Singapore Banking Monthly - Interest rates climb while loans growth slows

5 Dec 2022- November 3M-SORA was up by 41bps MoM to 2.69%. YTD22 3M-SORA is up 87bps.

- Singapore domestic loans grew 2.75% YoY in October, below our estimates, while Hong Kong’s domestic loans declined 2.70% YoY in October. CASA balance stable at 21.1%.

- Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with upside surprise due to excess capital ratios. We expect bank NIMs to rise another 34bps in 4Q22. SGX is another beneficiary of higher interest rates [SGX SP, BUY, TP S$11.71].

3M-SOR and 3M-SIBOR continued to climb in November

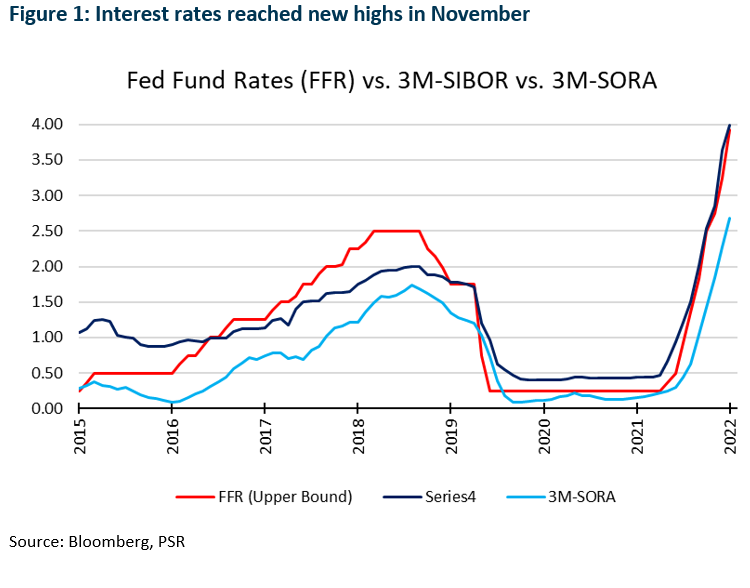

Interest rates continued to increase in November. The 3M-SORA was up 41bps MoM to 2.69%, while the 3M-SIBOR was up 36bps MoM to 3.99%. The SORA MoM increase was 3bps lower than the previous month but still the second highest on record, while the SIBOR MoM increase was lower than the previous month’s record increase of 78bps. The 3M-SORA is 124bps higher than its 3Q22 average of 1.45% and has improved by 253bps YoY. The 3M-SIBOR is 151bps higher than its 3Q22 average of 2.48% and has improved by 355bps YoY (Figure 1).

Singapore loans growth fall below forecast

Overall loans to Singapore residents – which captured lending in all currencies to residents in Singapore – rose by 2.75% YoY in October to S$826bn. This is below our estimate of mid-single digit growth for 2022 as the rise in interest rates start to be more fully felt.

Business loans grew by 2.92% YoY in October, as business loans dipped by 2.01% for the month. Loans to the building and construction segment, the single largest business segment grew 3.56% YoY to S$170.7bn, while loans to the manufacturing segment grew 8.7% YoY in October to S$27.1bn.

Consumer loans were up 2.5% YoY in October to S$314.7bn, aided by strong loan demand in the housing segment. Housing loans, which make up ~70% of consumer lending, grew 4.5% YoY in October to S$221.9bn for the month.

Total deposits and balances – which captured deposits in all currencies to non-bank customers – grew by 10.2% YoY in October to S$1,743bn. The Current Account and Savings Account (CASA) proportion dipped slightly to 21.1% (Sep22: 22.2%) of total deposits or S$368bn as there was a move towards FDs due to the high interest rate environment.

Fastest growing loan segments were – Financial Institution and Housing loans

Amongst the various loans segments over the past 5 years, Financial Institution, Investment and Holding Companies (FI) was the fastest growing. We believe bulk of these loans were for commercial property acquisitions especially for REITs.

The three local banks combined loans to the Financial Institution, Investment and Holding Companies segment grew by 25% in 2021 to S$103.4bn and grew at a CAGR of 6.9% over the past five years. It outpaces total loans CAGR of 4.9%.

The housing loan segment grew by 4.4% in 2021 to S$211.5bn and grew at a more moderate CAGR of 0.8% over the past five years. The housing loan segment is the second largest loan segment, making up 21% of FY21 total loans.

The largest stress in loans portfolio is possibly from the FI segment as it was the fastest growth category. Anecdotally, we do observe stress in commercial property loans to listed companies with exposure in emerging countries such as, China, Malaysia, and Myanmar.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

About the author

Glenn Thum

Research Analyst

PSR

Glenn covers the Banking and Finance sector. He has had 3 years of experience as a Credit Analyst in a Bank, where he prepared credit proposals by conducting consistent critical analysis on the business, market, country and financial information. Glenn graduated with a Bachelor of Business Management from the University of Queensland with a double major in International Business and Human Resources.

Netflix Inc. - Pricing power on display

Netflix Inc. - Pricing power on display Keppel DC REIT - DXC settlement offers partial relief from uncollected rents

Keppel DC REIT - DXC settlement offers partial relief from uncollected rents Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY)