DAILY MORNING NOTE | 25 February 2025

Recent Podcasts:

Shopify Inc. – Solid results, but valuations look full

Singapore Air Transport – Feb25 – Cargo headwinds from cancellation of De Minimis

Far East Hospitality Trust – RevPAR growth is expected to continue in FY25e

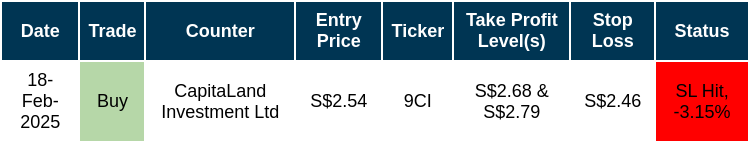

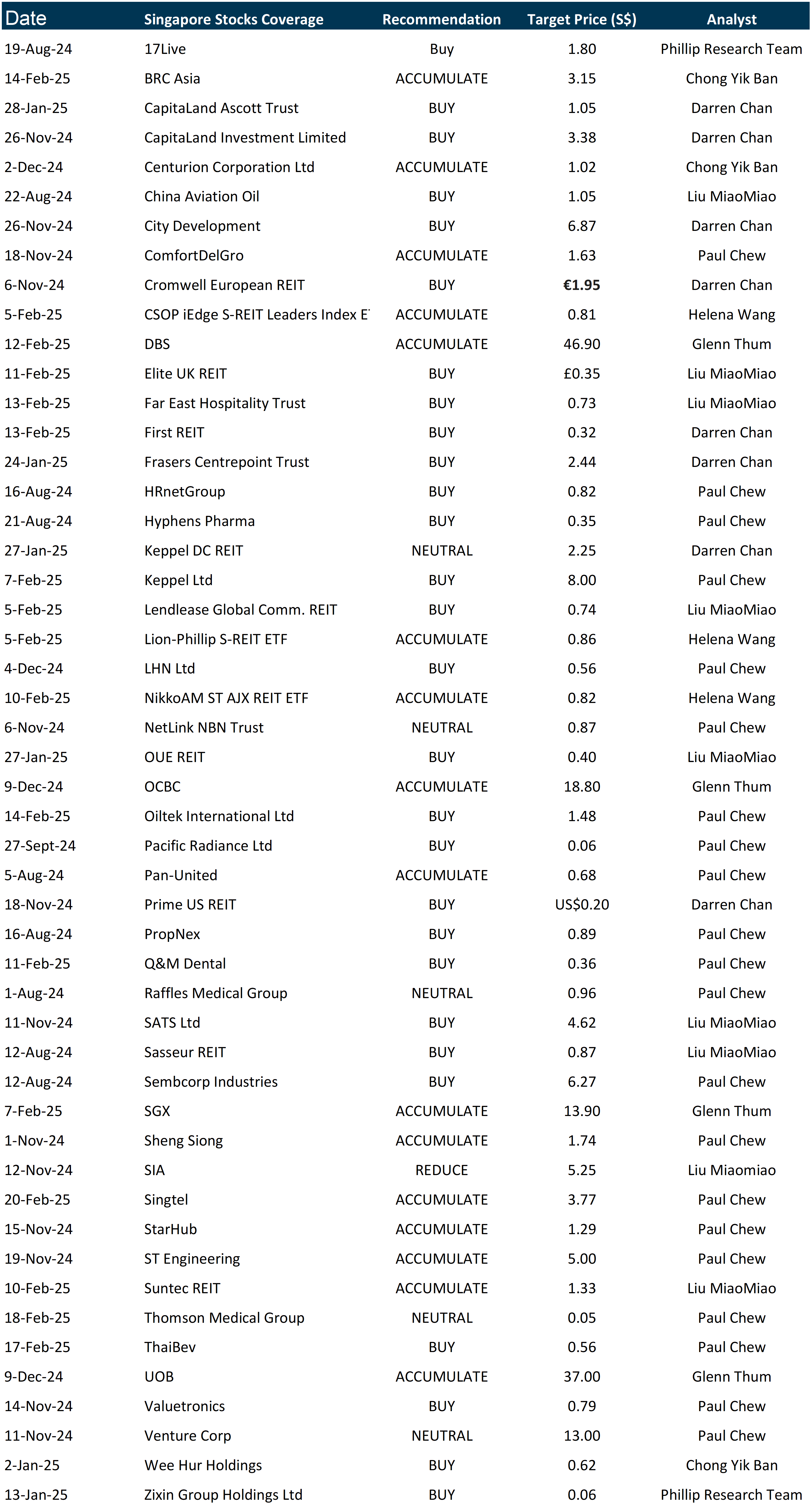

Trade Initiated in Past Week

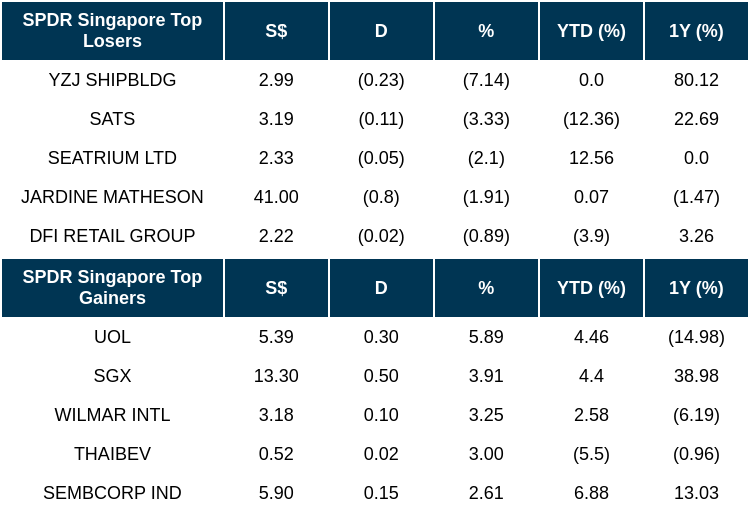

Singapore equities fell 0.1 per cent at the end of the first trading session since the Monetary Authority of Singapore (MAS) unveiled plans to boost the stock market. The top gainer was property developer UOL, which rose 5.9 per cent or S$0.30 to S$5.39. The Singapore Exchange (SGX) was the next-highest gainer. It rose 3.9 per cent or S$0.50 to S$13.30. Meanwhile, maritime player Yangzijiang Shipbuilding tumbled 7.1 per cent or S$0.23 to S$2.99, and was the biggest loser. The three local banks finished in the red. DBS fell 0.6 per cent or S$0.27 to S$46.35, UOB slid 0.1 per cent or S$0.03 to S$38.35, and OCBC decreased 0.2 per cent or S$0.04 to S$17.69.

The Nasdaq Composite fell 1.21% on Monday, with big technology stocks creating the biggest drag as investors worried about demand for technology supporting artificial intelligence while they waited for results from market heavyweight Nvidia. The S&P 500 closed 0.50% lower, marking its third straight day of declines, while the Dow managed to eke out a slight gain of 0.08%.

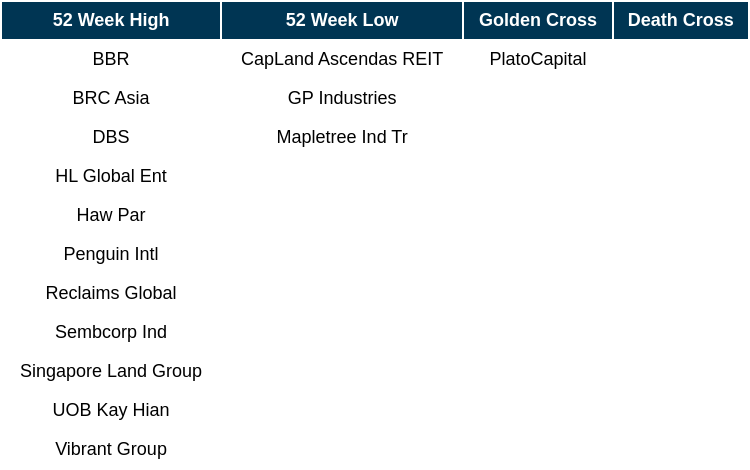

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

TOP 5 GAINERS & LOSERS

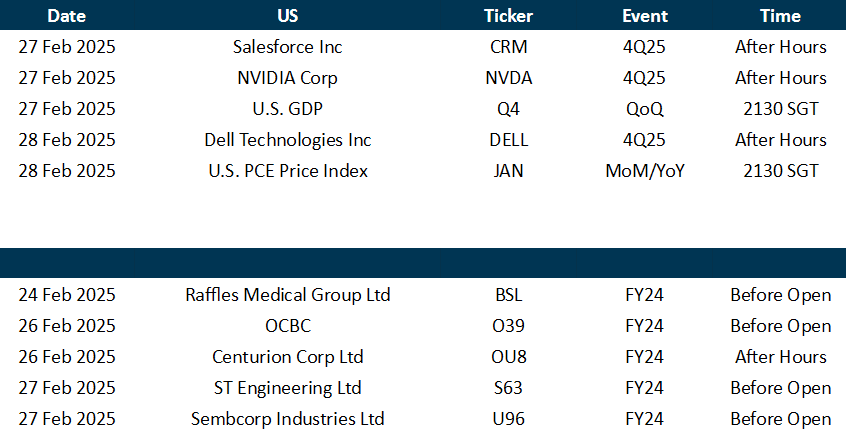

Events Of The Week

SG

Singapore’s core and headline inflation came in sharply lower than expected in January, data from the Department of Statistics showed on Monday (Feb 24). But the official full-year forecast ranges for both core and headline inflation remained unchanged, based on a joint release by the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI). January’s core inflation, which excludes accommodation and private transport, was 0.8 per cent. This was lower than both the 1.7 per cent rate in December and the median forecast of 1.5 per cent. Headline inflation was 1.2 per cent, down from 1.5 per cent in December and lower than economists’ median forecast of 2.4 per cent. On a month-on-month basis, overall CPI fell by 0.7 per cent in January, while core CPI dropped by 0.2 per cent.

