DAILY MORNING NOTE | 16 July 2025

Recent Podcasts:

Semiconductor 1Q25 Update – AI demand offsets impact from US export controls

Sea Ltd. – Outperformance likely to continue, but valuations stretched

BRC Asia Ltd – Still record order book

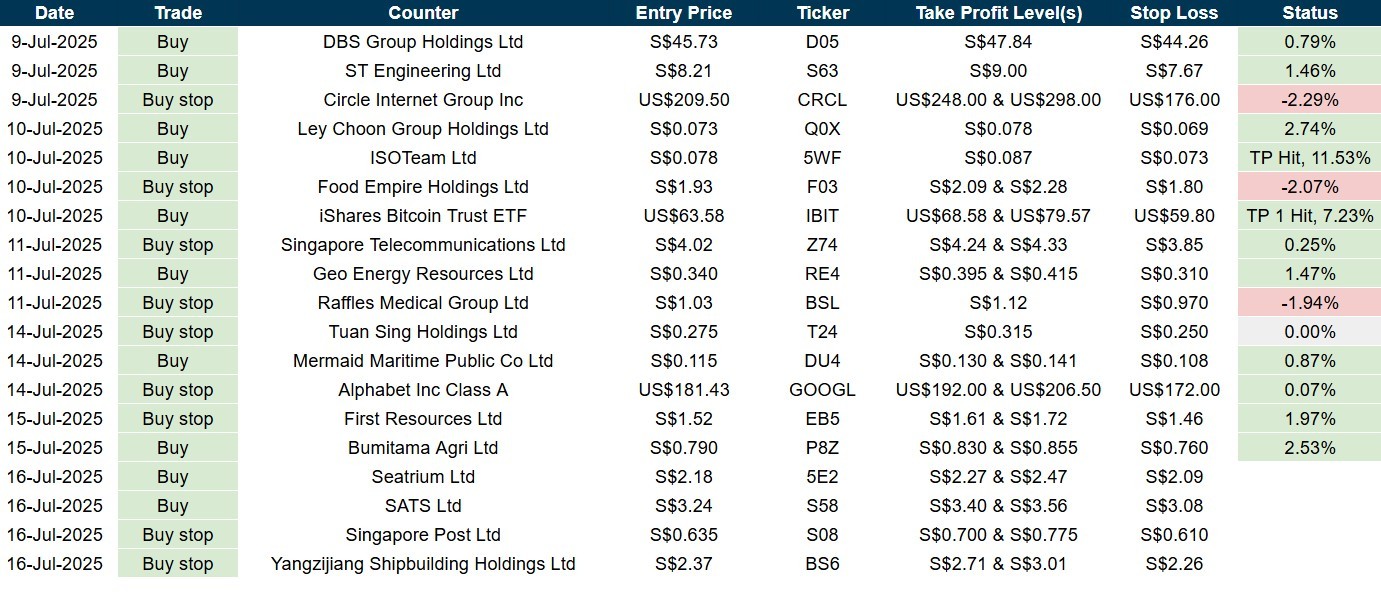

Trade of The Day

Yangzijiang Shipbuilding Holdings Ltd (SGX: BS6)

Analyst: Zane Aw

(Current Price: S$2.36) – TECHNICAL BUY

Buy stop: S$2.37 Stop loss: S$2.26 (-4.64%)

Take profit 1: S$2.71 (+14.34%) Take profit 2: S$3.01 (+27.00%)

Analyst: Zane Aw

(Current Price: S$0.630) – TECHNICAL BUY

Buy stop: S$0.635 Stop loss: S$0.610 (-3.93%)

Take profit 1: S$0.700 (+10.23%) Take profit 2: S$0.775 (+22.04%)

Analyst: Zane Aw

(Current Price: S$3.24) – TECHNICAL BUY

Buy price: S$3.24 Stop loss: S$3.08 (-4.93%)

Take profit 1: S$3.40 (+4.93%) Take profit 2: S$3.56 (+9.87%)

Analyst: Zane Aw

(Current Price: S$2.18) – TECHNICAL BUY

Buy price: S$2.18 Stop loss: S$2.09 (-4.12%)

Take profit 1: S$2.27 (+4.12%) Take profit 2: S$2.47 (+13.30%)

Trades Initiated in Past Week

The local benchmark continued its record-breaking streak for a second day running to close higher on Tuesday (Jul 15). It rose 0.3 per cent or 10.61 points to 4,119.82, after hitting an intra-day high of 4,129.77. Across the broader market, advancers outnumbered decliners 370 to 163, after 1.8 billion securities worth S$1.4 billion were traded.

U.S. stocks fell Tuesday as worries over U.S. inflation and a mixed bag of big bank earnings dragged the blue-chip index lower. The Nasdaq Composite got a boost from gains in Nvidia. The 30-stock Dow lost 436.36 points, or 0.98%, and closed at 44,023.29. The S&P 500 lost 0.40% and closed at 6,243.76, easing from a fresh record high reached earlier in the session. The Nasdaq was an outperformer, adding 0.18% and posting a record close of 20,677.80. The tech-heavy index was aided by a 4% rise in Nvidia shares after the chip company said it hopes to soon resume deliveries of its H20 GPU sales to China.

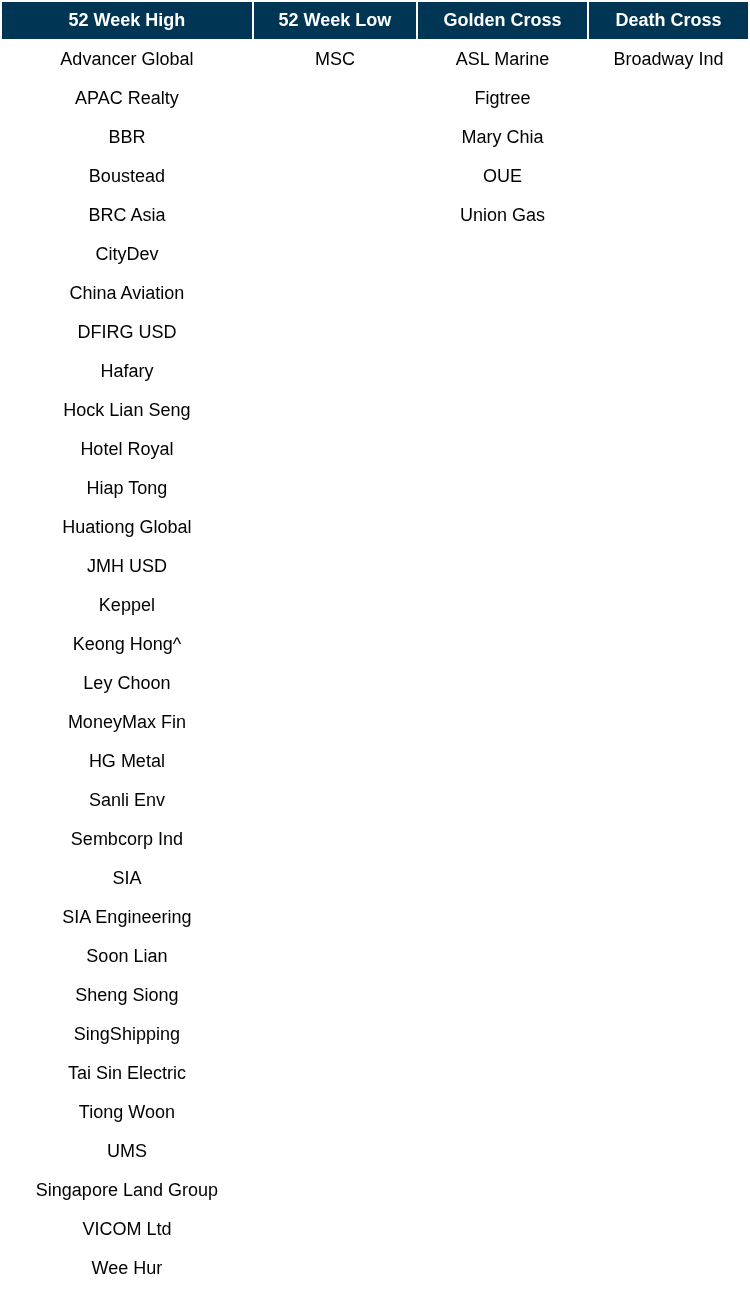

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

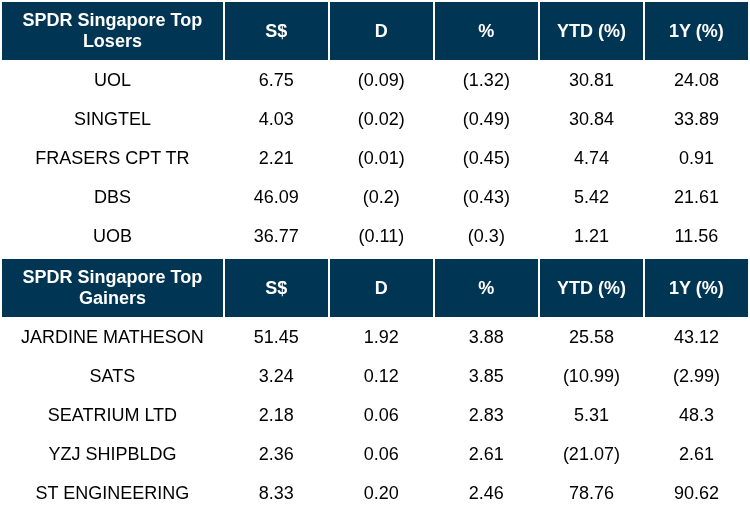

TOP 5 GAINERS & LOSERS

Events Of The Week

SG

Shareholders of TalkMed on Tuesday (Jul 15) approved a proposed privatisation offer from Tamarind Health. On Dec 23, 2024, TW Troy, a special-purpose vehicle managed by Tamarind Health, proposed to privatise mainboard-listed TalkMed by way of a scheme of arrangement, at S$0.456 per share. Following the approval given by shareholders at the meeting, TalkMed said it will submit to the court its application to sanction the scheme. The company expects the hearing for this application to be held on or around Aug 5, and the last day for its shares to be traded to be on or around Aug 8. Its books are expected to be closed at 5 pm on Aug 19.

UOL’s unit UOL Treasury Services (UTS), a special purpose entity, has issued S$225 million notes at 2.78 per cent yield, said the property developer on Tuesday (Jul 15). The notes are expected to be listed on the Singapore Exchange on Wednesday. They are issued as the first tranche of the fifth series of notes under a S$2 billion multicurrency medium-term note programme established by UTS in November 2014.

Singapore Airlines and its low-cost arm Scoot reported a 4.5 per cent year-on-year increase in passenger traffic in June, the group’s operating results showed on Tuesday (Jul 15). It was driven by strong demand for air travel across all route regions, supported by the start of the summer travel season and the mid-year school holidays in Singapore. The growth in passenger traffic of the group outpaced the 3.1 per cent year-on-year increase in passenger capacity in the same month.

Centurion Corporation has unveiled a premium brand for its latest purpose-built student accommodation (PBSA) property in Macquarie Park in Sydney. The Epiisod brand will offer higher-end amenities to clients expecting these, properties under this brand are to be injected into the Reit later. The rates at facilities in the Epiisod stable are likely to be higher than those for Centurion’s current Dwell brand, which is targeted at the more budget-conscious market.

Far East Hospitality announced on Tuesday (Jul 15) the opening of two hotels in the Namba South and Honmachi districts in Osaka, in a bid to expand its presence in Japan. This is in partnership with Singapore-based property investment advisory firm Anglo Fortune Capital Group. The introduction of Far East Village hotels in these two areas is part of the group’s strategy to double its footprint to 2,000 rooms within the next five years across Japan’s key gateway cities of Tokyo, Osaka, Kyoto and Fukuoka.

Shares of China Medical System (CMS) jumped 6 per cent at the debut of its secondary listing on Tuesday (Jul 15). The company’s shares were last at S$2.28, up 11.2 per cent with around 150,000 shares changing hands. CMS is a specialty pharmaceutical company with a focus on sales and marketing in China. The company has capabilities across the full lifecycle of drug development, from identifying clinical needs to research and development (R&D) regulatory approval, and commercialisation.

US

The US annual inflation rate ticked higher in June, in line with expectations, as lower prices at the gasoline pump somewhat offset higher prices at the grocery store. The consumer price index rose 2.7% on an annual basis in June 2025, up from 2.4% in May, according to the Bureau of Labor Statistics. Core inflation, which excludes volatile food and energy prices, was 2.9%, also in line with forecasts. Economists said they expect the full impact from the Trump administration’s tariff agenda to raise consumer prices more in the months ahead, but they said trade policies have already started to noticeably affect inflation.

SiriusXM, the audio entertainment company that’s long been known as a commercial-free option for in-car radios, is betting on advertising to propel its business. On Tuesday the company launched its first ad-supported subscription plan for car listening called SiriusXM Play. It’s a cheaper option than its long-standing offering and will cost less than $7 each month for in-car and streaming. It features a limited set of commercials on a subset of its music, sports, news and talk show offerings. The option will currently be available on a limited basis, but SiriusXM expects to make the package available to nearly 100 million vehicles by the end of 2025.

JPMorgan Chase on Tuesday topped analysts’ estimates on better-than-expected revenue from fixed income trading and investment banking. The bank said that second-quarter earnings fell 17% to $14.9 billion, or $5.24 a share, from the year-earlier period, when it had a $7.9 billion gain on Visa shares. But even when backing out a $774 million income tax benefit that boosted per share earnings by 28 cents, JPMorgan topped estimates for the quarter. Revenue fell 10% to $45.68 billion, though the comparison with a year ago was also impacted by the bank’s Visa stake. The bank also boosted its guidance around net interest income for the full year to roughly $95.5 billion, or about $1 billion more than an earlier forecast.

Jamie Dimon says JPMorgan Chase will get involved in stablecoins as fintech threat looms. Stablecoins, as the name suggests, are a type of cryptocurrency designed to maintain a steady value that are usually pegged to a fiat currency like the U.S. dollar. Last month, JPMorgan announced it will launch a more limited version of a stablecoin that only works for JPMorgan clients; a true stablecoin would presumably be more universally accepted.

General Motors said it will move production of the Cadillac Escalade to an assembly plant in Michigan. The automaker will also expand manufacturing of the Chevrolet Silverado and GMC Sierra light duty pickups at Orion Assembly. The move builds on GM’s plans to invest $4 billion in U.S. facilities, which the automaker announced in June.

Amazon turns to rival SpaceX to launch next batch of Kuiper internet satellites. Elon Musk’s SpaceX is helping Amazon launch more of its Kuiper internet satellites into orbit. A Falcon 9 rocket carrying 24 Kuiper satellites is slated to take off on Wednesday. Amazon is racing to catch up to SpaceX’s Starlink, which currently dominates the market with a constellation of roughly 8,000 satellites.

Citigroup’s profit jumped 25% in the second quarter, lifted by higher fees from dealmaking and its trading business. The bank reported a profit of $4.02 billion, or $1.96 a share, compared with $3.22 billion, or $1.52 a share, in the year-ago period. Revenue rose 8% to $21.67 billion, ahead of analysts’ estimates for $20.96 billion. Trading revenue rose 16%, while investment banking fees were up 13%. Net interest income, a measure of the bank’s core lending business, was up 12% from a year ago to $15.18 billion.

State Street’s second-quarter profit fell despite higher revenue, as increased costs offset a jump in fee revenue. The provider of financial services to institutional investors on Tuesday said profit fell 2.5% to $693 million. Earnings were $2.17 a share, missing the $2.35 a share that analysts polled by FactSet expected. Total revenue climbed 8.1% to $3.45 billion. Wall Street modeled revenue of $3.35 billion. Fee revenue, its biggest contributor to the top line, jumped 11% to $2.72 billion, ahead of analyst estimates for $2.62 billion. The company said that higher fee revenue reflected broad-based strength across the franchise.

Bank of New York Mellon logged higher-than-expected earnings and revenue in the second quarter, helped by its fast-growing net interest income. The bank on Tuesday posted a profit of $1.42 billion, or $1.93 a share, in the second quarter, compared with $1.17 billion, or $1.52 a share, in the same period a year earlier. Revenue rose 9%, to $5.03 billion, beating analyst projections for $4.78 billion. Net interest income was up 17%, at $1.2 billion, as maturing investment securities were reinvested at higher yields, which offset unfavorable changes in deposit mix. For the full year, BNY raised its net interest income outlook to a high-single-digit-percentage increase, up from prior guidance of a mid-single-digit increase.

Wells Fargo beat second-quarter profit estimates on Tuesday but cut its 2025 guidance for net interest income, sending the shares of the lender down 2% in trading before the bell. The bank expects its interest income to be roughly in line with the 2024 level of $47.7 billion. In April, it said NII growth would be at the low end of the 1% to 3% range. Wells Fargo said lower interest income in its markets business led to the NII forecast cut. Analysts and investors were skeptical about its ability to meet its interest income targets after a slow start to 2025.

J.B. Hunt Transport Services logged lower earnings in the second quarter as medical expenses, insurance costs and driver wages rose. The company on Tuesday posted a profit of $128.6 million, or $1.31 a share, in the quarter ended June 30, compared with $135.9 million, or $1.32 a share, a year earlier. The decrease in earnings was primarily due to increases in casualty insurance and group medical claims expenses, as well as higher professional driver wages and equipment-related costs. Revenue was roughly flat with the prior-year quarter at $2.93 billion. Revenue was driven by a 6% increase in intermodal loads and a 13% increase in truckload loads.

Apple said it would buy $500 million of rare-earth magnets from MP Materials, expanding its U.S. supply chain for a critical element of its devices while under pressure from the Trump administration. MP will supply Apple with magnets it produces in a Texas facility, using recycled materials processed at a site MP will build in California. Such magnets go into the iPhone component that buzzes and vibrates to provide tactile feedback, known as a haptic engine. They are also used in audio equipment and microphones inside various Apple products.

Tesla has made its long-awaited debut in India, where it will sell its electric SUV, the Model Y, starting at $69,770, a significant markup from other major markets. The sales launch comes the same day the American electric vehicle maker opened a showroom in Mumbai, its first in the country. Isabel Fan, Southeast Asia Director at Tesla, also announced that the company would soon launch a showroom in the Indian capital of New Delhi.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

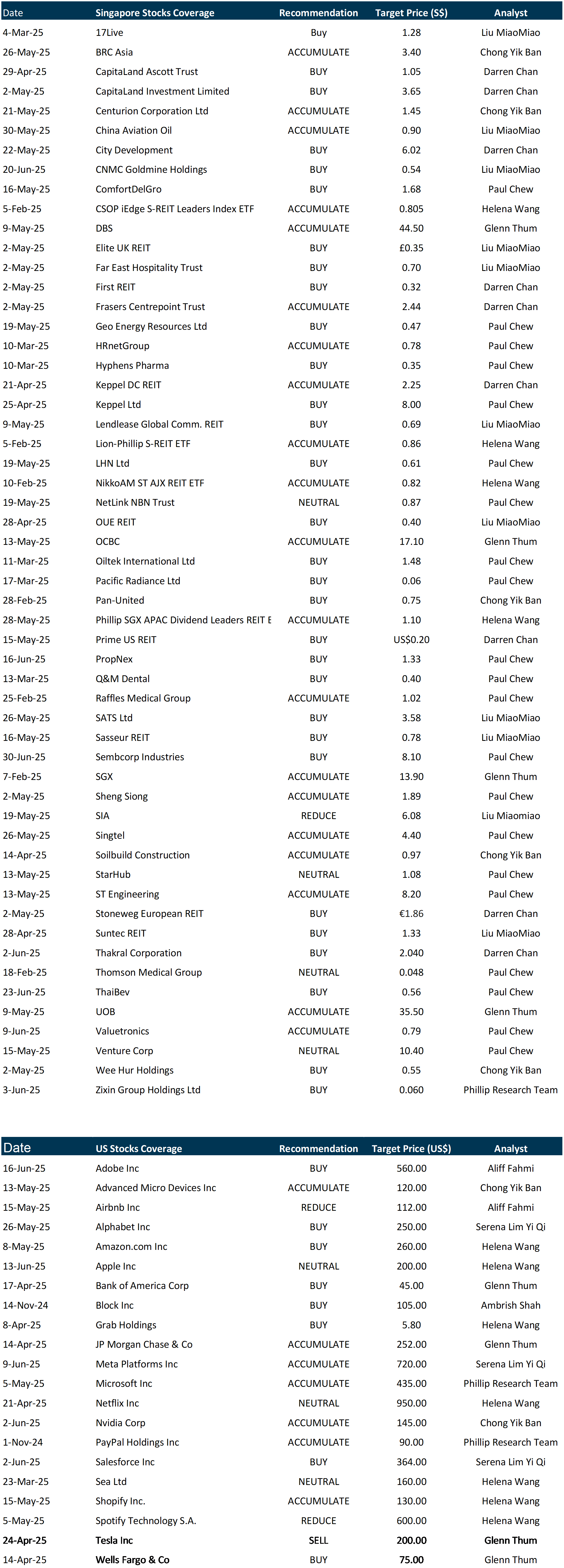

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by MoneyHero Group

Date & Time: 24 July 25 | 12PM-1PM

Register: poems-20250724-124047

Corporate Insights by Keppel Pacific Oak US REIT (KORE)

Date & Time: 29 July 25 | 12PM-1PM

Register: poems-20250729-125320

Corporate Insights by Combine Will International Holdings Limited

Date & Time: 30 July 25 | 12PM-1PM

Register: poems-20250730-124045

Corporate Insights by AA REIT [NEW]

Date & Time: 31 July 25 | 12PM-1PM

Register: poems-20250731-125608

Corporate Insights by Keppel DC REIT [NEW]

Date & Time: 1 August 25 | 12PM-1PM

Register: poems-20250801-125512

Corporate Insights by BHG Retail REIT

Date & Time: 12 August 25 | 12PM-1PM

Register: poems-20250812-125487

Corporate Insights by Manulife US REIT [NEW]

Date & Time: 19 August 25 | 12PM-1PM

Register: poems-20250819-125582

Research Videos

Weekly Market Outlook: Frencken Group Ltd, Frasers Property, Tech Analysis, MAG-7, SG Weekly & More!

Date: 14 July 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials