DAILY MORNING NOTE | 22 October 2024

Recent Podcasts:

Zixin Initiation Report | SGX Company Insights | 30 September 2024

Shopify Initiation Report | US Company Insights | 9 September 2024

Salesforce Inc 2Q25 Results | US Company Insights | 30 August 2024

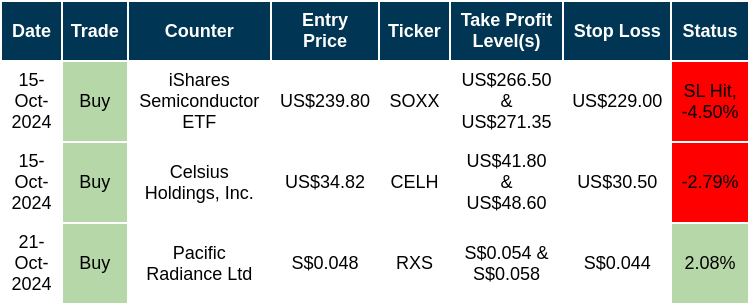

Trade Initiated in Past Week

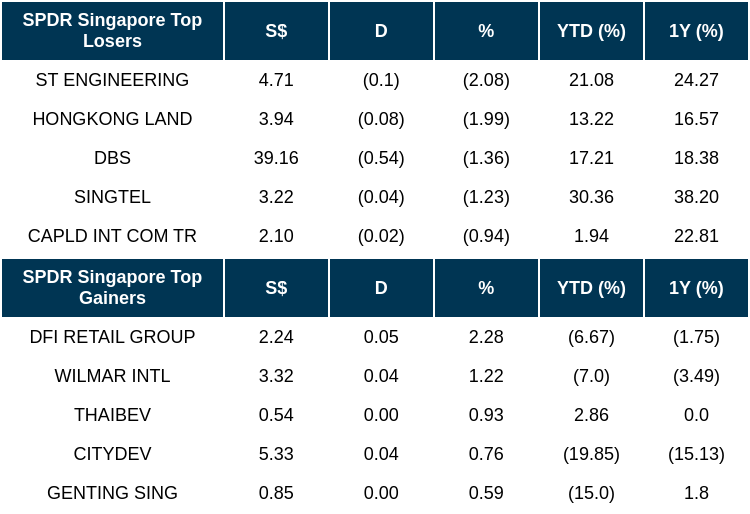

Singapore shares ended 0.7 per cent lower on Monday (Oct 21). The three banking stocks all closed lower. DBS dipped S$0.54 or 1.4 per cent to S$39.16, OCBC was down S$0.12 or 0.8 per cent at S$15.28, and UOB declined S$0.12 or 0.4 per cent to S$32.48. Keppel DC Reit closed at S$2.28 – a 52-week high – after rising 1.3 per cent or S$0.03.

The Dow Jones Industrial Average fell Monday, giving back some of the strong gains from last week, as Treasury yields rose and investors awaited new earnings reports. The Dow lost 0.8% to close at 42,931.60 and snap a three-day run of winning sessions. The S&P 500 slipped 0.18% to 5,853.98. The Nasdaq Composite was the outlier, rising 0.27% and ending at 18,540.01.

