Should I Invest In US Funds Amid COVID-19 Pandemic?

Should I Invest In US Funds Amid COVID-19 Pandemic?

Markets have been extremely volatile due to the coronavirus (COVID-19) situation and oil price war. Panic has seeped into the global stock markets and caused a market carnage. It is not just the volatility, but also the velocity of the market crash that caught us by surprise.

On 11 March 2020, S&P 500 fell more than 20% from its recent peak and took the shortest amount of time in history, a record of 16 days to go into bear market.

The market has since entered an extended period of panic, with S&P 500 recording the worst start to a quarter in history.

United States may still be able to turn the tide despite COVID-19. Pent-up demands could drive the economy recovery in the second half of the year. The COVID-19 pandemic has yet to peak, hence we may see more selling pressure before witnessing a US comeback. Recently, investment houses have been racing to cut their economic growth outlook as economic data are expected to reflect the massive negative impact due to COVID-19.

While there is still ongoing fear and anxiety, the pandemic shall eventually pass and consumption behaviour will return to some sort of normality just like it did after previous crisis such as 9/11.

Is the Market Correction over?

We are closely monitoring signs that possibly suggest the end of market corrections caused by COVID-19.

Table 1: Market Bottoming Signals

| Key Bottoming Signals | My View |

| Peak in daily new cases and deaths | Global daily new cases and deaths have not yet reached their peaks. |

| Policy Response | We may see more policy support as all industries have been affected by the COVID-19 pandemic. |

| Market does not respond to bad economic data | Economic data has yet to show the full impact of COVID-19 pandemic. |

Key Bottoming Signals

- Peak in daily new cases and deaths

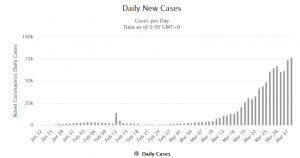

Chart 2: Daily New Cases and Deaths of COVID-19

Source: Worldometer, 1 April 2020

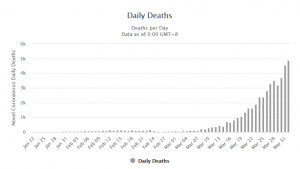

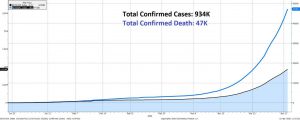

Chart 3: Total Cases and Total Deaths from COVID-19

Source: Bloomberg Data, 1 April 2020

Daily new cases and deaths have not reached their peaks. Furthermore, global confirmed cases and death toll have both shown steepening curve.

- Policy Support

In term of policy support, governments and central banks are trying to use monetary and fiscal policies to support the economy and let markets to bottom out. The US Federal Reserve has vowed to buy unlimited Treasury bonds and mortgage-backed securities. We may see more policy support as all industries have been affected by the COVID-19 pandemic.

- Market does not respond to bad economic data

US equity market may face selling pressure upon the release of more negative economic data. But if the stock market does not respond to worsening economic data and rebound instead, then this could be one of the bottoming signals as market may have priced in the impact of negative economic data.

Overall, we are not calling for the market bottom yet as there are still no clear signs of market bottoming based on various indicators.

However, it is unlikely that investors could perfectly time the market and buy at the exact market bottom. Thus, we advocate dollar-cost averaging approach in this volatile market.

Dollar-cost averaging is a long-term strategy that allows you to make regular investments. For example, you have $1000 to invest, and you invest $100 every month instead of $1000 at one go.

This is an attractive strategy as it helps to “smooth” your purchases – lowers the average cost of investment – over time, and reduces the woes of entering the market at a “wrong” time.

With as little as S$100 a month, you can start a Regular Savings Plan on POEMS to reduce the impact of volatility.

Keep Calm and Carry On

While we are still expecting bouts of volatility in the US market, we believe fortune favours those who are prepared. Investors should have a list of investment products worthy of long-term investment.

While we think the COVID-19 led sell off may not be done despite recent stock market plunge, we believe the market dips provide opportunities for you to get started with trading in the US equity market given the fair valuation. Investors could look to build a long-term portfolio through the dollar cost averaging approach.

Fair Valuation

While US equity’s valuation is considered relatively expensive when compared with Asian equity, the valuation premium is justifiable if investors consider the high growth potential in US companies and state of US economy.

Chart 4: Forward PE for S&P 500

Source: Bloomberg Data, 1 April 2020

Chart 5: Forward PB for S&P 500

Source: Bloomberg Data, 1 April 2020

The recent market weakness resulted in fair valuations for S&P 500. The S&P 500’s price-to-earnings (PE) ratio and price-to-book (PB) are both trading near their 10-year mean.

We are cautiously optimistic in longer term as we believe pent-up demands and resumption of economic activities should induce growth for the US economy in the second half of 2020.

However, a V-shaped recovery may be too optimistic as we have not seen the full magnitude of the coronavirus-led economic disruption.

Why should you invest in US mutual funds?

Unlike investing into individual stocks that are exposed to single counter and concentration risks, a mutual fund manager could invest into a basket of stocks to benefit from a diversified portfolio.

A mutual fund is actively managed by professional fund managers. During market volatility, a fund manager could actively switch in or out security selection to ensure the fund is well positioned to weather market volatility.

US Equity Mutual Funds

Investors may consider adding large cap mutual funds into their investment portfolio as large cap companies generally have sustainable profitability and healthier balance sheet to better weather tough times. We also favour mutual funds that focus on sustainable, multi-year growth trends as high quality, growth companies are well positioned for a recovery. Investors should prepare a list of quality US equity funds to position for long term.

How to get started?

With a wide variety of US equity funds on POEMS, you can select from more than 80 US equity funds across 17 fund providers based on your investment needs. You will also get to enjoy 0% platform fees, 0% sales charge and 0% switching fees for your Unit Trust investments on POEMS.

Visit our website at https://www.poems.com.sg/fund-finder/ to explore your options!

Want to Learn More?

Get your insights at our upcoming Unit Trust Semi-Annual Webinar: Navigating the COVID-19 Panic on 30 May, 10 am. Join this informative session to get insights on what investors can do during the current trying market conditions.

Click here to register and find out more: https://zoom.us/webinar/register/WN_tXvwY8UZSkms2ZHYiXfmJQ