 March 25 | 12PM-1PM

Register: poems-20250321-115144

Strategy & Stock Picks – SG Market [NEW]

Date & Time: 5 April 25 | 10AM-12PM

Register: poems-20250405-114051

Strategy & Stock Picks – US Market [NEW]

Date & Time: 10 April 25 | 7PM-9PM

Register: poems-20250410-114061

Research Videos

Weekly Market Outlook: Sea Ltd, CAO, NVIDIA, Centurion, HRnet, Hyphens Pharma, Tech Analysis & More!

Date: 10 March 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials