DAILY MORNING NOTE | 29 October 2025

Recent Podcasts:

Semiconductor 2Q25 Update

Shopify Inc. – Growth momentum to continue, but stock overvalued

Grab Holdings – Super-app strategy delivering scale efficiently

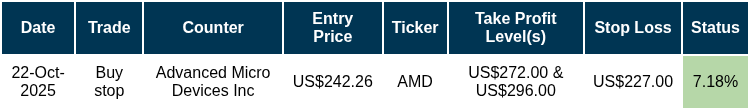

Trades Initiated in Past Week

All three major US stock indexes posted record closing highs again on Tuesday as Nvidia shares gained following news it will build artificial intelligence supercomputers for the US energy department, and as investors were optimistic about corporate earnings ahead of key results from megacaps this week.

Singapore stocks ended higher on Tuesday (Oct 28), tracking a rally in US stocks following a trade deal between Washington and Beijing. Stocks gained 0.2 per cent or 10.06 points to 4,450.36. Across the broader market, losers outnumbered gainers 313 to 292, after 1.8 billion securities worth S$1.8 billion changed hands.

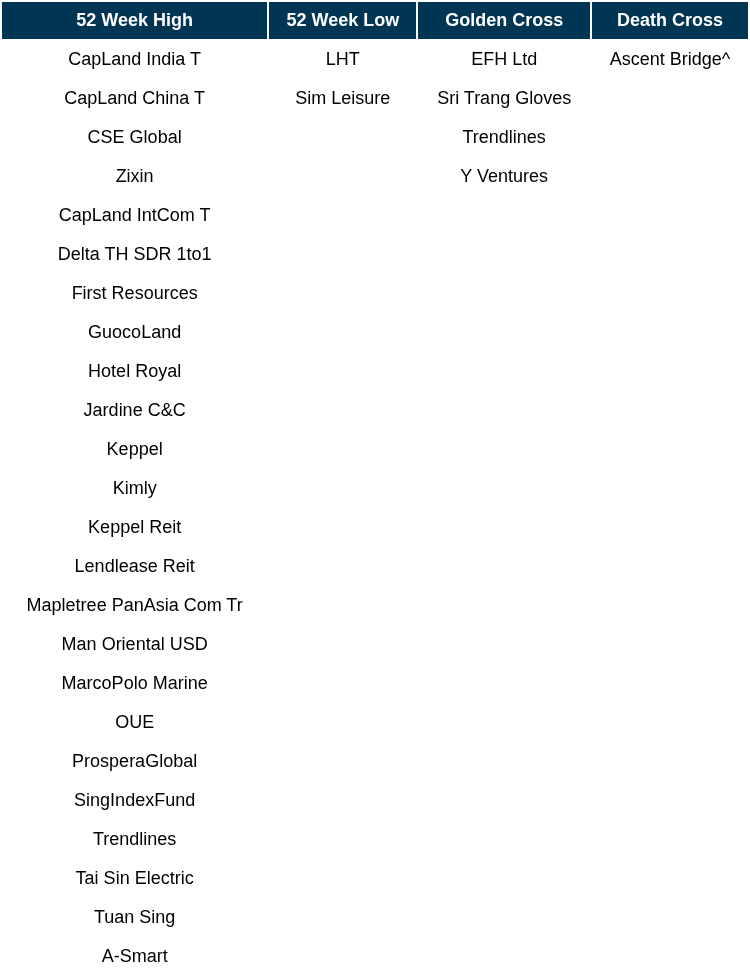

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

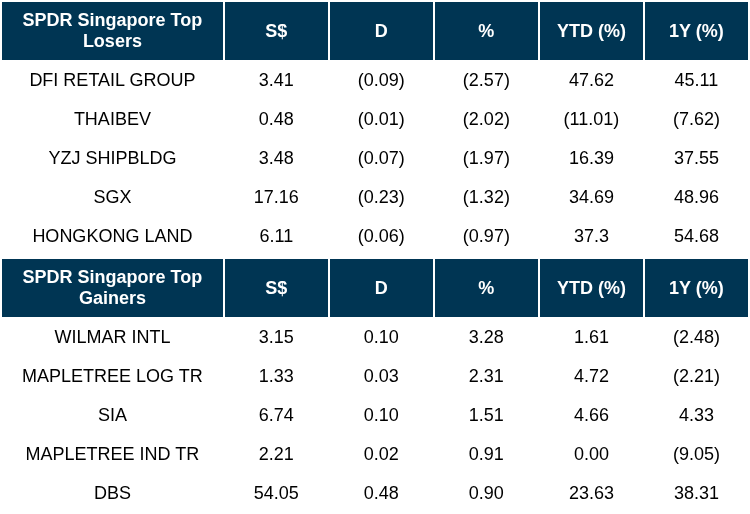

TOP 5 GAINERS & LOSERS

Events Of The Week

SG

First Real Estate Investment Trust (Reit) reported a 6.1 per cent fall in the trust’s distributable income for the nine-month period ending Sep 30 to S$34.8 million, from S$37 million in the corresponding period in the previous year. The distribution will be paid out on Dec 18.

Seatrium announced that it has clinched S$170 million worth of repair and upgrading contracts comprising major cruise, leisure and naval vessel projects, ahead of its third-quarter results due on Nov 13.

Property management services group LHN’s co-living business Coliwoo has launched its initial public offering (IPO) of 80.3 million shares at S$0.60 each, in conjunction with its listing on the mainboard of the Singapore Exchange.

Keppel Pacific Oak US Reit posted a distributable income of US$30.4 million for the first nine months of the financial year ended Sep 30, down 14.8 per cent from US$35.7 million in the previous corresponding period. The lower distributable income was due to a drop in cash rental income from higher free rents due to timing differences in leases completed, as well as higher finance and other trust expenses.

CapitaLand Integrated Commercial Trust’s (CICT) net property income (NPI) grew 1.6 per cent year on year to S$294.4 million for the third quarter ended September 2025, with revenue increasing 1.5 per cent to S$403.9 million.

Property developer First Sponsor said that its European portfolio recorded a 1.3 per cent increase in operating income, which rose to 14.9 million euros (S$22.5 million) for Q3 2025, from 14.7 million euros in the year-ago period.

Keppel Infrastructure Trust (KIT) on Tuesday (Oct 28) reported distributable income of S$168.9 million for the first nine months of 2025, up 59.2 per cent from S$106.1 million in the year-ago period. This was attributed to higher contributions from piped-gas provider City Energy, its industrial-infrastructure business Ixom and Australian bus service business Ventura Motors, and a boost from S$49 million worth of divestment gains.

HarbourFront Centre is set to close in the second half of 2026 for a makeover that will see it redeveloped into a mixed-use building with an elevated park. Owner and real estate firm Mapletree Investments said there will be 26 floors of Grade A offices and five floors of “engaging spaces for an experiential visit”.

US

Uber and Nvidia on Tuesday announced an alliance to deploy 100,000 robotaxis starting in 2027. Together with Uber, Nvidia is creating a framework for the entire industry to deploy autonomous fleets at scale, powered by Nvidia AI infrastructure.

Nvidia chief executive officer Jensen Huang announced a flurry of new partnerships and dismissed concerns about an AI bubble, saying the company’s latest chips are on track to generate half a trillion US dollars in revenue. The Blackwell processor, Nvidia’s flagship artificial intelligence (AI) accelerator, and the newer Rubin model are fuelling an unprecedented surge of sales growth to 2026.

Nvidia plans to make a US$1 billion equity investment in Nokia Oyj, an apparent vindication of the Finnish company’s pivot from mobile networking kit into artificial intelligence by the sector’s kingmaker.

OpenAI is giving its long-time backer Microsoft a 27 per cent ownership stake as part of a restructuring plan that took nearly a year to negotiate, removing a major uncertainty for both companies and clearing the path for the ChatGPT maker to become a for-profit business. Under the revised pact, Microsoft will get a stake in OpenAI worth about US$135 billion.

US consumer confidence fell in October for a third straight month on dimmer views about the outlook for the economy and labour market. The Conference Board’s gauge decreased 1 point to 94.6, the lowest since April, data out on Tuesday (Oct 28) showed.

US private payrolls increased by an average 14,250 jobs in the four weeks ending Oct 11, the ADP National Employment Report’s inaugural weekly preliminary estimate showed on Tuesday (Oct 28).

Apple is preparing major changes to its MacBook Air, iPad mini and iPad Air lines, with a plan to give the popular devices higher-end displays. The company is testing new versions of each product with organic light-emitting diode (Oled) screens.

Amazon.com said it was cutting about 14,000 jobs in a major restructuring. The positions will be eliminated across the corporate workforce.

PayPal Holdings raised its full-year earnings guidance and announced a tie-up with OpenAI to embed its digital wallet into ChatGPT, sending its shares soaring in early New York trading. With consumers continuing to show spending strength, PayPal raised its 2025 adjusted earnings-per-share forecast to US$5.35 to US$5.39, up from the US$5.15 to US$5.30 it reported in July. The firm also announced a dividend programme that will pay 14 cents a share this quarter.

Advanced Micro Devices (AMD) is teaming up with the US Energy Department to develop a pair of supercomputers at the Oak Ridge National Laboratory that will deploy the company’s artificial intelligence (AI) chips to seek breakthroughs in energy and scientific research.

United Parcel Service (UPS) smashed Wall Street’s third-quarter profit expectations, sending its shares soaring and fuelling confidence in the courier’s comeback plans. UPS is cutting some 48,000 jobs as part of a major reorganisation connected to a planned reduction in delivery services for Amazon packages. The shipping giant’s driver workforce has fallen by about 34,000 from a year ago, Brian Dykes, chief financial officer for the United Parcel Service, said on an earnings conference call.

Visa reported a rise in fourth-quarter adjusted profit on Tuesday (Oct 28), as strong consumer spending helped the global payments processing company’s card transaction volumes. More people swiped their cards for day-to-day expenses in the July to September quarter, keeping overall consumer spending steady, although worries over the economy slowed down discretionary spend.

SK Hynix posted on Wednesday a record quarterly profit, spurred by an artificial intelligence boom that has driven up demand for both advanced chips and conventional products. The Nvidia supplier reported an 11.4 trillion won (S$10.4 billion) operating profit for the July-September period, up 62 per cent from a year earlier.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

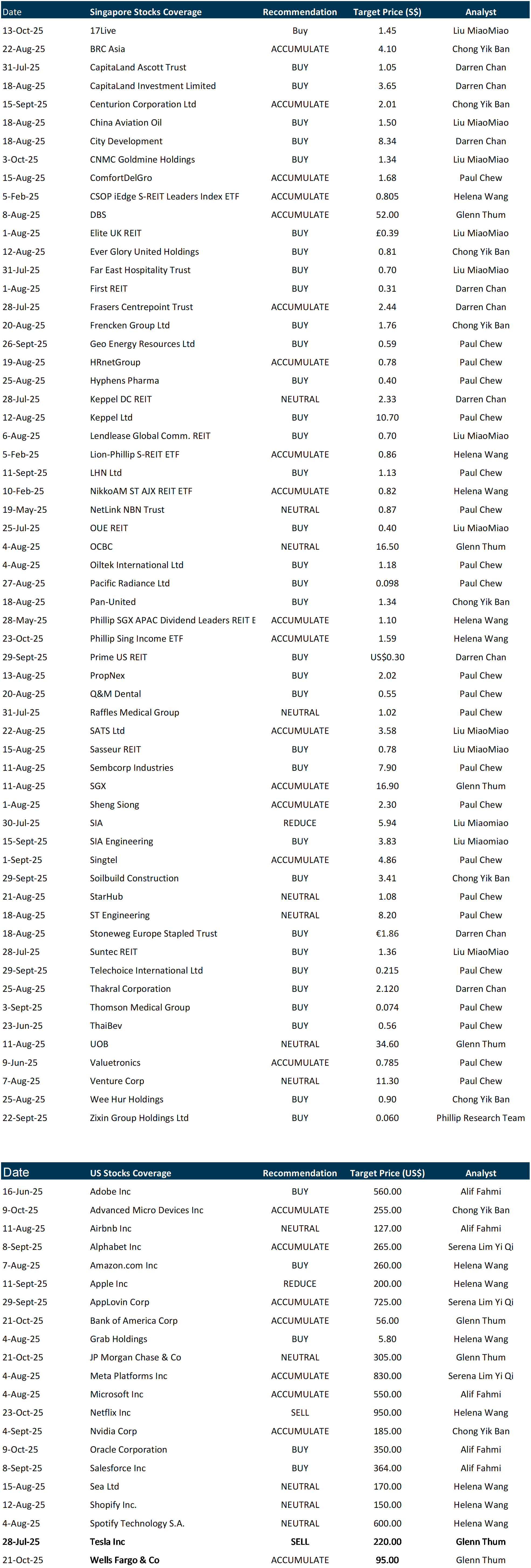

RESEARCH REPORTS

Tesla Inc. – EV tax credit removal benefits deliveries

Recommendation: SELL; TP US$220.00; Last close: US$452.52; Analyst Glenn Thum

- 3Q25 results were slightly above our expectations. 9M25 Revenue/Adj. PATMI was at 80%/78% of our FY25e forecasts, driven by higher-than-expected auto deliveries. Adj. PATMI (excl. stock-based compensation, “SBC”) fell 29% due to lower margins from higher average cost per vehicle, lower regulatory credit revenue, and higher OPEX from AI projects.

- 497k deliveries (+7% YoY), a new quarterly record and the highest YoY growth in 7 quarters. Gross margins contracted by 185bps to 18% but improved QoQ. ASPs were flat after declining for 10 consecutive quarters, while auto revenue rose 6% YoY, the first in four quarters.

- We maintain our SELL recommendation and the DCF target price of US$220 remains unchanged. We expect auto deliveries and ASPs to decline in 4Q25 due to the removal of the US$7,500 EV tax credit in the US. Our WACC/growth rate assumptions of 9%/5% remain unchanged. We remain cautious about TSLA, with multiple headwinds, including tariffs, loss of tax credits, and market-share decline in China. Significant revenue contribution from multi-year initiatives (FSD, Robotaxi, Optimus robot) is still several (3-5) years out, and steep valuations of ~250x PE FY25e suggest this has already been priced ahead of time.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by AA REIT [NEW]

Date & Time: 5 November 25 | 12PM-1PM

Register: poems-20251105-132684

Corporate Insights by Keppel Infrastructure Trust (KIT)

Date & Time: 6 November 25 | 12PM-1PM

Register: poems-20251106-132232

Research Videos

Weekly Market Outlook: JPM, Wells Fargo, BAC, Netflix, Oracle, Keppel DC REIT, Tech Analysis & More!

Date: 27 Oct 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials