LION-PHILLIP S-REIT - Stock Analyst Research

| Target Price* | 0.91 |

| Recommendation | ACCUMULATE› ACCUMULATE |

| Market Cap* | - |

| Publication Date | 1 Apr 2024 |

*At the time of publication

Lion-Phillip S-REIT - ETF Resilient Dividends Despite Rate Hikes

- We value Lion-Phillip S-REIT ETF (LP SREIT) using a combination of historical dividend yield spread and price-to-book ratios. Using these two valuation methods, the target price are S$0.85 and S$0.97, respectively. Applying equal weightage to both valuations, we initiate coverage with an ACCUMULATE recommendation and target price of S$0.91.

- Lion-Phillip S-REIT ETF gives exposure to the 21 REITs in Singapore. It is the first ETF whose holdings are entirely Singapore REITs. This ETF offers investors a diversified, convenient and efficient access Singapore REITs, stable income, and attractive book value.

- We expect dividends from REITs to remain under pressure from higher interest rates. Due to interest rate hedges, effective interest rates will still creep up until 2025. In contrast, property valuations in Singapore have been stable supported by transaction prices. Interest rate cuts can provide REITs the triple benefit of a yield more attractive to bonds, lower interest expenses and increase valuations as cap rates compress.

ETF Background

The LP SREIT is an investment product that provides investors with exposure to a diversified portfolio of Real Estate Investment Trusts (REITs) listed in Singapore. It replicates closely the performance of the Morningstar® Singapore REIT Yield Focus Index. Established in 2017, LP SREIT comprises of 21 securities with a market cap of S$355 mn as of 31 March 2024. Among the five REITs ETFs in Singapore, it is the second largest in terms of market cap.

Investment Merits

- Investors gain the opportunity to participate in the potential income and capital appreciation generated by the Singapore REIT market, offering a convenient and efficient way to access this segment of the real estate sector.

- Sustainable income over the years(Figure 2). LP SREIT dividends have been rising since its IPO, from an annual dividend of 1.80 cents at the IPO to 5.07 cents as of 31 Dec 2023 .

- Book value of the ETF has become more attractive over the last year (Figure 6).

ETF Benchmark

LP SREIT replicates as closely as possible the performance of the Morningstar® Singapore REIT Yield Focus Index, which is designed to screen for REITS with high dividend, good profitability track record and less likelihood of default. Regarding constituent selection, each S-REIT is evaluated based on three proprietary factors: quality, financial health and trailing 12-month dividend yield, with all these factors given equal weight in the assessment. A 10% weightage cap is imposed on each S-REIT to promote diversification.

S-REITs with the highest scores are incorporated into the Index. The final weighting of each underlying S-REIT is then adjusted based on its trading liquidity, ensuring the ETF can effectively mirror the constituents. With a bi-annual rebalancing schedule, the Index constructs a diversified portfolio. By mirroring this Index, the LP SREIT provides investors with access to sustainable income.

*Both Phillip Capital Management and Phillip Securities Research are part of the Phillip Capital Group.

Valuation

Dividend Yield Spread valuation

Dividend Yield measures the annual value of dividends received relative to the market value per unit of a fund. We will use the average dividend yield spread to a 10-year bond (Figure 4) to do a valuation. LP SREIT has had an average 2.66% spread to a 10-year bond since its inception. The three-year average is 2.55%. The current spread is 2.79%.

We peg our valuation at 2.55% dividend yield spread, its 3-year average spread. We believe that is appropriate to accounts for the recent rise in interest rates. At a 2.55% dividend yield spread, we value LP SREIT at S$0.85.

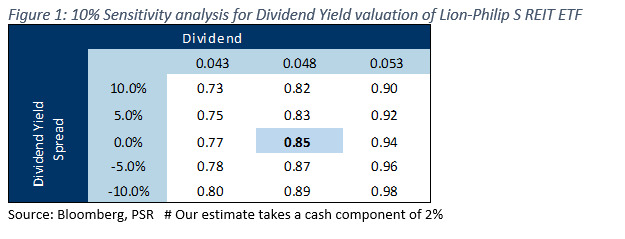

To determine the range of valuations, we applied a 5% and 10% discount and premium to both Dividend Yield Spread and Forward Dividend (Figure 1). At the bottom end of our valuation range, with a 10% higher projected dividend yield spread and a 10% lower forward dividend, the ETF price is S$0.73 (Figure 1). At the top end of our valuation range, we use a 10% lower projection of Dividend Yield Spread and a 10% higher Forward Dividend, and the ETF price is S$0.98.

Price-to-Book valuation

The book value of a company is the company’s total assets minus its total liabilities. We will be using the Price-to-Book ratio (Figure 7), which is calculated by weighting the average of ETF constituents’ Price-to-Book ratio. Lion-Phillip S REIT has traded at an average P/B of 1.16x since its inception. The three-year average is 1.14x. The current P/B is 0.96x.

We peg our valuation at 1.14x P/B, its 3-year average P/B. We believe that is appropriate to accounts for the recent rise in interest rates. On this basis, we value LP SREIT at S$0.97 (1.14x P/B).

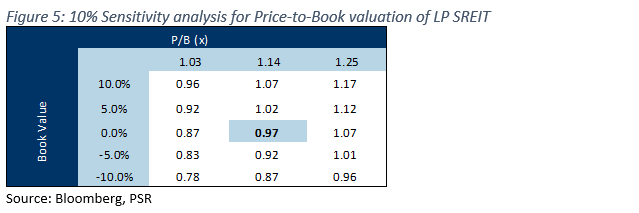

To determine the range of valuations, we applied a 5% and 10% discount and premium to both Book Value and P/B metrics (Figure 5). At the bottom end of our valuation range, with a 10% lower projected book Value and a 10% lower P/B of 1.03x, the ETF price is S$0.78 (Figure 5). At the top end of our valuation range, we use a 10% higher projection of book value and a P/B of 1.25x, and the ETF price is S$1.17.

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

About the author

Helena Wang

Research Analyst

PSR

Helena covers Hardware/Marketplaces/ETF. Helena graduated with a master degree in Financial Technology from Nanyang Technological University

Wells Fargo & Company - NII decline hurt earnings

Wells Fargo & Company - NII decline hurt earnings Bank of America Corporation - Earnings hurt by NII and FICC

Bank of America Corporation - Earnings hurt by NII and FICC CapitaLand Investment Limited - Capital recycling picks up pace

CapitaLand Investment Limited - Capital recycling picks up pace Sheng Siong Group Ltd - Seasonal and base effect bump

Sheng Siong Group Ltd - Seasonal and base effect bump