StarHub Limited - Upfront investments to drag FY22e earnings

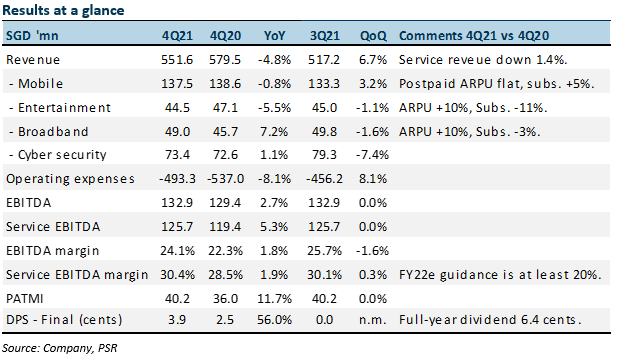

14 Feb 2022- 4Q21 revenue met our expectations. EBITDA beat estimates at 109% of our FY21 forecast.

- Operating expenses declined 8% YoY in 4Q21 led by lower content cost, dealer commissions, marketing and staff cost. FY21 FCF was a record $485mn.

- StarHub guided a steep decline in service margins from 30% in FY21 to at least 20% in FY22e. StarHub will be investing in technology OPEX, staff cost and maintenance for its transformation road map of growth (DARE+). Another trigger for higher cost is electricity expenses. CAPEX to sales will rise from 4% to 12-15% of sales.

- We cut FY22e EBITDA by 22%. The NEUTRAL recommendation is maintained with a higher target price of S$1.35 (previous S$1.24). Our valuation is raised from 6x to 8x FY22e EV/EBITDA due to appreciation in peer valuation. We raised mobile ARPU expectations by 14% for FY22e as roaming revenue begins to normalise.

The Positives

+ Transformation-led cost controls. Service EBITDA margin of 30% for FY21 beat our expectations of 26% and guidance of at least 26%. 4Q21 experienced a significant 8% YoY decline in operating expenses to S$493mn. We believe StarHub’s transformation efforts to realign pay TV programming and digitalise processes resulted in lower content cost, dealer commissions and staff cost.

+ Record FCF supported dividends. FCF generated in FY21 was a record $485mn, a $97mn YoY improvement. A combination of higher operating cash-flow and lower CAPEX drove the improvement in FCF. Final dividend declared was 3.9 cents, up 56% YoY. Full-year dividend of 6.4 cents exceeds our forecast of 5 cents. Guidance was at least 5 cents or 80% payout ratio.

The Negatives

– Lack of revenue growth. Service revenue declined 1.4% YoY in 4Q21. Dragging down revenues were network solutions (-9%), mobile (-1%) and entertainment and modest growth in cybersecurity. ARPU for mobile was flat YoY despite 300,000 5G subscribers (or 20% of postpaid). The absence of roaming remains a major headwind.

– Cybersecurity still in investment mode. FY21 revenue for cybersecurity (Ensign and D’Crypt) jumped 22% YoY to S$268mn. However, EBITDA declined by 7% YoY to S$25.5mn. Net profit almost halved to S$1.7mn. Profitability was impacted by an inventory write-off of S$4.2mn in 2H21.

Outlook

StarHub has made tremendous headway in removing fixed cost. Over the past three years, service revenue from legacy businesses (excluding cyber-security and regional ICT) has declined by almost S$500mn, whilst EBITDA only dropped S$54mn. Aggressive cost initiatives have supported earnings. The major decline in fixed costs over the past three years are staff cost (-S$86mn), operating leases (-S$80mn) and cost of services (-S$126mn). Cost of services includes content cost and dealer commissions.

With most of the cost restructuring almost completed, StarHub needs to invest for growth (DARE+ FY22-26 growth roadmap). The current upfront investments in technology and staff are to further digitalise its internal platforms and 5G network. After the completion of these investments, profit opportunities are S$220mn and cost savings S$280mn, as guided by management. Some revenue opportunities after the transformation include cloud gaming and 5G solutions for the enterprise market.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

About the author

Paul Chew

Head of Research

Phillip Securities Research Pte Ltd

Paul has 20 years of experience as a fund manager and sell-side analyst. During his time as fund manager, he has managed multiple funds and mandates including capital guaranteed, dividend income, renewable energy, single country and regionally focused funds.

He graduated from Monash University and had completed both his Chartered Financial Analyst and Australian CPA programme.

Spotify Technology S.A. - Raised prices and subscribers still grew

Spotify Technology S.A. - Raised prices and subscribers still grew Suntec REIT - Higher-for-longer interest rate continue eroding DPU

Suntec REIT - Higher-for-longer interest rate continue eroding DPU Apr 25th - Things to Know Before the Opening Bell

Apr 25th - Things to Know Before the Opening Bell JPMorgan Chase & Co - NII continues to rise, guidance maintained

JPMorgan Chase & Co - NII continues to rise, guidance maintained