PropNex Limited recorded a net profit of S$40.9 million on revenue of S$783.0 million for the full year ended 31 December 2024 (FY2024). FY2024’s lower revenue was primarily due to a 23.4% year-on-year (YoY) decrease in commission income from project marketing services to S$185.6 million. Commission income from agency services rose slightly to S$591.6 million. The financial impact of last quarter’s significant rebound in private new home launches for the period ended 31 December 2024 was not reflected in FY2024 results, as revenue is typically recognised three to four months later. The Board of Directors has proposed a final cash dividend of 3.00 cents a share, together with a special cash dividend of 2.50 cents a share to mark the Group’s 25th anniversary in 2025. This brings the total dividend for FY2024 to 7.75 cents a share, reflecting a payout ratio of 140.1% of its net attributable profit and a dividend yield of 8.2% (based on share price as at 31 December 2024).

Yangzijiang Financial Holding Ltd. reported total income of S$326.2 million for FY2024, reflecting a 6% decline from S$348.4 million in FY2023. This decrease was primarily driven by lower interest income, which fell to S$195.8 million in FY2024 due to a reduced average balance of debt investments in China. However, the decline was partially offset by stronger contributions from cash management activities and fund investments. Net profit attributable to equity holders of the Company grew by 51%, reaching S$304.6 million, up from S$201.8 million in FY2023. The Group reported diluted earnings per share of 8.66 Singapore cents. The board is proposing a final dividend of 3.45 Singapore cents per share, amounting to a payout ratio of 40% and a dividend yield of 6.1%. This is subject to shareholders’ approval at the forthcoming Annual General Meeting (AGM) to be held in April 2025.

Great Eastern Holdings Limited registered Total Weighted New Sales (TWNS) growth for FY24, reporting an increase of 8% over last year. 4Q24 Group’s TWNS decreased 16% against the previous year, reflecting lower single premium sales in the Singapore market. In 4Q24, the Group has written down its New Business Embedded Value (NBEV) by S$91.7m reflecting revised actuarial assumptions following the annual review exercise at end of the year. Excluding this impact, 4Q24 NBEV would have been S$197.4m, 13% lower than the same period last year due mainly to the lower TWNS. Similarly, for FY24, excluding this impact, NBEV would have been S$713.2m, an increase of 4% over FY23 driven by higher TWNS. Group’s Profit Attributable to Shareholders in FY24 registered year-on-year growth of 28% driven mainly by improved expense variances from effective cost management initiatives and improved claims experience from individual life business, as well as favourable investment performance from shareholders’ fund. The Board of Directors has recommended, for shareholders’ approval at the Annual General Meeting, the payment of a final one-tier tax exempt dividend of 45 cents per ordinary share. Upon approval, the final dividend will be payable on 6 May 2025. Including the interim one-tier tax exempt dividend of 45 cents per ordinary share paid in August 2024, the total dividend declared for FY24 would amount to 90 cents per ordinary share.

AVJennings Ltd announced its financial results for the six-month period ended 31 December 2024 (1H25), reporting a Profit Before Tax (PBT) of $3.6M, down 14% compared to the Prior Corresponding Period (PCP) (1H24 PBT: $4.2M). Net Profit After Tax (NPAT) for the period was $2.4M (1H24 NPAT: $2.8M). During 1H25, the Company settled 325 lots, representing a 20% increase on the 270 lots settled in 1H24. Revenue for the period grew by 9% on the PCP to $131.4M (1H24: $120.4M), driven by a significant increase in apartment settlements. Given the ongoing due diligence process underway with Proprium Capital Partners and AVID Property Group jointly (AVID), and Ho Bee Land Limited (HBL) both having made Non-Binding Indicative Offers (NBIO) for AVJennings shares, the Board felt it prudent to await the outcome of the due diligence process and the finalisation of the proposed offer terms, structure and documentation prior to considering any 1H25 dividend. While the exclusivity period for both parties expired on 21 February 2025, AVJennings remains in active discussions with both parties as they continue to conduct due diligence to pursue a binding proposal.

EC World Asset Management Pte. Ltd. reported a full year 2024 (FY2024) lower operating performance across its portfolio. Gross revenue in RMB terms was 14.5% lower compared to FY2023, mainly due to termination of master lease agreements (MLAs) upon lease expiry, coupled with effect of novation of underlying leases from master leases and related party leases. NPI in RMB terms was 18.5% lower as compared to FY2023, mainly due to lower revenue, bad debt provision, higher business tax as a result of accrual of late payment penalty, and slightly offset by capitalization of expenses. As of 31 December 2024, the accrued overdue rent receivables owing to ECW and its subsidiaries (collectively, the ECW Group) by the Sponsor and its subsidiaries (collectively, the Sponsor Group) has exceeded RMB629.9 million (S$117.4 million). Of the outstanding rent receivables, RMB547.4million (S$102.0 million) represents the rent payable accrued pursuant to master leases, while the balance RMB82.5 million (S$15.4 million) represents the rent payable accrued by the Sponsor Group entities pursuant to other related party leases. Calculated distribution to Unitholders of S$15.8 million represents S$13.8 million or 46.7% decrease compared to FY2023, mainly due to lower revenue, higher operating expenses and interest cost. No distribution has been declared for the period from 1 July 2024 to 31 December 2024 (2HFY2024) due to events of default continuing under the Offshore Facility Agreement and ECW having insufficient funds to make the distribution.

Credit Bureau Asia Limited announced for the full year ended 31 December 2024 (FY2024), revenue grew 10% to S$59.7 million and net profit before tax grew 14% to S$30.5 million. PATMI grew 14% to S$11.2 million. The Board is recommending a final dividend of 2.0 Singapore cents per ordinary share, bringing the total dividend payout for FY2024 to 4.0 Singapore cents per ordinary share, an increase of 8.1% over FY2023.

DBS Bank has increased its stake in Netlink NBN Trust to 1.217% after buying 500,000 units in the latter via the open market. DBS made the transaction on Feb 17, buying the units for S$427,500 or 85.5 cents apiece.

Kimly Limited’s wholly-owned subsidiary, Kimly Makan Place Pte. Ltd. (KMP) has, on 24 February 2025, entered into a joint venture agreement (JVA) with 206 Holdings Pte. Ltd. (206 Holdings) in relation to, inter alia, the operation and management of the short-term Housing and Development Board (HDB) coffee shop lease of the coffee shop located at Block 206 Toa Payoh North #01-1197 Singapore 310206 (Toa Payoh 206 coffee shop) leased by the joint venture company, 206 Management Food Court Pte. Ltd. (JVCO).

Progen Holdings Ltd. is expected to report a net profit for the half year ended 31 December 2024 (2H2024) as compared to the net loss recorded in the corresponding period of the previous financial year. However, the Group is still expecting to report a net loss for the full year ended 31 December 2024 (FY2024). The profit for 2H2024 is mainly due to the higher revenue recorded in 2H2024 and this contributed towards a lower net loss for FY2024. Further details of the Group’s financial performance will be disclosed in the announcement of the Group’s unaudited financial results for 2H2024 and FY2024 to be released by 1 March 2025.

CosmoSteel Holdings Limited provided a voluntary results announcement for the first quarter of its financial year ending 30 September 2025 (1QFY2025). The Group has returned to profitability, after recording a loss for the financial year ended 30 September 2024 (FY2024), reporting a profit before tax of S$2,491,000 and profit after tax of S$2,489,000 for 1QFY2025. Such level of profitability was achieved after taking into account, inter alia, the fulfilment of certain orders, the delivery of which was delayed in FY2024 and carried over into 1QFY2025 and reporting of other gains of S$1,940,000 arising from foreign exchange transaction and translation gains and reversal of write-down of inventories.

KTMG Limited expects to report a loss for 2H2024 and FY2024. Despite an increase in revenue in 2H2024 and FY2024, the Group anticipates reporting a net loss, primarily due to rising raw material costs attributable to changes in the product mix, increased labour costs from production bottlenecks in the cutting department caused by delays in commissioning of new machinery, resulting in production delays during peak period, as well as higher export handling and air freight expenses stemming from these delays. The Group is in the process of finalising its unaudited consolidated financial results for 2H2024 and FY2024. Further details of the Group’s financial performance will be disclosed when the Company announces the unaudited consolidated financial results for 2H2024 and FY2024, which will be released on or before 27 February 2025.

ZICO Holdings Inc. has decided to change its presentation currency from Malaysian Ringgit (MYR) to Singapore Dollars (SGD) as it is more reflective of the underlying transactions of the Group and events and conditions relevant to the Group. In line with the change in presentation currency, the Company will present its upcoming financial statements of the Company and the Group for the financial year ended 31 December 2024 in SGD.

Pollux Properties Ltd. is expected to report a lower profit for FY2024 as compared to the financial year ended 31 December 2023. The lower profit for FY2024 is mainly attributable to the following: (a) The fair valuation loss recorded on the Group’s investment properties as at 31 December 2024; (b) The depreciation of Indonesian Rupiah against Singapore Dollar; and (c) Increase in property tax. The Company is still in the process of finalising the financial results of the Group for FY2024. Further details of the Group’s financial performance will be disclosed when the Company announces its unaudited financial results for FY2024 on or before 28 February 2025.

Pharmesis International Ltd. is expected to report a net profit for the unaudited condensed interim financial statements for the six months and full year ended 31 December 2024 (FY2024). The Group is in the process of finalising its financial results for FY2024 and further details of the Group’s financial performance will be disclosed when the Company announces its unaudited condensed interim financial statements for FY2024.

World Precision Machinery Limited announced that following a preliminary review of the unaudited consolidated financial results of the Group for the fourth quarter ended 31 December 2024 (4QFY2024) and full year ended 31 December 2024 (FY2024), the Group is expected to report a profit after tax in 4QFY2024 and FY2024. Further details of the Group’s financial performance will be disclosed when the Company announces its unaudited consolidated financial results of the Group for 4QFY2024 and FY2024 on 1 March 2025.

Keppel DC REIT has established its inaugural Green Financing Framework to bolster its sustainability efforts and progress towards achieving its environmental, social and governance (ESG) targets and commitments. The Framework will guide green financing transactions undertaken by Keppel DC REIT, exclusively funding green data centre projects that meet the eligibility criteria in five categories: green buildings, renewable energy, energy efficiency, climate change adaptation and sustainable water management. Eligible types of investments include acquisitions of new or existing data centres, capital and operating expenditure, as well as asset enhancement initiatives. The Framework also outlines the management of funds for green data centre projects, and establishes methodologies to monitor and report the environmental outcomes of the green financing transactions.

Following the Memorandum of General Agreement (MOGA) entered into among GuocoLand’s wholly-owned subsidiary, GuocoLand (Singapore) Pte. Ltd. (GLS) with TID Residential Pte. Ltd. (TIDR) and Intrepid Investments Pte. Ltd. (Intrepid), GLS has today entered into a Joint Venture Agreement (JVA) with TIDR, Intrepid and Faber Walk Residence Pte. Ltd., a company that was established for the development of the Land Parcel at Faber Walk, Singapore. Pursuant to the terms of the MOGA and JVA, the rights and obligations of GLS, TIDR and Intrepid (collectively, the JV Partners) in the joint venture for the acquisition, development and dealing of the Land Parcel are borne by the JV Partners in their shareholdings of 50%, 40% and 10% respectively.

US

Following a union complaint about unfair Chinese competition in shipping and shipbuilding, the Trump administration‘s trade representative has proposed unprecedented access fees for Chinese-operated and Chinese-built ships – fees large enough to change the economics of container shipping in the U.S. market. The proposed fee structure is complex and steep, and the register notice contains several policy alternatives. All would be quite costly for the operator: (a) Each U.S. port call for any vessel operated by Chinese interests will be subject to a fee of either US$1 million per ship for any size vessel, from tugboats up to VLCCs; or US$1,000 per deadweight tonne – a far lower price (b) Each U.S. port call for each vessel built in China, but operated by non-Chinese interests, will be subject to a fee of up to US$1 million, depending on the proportion of Chinese-built ships in that operator’s fleet (c) Operators who have newbuilds on order in China will face additional fees of up to US$1 million per port call (d) If an operator owns a U.S.-built vessel, each port call of that vessel in the U.S. could generate a refund in an amount of up to US$1 million per entry. Specifics for minimum vessel size, cargo volume, voyage distance or port call duration were not provided.

President Donald Trump said Monday that sweeping U.S. tariffs on imports from Canada and Mexico “will go forward” when a month long delay on their implementation expires next week. “The tariffs are going forward on time, on schedule,” Trump said when asked at a White House press conference if the postponed tariffs on the two U.S. trading partners would soon go back into effect. The president claimed that the U.S. has “been taken advantage of” by foreign nations on “just about everything,” and reiterated his plan to impose so-called reciprocal tariffs. “So the tariffs will go forward, yes, and we’re going to make up a lot of territory,” Trump said.

Tesla is readying a software update for customers in China to offer driving-assistance capabilities similar to its full self-driving (FSD) features in the U.S., citing a person familiar with the matter. The capabilities will be deployed to customers who have paid 64,000 yuan (US$8,831.73) for what Tesla calls FSD, the report said. The self-driving update will allow Tesla owners to use driver-assist features on city streets, the report said, adding that it will be introduced on select models and gradually expanded.

Apple plans to open a new factory for artificial intelligence servers in Texas as part of a US$500 billion investment in the U.S., the company said on Monday. The U.S. technology giant said it would work with partners to open a 250,000-square-foot server manufacturing facility in Houston to produce servers for Apple Intelligence, its AI personal assistant for iPhone, iPad and Mac computers. The new factory, which is slated to open in 2026, will form part of a major investment plan Apple is committing to over the next four years. In addition to the new Texas facility, Apple said it also plans to hire around 20,000 new employees across the U.S. Most of the new hires will be focused on research and development (R&D), silicon engineering, software development, and AI and machine learning, Apple said. The move comes after Apple’s chief executive met with President Donald Trump last week.

Domino’s Pizza reported fourth quarter earnings and revenue that fell short of estimates. The world’s largest pizza chain posted adjusted earnings per share of US$4.89, missing the consensus forecast of US$4.96. Revenue came in at US$1.44 billion, below expectations of US$1.49 billion. Global retail sales growth, excluding foreign currency impact, was 4.4% in Q4 compared to 4.9% growth in the same period last year. U.S. same-store sales increased a modest 0.4% year-over-year. International same-store sales growth, excluding foreign currency impact, was 2.7% in Q4 versus just 0.1% growth a year ago. Domino’s board approved a 15% increase in its quarterly dividend to US$1.74 per share.

Intel on Monday said that the first two cutting-edge lithography machines from ASML Holding are “in production” at its factories, with early data indicating they are more reliable than earlier models. At a conference in San Jose, California, Intel senior principal engineer Steve Carson said Intel has produced 30,000 wafers, the large discs of silicon that can yield thousands of computing chips, in a single quarter with ASML’s high numerical aperture (NA) lithography machines.

Hims & Hers Health shares plunged in extended trading on Monday after investors looked past better-than-expected revenue and earnings and focused instead on the disappointing gross margin. Earnings per share was 11 cents vs. 10 cents expected and revenue came in at US$481 million vs. US$470 million expected. However, the company’s gross margin was 77%, while analysts were expecting 78.4%. For the first quarter, Hims & Hers expects to report revenue of US$520 million to US$540 million, while analysts were expecting US$497 million. Adjusted earnings will be between US$55 million and US$65 million for the period, the company said.

Tempus AI, Inc. reported fourth quarter results Monday, following which shares were down in after-hours trading. The artificial intelligence-powered precision medicine company posted revenue of US$200.7 million for the quarter ended December 31, 2024, up 35.8% YoY. Adjusted loss per share came in at US$0.18, narrower than the US$1.58 loss reported in the same quarter last year. Tempus said its genomics business generated US$120.4 million in Q4 revenue, up 30.6% YoY, while data and services revenue grew 44.6% to US$80.2 million. For the full year 2025, Tempus expects revenue of approximately US$1.24 billion, representing 79% annual growth. The company also anticipates achieving positive adjusted EBITDA of US$5 million in 2025, an improvement of about US$110 million over 2024. Tempus ended 2024 with US$940 million in total remaining contract value and 140% net revenue retention. The company completed its acquisition of Ambry Genetics on February 3, 2025.

Trip.com Group Limited announced its unaudited financial results for the fourth quarter and full year of 2024. International businesses experienced robust growth across all segments in the fourth quarter of 2024. Outbound hotel and air ticket bookings have recovered to more than 120% of the pre-COVID level for the same period in 2019. Air ticket and hotel bookings on its international OTA platform increased by over 70% year-over-year. Inbound travel bookings surged by more than 100% year-over-year. Net revenue for the fourth quarter was RMB12.7 billion (US$1.7 billion), representing a year-over-year growth of 23%. Net income for the fourth quarter was RMB2.2 billion (US$300 million), compared to RMB1.3 billion for the same period in 2023. Adjusted EBITDA for the fourth quarter was RMB3.0 billion (US$408 million), an improvement from RMB2.9 billion for the same period last year.

Zoom Communications forecast revenue for the full year and the first quarter below Wall Street estimates on Monday. Zoom expects fiscal 2026 revenue between US$4.79 billion and US$4.80 billion, compared with the average estimate of US$4.81 billion. The company will launch an upgraded version of its AI companion in April, to automate workplace tasks through custom agents.

Anthropic says it’s developed the company’s “most intelligent” AI model yet. The Amazon-backed startup on Monday unveiled Claude 3.7 Sonnet. What makes it unique is its so-called hybrid model, which combines an ability to reason — or stopping to think about complex answers — with a traditional model that spits out answers in real time. Anthropic says it’s the only “hybrid” model of its kind available on the market, and will go live immediately. Anthropic co-founder and science chief Jared Kaplan likened it to the way the human brain operates. Some questions require deep thinking, some require quick responses. But Anthropic is looking to integrate both capabilities, rather than have an entirely separate model for both.

Chegg on Monday filed suit in federal district court against Google, claiming that artificial intelligence summaries of search results have hurt the online education company’s traffic and revenue. Chegg will look at strategic options, including getting acquired and going private, President and CEO Nathan Schultz said in Monday’s earnings call. Chegg reported a US$6.1 million net loss on US$143.5 million in fourth-quarter revenue, a 24% decline year over year, according to a statement. Analysts had expected US$142.1 million in revenue. Management called for first-quarter revenue between US$114 million and US$116 million, below analyst forecasts of US$138.1 million.

Robinhood said on Monday the U.S. Securities and Exchange Commission had closed its investigation into the company’s crypto trading arm with no action. In May 2024, Robinhood had received a notice warning that it could be charged for a potential violation of securities law within its crypto unit.

Moody’s Ratings has placed all credit ratings of Coinbase Global, Inc. on review for upgrade, including the B2 Corporate Family Rating (CFR) and B1 Backed Senior Unsecured ratings. This comes after the previously stable outlook was changed. The review for upgrade follows Coinbase’s announcement that it has reached an agreement with the US Securities and Exchange Commission (SEC) to dismiss pending litigation against the company. This is subject to approval by the SEC’s commissioners. The review also reflects significant improvements in Coinbase’s financial profile and liquidity position.

Bitcoin treasury company Strategy (formerly MicroStrategy) acquired an additional 20,356 BTC for approximately US$1.99 billion at an average price of US$97,514 per bitcoin between Feb. 18 and Feb. 23, according to an 8-K filing with the Securities and Exchange Commission on Monday. The company now holds 499,096 BTC, worth over $47 billion.

Johnson & Johnson said on Monday it had filed a lawsuit against Samsung Bioepis for breaching its contract agreement with the drugmaker over the launch of a biosimilar to Stelara, J&J’s autoimmune drug. J&J said it is seeking a preliminary injunction for Samsung Bioepis’ close copy of Stelara over an unauthorized sublicense deal with a private label provider, which the drugmaker declined to identify.

Starbucks will lay off 1,100 corporate employees and will not fill several hundred other open positions, the coffee chain’s CEO Brian Niccol said Monday. The cuts will not affect workers at the company’s cafes.

MongoDB, Inc., a leading modern application database provider, has announced the acquisition of Voyage AI, a company specializing in advanced embedding and reranking models for AI applications. This integration will allow organizations to build reliable, AI-powered applications by providing precise and pertinent information retrieval deeply integrated with operational data.

Unity Software announced plans to offer US$500 million in convertible senior notes due in 2030. The offering, which is subject to market conditions, aims to attract qualified institutional buyers and includes an option for an additional US$75 million in notes. Unity intends to use the proceeds from the offering to finance the repurchase of its 0% Convertible Senior Notes due in 2026, with any remaining funds allocated for general corporate purposes, including potential acquisitions or investments, though no plans have been disclosed. The company also plans to enter into capped call transactions to minimize potential dilution from the conversion of the new notes.

BP‘s chief executive will scrap a target to increase renewable generation 20-fold by 2030, returning the focus to fossil fuels, as part of a strategy shift announced on Wednesday to tackle investor concerns over earnings.

Chevron said on Monday it would reorganize some of its business structures and reshuffle the leadership team, the latest move by the U.S. energy major to simplify its operations. The company has said it would lay off up to 20% of its global workforce by the end of 2026, as it navigates cost overruns and delays in a large Kazakhstan project. Its US$53 billion acquisition of Hess has been stalled due to an arbitration battle with larger rival Exxon Mobil.

NVIDIA Corporation has secured more than 70% of contract chipmaker TSMC‘s advanced chip packaging capacity for 2025, Taiwanese media reported on Monday, amid increased artificial intelligence demand for chips.

Australia’s Perpetual on Monday said it has ended talks with KKR for the sale of its wealth management and corporate trust units, while confirming plans to pursue a sale of its wealth management business separately. The deal with KKR, which was initially announced in May last year, was deemed to be not in the best interests of shareholders by an independent expert.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

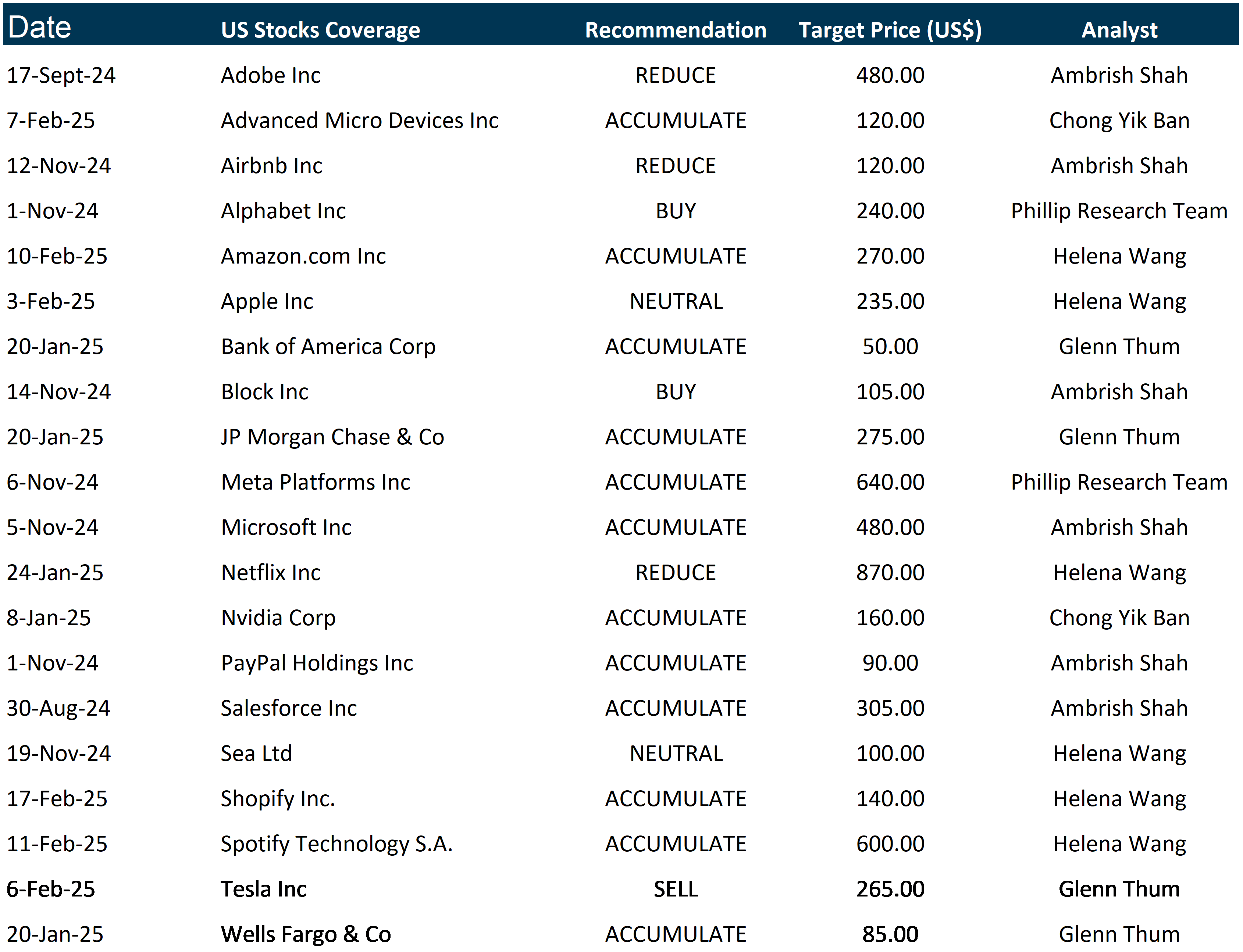

RESEARCH REPORTS

PRIME US REIT – Unexpected rise in portfolio valuations

Recommendation: BUY; TP US$0.200; Last close: US$0.153; Analyst: Darren Chan

- 2H24/FY24 DPU of 0.11/0.29UScts (-52%/-88% YoY) were below expectations at 33%/88% of our FY24e forecast. The YoY decline was due to: 1) the manager retaining c.90% of DI for capital expenditure, 2) the divestment of One Town Center in July 24, 3) Waterfront at Washingtonian’s asset enhancement initiative (AEI), and 4) higher finance expenses. 2H24/FY24 DI was 36%/93% of our FY24e forecast.

- Portfolio valuations rose 2.2% YoY to US$1.352bn, driven by stronger operating performance and positive leasing momentum, despite a slight increase in cap and discount rates. FY24 leasing volume grew 1.9% YoY, with leases signed at a 1.8% positive rental reversion.

- We maintain BUY with an unchanged TP of US$0.20. We lower our FY25e/26e DPU estimates by 21%/20% to reflect a lower NPI margin, aligning with FY24 levels as we roll forward our forecasts. Assuming the 10% payout ratio continues through FY25e and Prime resumes full distributions in FY26e, the current share price implies an FY25e/26e DPU yield of 1.7%/19.5%. We expect a return to 100% distribution in FY26e, supported by higher portfolio occupancy, lower capex and tenant incentive requirements, and cash contributions from leases signed in FY24/FY25 as rent-free periods and incentives phase out. With more employers mandating return-to-office five days a week, Prime is well-positioned to benefit from this trend and the improving leasing momentum. Prime is currently trading at a steep discount at 0.26x P/NAV.

Raffles Medical Group Ltd – Returning to stable growth

Recommendation: ACCUMULATE; TP S$1.02; Last close: S$0.880; Analyst: Paul Chew

- FY24 revenue and PATMI exceeded our expectations at 116% /127% of our FY24e estimates respectively. 2H24 adj. PATMI jumped 49% YoY to S$34.9mn.

- Revenue rebounded 14% in 2H24 from a recovery in elective surgeries and foreign patients in Singapore and a bounce in China volume. Margins expanded as staff costs stabilised and insurance operations broke even in 2H24.

- We raise our FY25e PATMI by 38% to S$71.6mn. The healthcare services from clinics have been surprisingly strong in Singapore. Our DCF target price is raised to S$1.02 (prev. S$0.96), and the recommendation is raised to ACCUMULATE from NEUTRAL. With the bulk of investments in China completed, the company is raising the dividend payout ratio to at least 50% (prev. up to 50%). It also plans to buy back up to 100mn shares over the next 2 years. The revenue momentum in China could allow it to break even in FY26e.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Prime US REIT

Date & Time: 25 February 25 | 12PM-1PM

Register: poems-20250225-111267

Corporate Insights by IREIT Global

Date & Time: 27 February 25 | 12PM-1PM

Register: poems-20250227-110518

Corporate Insights by Netlink NBN Trust

Date & Time: 4 March 25 | 12PM-1PM

Register: poems-20250304-112646

Corporate Insights by SunCar Technology Group Inc.

Date & Time: 5 March 25 | 12PM-1PM

Register: poems-20250305-110131

Corporate Insights by APAC Realty

Date & Time: 7 March 25 | 12PM-1PM

Register: poems-20250307-111928

Corporate Insights by TeleChoice [NEW]

Date & Time: 11 March 25 | 12PM-1PM

Register: poems-20250311-112959

Research Videos

Weekly Market Outlook: BRC Asia, Spotify, Shopify, DBS, ThaiBev, Tech Analysis, SG Weekly & More!

Date: 17 February 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials