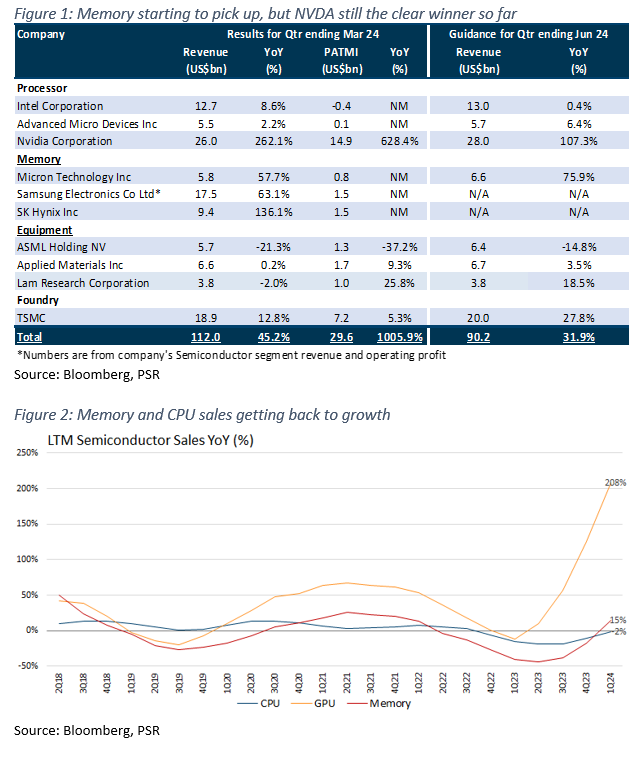

Semiconductor 1Q24 Update - Memory in full recovery mode

6 Jun 2024- 1Q24 revenue growth accelerated significantly to 45% YoY (4Q23: 25% YoY). NVDA’s >3.5x spike in revenue (accounting for 22% points of the sector’s YoY growth) helped to offset lingering weakness in Equipment.

- AI demand remained very robust, with AI GPUs (NVDA) still the main beneficiaries. Memory companies are seeing a huge return to growth after 4 quarters of decline. Semiconductors still outperforming vs S&P 500 on 1M/3M/1Y.

- Forward guidance is for 2Q24e revenue growth of ~32% YoY. We expect growth to be supported by increasing AI-related spending on GPUs and High Bandwidth Memory (HBM), a slight recovery in the PC market, and higher wafer fabrication of <7nm chips.

Summary

Processor: More upbeat on PC demand due to upcycling and improved customer inventory levels. Demand for Data Centre GPUs still outstripping supply. All three processor companies issued results that were either in line with or beat expectations. Both Intel and AMD’s PC segments benefitted from improving channel inventory levels while also seeing commercial PC strength, with OEMs beginning to ramp up their new notebook designs. Intel’s PC business was +31% YoY, while AMD’s grew +85% YoY. However, forward guidance from both Intel and AMD was lukewarm, with Intel noting some near-term wafer assembly supply constraints and AMD dragged by its embedded and gaming segments. Demand for AI GPUs remains extremely robust, with demand still outstripping supply. AMD increased FY24e sales expectations for its MI300x AI GPU to >US$4bn (prev. US$3.5bn), while Nvidia is seemingly ramping its AI GPU (Hopper + Blackwell) supply at a ~US$4bn a quarter rate – which would put its FY25e AI GPU revenue contribution at ~US$105bn (~30% higher than our previous estimates and >2x YoY). Nvidia also sees a broadening in its customer base as different industries begin their AI journey, and announced a yearly cadence for new product launches post-Blackwell. Catalysts for processor growth are 1) early-stage enterprise refresh cycle and AI PC momentum, 2) recovery in traditional server demand, and 3) continued robust demand for AI GPUs for inferencing and training AI models.

Memory: Pricing continues to climb due to demand-supply dynamics tightening, and all 3 companies are back to profitability. Micron, Samsung, and SK Hynix all reported an acceleration in revenue growth due to 1) rapid growth in demand for High Bandwidth Memory (HBM) + DDR5 to support stronger AI server demand – Nvidia’s new Blackwell AI GPU platform features ~33% more HBM content vs older platforms; 2) improving end-market inventory for Data Centres; and 3) higher prices for memory due to tighter demand-supply dynamics. More importantly, all 3 companies returned to profitability after 4 quarters of losses. Given the significant AI-related demand for memory, the expectation is for memory prices to continue rising further into FY24e, with the memory market entering a full recovery with the strength of AI and demand improvement from PC upcycling due to growing interest in AI PCs and the end of Windows 10 support. Both Samsung and SK Hynix expect higher FY24e CAPEX as they increase investments to meet the elevated levels of demand – while allocating production more to server storage use cases (vs PC + mobile). Only Micron issued forward guidance, expecting 2Q24e revenue growth to further accelerate to 76% YoY.

Equipment: Improving inventory and utilisation levels, optimistic forward guidance indicates the sector has bottomed out. Semiconductor equipment makers ASML, Applied Materials, and Lam Research all reported 1Q24 revenue, either in line with or above estimates. ASML’s YoY growth contracted quite significantly (-21% YoY) as orders slipped to EUR3.6bn from EUR3.8bn in 1Q23, while Lam Research came close to ending 4 quarters of contraction as revenue growth was almost flat YoY (4Q23: -29% YoY) – mainly due to stronger domestic investments in China (42% of total revenue). Equipment utilisation rates continue to improve, in line with a general recovery in the semiconductor industry. Forward guidance from all 3 companies was positive, with Lam Research expecting a reacceleration in growth (+29% YoY). AI-related demand remains the key driver for equipment companies, with Applied Materials now expecting HBM-related DRAM and packaging revenue to >6x YoY in FY24e (>US$600mn). Lam Research also increased its FY24e expectations for wafer fabrication equipment (WFE) spending by US$5bn to US$92.5bn.

Foundry: Building out new Fabrication plants to support increasing semiconductor demand. TSMC reported results that beat expectations on all levels. Its 1Q24 revenue grew 13% YoY, a sharp rebound after 4 quarters of contraction. The company laid plans to build an additional 7 fabrication plants (3 in Arizona, 2 in Japan, 2 in Germany) to support future demand – particularly in 3nm and 2nm chips. It expects the first of its Arizona plants to begin volume production in 1H25, and construction on its Japan and Germany plants to begin in 4Q24. TSMC also guided to continued acceleration in growth (2Q24: +27% YoY) as it sees significant demand in its advanced technologies nodes (<7nm) while maintaining its FY24e revenue growth forecast of 20-25% YoY – implying a stronger 2H24e vs 1H24 with more ramp-up of its 3nm chips. It also expects revenue from AI servers to >2x in FY24e, representing 10-15% of total revenue. However, TSMC did guide to a slight 110bps decline in gross margins due to 1) higher electricity costs (which it is working on passing through to customers) and 2) production lost from the 7.2 magnitude earthquake in Taiwan on 3 April 2024. TSMC also reduced its overall semiconductor market growth expectations to 10% YoY (from 20% YoY prev.), with a more mild and gradual recovery due to still sluggish traditional server demand and a shift in expectation from growth to contraction for automotive platforms.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Important Information

This report is prepared and/or distributed by Phillip Securities Research Pte Ltd ("Phillip Securities Research"), which is a holder of a financial adviser’s licence under the Financial Advisers Act, Chapter 110 in Singapore.

By receiving or reading this report, you agree to be bound by the terms and limitations set out below. Any failure to comply with these terms and limitations may constitute a violation of law. This report has been provided to you for personal use only and shall not be reproduced, distributed or published by you in whole or in part, for any purpose. If you have received this report by mistake, please delete or destroy it, and notify the sender immediately.

The information and any analysis, forecasts, projections, expectations and opinions (collectively, the “Research”) contained in this report has been obtained from public sources which Phillip Securities Research believes to be reliable. However, Phillip Securities Research does not make any representation or warranty, express or implied that such information or Research is accurate, complete or appropriate or should be relied upon as such. Any such information or Research contained in this report is subject to change, and Phillip Securities Research shall not have any responsibility to maintain or update the information or Research made available or to supply any corrections, updates or releases in connection therewith.

Any opinions, forecasts, assumptions, estimates, valuations and prices contained in this report are as of the date indicated and are subject to change at any time without prior notice. Past performance of any product referred to in this report is not indicative of future results.

This report does not constitute, and should not be used as a substitute for, tax, legal or investment advice. This report should not be relied upon exclusively or as authoritative, without further being subject to the recipient’s own independent verification and exercise of judgment. The fact that this report has been made available constitutes neither a recommendation to enter into a particular transaction, nor a representation that any product described in this report is suitable or appropriate for the recipient. Recipients should be aware that many of the products, which may be described in this report involve significant risks and may not be suitable for all investors, and that any decision to enter into transactions involving such products should not be made, unless all such risks are understood and an independent determination has been made that such transactions would be appropriate. Any discussion of the risks contained herein with respect to any product should not be considered to be a disclosure of all risks or a complete discussion of such risks.

Nothing in this report shall be construed to be an offer or solicitation for the purchase or sale of any product. Any decision to purchase any product mentioned in this report should take into account existing public information, including any registered prospectus in respect of such product.

Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may provide an array of financial services to a large number of corporations in Singapore and worldwide, including but not limited to commercial / investment banking activities (including sponsorship, financial advisory or underwriting activities), brokerage or securities trading activities. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have participated in or invested in transactions with the issuer(s) of the securities mentioned in this report, and may have performed services for or solicited business from such issuers. Additionally, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may have provided advice or investment services to such companies and investments or related investments, as may be mentioned in this report.

Phillip Securities Research or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report may, from time to time maintain a long or short position in securities referred to herein, or in related futures or options, purchase or sell, make a market in, or engage in any other transaction involving such securities, and earn brokerage or other compensation in respect of the foregoing. Investments will be denominated in various currencies including US dollars and Euro and thus will be subject to any fluctuation in exchange rates between US dollars and Euro or foreign currencies and the currency of your own jurisdiction. Such fluctuations may have an adverse effect on the value, price or income return of the investment.

To the extent permitted by law, Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may at any time engage in any of the above activities as set out above or otherwise hold an interest, whether material or not, in respect of companies and investments or related investments, which may be mentioned in this report. Accordingly, information may be available to Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, which is not reflected in this report, and Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited to its officers, directors, employees or persons involved in the issuance of this report, may, to the extent permitted by law, have acted upon or used the information prior to or immediately following its publication. Phillip Securities Research, or persons associated with or connected to Phillip Securities Research, including but not limited its officers, directors, employees or persons involved in the issuance of this report, may have issued other material that is inconsistent with, or reach different conclusions from, the contents of this report.

The information, tools and material presented herein are not directed, intended for distribution to or use by, any person or entity in any jurisdiction or country where such distribution, publication, availability or use would be contrary to the applicable law or regulation or which would subject Phillip Securities Research to any registration or licensing or other requirement, or penalty for contravention of such requirements within such jurisdiction.

This report is intended for general circulation only and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. The products mentioned in this report may not be suitable for all investors and a person receiving or reading this report should seek advice from a professional and financial adviser regarding the legal, business, financial, tax and other aspects including the suitability of such products, taking into account the specific investment objectives, financial situation or particular needs of that person, before making a commitment to invest in any of such products.

This report is not intended for distribution, publication to or use by any person in any jurisdiction outside of Singapore or any other jurisdiction as Phillip Securities Research may determine in its absolute discretion.

IMPORTANT DISCLOSURES FOR INCLUDED RESEARCH ANALYSES OR REPORTS OF FOREIGN RESEARCH HOUSE

Where the report contains research analyses or reports from a foreign research house, please note:

- recipients of the analyses or reports are to contact Phillip Securities Research (and not the relevant foreign research house) in Singapore at 250 North Bridge Road, #06-00 Raffles City Tower, Singapore 179101, telephone number +65 6533 6001, in respect of any matters arising from, or in connection with, the analyses or reports; and

- to the extent that the analyses or reports are delivered to and intended to be received by any person in Singapore who is not an accredited investor, expert investor or institutional investor, Phillip Securities Research accepts legal responsibility for the contents of the analyses or reports.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

Tesla Inc. – EV tax credit removal benefits deliveries

Tesla Inc. – EV tax credit removal benefits deliveries 老鋪黃金 (6181.HK) 金價之上,價值為王:古法工藝有望持續引領消費熱潮

老鋪黃金 (6181.HK) 金價之上,價值為王:古法工藝有望持續引領消費熱潮 Keppel DC REIT – DPU growth despite the preferential offering

Keppel DC REIT – DPU growth despite the preferential offering