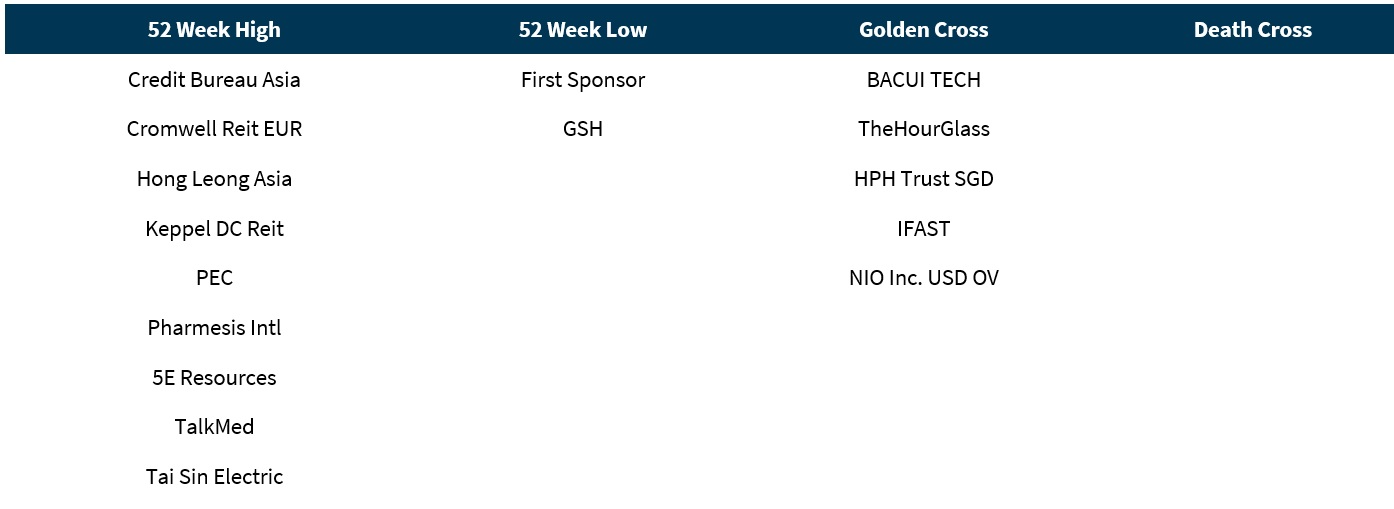

Singapore Technical Highlights

Top gainers & losers

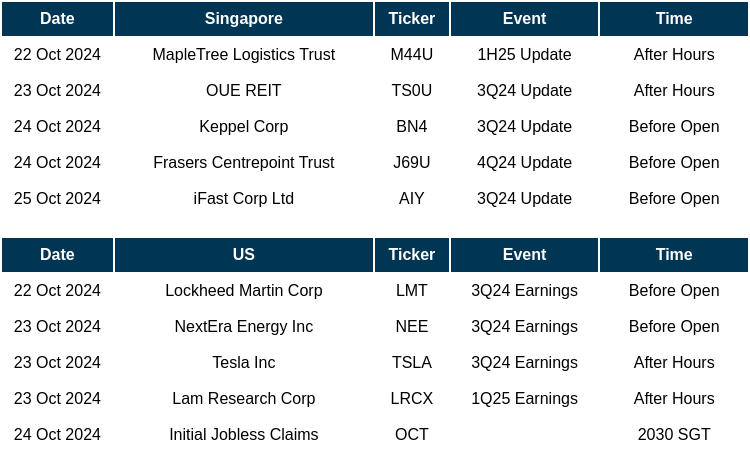

Events Of The Week

SG

Keppel REIT announced key business and operational updates for the third quarter of 2024. 9M 2024 property income and net property income (NPI) increased by 12.3% to S$193.7 million and 10.8% to S$148.5 million year-on-year respectively, stemming from strong operational performance, as well as contributions from 2 Blue Street and 255 George Street. The REIT recorded rental reversion of 10.2% and an increase in portfolio committed occupancy to 97.6%. Portfolio weighted average lease expiry (WALE) and top 10 tenants’ WALE remained at 4.6 years and 8.2 years respectively. As at 30 September 2024, aggregate leverage was 41.9% and 68% of total borrowings were on fixed rates. Weighted average term to maturity of borrowings was 2.9 years and all-in interest rate was 3.38% per annum with adjusted interest coverage ratio at 2.7 times.

Seatrium Limited announced that it has secured multiple contracts for repairs and upgrades, with a total value of S$100 million from various long-standing partners and regular customers. These projects will set to be completed by Q12025, further strengthening Seatrium’s position as a market leader in vessel repairs, upgrades and conversions. The contracts encompass a range of complex projects, including Carbon Capture and Storage (CCS) retrofits, major repairs on yachts, cruise ships, LNG carriers, offshore vessels, tankers, as well as damage repairs.

China on Monday lowered its main benchmark lending rates by 25 basis points at the monthly fixing. The one-year loan prime rate (LPR) has been cut to 3.1%, while the five-year LPR has been trimmed to 3.6%, the People’s Bank of China (PBOC) said. The one-year LPR influences corporate loans and most household loans in China, while the five-year LPR serves as a benchmark for mortgage rates. The move was expected. China’s central bank governor Pan Gongsheng had indicated on Friday during a forum held in Beijing that the loan prime benchmark rates would be lowered by 20 to 25 basis points.

Sembcorp Industries said on Monday (Oct 21) that its wholly owned subsidiary, Sembcorp Utilities, is partnering with Indonesian government-owned electricity producer PLN’s sub-holding company, PLN Energi Primer Indonesia, on a green hydrogen production facility. The facility, to be sited in Sumatra, will produce 100,000 metric tonnes of green hydrogen a year, the company said in a bourse filing. The two sides signed a joint-development agreement at the Singapore International Energy Week 2024. The agreement follows a joint-development study agreement between the two companies, announced a year ago. The next phase of the project will entail detailed engineering and commercial structuring of the project.

Keppel has signed a conditional offtake term sheet with Woodside Energy, Australia’s largest oil and gas developer, for the supply and purchase of liquid hydrogen aimed at powering Keppel’s data centres in Singapore. The term sheet follows the signing of a non-binding heads of agreement between the two parties in April 2023 to evaluate the potential supply of liquid hydrogen to Singapore. Their deal tables commercial principles that may pave the way for an eventual binding offtake agreement for the supply of liquid hydrogen from as early as 2030, Keppel announced on Monday (Oct 21). The sources of liquid hydrogen would include Woodside’s proposed production facilities such as H2Perth, its facility in Perth, Western Australia.

Great Eastern Holdings now has until Jan 24, 2025, to explore options to comply with free float requirements under the Singapore Exchange’s (SGX) listing rules. The insurer had made an application to SGX for a further extension of time to examine its options for complying with these requirements, as OCBC’s final shareholding in Great Eastern will be known only on Oct 23. SGX has no objection to granting the extension, the insurer said on Monday (Oct 21).

The manager of Keppel Pacific Oak US REIT (KORE) says the REIT’s trustee, Perpetual (Asia) Limited, has secured a US$45 million (S$39.5 million) loan facility. The transaction is not expected to have a material impact on the net tangible assets or earnings per unit of KORE for the current financial year ending Dec 31.

Beng Kuang Marine has redeemed its S$3.5 million bond due Nov 5. The bonds were previously issued by the group on Nov 5, 2021. According to an Oct 21 bourse filing, the group has also proposed to issue up to S$3.5 million bonds due 2027. The bonds are expected to be issued at subscription price of 100% of the principal amount of the 2027 bonds and will carry an interest rate of 9% per annum, which will be payable semi-annually in arrears. Additionally, the 2027 bonds are set to be issued in denominations of S$250,000 or integral multiples thereof. Proceeds from the 2027 bonds are expected to go towards refinancing the existing bonds.

Thomson Medical Group has launched and priced S$160 million of notes due 2029, according to an Oct 21 bourse filing. The notes are issued under the group’s S$1 billion multi-currency debt issuance programme, which was established on June 28, 2019. The notes are set to carry an interest of 4.65% annum payable semi-annually in arrear, which will mature five years from the date of issue. The net proceeds from the notes are expected to go towards the refinancing of existing borrowings and general working capital of the group. The notes are set to be issued on the Singapore Exchange Securities Trading (SGX-ST) on Oct 29.

Human resource services (HR) provider Sheffield Green says its wholly owned-subsidiary, Wind Asia Training (WATPL), has entered into a non-binding memorandum of understanding with Grupo Stier XXI for the acquisition of its training centre business in Gran Canaria, Spain. Grupo Stier XXI focuses on the business of operating a training centre and maritime business, which includes providing protection and indemnity (P&I) insurance emergency assistance and providing ship agency solutions. According to an Oct 21 release, the acquisition is expected to “complement the group’s business of providing human resource and ancillary services in the renewable energy industry”.

Acrometa Group has entered into a sale and purchase agreement (SPA) with Altea LSI Asset Management Limited for the disposal of its 70% stake in Life Science Incubator Holdings (LSI). Under the SPA, the disposal has a purchase consideration of S$2.7 million. Upon completion, LSI will cease to be a subsidiary of the group. The net proceeds from the disposal are expected to go towards the group’s general working capital purposes to cover the Acrometa’s operating expenses.

Advanced Holdings says its wholly-owned subsidiary, Advanced Engineering Holdings, has entered into a sale and purchase agreement (SPA) and supplemental agreement with Advanced CAE for the disposal of Advanced CAE Saudi Arabia Company (CAEKSA), a wholly-owned subsidiary of the group. On Sept 17, the group announced that the purchase consideration of CAEKSA stood at S$1, due to the net liability value of the CAEKSA disposal shares and the losses incurred by CAEKSA. CAEKSA reported net tangible liabilities and a loss before tax of S$152,522 and S$149,213 respectively for the financial period ended June 30. According to the group, the disposal is “aligned with the group’s plan to exit from the business of engineering services to focus on its agri-technology operations”. Upon completion of the disposal, the group says that it is expected to redirect its managerial efforts into agri-technology operations. The disposal is expected to be completed by Oct 31.

US

Microsoft will allow businesses to start making their own autonomous artificial intelligence agents starting next month. At its “AI Tour” event in London on Monday, Microsoft revealed plans to allow organizations to create their own autonomous agents within Copilot Studio, the US tech giant’s platform for customizing and building so-called “copilot” assistants. These agents had previously been available in private preview after Microsoft announced them initially in May. Starting next month, they’ll move into public preview, meaning more organizations can start building AI agents of their own. AI agents can act as virtual workers that can carry out a series of tasks without supervision. They are touted as a major evolution of large language model-based AI from chat interfaces, creating an experience that blends more seamlessly into the background. Beyond adding the ability to create autonomous agents in Copilot Studio, Microsoft said it would also launch 10 new autonomous agents in Dynamics 365, the company’s suite of enterprise resource planning and customer relationship management apps. Microsoft plans to introduce new agents in Dynamics 365 for sales, service, finance and supply chain teams.

Google Gemini, the flagship generative AI from Alphabet, is being tapped by Honeywell to search for insights across the industrial giant’s massive data set that can lead to reduced maintenance costs, increased productivity and opportunities to upskill employees. AI-powered agents offered through Google will help automate tasks for engineers and help technicians resolve maintenance issues. Honeywell says while gen AI is already being used within the industrials sector, this partnership will take the opportunity to a higher level than current “gen AI point solutions,” going “beyond simple chat and predictions” by connecting Google AI to the Honeywell Forge IoT platform.

SAP raised its full-year guidance Monday after fiscal third-quarter results beat expectations on both the top and bottom lines, driven by jump in cloud revenue. SAP raised its 2024 outlook adjusted operating profit to between €7.8 billion and €8.0 billion, up from prior guidance of €7.6 billion to €7.9 billion. The stronger guidance was supported by expectations for larger cloud and software revenue. The company now sees cloud and software revenue in a range of €29.5 billion to €29.8 billion, up 10% to 11% from a year earlier and up from a prior forecast range of €29.0 billion to €29.5 billion. For the three months ended Sept. 30, SAP reported adjusted earnings of €1.23 per share on revenue of €8.47 billion, beating the consensus estimates of €1.06 per share and €8.63 billion, respectively.

Nucor reported a nearly 78% slump in third-quarter profit on Monday as the company recorded impairment charges related to its steel products and raw materials businesses. Nucor expects further sequential decline in fourth-quarter net earnings in its steel mills and products segments. The company posted a quarterly profit of nearly US$250 million, or US$1.05 per share, for the third quarter, accounting for impairment charges of US$123 million. Excluding items, the steelmaker earned US$1.49 per share, beating average estimates of US$1.47. Revenue fell more than 15% to US$7.44 billion as the company struggled with weak prices and soft demand. That compared with estimates of US$7.28 billion. Average sales price per ton in the third quarter decreased 6% from the second quarter and 15% from a year earlier.

UBS is offloading part of the Credit Suisse business it acquired last year with a deal to sell the fallen bank’s 50 per cent stake in credit card provider Swisscard. UBS will sell its 50 per cent holding in the company to its joint venture partner American Express (Amex), Swisscard said. Terms of the deal were not disclosed. After the deal, Amex will become the sole owner of Swisscard, with Credit Suisse customers transferring to the existing UBS credit card platform.

Lumen Technologies announced a strategic partnership with Meta Platforms aimed at significantly increasing network capacity to support Meta’s growing artificial intelligence (AI) infrastructure. The new collaboration will leverage Lumen’s Private Connectivity Fabric to provide Meta with enhanced interconnection and bandwidth flexibility, enabling the tech giant to meet the increasing demand for AI-driven services. The partnership highlights the growing need for infrastructure as AI technology evolves to handle complex tasks like real-time language translation and image generation. The initiative will offer access to both existing and new fiber routes between data centers, allowing Meta to continue to meet the needs of billions of users globally. Lumen’s network solutions aim to prepare both companies for future developments in AI by supporting increasingly complex computing tasks.

Eli Lilly said on Monday it sued three medical spas and online vendors for selling products claiming to contain tirzepatide, the main ingredient in its popular weight-loss medicine Zepbound, including in the form of dissolvable tablets. The new lawsuits, which name Pivotal Peptides, MangoRx and Genesis Lifestyle Medicine of Nevada, are the first related to copycat tirzepatide filed since the US Food and Drug Administration took the drug off its list of medicines in short supply earlier this month. The lawsuits were filed in federal and state courts in Indiana, Texas and Washington, accusing each defendant of false advertising and promotion. Lilly said it sent a cease and desist letter to Pivotal Peptides before filing the lawsuit.

Activist investor Starboard Value has a large stake in Kenvue , which spun out of Johnson & Johnson in mid-2023, according to people familiar with the matter. The activist is looking for the company to improve its share price, said the people, who requested anonymity to discuss private information freely. Starboard’s Jeff Smith is expected to discuss the activist’s plans for the company in detail at 13D Monitor’s Active-Passive Investor Summit on Tuesday. Starboard’s push at Kenvue comes just two weeks after news broke that it had amassed a roughly US$1 billion stake in struggling pharmaceutical company Pfizer.

JAB Holding Company has agreed to buy Mondelez International’s 86 million shares in JDE Peet’s for €25.10 per share, a deal worth about €2.16 billion. This purchase will boost JAB’s control over JDE Peet’s, one of the largest coffee companies in the world. Along with this deal, JAB distributed 43 million JDE Peet’s shares to more than 70 investors in its JAB Consumer Partners fund. This represents about 9% of the total shares in the company and raises the amount of JDE Peet’s stock that is available for public trading to 32%. After these transactions, JAB’s ownership of JDE Peet’s will increase to 68%, giving it even more control over the company.

US investment firm KKR has extended by 10 working days the first stage of its tender to take Japanese IT services firm Fuji Soft private, it said in a filing on Monday. The first stage of the binding offer was previously due to expire on Monday, Oct. 21 but will now expire on Nov. 5. Fuji Soft shareholders will still have a second opportunity to tender to KKR’s offer after the first stage concludes. Both stages are priced at 8,800 yen (US$58.73) per share, around 7% lower than a rival binding proposal made by Bain Capital on Oct. 11 at 9,450 yen per share.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

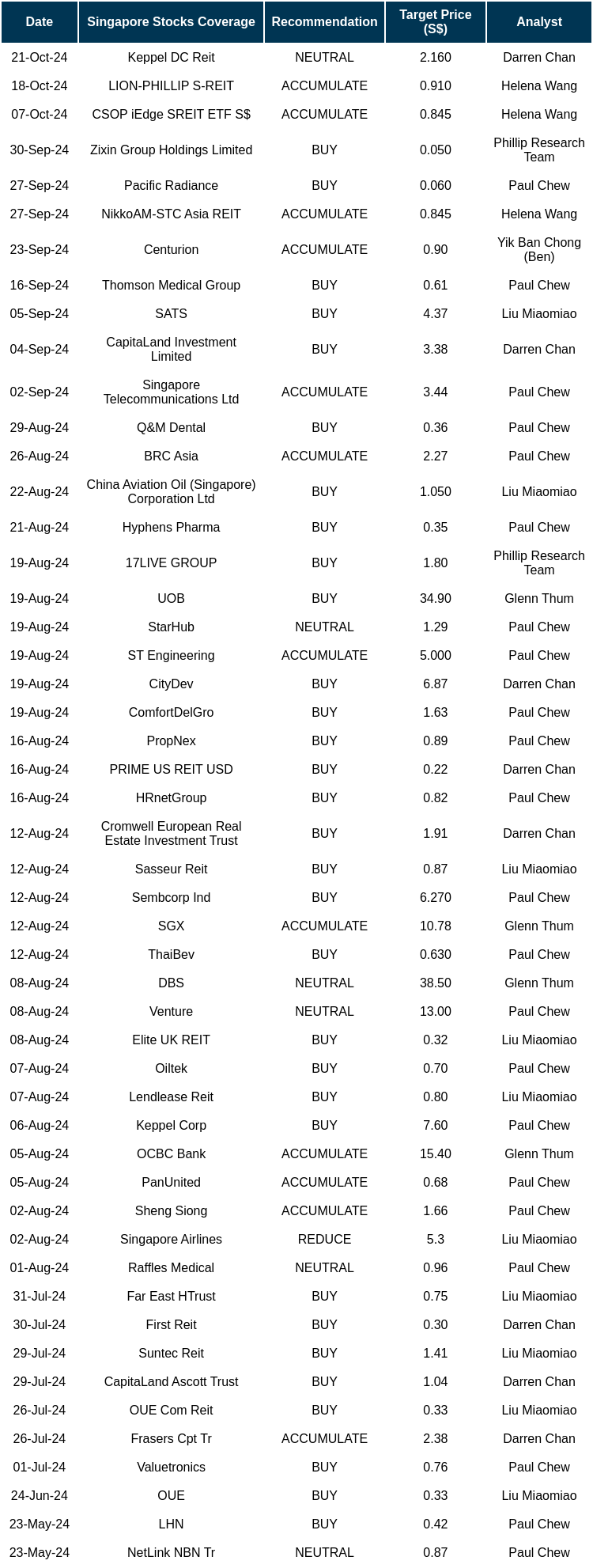

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Keppel Pacific Oak US REIT (KORE)

Date & Time: 24 October 24 | 12PM-1PM

Register: poems-20241024-102062

Corporate Insights by AIMS APAC REIT

Date & Time: 5 November 24 | 12PM-1PM

Register: poems-20241105-104472

Corporate Insights by PropNex

Date & Time: 6 November 24 | 12PM-1PM

Register: poems-20241106-104312

Corporate Insights by Manulife US REIT

Date & Time: 7 November 24 | 12PM-1PM

Register: poems-20241107-104496

Corporate Insights by Lendlease Global Commercial REIT [NEW]

Date & Time: 19 November 24 | 12PM-1PM

Register: poems-20241119-104563

Corporate Insights by Centurion Corporation Limited

Date & Time: 26 November 24 | 12PM-1PM

Register: poems-20241126-104402

Research Videos

Weekly Market Outlook: Netflix, Keppel DC, Wells Fargo, Bank of America, Tech Analysis & More!

Date: 21 October 2024Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials