DAILY MORNING NOTE | 4 September 2025

Recent Podcasts:

Shopify Inc. – Growth momentum to continue, but stock overvalued

Grab Holdings – Super-app strategy delivering scale efficiently

Apple Inc. – Good results, but still cautious

Wall Street stocks finished mostly higher on Wednesday following gains by Google parent Alphabet and Apple as markets look ahead to key US jobs data later in the week. Shares of Alphabet jumped around nine per cent after a US judge imposed a number of conditions to restore competition following an August 2024 ruling that Google illegally maintained monopolies in online search, a decision that also boosted Apple shares. The tech-rich Nasdaq Composite Index finished up 1.0 per cent at 21,497.73.

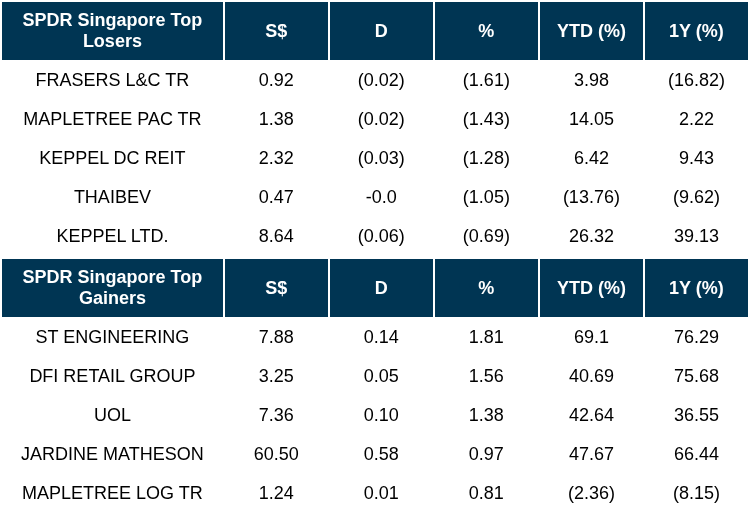

Singapore stocks ended Wednesday (Sep 3) lower, even as data showed that manufacturing in Singapore improved slightly. The sector’s purchasing managers’ index (PMI) edged up to 50 in August from 49.9 in July, the threshold between contraction and expansion, data released on Tuesday by the Singapore Institute of Purchasing and Materials Management indicated. Stocks fell 0.2 per cent or 9.18 points to 4,289.33. Across the broader market, gainers beat losers 301 to 228, after 1.3 billion securities worth S$1.3 billion were transacted. ST Engineering was the top gainer. The counter added 1.8 per cent or S$0.14 to close at S$7.88.

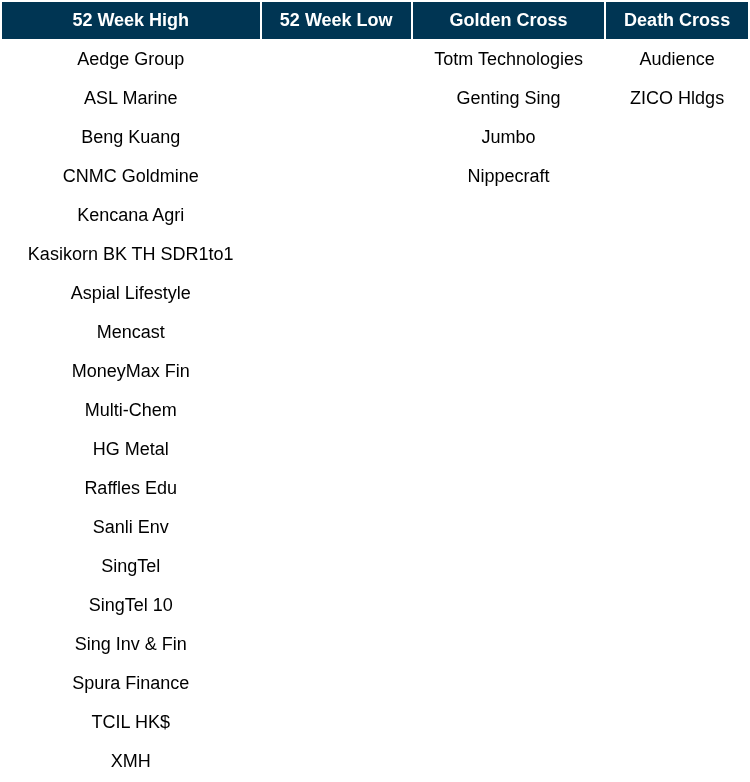

Singapore Technical Highlights

* ^ denotes companies placed on SGX Watch-list

* ^ denotes companies placed on SGX Watch-list

TOP 5 GAINERS & LOSERS

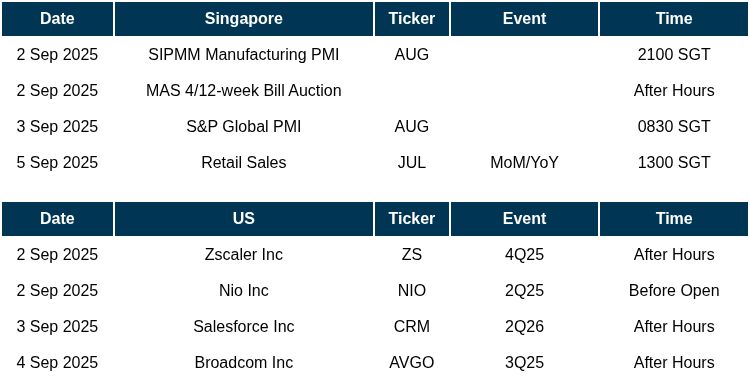

Events Of The Week

SG

Keppel DC Real Estate Investment Trust (Reit) has acquired the 51 per cent remaining interest in two artificial intelligence-ready hyperscale data centres in Singapore from sponsor Keppel for up to S$8.4 million.

Shares of CNMC Goldmine surged more than 12 per cent on Wednesday (Sep 3) – continuing gains since the release of its outstanding first half-year results in mid-August as the company rides rising gold prices.

City Developments Ltd (CDL) has put Quayside Isle @ Sentosa Cove up on the market for sale at S$111 million. This translates to S$2,515 per square foot (psf) for Sentosa Cove’s only mall.

Even after Hyflux won its bid for the S$890 million Tuaspring project in March 2011, it managed to secure only a S$150 million bank loan. This was because the banks estimated that cash flows from the desalination plant would support only around S$150 million to S$170 million of debt.

US

US job openings fell in July to the lowest in 10 months, adding to other data that show a gradually diminishing appetite for workers amid heightened policy uncertainty. Available positions decreased to 7.18 million from a downwardly revised 7.36 million reading in June, according to Bureau of Labor Statistics data published on Wednesday.

Google won’t have to sell its Chrome browser, a judge in Washington said on Tuesday, handing a rare win to Big Tech in its battle with US antitrust enforcers, but ordering Google to share data with rivals to open up competition in online search. US District Judge Amit Mehta also ruled Google could keep its Android operating system, which together with Chrome help drive Google’s market-dominating online advertising business.

Apple is planning to launch its own artificial intelligence (AI)-powered web search tool next year, stepping up competition with OpenAI and Perplexity AI. The company is working on a new system, dubbed internally as World Knowledge Answers, that will be integrated into the Siri voice assistant, according to sources with knowledge of the matter. Apple has also discussed eventually adding the technology to its Safari web browser and Spotlight, which is used to search from the iPhone home screen.

Salesforce projected lacklustre quarterly sales growth, suggesting its artificial intelligence (AI) product is not yet paying off as quickly as hoped amid competition from emerging AI companies. Revenue will be US$10.2 billion to US$10.3 billion in the period ending in October, the company said on Wednesday (Sep 3). Analysts, on average, estimated US$10.3 billion.

Tesla’s sales slump is dragging on across almost all of Europe’s biggest electric vehicle markets, costing the company significant share in countries seeing stronger EV demand. New Tesla vehicle registrations dropped 39 per cent last month in Germany and plunged 56 per cent through the first eight months of the year, the Federal Motor Transport Authority said on Wednesday.

The US has revoked Taiwan Semiconductor Manufacturing Co’s (TSMC) authorisation to freely ship essential gear to its main Chinese chipmaking base, potentially curtailing its production capabilities at that older-generation facility. American officials recently informed TSMC of their decision to end the Taiwanese chipmaker’s so-called validated end user (VEU), status for its Nanjing site. The action mirrors steps the US took to revoke VEU designations for China facilities owned by Samsung Electronics and SK Hynix. The waivers are set to expire in about four months.

Singapore police have ordered Meta to implement anti-scam measures against advertisements, accounts, profiles and business pages impersonating key government office holders on its social media network Facebook to combat scams. Meta could be fined up to S$1 million if it fails to comply as part of the first such order under the new Online Criminal Harms Act, which came into force in February 2024.

Aviation giant GE Aerospace on Wednesday (Sep 3) announced plans to invest US$75 million across its Asia-Pacific (Apac) maintenance, repair and overhaul (MRO) and component repair facilities, through the end of 2025. Its Singapore and Malaysia facilities are set to enjoy a “significant portion” of the investment.

OpenAI has agreed to buy product testing startup Statsig for US$1.1 billion in an all-stock deal, the company said, marking one of the largest acquisitions in the ChatGPT maker’s history. Statsig, founded in 2021, builds tools to help software developers test and flag potential new features. Its services have been used by employees at OpenAI, Eventbrite, SoundCloud and other tech firms.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, The Edge Singapore, PSR

RESEARCH REPORTS

Geo Energy Resources Ltd – Reinforcing a massive infrastructure network

Recommendation: BUY; TP S$0.470; Last close: S$0.3900; Analyst Paul Chew

- 1H25 results were within expectations: revenue and adj. PATMI were 54% and 43% respectively of our FY25e forecast. Adj. PATMI spiked 140% YoY to US$20mn supported by 144% jump in production to 6.6mn MT. The new hauling road is almost 98% land cleared with an est. 26% cut and filled.

- Geo announced the acquisition of a 51% stake in two companies that own 27 sets of tugs and barges for US$128mn (paid by cash, shares, and assignment of debtors). The transaction is deemed a related party due to part ownership by the major shareholder. At a 33x historical P/E, the purchase price is not inexpensive. However, we view the transaction as strategic (immediate availability of vessels and operational expertise) with a huge profit opportunity by transporting the expected 25mn coal when the new hauling road is completed in the middle of next year.

- We are lowering our FY25e earnings by 10% to US$41.5mn. Coal prices are trending below our forecast. There is no change to our DCF target price of S$0.47 and BUY recommendation. Geo is continuing the build-out of its massive infrastructure business (road, jetty, barge) in Sumatra, Indonesia. Upon completion, there will be multiple sources of earnings: (i) coal production will ramp to 25mn MT; (ii) toll revenue from the 15-25m MT of extra capacity from the new road; (iii) river transhipment of the coal; and (iv) asset monetisation opportunities from stakes in the road and barge operator.

NVIDIA Corporation – Data centre segment still growing

Recommendation: ACCUMULATE; TP US$185.00; Last close: US$170.78; Analyst Yik Ban Chong (Ben)

- 2Q26 revenue/PATMI were within our expectations, at 44%/45% of our FY26e forecasts. Revenue increased 56% YoY, driven by the data centre segment where there is still strong demand for Nvidia’s Blackwell GPU from hyperscalers. We expect 2H26e growth to be driven higher CAPEX on AI infrastructure by hyperscalers. GOOG and META announced higher 2025 CAPEX guidance in their June 2025 quarter results, while AMZN and MSFT hinted at higher CAPEX for AI infrastructure for the rest of 2025e.

- Nvidia’s 3Q26e revenue guidance (+54% YoY) excludes potential H20 chip sales to China which impacted 2Q26 revenue by ~9%. The US government granted some licenses for Nvidia’s China-based customers in August 2025. We expect approximately US$3.5bn H20 sales in 3Q26e as Nvidia has ready H20 inventory on hand to ship to China. Including this, we could see 3Q26e revenue increase by ~64% YoY.

- We maintain ACCUMULATE with a higher target price of US$185 (prev. US$145). We maintain our FY26e forecasts. We raise our FY27e revenue/PATMI by 24%/31% due to an expected increase in hyperscalers’ CAPEX in AI infrastructure, robust demand for Nvidia’s GeForce GPUs, and the US government’s reversal of the ban on H20 chips to China. Nvidia is trading at a forward PE of ~41.8x, close to its historical average of 41.7x.

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Corporate Insights by Lum Chang Creations

Date & Time: 5 September 25 | 12PM-1PM

Register: poems-20250905-127587

Corporate Insights by Yoma Strategic

Date & Time: 9 September 25 | 12PM-1PM

Register: poems-20250909-128571

Corporate Insights by ComfortDelGro

Date & Time: 10 September 25 | 12PM-1PM

Register: poems-20250910-127804

Corporate Insights by 17LIVE [NEW]

Date & Time: 11 September 25 | 12PM-1PM

Register: poems-20250911-129170

Corporate Insights by LMS Compliance

Date & Time: 17 September 25 | 12PM-1PM

Register: poems-20250917-127971

Corporate Insights by Keppel REIT

Date & Time: 23 September 25 | 12PM-1PM

Register: poems-20250923-127589

Research Videos

Weekly Market Outlook: Pacific Radiance, Singtel, Phillip on The Ground, SG Weekly & More!

Date: 1 Sep 2025Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials