Sembcorp Industries - Completes demerger of Sembcorp Marine

17 Sep 2020- Distribution-in-specie of the capital of Sembcorp Marine (SCM) to all Sembcorp Industries (SCI) shareholders completed.

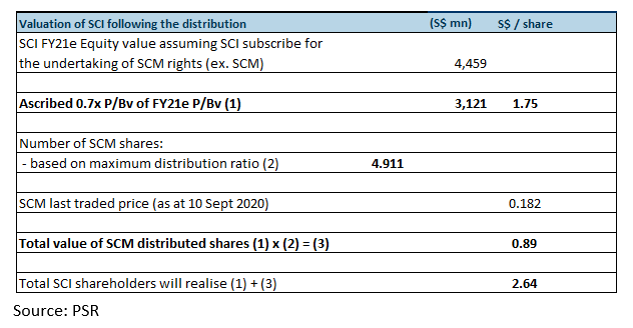

- Entitled SCI shareholders will have received 4.911 of SCM shares for every 1 SCI shares held, amounting to about S$0.89, based on 10 September share price.

- We maintain our BUY recommendation with an unchanged target price of $1.75 on standalone SCI (ex. SCM).

Update

Following the issue of 10,462,690,870 SCM rights shares to entitled SCI shareholders on 11 September, the proposed distribution and demerger has been completed. Entitled SCI shareholders will have received their entitlement of 4.911 SCM shares for every 1 SCI share held, amounting to approximately S$0.89 (4.911 x S$0.182). We arrived at this by taking the number of SCM shares distributed for every 1 SCI shares held and multiplied this by the closing price of the SCM shares as at 10 September 2020 of S$0.182, which is the date before the distribution to SCI holders.

This means that the ex-distribution price of SCI following the distribution is approximately S$1.02 (S$1.91 – $0.89). This is arrived at by subtracting the total value of SCM shares received by SCI shareholders with the closing price of SCI on the 10 September, the date before the distribution.

In total, SCI shareholders could realise a total of $2.64/share (S$1.75 + (4.911 x S$0.182)).

Outlook

We are positive on the Group’s outlook. Following the deconsolidation of SCM, we think SCI will see a potential positive re-rating as the Group’s operating metrics improve in Fy21e from improving energy demand.

Maintain BUY with an unchanged target price of S$1.75

We maintained our BUY recommendation on SCI following the distribution-in-specie of the capital of SCM to entitled SCI shareholders. Our target price of S$1.75 for standalone SCI (ex. SCM) is pegged to a P/BV of 0.7x FY21e, which is a slight discount to their 10-year historical average equity value (ex. SCM). We expect SCI to see improved operating metrics with the Group expected to generate positive operating CF of $854mn for FY21e and return on equity of 7.6% for FY21e.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

About the author

Terence Chua

Senior Research Analyst

Phillip Securities Research

Terence specialises in the consumer, conglomerate and industrials sector. He has over five years of experience as an analyst in the buy- and sell-side. As an institutional fund management analyst, he sat on the China-Hong Kong desk. Terence was ranked top 3 for Best Analyst under the small caps and energy category in the Asia Money poll 2018.

He graduated from the Singapore Management University with a major in Finance (Honours), and is the honoured recipient of the CFA scholarship.

JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA)

Trade of the Day - NVIDIA Corporation (NASDAQ: NVDA) Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT)

Trade of the Day - Applied Materials, Inc. (NASDAQ: AMAT) CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising

CapitaLand Ascott Trust - Occupancy to improve with ADRs stabilising