Tesla - Stock Analyst Research

| Target Price* | 145.00 |

| Recommendation | REDUCE› REDUCE |

| Market Cap* | - |

| Publication Date | 29 Apr 2024 |

*At the time of publication

Tesla Inc. - Cut in volume and prices

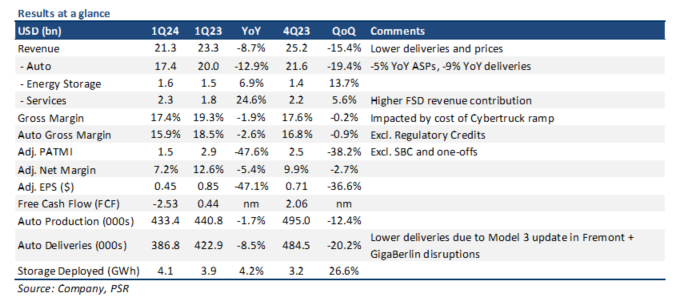

- 1Q24 results were below expectations due to slower vehicle deliveries and pricing pressures. Revenue/Adj. PATMI was at 19%/15% of our FY24e forecasts. ASPs declined for a fifth straight quarter.

- 13% YoY contraction in EV sales led by decline in both volume (-9% YoY) and prices (-5% YoY). EV industry growth under pressure from prioritisation of Hybrids, with TSLA losing market share to traditional OEMs. Margins remain under pressure from negative pricing.

- We cut our FY24e revenue/EBITDA estimates by 6%/19%, respectively, to reflect lower unit growth and margin headwinds. Our DCF target price is cut to US$145 (prev. US$175). We downgrade to REDUCE from NEUTRAL. Our WACC assumption of 9% remains unchanged, while we reduce the growth rate to 4% (prev. 5%).

The Positive

+ Accelerating new low-cost Model 2 production timeline to 1H25e. TSLA reaccelerated the timeline for launching its new EV products (Model 2 in particular) to 1H25e, from 2H25e. This should be a plus for FY25e unit growth, with the new models also able to fully utilise current manufacturing platforms and product lines for greater cost efficiency.

The Negatives

– Auto revenue suffered due to a decline in both volume and price. TSLA’s revenue from the sale of EVs contracted (-13% YoY) for the first time since the pandemic. The decline was due to: 1) factory disruptions in GigaBerlin and Fremont, which led to a -9% YoY drop in deliveries, and 2) -5% YoY dip in ASPs due to ongoing price wars with other EV manufacturers. Even with TSLA positive about growing EV volumes in FY24e, we still expect revenue growth headwinds due to pricing pressures from increasing competition. We forecast 3% YoY auto revenue growth for FY24e.

– Negative Free Cash Flow (FCF) for the first time in 5 years. TSLA recorded -US$2.5bn in FCF for 1Q24, its first quarter of negative FCF in 5 years. This was mainly due to a US$2.4bn increase in inventory, and US$1bn CAPEX spending on Nvidia H100 GPUs to develop its core AI infrastructure. TSLA currently has 35K active H100s, expecting ~85K by the end of FY24e.

– Market share losses vs. overall automotive industry. TSLA lost market share over the trailing twelve months vs. the overall automotive industry in its three main regions (1Q24: 8.8% vs. 4Q23: 9.2%). Most of its losses come in North America with OEMs like Ford and General Motors prioritising Hybrids vs. EVs. By our estimates, sales of Hybrids grew ~5-10% YoY, while overall auto industry growth was flat. Ford recently pushed back the launch of its 3-row EVs from FY25e to FY27e while expanding its Hybrid offerings.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

About the author

Jonathan Woo

Research Analyst

PSR

Jonathan covers the US technology sector focusing on internet companies. Formerly a national and professional athlete, he graduated from the University of Oregon with a Bachelor’s Degree in Social Sciences.

May 17th - Things to Know Before the Opening Bell

May 17th - Things to Know Before the Opening Bell Trade of the Day - Boeing Co. (NYSE: BA)

Trade of the Day - Boeing Co. (NYSE: BA) Singapore Banking Monthly - Fee income the driver

Singapore Banking Monthly - Fee income the driver May 16th - Things to Know Before the Opening Bell

May 16th - Things to Know Before the Opening Bell