Japan-Weekly Strategy Report “AT1 bonds, downward revision of domestic regional banks, foreign bonds and yen appreciation / bond appreciation”

28 Mar 2023Report type: Weekly Strategy

AT1 bonds, downward revision of domestic regional banks, foreign bonds and yen appreciation / bond appreciation

Banking instability caused by a string of US regional bank failures spilled over into Europe, and in Switzerland, Credit Suisse agreed to be acquired by UBS. At that time, the bond market was shocked when about 2.2 trillion yen worth of “Additional Tier 1 Bonds (AT1 Bonds)”, a type of subordinated bond issued by Credit Suisse for core capital expansion, was deemed worthless. These AT1 bonds are also known as contingent convertible bonds (CoCo bonds) and are sometimes referred to as “high-yield investments with a hand grenade attached”. CoCo bonds are essentially a hybrid of bonds and stocks, and are considered a means of pulling financial institutions out of a crisis while avoiding burdening taxpayers and diluting existing shareholders’ stock in the event of a bank failure. When a bank’s capital level falls below a certain level, the bonds may be converted into bank shares (capital), or the value of some or all of the bond’s principal may be reduced.

Silicon Valley Bank is said to have invested and managed its rapidly growing deposits in long-term US Treasury bonds and mortgage-backed securities, which led to unrealized losses on bonds as interest rates rose, eating up most of its equity capital. This is a special exception and does not apply to Japanese regional banks. Nevertheless, before the announcement of financial results for the fiscal year ending March 2023, some regional banks have begun to revise their full-year earnings outlook downward. Fukuoka Financial Group (8354) was reported to have executed loss-cutting measures due to an expansion of unrealized losses in its US bond investments. Mebuki Financial Group (7167), which owns Joyo Bank and Ashikaga Bank, is selling foreign bonds that have become less profitable due to rising overseas interest rates to improve its portfolio. Nara-based Nanto Bank (8367), Nagoya Bank (8522), and Hirogin Holdings (7337), which has Hiroshima Bank as its core, have also revised their earnings forecasts downward for similar reasons.

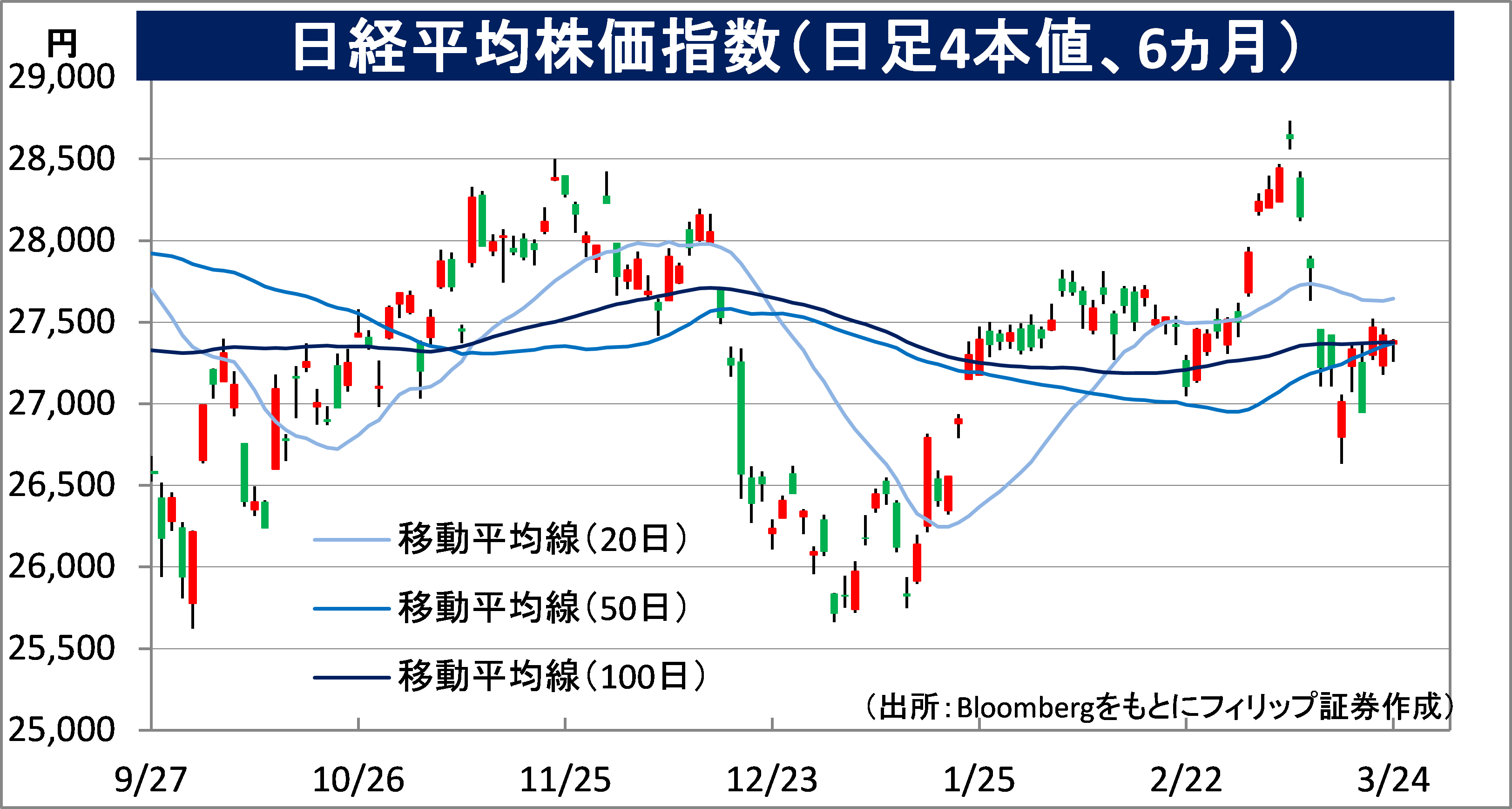

As of the close of 23/3, the domestic bond market was hovering around a yield of 0.3% for the benchmark new 10-year JGB, well below the upper limit of the allowable range of 0.5% under the BOJ’s YCC (Yield Curve Control) policy. While in large part keeping pace with the foreign bond market, it is also believed that in many cases funds from the sale of foreign bonds are repatriated to Japan to purchase domestic bonds, which may in part support a stronger yen and higher domestic bond prices (i.e., lower long-term interest rates). The Nikkei Average is therefore expected to remain firm until the end of the March fiscal year, as lower domestic long-term interest rates are likely to support the Japanese stock market.

The consumer price index (CPI) for February, announced on 24/3, showed a 3.1% increase YoY in the composite CPI (excluding fresh food), the first slowdown in 13 months. However, the composite CPI excluding fresh food and energy increased by 3.5% YoY, accelerating from January’s 3.2% increase. The national average of public land prices as of 1/1, announced on 22/3, rose for the second consecutive year by 1.6% YoY for all uses. The domestic inflation trend will be closely monitored.

In the 27/3 issue, we will be covering Daiseki Eco Solution (1712), Stella Chemifa (4109), Life Corp (8194), and NTT Data (9613).

Daiseki Eco Solution Co. Ltd (1712) 921 yen (24/3 closing price)

・Established in 1996. With Daiseki (9793), a major industrial waste management company based in Nagoya as its parent, company operates various businesses including the mainstay soil contamination survey and treatment business, waste gypsum board recycling, environmental analysis, PCB and BDF (biodiesel fuel) businesses.

・For 9M (Mar-Nov) results of FY2023/2 announced on 5/1, net sales decreased by 10.6% to 11.872 billion yen compared to the same period the previous year, and operating income decreased by 48.9% to 930 million yen. Sales and operating income increased in the waste gypsum board recycling business due to higher sales volume, but sales in the mainstay soil contamination survey and treatment business declined 13% YoY and operating income fell 48% YoY due to lower-than-planned large-scale infrastructure improvement projects.

・For its full year plan, net sales is expected to decrease by 13.3% to 14.8 billion yen compared to the previous year, operating income to decrease by 52.4% to 1.0 billion yen, and annual dividend to increase by 2 yen to 10 yen. Both operating income and operating margin are expected to recover from 1Q (Mar-May) to 3Q (Sep-Nov) on a quarterly basis due to focus on high value-added projects. The industrial waste treatment industry has high barriers to entry and tends to become an oligopoly through M&A. In this context, it may be easier to improve profit margins through group restructuring.

Stella Chemifa Corp (4109) 2,596 yen (24/3 closing price)

・Founded by Jisaburo Hashimoto in Sakai City in 1916 to manufacture nitrate salt. Besides its High-purity Chemical Business, which includes fluorides for semiconductors and lithium-ion rechargeable batteries, Stellar Pharma (4888) is involved in boron pharmaceuticals for cancer radiotherapy.

・For 9M (Apr-Dec) results of FY2023/3 announced on 10/2, net sales increased by 4.2% to 28.27 billion yen compared to the same period the previous year, and ordinary income including equity in earnings of affiliates decreased by 4.7% to 3.75 billion yen. Net income declined 47.5% YoY to 1.658 billion yen due to impairment losses on property, plant, and equipment held for the purpose of increasing production of additives for lithium-ion rechargeable batteries in the High-purity Chemical Business.

・Company has revised its full year plan downwards. Net sales is expected to decrease by 4.5% to 35.6 billion yen (original plan 37.5 billion yen) compared to the previous year, and operating income to decrease by 18.2% to 3.75 billion yen (original plan 4.6 billion yen). Annual dividend to remain unchanged at 60 yen. Sales in the semiconductor sector of the High-purity Chemical Business, which was the main cause of the downward revision, are expected to improve due to the Japanese government’s decision to relax strict export controls on hydrogen fluoride to the ROK. Estimated PER of 15.3x and PBR of 0.7x at the closing price on 23/3.

About the author

Phillip Research Team (Japan)

About the author

Apr 19th - Things to Know Before the Opening Bell

Apr 19th - Things to Know Before the Opening Bell Trade of the Day - iFAST Corporation Ltd (SGX: AIY)

Trade of the Day - iFAST Corporation Ltd (SGX: AIY) Trade of the Day - Singapore Airlines (SGX: C6L)

Trade of the Day - Singapore Airlines (SGX: C6L) Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)

Trade of the Day - COSCO Shipping International (Singapore) Co Ltd (SGX: F83)