How to select a unit trust

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available on POEMS, deciding which fund to invest in is no small task. Whether you’re stepping into the investment arena for the first time or looking to diversify your portfolio, understanding the fundamentals of unit trusts is pivotal. This guide aims to walk you through the key considerations and strategies for selecting a unit trust that resonates with your financial goals, life stage, and risk tolerance, setting you on a path towards informed and fruitful investing. Here are some considerations to guide you along:

What life stage am I at?

When you are working, you’ll find yourself in one of these three categories:

- New to the workforce: As a newcomer to the workforce, you possess a longer investment runway. This advantage gives you the ability to compound your returns to greater effect. Short-term market downturns such as financial crises or global pandemics may impact your portfolio value, but the compounding effect is likely to compensate for these over time. At this life stage, you can afford to take on more risk and may consider investing in higher-risk unit trusts.

- Wealth accumulators: This is the phase of life where you should be approaching the peak of your earning potential. While you may be earning more as compared to a newcomer to the workforce, a black swan event (an unpredictable event with potentially severe consequences such as the 2001 dot-com bubble) during this phase could impact your overall ability to accumulate wealth or even cause you to dip into your savings. Your runway for wealth accumulation is also shorter by this time. Hence, it is prudent to adopt a more moderate risk level compared to the early stages of your career. to generate greater returns with more capital at hand albeit within a shorter time frame.

- Pre-Retirement/Retirement: It is crucial to assess your portfolio as you approach or enter retirement. Consider shifting your investments into less risky assets. Money market funds are an excellent option to ensure your funds keep up with inflation without undertaking too much risk.

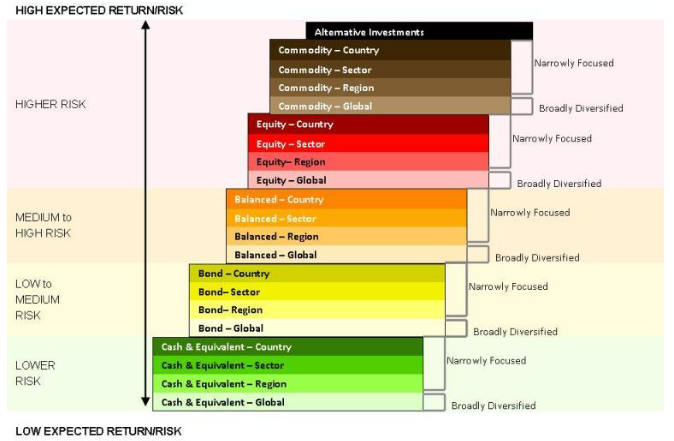

What are considered high risk funds?

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund’s underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

How do I identify a high quality fund?

Past performance: While it is widely acknowledged that past performance is not necessarily indicative of future results, it can provide insights into how a fund manager has performed previously, especially during turbulent periods.

Comparing the fund’s performance with its benchmark index can reveal if it is delivering value relative to the market index. Additionally, you can also compare a fund against its peers, which will give you insights into the fund manager’s strategy and execution.

A fund manager with a good track record over a long period of time could indicate that this fund manager has found a way to consistently outperform the market.

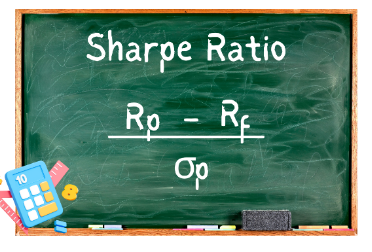

Rp = return of portfolio

Rf = risk-free rate

σp = standard deviation of the portfolio’s excess return

Risk-adjusted returns: The Sharpe Ratio is an excellent metric to measure how well a fund has performed against the risk it is undertaking. It compares the returns of an investment to the risk involved by dividing the returns in excess of the risk-free rate over the risk involved (which is measured by standard deviation).

The higher the Sharpe Ratio, the better the fund has performed per unit of risk. However, there may be situations where a fund with a great Sharpe Ratio does not end up having the best overall performance. Consideration should be given to whether the potential for higher returns justifies the additional risk in a unit trust with a lower Sharpe Ratio but better performance.

Fees and Expenses: High fees can significantly impact your returns over time. Every fund has an expense ratio, which you can use to compare to its peers. The higher the expense ratio, the more likely fees will erode your returns over a long period of time.

Fund manager reputation: With 1194 registered and licensed fund management companies in Singapore, and 144 of them newly registered in 2022, the reputation of fund managers plays a crucial role in the selection process. Thorough research into the management company’s reputation is essential.

Holdings and Diversification: Fund managers provide factsheets that give investors a quick insight into a unit trust strategy as well as some of the holdings and geographical distribution of its overall holdings. Some even provide a breakdown of the overall type of companies they invest in, splitting them into categories such as IT, infrastructure, healthcare, financials etc. Assess the fund’s exposure and ensure it aligns with your investment strategy and comfort level.

Conclusion

While it is daunting to choose from the vast array of funds available, applying a thoughtful approach that considers your life stage, risk appetite, and investment goals can help you identify the funds that align with your financial goals. Remember, selecting the right unit trust involves more than just examining past performance or fund ratings. It requires a deep dive into the fund’s management style, fee structure, and the diversity of its holdings to ensure it complements your investment strategy.

As you explore the vast world of unit trusts, let your financial objectives and a well-researched strategy guide your decisions. Utilise tools like our fund finder to sift through the options and make informed choices. By approaching your investment with knowledge and strategic foresight, you’ll be well-equipped to select unit trusts that not only meet your financial goals but also contribute to a stable and prosperous investment journey.