- Home

- UT Articles & Announcements

The Future of Weight Management: Innovations in Weight Loss Drugs

As societies grapple with escalating obesity rates and their associated health risks, the demand for effective weight management solutions has never been more urgent. Amid this backdrop, a revolutionary advancement is reshaping the landscape: a new class of weight loss drugs developed by pharmaceutical giants. These drugs, which double as treatments for both diabetes and obesity, are not just breakthroughs in medical science—they represent a beacon of hope for millions. Beyond the significant health implications, these innovations open substantial investment opportunities.

This article delves into the pioneering approaches spearheaded by Novo Nordisk and Eli Lilly, exploring how they could herald a new era in managing and potentially reversing obesity trends, while also offering lucrative prospects for savvy investors to capitalise on the expanding market. These drugs, used to treat both diabetes and obesity, include:

As societies grapple with escalating obesity rates and their associated health risks, the demand for effective weight management solutions has never been more urgent. Amid this backdrop, a revolutionary advancement is reshaping the landscape: a new class of weight loss drugs developed by pharmaceutical giants. These drugs, which double as treatments for both diabetes and obesity, are not just breakthroughs in medical science—they represent a beacon of hope for millions. Beyond the significant health implications, these innovations open substantial investment opportunities.

This article delves into the pioneering approaches spearheaded by Novo Nordisk and Eli Lilly, exploring how they could herald a new era in managing and potentially reversing obesity trends, while also offering lucrative prospects for savvy investors to capitalise on the expanding market. These drugs, used to treat both diabetes and obesity, include:

- Semaglutide (marketed as Ozempic and Wegovy by Novo Nordisk)

- Tirzepatide (marketed as Mounjaro and Zepbound by Eli Lilly)

The active ingredients in these drugs (semaglutide and tirzepatide) are GLP-1 receptor agonists, which work by mimicking a natural gut hormone called glucagon-like peptide-1 (GLP-1). GLP-1 helps regulate appetite, blood sugar, and insulin levels.

These drugs have been shown to be remarkably effective in helping people lose weight. Clinical trials have shown that overweight or obese patients using semaglutide medications over a few months helped patients lose an average of 10-18% of their body weight.

Ozempic was initially approved for the treatment of type 2 diabetes, helping to manage blood sugar levels and offering cardiovascular benefits. Following this, Wegovy later received approval for chronic weight management, addressing the growing obesity epidemic. Similarly, Eli Lilly's tirzepatide drugs were approved for diabetes in 2022 and obesity in 2023, with Zepbound recently outpacing Wegovy in new US prescriptions.

It's important to note that these drugs are not a cure-all solution. For the best results, they should be used in conjunction with a healthy diet and exercise plan. If you are considering taking weight loss medication, it is important to consult a healthcare professional to ensure if it's suitable for you.

Potential Market for GLP-1 Drugs

The market for GLP-1 receptor agonists in weight loss is poised for substantial growth in the coming years, with a report by JP Morgan estimating as much as US$100 billion in yearly revenue by 2030. These drugs are set to become a key component in the treatment of obesity and related health conditions. The business case for this drug alone in the United States is significant, given how 2 out of 3 adults are considered overweight and 1 out of 3 adults are considered obese.

Following strong demand for both approved and off-label use, the prescription of Ozempic had to be restricted to patients with type-2 diabetes, while the firm ramped up manufacturing.

Novo Nordisk isn’t the only one facing supply issues. Eli Lilly’s Mounjaro and Zepbound are both listed with “Limited Availability” on the FDA Drug Shortages database, further proving the strong demand for the weight loss drugs.

As the current drugs are administered through self-injection, the race is on for the pharma giants to develop a formulation which can be administered orally, while reducing side effects such as loss of muscle mass and gastrointestinal effects. At the time of writing, Eli Lilly has begun clinical trials for an oral weight loss drug, orforglipron, in India.

The companies behind these drugs

Both Ozempic and Wegovy are developed by Novo Nordisk, a Danish multinational pharmaceutical company. The success of both drugs had a dramatic impact on the business fortunes as well as the stock market performance of Novo Nordisk. At time of writing, Novo Nordisk stock price has risen over 150% over the last 2 years.

Zepbound and Mounjaro by Eli Lilly have boosted their financials, with the American pharmaceutical company seeing a 26% increase in revenue in Q1 2024. Lilly's chair and CEO attributed the year-over-year revenue growth to strong sales of the two drugs. Similar to Novo Nordisk, Eli Lilly’s stock price has risen more than 200% over the last 2 years.

Beyond investing solely in the companies’ stocks, less volatile instruments like unit trusts offer decent exposure to the pharma firms.

AllianceBernstein’s AB SICAV I - International Health Care Portfolio fund has an exposure of 8.59% and 8.30% to Eli Lilly and Novo Nordisk respectively, with an annualised 7.79% per annum since inception for the A USD class at time of writing.

The BlackRock World Healthscience Fund, a strong contender, has an exposure of 7.41% and 7.16% to Eli Lilly and Novo Nordisk respectively. The performance of the fund since inception in 2001 has also been a respectable annualised 8.50% per annum for the A2 Singapore Hedged Class.

Both Ozempic and Wegovy are developed by Novo Nordisk, a Danish multinational pharmaceutical company. The success of both drugs had a dramatic impact on the business fortunes as well as the stock market performance of Novo Nordisk. At time of writing, Novo Nordisk stock price has risen over 150% over the last 2 years.

Zepbound and Mounjaro by Eli Lilly have boosted their financials, with the American pharmaceutical company seeing a 26% increase in revenue in Q1 2024. Lilly's chair and CEO attributed the year-over-year revenue growth to strong sales of the two drugs. Similar to Novo Nordisk, Eli Lilly’s stock price has risen more than 200% over the last 2 years.

Beyond investing solely in the companies’ stocks, less volatile instruments like unit trusts offer decent exposure to the pharma firms.

AllianceBernstein’s AB SICAV I - International Health Care Portfolio fund has an exposure of 8.59% and 8.30% to Eli Lilly and Novo Nordisk respectively, with an annualised 7.79% per annum since inception for the A USD class at time of writing.

The BlackRock World Healthscience Fund, a strong contender, has an exposure of 7.41% and 7.16% to Eli Lilly and Novo Nordisk respectively. The performance of the fund since inception in 2001 has also been a respectable annualised 8.50% per annum for the A2 Singapore Hedged Class.

Key considerations when investing in a unit trust for specific exposure

Fund holdings are dynamic: Although your initial intention when investing in a unit trust might be to gain exposure to the aforementioned shares, there is a possibility that the underlying securities in the fund might have shifted by the time you invest, or over your investment period. It is important that you review the investment objective of the fund before investing.

Management fees: Understand the management fees and how they compare to other unit trusts with similar objectives. Lower fees can enhance overall returns over time.

Concentration risk: Since the investment objectives of both funds are thematic in nature, this could create the risk of having too much invested into a niche area. It is important that investors do their own due diligence and allocate their portfolio accordingly.

Do your own due diligence before investing into any unit trusts. Consider your investment goals and risk tolerance before making a decision. Investing in Gold with Unit Trusts

When gold was first discovered about 4500 years ago, it was valued for its malleability and ductility, making it easy to shape into intricate patterns, for jewellery. In modern times, gold has remained an all-weather store of value, contributing to its current status as the reserve asset of central banks. Retail investors also trade in gold for the following reasons:

Common reasons to invest in gold

- Hedge Against Inflation: Gold has historically maintained its value over the long term, making it a strong hedge against inflation. As the cost of living increases, the value of gold tends to rise alongside it.

- Safe Haven Asset: During times of economic uncertainty or geopolitical tension, investors often turn to gold as a safe haven asset. Its value is not directly tied to any specific country's economy or political stability, making it a reliable store of value.

- Diversification: Gold can diversify an investment portfolio, reducing risk. Its price movements are often uncorrelated with those of other assets like stocks and bonds, providing a buffer against market volatility.

- Liquidity: Gold is a highly liquid asset, meaning it can be easily bought and sold. There's always a market for gold, whether in the form of bullion, coins, or digital gold investments.

However, there are some things one should take note when investing in gold:

- No Yield: Gold does not pay dividends or interest. Unlike stocks or bonds, the only return on investment comes from price appreciation, which may not occur over your desired investment horizon.

- High Volatility: The price of gold can be highly volatile in the short term, influenced by changes in market sentiment, monetary policy, and global economic indicators. This volatility can lead to substantial fluctuations in investment value.

- Opportunity Cost: Investing a significant portion of your portfolio in gold could mean missing out on the potentially higher returns offered by other investments, such as stocks or real estate.

- Regulatory and Market Risks: Changes in government policies regarding gold ownership or taxation can affect its attractiveness as an investment. Additionally, large institutional investors and central banks can influence the gold market, potentially leading to unpredictable price movements

Under a diversified investment strategy, investing in gold is especially useful for those looking to hedge against inflation and economic uncertainty. However, weighing the lack of yield and opportunity cost against the benefits of holding this precious metal is important. As with any investment, it's crucial to consider your financial goals, risk tolerance, and investment horizon when deciding how much gold to include in your portfolio.

Investing in Gold Miner Funds

Investing in gold miner funds and investing directly in gold are two distinct strategies, each with its own set of benefits. Understanding their differences can help investors choose the option that best aligns with their investment goals, risk tolerance, and market outlook.

Gold miner funds typically invest in stocks of companies involved in the exploration, mining, and production of gold. These funds can be unit trusts or exchange-traded funds (ETFs).

In unit trust investments, fund managers adopt active management by actively selecting companies that outperform the fund’s benchmark over time. Fund managers have the flexibility to hold cash in a market downturn and buy low during periods of heightened market volatility. Thus, the fund manager plays a pivotal role in the fund's performance.

Gold Miner Unit Trusts offer various currency share classes that differ from their base currency. An SGD hedged share class will help investors reduce the impact of SGD currency movement against other currencies, which may affect an investor’s returns. In an unhedged SGD share class, investors will be exposed to FX gains or losses.

Benefits:

- Leverage to Gold Prices: Gold mining companies often experience a higher percentage increase in their stock prices compared to the rise in gold prices. This is because operational costs may remain relatively fixed as gold prices increase, potentially leading to higher profit margins and, consequently, higher stock prices.

- Dividend Income: Unlike physical gold, which does not generate income, shares in gold mining companies pay dividends. This provides an income stream in addition to any capital gains.

- Operational Improvements: Unit trusts invested in gold mining companies offer the potential to benefit from operational improvements, exploration success, and resource expansion of the companies they invest in. Effective management can significantly increase a company's value independent of gold price movements.

Considerations:

- Volatility: When gold prices fluctuate, gold mining companies may move faster in the same direction than anticipated by investors as there is a high positive correlation between them. Gold mining stocks are subject to both the volatility of the gold market and the stock market and company-specific risks, which can lead to greater price swings compared to direct gold investments. Therefore, the investment returns for gold mining companies tend to be more volatile.

- Costs and Management Risks: Gold miner unit trusts come with management fees and are subject to the competence of the fund's management team. Operational risks, such as mining accidents or regulatory issues, can also affect performance.

Gold Miner Funds available on POEMS:

BlackRock World Gold

The World Gold Fund seeks to maximise total return. The fund invests globally at least 70% of its total assets in the equity securities of companies whose predominant economic activity is gold mining. It may also invest in the equity securities of companies whose predominant economic activity is other precious metal or mineral and base metal or mineral mining. The fund does not hold physical gold or metal.

DWS Noor Precious Metals Securities Fund

The fund seeks to achieve its investment objective by investing in Shariah-compliant equity and equity-related securities of companies engaged in activities (exploration, mining, and processing) related to gold, silver, platinum, or other precious metals or minerals.

FTIF Franklin Gold and Precious Metals Fund

The fund’s principal investment objective is capital appreciation, with a secondary objective of generating income. Under normal market conditions, the fund invests principally its net assets in securities issued by gold and precious metals operation companies. The fund principally invests in equity and/or equity-related securities such as common stocks, preferred stocks, warrants, and convertible securities issued by gold and precious metals operation companies located anywhere in the world (including Emerging Markets) and across the entire market capitalisation spectrum, including small-cap and medium-cap companies, as well as in American, Global and European Depositary Receipts.

Schroder ISF Global Gold Fund

The fund aims to provide capital growth by investing in equities of companies in the gold industry. It invests at least two-thirds of its assets in equities of companies worldwide involved in the gold industry. It will also invest directly in equities relating to other precious metals and indirectly in gold and other precious metals through other funds. The fund may hold up to 40% of its assets in cash and will not be exposed to any physical commodities directly nor will it enter into any contracts related to physical commodities. The fund may use derivatives with the aim of reducing risk or managing the fund more efficiently.

UOB United Gold & Gen Fund

The fund aims to achieve returns on investment primarily through securities of corporations, whether listed or not, anywhere in the world. Its focus is on businesses substantially involved in the mining or extraction of gold, silver, or other precious metals (e.g., platinum, palladium, rhodium), bulk commodities (e.g., coal, iron ore, steel), base metals of all kinds (e.g., copper, aluminium, nickel, zinc, lead, tin), and other commodities (e.g., industrial minerals, titanium dioxide, borates). It also includes the mining or extraction of oil, gas, coal, alternative energy, and other minerals, as well as other authorised investments as set out in Clause 1 of the Deed and as described in paragraph 20.6 of this Prospectus.

Conclusion:

The choice between investing in gold miner unit trusts and investing directly in gold depends on the investor's objectives and risk appetite. Gold miner unit trusts offer leverage to gold prices and potential income through dividends but come with higher volatility and operational risks. Direct gold investments offer a hedge against inflation and economic uncertainty with lower volatility but lack an income component. Diversification, understanding the inherent risks, and aligning with investment goals are key factors to consider when choosing between these two investment options.

Trade unit trusts on POEMS! Open an account here: https://www.poems.com.sg/open-an-account/ Unit Trusts vs Exchange Traded Funds (ETFs) – Which is better for your portfolio?

Imagine you are dining at a nice restaurant, feeling overwhelmed by the variety of seemingly delectable dishes. However, you have a limited budget and you can only afford to order one dish.

This situation is frustratingly similar to being new to investing and overwhelmed with the variety of investment options in the market. With a limited budget, you will need to carefully weigh the pros & cons of each investment product before you make your investment decision.

What are Unit Trusts and ETFs?

Unit trusts and ETFs are both funds. In simple terms, a fund is usually a basket of assets that offers diversification to investors.

Unit Trusts: Also known as mutual funds, Unit Trusts are a form of investment for which professional fund managers pool investors’ monies together to invest in a diversified portfolio of assets. A typical unit trust consists of bonds, stocks, and other types of securities.

Fund managers aggregate the value of all the different types of assets they invest in and generate a Net Asset Value (NAV). This NAV represents the value per unit of the fund, which is also the price at which it is traded. The performance of a unit trust generally depends on the fund manager’s ability to generate returns above a benchmark index.

Exchange-traded funds (ETFs) are open-ended investment funds listed and traded on a stock exchange. They aim to track or replicate the performance of an underlying index or asset. ETFs provide access to a wide variety of markets and asset classes.

The price of ETFs is determined by the value of their underlying asset and the market demand and supply of the ETF, while their performance depends on the respective index that the ETF tracks.

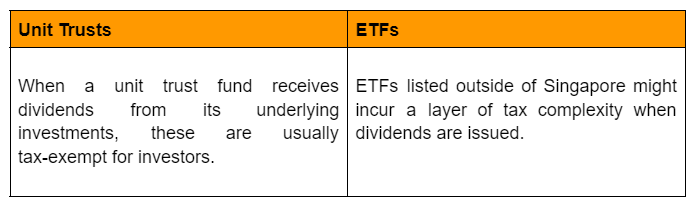

What are the differences between Unit Trusts and ETFs?

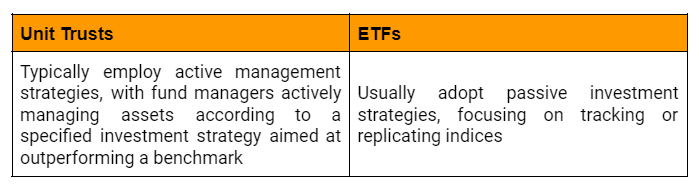

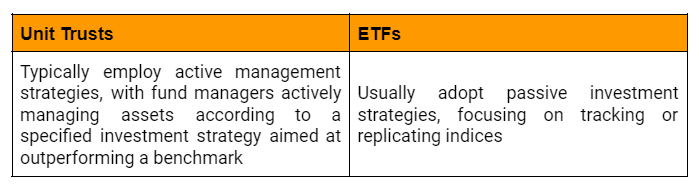

- Passive vs. Active Management

Passive Management refers to an investment style whereby the objective is to track or “mirror” an established index like the Singapore Straits Times Index (STI) or the US S&P 500 Index. This is the opposite of Active Management, which involves active screening and selection of stocks, bonds, or other securities to meet an investment objective or outperform a benchmark.

Unit trusts are typically managed by experienced fund managers who use their expertise to make discretionary investment decisions, aiming to outperform the market or a specific benchmark. In contrast, ETFs are more commonly associated with a passive management style, primarily focusing on tracking indexes.

Whether you should adopt a more active or passive approach depends on what you’re investing in and your knowledge about the markets. For example, given their smoother flow of capital, developed markets might be well-served by passively managed options. On the other hand, active management could give your portfolio an edge in emerging markets where efficiently picking stocks may have a more significant impact.

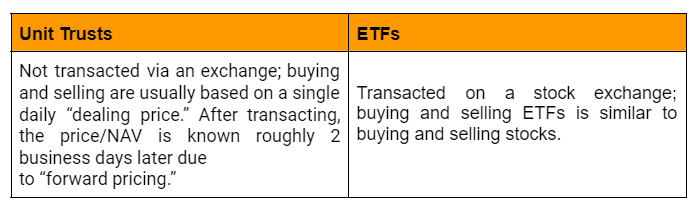

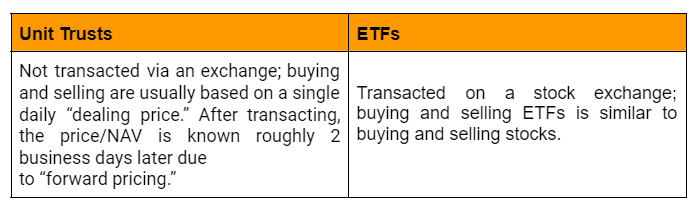

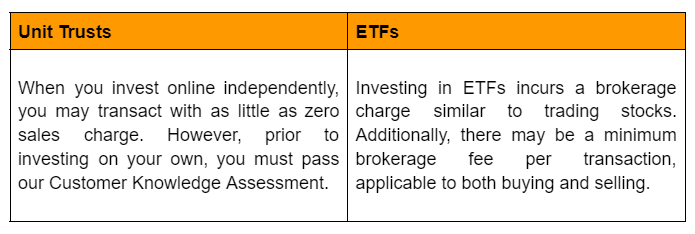

- Exchange vs. Non-exchange Trading

Unit trusts are not traded on an exchange and are “forward priced.” Forward pricing is used to determine the price of a fund’s “units” based on the end of day net asset value (NAV) of the fund. Transactions typically use a single daily “dealing price”; and the transacted price or NAV is known about two business days after the purchase is made.

As the name suggests, ETFs are traded on a stock exchange which allows for real-time price dissemination and transactions. The price of an ETF is influenced by a combination of market demand and the performance of the underlying index that the ETF is tracking.

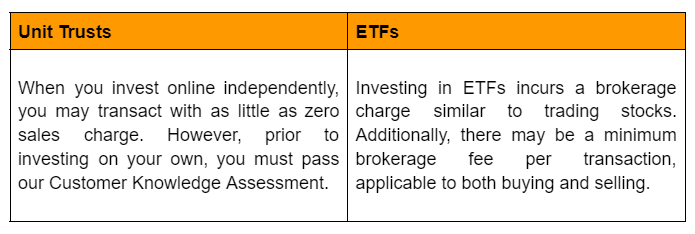

These costs can add up, especially with smaller investment amounts. Since ETFs typically require the purchase of whole shares, frequent commission fees can chip away at your returns. In contrast, Unit trusts allow you to invest any amount, thereby minimising the impact of these fees.

These costs can add up, especially with smaller investment amounts. Since ETFs typically require the purchase of whole shares, frequent commission fees can chip away at your returns. In contrast, Unit trusts allow you to invest any amount, thereby minimising the impact of these fees.

Conclusion

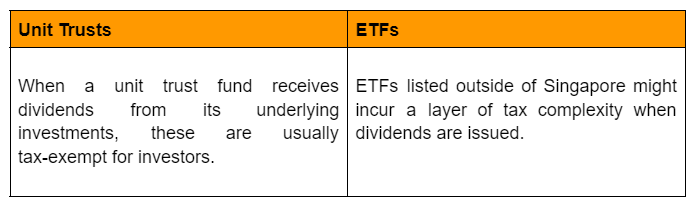

If you’re a new investor in Singapore with a smaller budget, unit trust funds might be your perfect gateway to the world of investments. Their flexibility in terms of investment amount, potentially simpler tax structure, and the option for active management in specific markets make them a compelling choice. Are you ready to explore the delicious world of unit trust funds and start building your financial future?

Winshern Ho

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/TTPWinshernHo

Winshern Ho

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/TTPWinshernHo What is ESG investing, and why is it important?

Over the last five years, Environmental, Social, and Governance (ESG) investing has evolved from being a niche strategy to becoming a fundamental approach adopted by investment managers around the globe. There has been an increase in global awareness about how sustainable business practices lead to net positive outcomes for everyone, from investors to society at large. This transition is not just about doing good, but also about aligning investors’ values with their financial objectives.

Understanding ESG Investing

ESG investing considers the environmental, social, and governance practices of the entities being invested in. This helps investors to evaluate potential risks and growth opportunities beyond traditional financial analysis. This approach recognises that ESG factors can significantly affect an organisation's performance and its long-term sustainability.

Here’s an overview of the three pillars of ESG:

- Environmental: How a company performs as a steward of the natural environment, such as their carbon footprint, or efforts to reduce their environmental impact

- Social: How a company manages relationships with its stakeholders - employees, suppliers, customers, and communities

- Governance: Deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights

Benefits of ESG Investing

- Enhanced Risk Management:

Companies that neglect or wilfully ignore environmental regulations can ultimately face hefty fines and severe reputational damage, which could greatly impact their stock prices and also future growth prospects. By considering a company’s underlying ESG framework, investors can avoid potentially volatile investments and enhance the stability of their portfolios. Applying an ESG viewpoint to investing acts as an additional layer of risk assessment, helping investors avoid firms with poor practices that could pose financial risks.

- Access to Investment Opportunities:

Companies leading in ESG often pioneer innovation, opening new markets or creating more efficient processes. Investment in renewable energy technologies, waste reduction techniques, and sustainable agriculture is not just good for the planet but also opens new avenues for business growth.

- Stakeholder and Consumer Preference:

Modern consumers and employees prefer engaging with socially responsible companies. This shift can lead to increased sales, improved employee morale, and lower turnover rates, all contributing to a company's financial success.

ESG Investing in Unit Trusts

The integration of ESG screening into unit trusts has enabled individual investors to participate in sustainable investing without having to perform complex individual security analysis on their own. Many unit trusts now focus exclusively on ESG factors, investing in companies that adhere to specific sustainability criteria. These funds often target specific themes such as clean energy, water conservation, or ethical labour practices. Below are some unit trusts where the fund managers consider sustainability when making investment decisions:

United Global Quality Fund

The United Global Quality Growth Fund aims to deliver long-term total return by investing in equity and equity-related securities of companies listed and traded on stock exchanges globally. This fund offers investors the opportunity to gain exposure to high-quality stocks with strong growth potential in the global market.

- Since its inception, this fund's accumulation class has performed at 9.32% per annum at an NAV-to-NAV level as of 31 March 2024.

- The underlying strategy is being managed by Lazard Asset Management

- The last monthly distribution in March 2024 had an annualised yield of 3.25% per annum for the hedged Singapore dollar distribution class.

Available Fund Classes for Investment:

Phillip Capital Management Sustainable Reserve Fund

This Fund invests all of its assets in global fixed-income instruments including short-term interest-bearing debt instruments and bonds, money market instruments, bank deposits, and fixed deposits. The fixed-income instruments may be issued by governments, government agencies, companies, and supranational bodies. The Fund is a short-duration bond fund with its investments broadly diversified with no specific industry or sectoral emphasis. The fund manager aims to invest at least 70% of the Fund’s total assets in deposits and instruments issued by issuers that meet industry-specific ESG criteria through positive screening and active management.

- The investment objective of the Sustainable Reserve Fund is to achieve income yield enhancement over the 6-month Singapore Overnight Rate Average.

- Weighted credit rating is at “A” as at 28 March 2024.

- Weighted average yield is at 3.89% as at 28 March 2024.

- Since inception it has outperformed the benchmark by 0.53% as at 28 March 2024.

Available Fund Classes for Investment:

Nikko AM Japan Dividend Equity SGD

The Fund's investment objective is to provide total return through capital growth and income over the medium to long term. It focuses on a diversified portfolio of dividend-producing equity investments listed and traded on the Tokyo Stock Exchange. These investments offer attractive and sustainable dividends from companies with relatively strong sustainable cash flows, stable growth, and stable dividend payouts. The Fund will be actively managed and may allocate up to 30% of its Net Asset Value (NAV) to cash to manage downside market fluctuations.

- As of 31 March 2024, on an NAV-to-NAV level, the Fund's Singapore dollar hedged share class performed at 11.88% per annum since inception.

- The Fund was within the top quartile of funds compared to its peers in 2023.

Available Investment Options:

Conclusion

ESG investing continues to transform the investment landscape, creating avenues for investors to align their financial goals with their ethical values. By focusing on the Environmental, Social, and Governance aspects, investors not only contribute to sustainable global practices but also position themselves to benefit from the resilience and innovation of ESG-compliant companies. Whether through funds that target specific sustainable themes or those like the Nikko AM Japan Dividend Equity Fund, which invests in dividend-rich, financially robust Japanese companies, ESG-focused unit trusts offer both financial returns and positive impact. As the market for responsible investments grows, integrating ESG criteria remains a strategic approach to achieving long-term investment returns and societal benefits. What are fixed-income funds?

In the diverse world of unit trusts, various funds employ distinct investment strategies aligned with investors’ goals and risk profiles. Each strategy offers a unique asset allocation and risk management approach tailored to specific investment objectives. In this article, we’ll cover fixed-income funds.

Fixed income investments, commonly known as bonds, are an asset class that offers regular payments to investors over a fixed interval until a predetermined maturity date. Upon maturity, investors will receive the principal amount that they originally invested. This asset class generally holds a higher claim priority compared to equity investments. When a default event occurs, any available funds that can be recovered from a bankrupt company will have to be paid to bondholders before shareholders.

A fixed-income unit trust consolidates various types of fixed-income securities into a single investment vehicle. Investing in a fixed-income fund presents several benefits, which we will discuss below:

Benefits of investing in fixed-income funds

Diversification: Instead of investing in a single bond, a bond/fixed income unit trust gives investors diversification across multiple types of securities and regions. This means that if one of the many bonds in the unit trust defaults (missing an interest or principal payment), your Net Asset Value will not be as severely impacted as if you held onto a single bond.

Professional Management: Fixed-income fund managers have the experience and knowledge to properly manage and analyse which assets to invest in. Leaning on these managers to find such investment opportunities saves investors time and effort to do their own research. As such, the reputation and track record of the fund manager should be considered when choosing which fund to invest in.

Accessibility: There are some fixed-income tools that normal retail investors do not have easy access to. These could include government treasury bills, fixed income from less accessible markets, or quasi-sovereign bonds. Fixed-income fund managers would have relationships with bond issuers, underwriters, and brokers. These relationships give managers access to unique investment opportunities at better pricing.

Income Generation: Fixed-income securities tend to pay a regular dividend, thus generating a regular stream of income for investors. By investing in a fixed income unit trust, investors could enjoy a monthly income stream compared to investing in a single bond. Most bonds only pay an income twice a year.

Liquidity: Fixed-income unit trusts offer higher liquidity compared to individual bonds, as investors can typically buy or sell fund units on any business day. This flexibility allows investors to respond more promptly to changing financial needs or market conditions.

Here are two features that you might find on the factsheet of a fixed income unit trust:

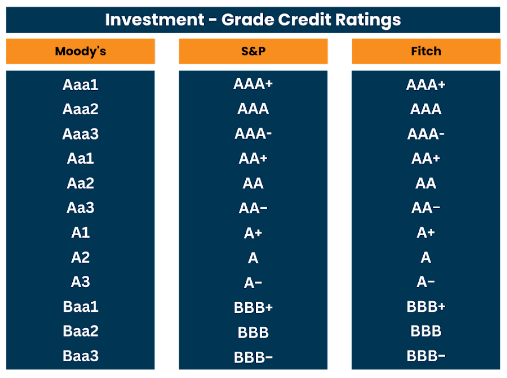

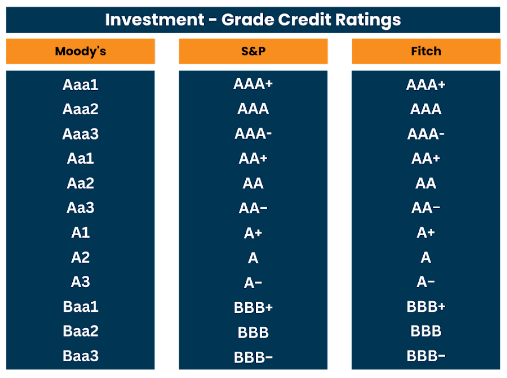

Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from 'AAA' to 'BBB-' (S&P and Fitch) or 'Baa3' (Moody's) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from 'AAA' to 'BBB-' (S&P and Fitch) or 'Baa3' (Moody's) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Risk of investing in fixed income funds

Interest rate risk: Fixed income securities are sensitive to interest rate changes. When interest rates rise, bond prices typically fall, and vice versa. Fixed income funds holding long-term bonds may be particularly vulnerable to interest rate fluctuations, potentially impacting fund performance and capital.

Credit risk: The risk that the issuer is unable to make timely interest payments and/or return the principal at maturity. Investing in funds that hold lower-rated (usually higher-yield) bonds may offer higher returns, but come with increased risk of default. It is important to do your own research and understand the regions and sectors a unit trust invests in, such as by studying the factsheet.

Learn more about fixed income at our upcoming event!

Hear from our partners, Fidelity International, Manulife Investment Management, and PIMCO, who will share their perspectives on fixed-income markets in 2024.

Sign up for the event here! https://tinyurl.com/pz8yu3c5

Conclusion

Fixed-income funds represent a fundamental component of a diversified investment portfolio, offering benefits like regular income, reduced risk, and professional management. While they are not devoid of risks, they play a crucial role in balancing portfolio performance across different market conditions. As with any investment, understanding the nuances of fixed-income funds and how they fit within your overall investment strategy is essential for achieving long-term financial success. How to select a unit trust

Navigating the vast world of unit trusts can be daunting. With nearly 2000 funds available on POEMS, deciding which fund to invest in is no small task. Whether you're stepping into the investment arena for the first time or looking to diversify your portfolio, understanding the fundamentals of unit trusts is pivotal. This guide aims to walk you through the key considerations and strategies for selecting a unit trust that resonates with your financial goals, life stage, and risk tolerance, setting you on a path towards informed and fruitful investing. Here are some considerations to guide you along:

What life stage am I at?

When you are working, you'll find yourself in one of these three categories:

When you are working, you'll find yourself in one of these three categories:

- New to the workforce: As a newcomer to the workforce, you possess a longer investment runway. This advantage gives you the ability to compound your returns to greater effect. Short-term market downturns such as financial crises or global pandemics may impact your portfolio value, but the compounding effect is likely to compensate for these over time. At this life stage, you can afford to take on more risk and may consider investing in higher-risk unit trusts.

- Wealth accumulators: This is the phase of life where you should be approaching the peak of your earning potential. While you may be earning more as compared to a newcomer to the workforce, a black swan event (an unpredictable event with potentially severe consequences such as the 2001 dot-com bubble) during this phase could impact your overall ability to accumulate wealth or even cause you to dip into your savings. Your runway for wealth accumulation is also shorter by this time. Hence, it is prudent to adopt a more moderate risk level compared to the early stages of your career. to generate greater returns with more capital at hand albeit within a shorter time frame.

- Pre-Retirement/Retirement: It is crucial to assess your portfolio as you approach or enter retirement. Consider shifting your investments into less risky assets. Money market funds are an excellent option to ensure your funds keep up with inflation without undertaking too much risk.

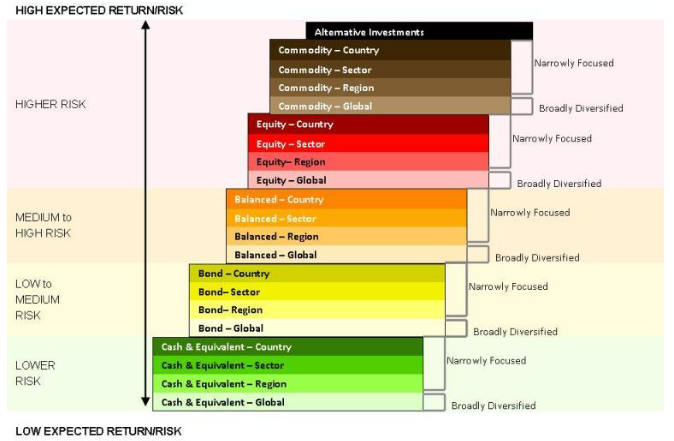

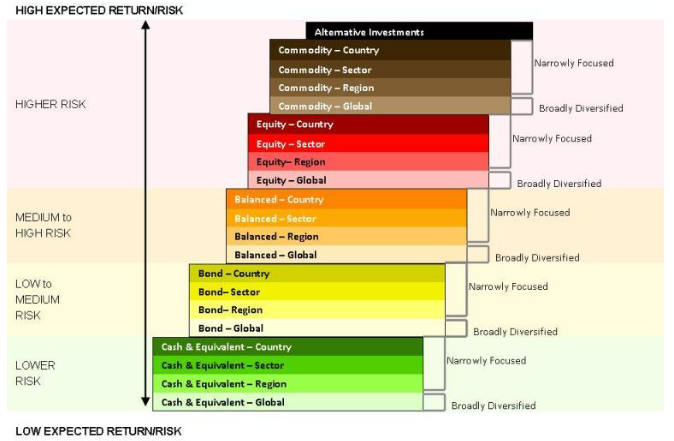

What are considered high risk funds?

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund's underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund's underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

How do I identify a high quality fund?

Past performance: While it is widely acknowledged that past performance is not necessarily indicative of future results, it can provide insights into how a fund manager has performed previously, especially during turbulent periods.

Comparing the fund's performance with its benchmark index can reveal if it is delivering value relative to the market index. Additionally, you can also compare a fund against its peers, which will give you insights into the fund manager’s strategy and execution.

A fund manager with a good track record over a long period of time could indicate that this fund manager has found a way to consistently outperform the market.

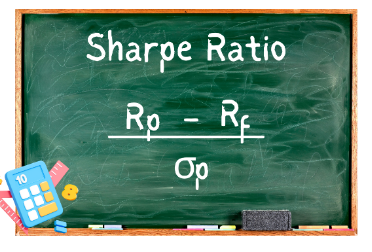

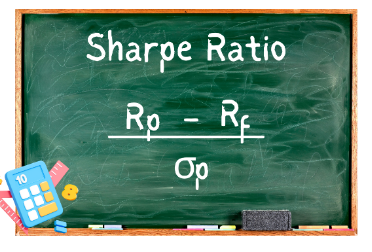

Rp = return of portfolio

Rf = risk-free rate

σp = standard deviation of the portfolio’s excess return

Risk-adjusted returns: The Sharpe Ratio is an excellent metric to measure how well a fund has performed against the risk it is undertaking. It compares the returns of an investment to the risk involved by dividing the returns in excess of the risk-free rate over the risk involved (which is measured by standard deviation).

The higher the Sharpe Ratio, the better the fund has performed per unit of risk. However, there may be situations where a fund with a great Sharpe Ratio does not end up having the best overall performance. Consideration should be given to whether the potential for higher returns justifies the additional risk in a unit trust with a lower Sharpe Ratio but better performance.

Fees and Expenses: High fees can significantly impact your returns over time. Every fund has an expense ratio, which you can use to compare to its peers. The higher the expense ratio, the more likely fees will erode your returns over a long period of time.

Fund manager reputation: With 1194 registered and licensed fund management companies in Singapore, and 144 of them newly registered in 2022, the reputation of fund managers plays a crucial role in the selection process. Thorough research into the management company's reputation is essential.

Holdings and Diversification: Fund managers provide factsheets that give investors a quick insight into a unit trust strategy as well as some of the holdings and geographical distribution of its overall holdings. Some even provide a breakdown of the overall type of companies they invest in, splitting them into categories such as IT, infrastructure, healthcare, financials etc. Assess the fund's exposure and ensure it aligns with your investment strategy and comfort level.

Conclusion

While it is daunting to choose from the vast array of funds available, applying a thoughtful approach that considers your life stage, risk appetite, and investment goals can help you identify the funds that align with your financial goals. Remember, selecting the right unit trust involves more than just examining past performance or fund ratings. It requires a deep dive into the fund's management style, fee structure, and the diversity of its holdings to ensure it complements your investment strategy.

As you explore the vast world of unit trusts, let your financial objectives and a well-researched strategy guide your decisions. Utilise tools like our fund finder to sift through the options and make informed choices. By approaching your investment with knowledge and strategic foresight, you'll be well-equipped to select unit trusts that not only meet your financial goals but also contribute to a stable and prosperous investment journey. Introduction to unit trust

In the diverse and complex world of investing , unit trusts stand out as a popular choice among investors, accounting for a significant share of the total investment capital. They offer a unique blend of diversification, professional management and accessibility.

What are unit trusts?

At their core, unit trusts are a form of investment where professional fund managers pool investors' monies together to invest in a diversified portfolio of assets. A typical unit trust consists of a variety of bonds, stocks, and other types of securities.

Key terms associated with unit trusts:

- Net Asset Value (NAV): Fund managers aggregate the value of all the different types of assets they have invested in and generate a Net Asset Value, or NAV, which signifies the value per unit of the fund. This provides investors with a convenient way to understand how their fund's underlying assets fare.

- Dividends: Many unit trusts distribute earnings to investors in the form of dividends, which can be a source of regular income. These distributions vary in frequency, from monthly to bi-annually and are calculated on a per-unit basis, contributing to the fund's appeal as a passive income generator.

- Investment strategy: Unit trusts employ various investment strategies to meet different investor goals and risk profiles. These strategies can range from fixed income and mixed assets to pure equity, with some funds also focusing on specific themes, such as environmental, social, and governance (ESG) criteria or technology advancements. Each strategy offers a unique approach to asset allocation and risk management, tailored to specific investment objectives.

Types of unit trusts and their investment focus

| Equity Funds |

Invest primarily in stocks |

| Bond Funds |

Focus on investments in government or corporate bonds |

| Balanced Funds |

Combine stocks and bonds for a balanced approach |

| Index Funds |

Aim to replicate the performance of a specific market index |

| Specialised Funds |

Invest in specific sectors, regions, or themes |

Advantages of investing in unit trusts

There are several advantages of investing in unit trusts, including the following:

- Diversification

A key benefit of investing in a unit trust is the ease of investors’ diversification of investment holdings without having to invest in each asset individually. This diversity ensures that the impact of poor performance in any single investment is minimised, as it's offset by better performance in others within the fund.

- Professional management

One of the key advantages of unit trusts is the expertise brought by professional fund managers, who dedicate their time researching and strategising the optimum way to generate returns for investors. The success of a unit trust heavily relies on the acumen and performance of its management team. As such, the most effective strategies and superior performance metrics naturally draw a greater number of investors. This dynamic creates a strong incentive for fund managers to continuously innovate and excel in their investment approaches, ensuring their funds remain attractive and competitive in the bustling investment landscape.

- Accessibility

A significant advantage of unit trusts is their accessibility, primarily due to the low initial investment requirement. This affordability opens the door to diversified investment portfolios at a minimal cost, enabling investors to partake in a range of financial markets that might otherwise be challenging to access directly. The reduced financial barrier also empowers investors to adopt a consistent investment approach, contributing regular amounts to a fund and thereby leveraging the Dollarost Averaging (DCA) principle.

- Dollar-cost Averaging (DCA)

Dollar-cost Averaging reduces price risk when investors buy stocks, ETFs, and unit trusts. Rather than buying only at one price, it involves investing at regular intervals, regardless of the price. This approach is useful for those who do not have the time or expertise to time the market to invest at a low price.

- Liquidity

Most unit trusts come with daily dealing pricing, which means that investors typically do not have to worry about being unable to sell their funds. Buying and selling can easily be done on most platforms that offer unit trust as an investment option.

Understanding fees and charges when investing in unit trusts

Investing in unit trusts involves various fees and charges, essential for investors to understand before making an investment. These costs are typically outlined in the product highlight sheet for each fund. Here’s a breakdown of the common fees associated with unit trust investments:

| Management fees |

The management fee covers the cost of operating the fund and the fund managers’ expertise in managing it. It covers the strategic allocation of assets, ongoing analysis, and decision-making processes that contribute to the fund’s performance. |

| Sales charges |

Sales charges are paid to the distributor (e.g., the platform on which you invest in the fund). These can be up to 5% of your investment amount.

Enjoy 0% sales charge when you trade unit trusts on POEMS. |

| Performance fee |

A performance fee is paid to the investment manager for generating returns above the benchmark. |

| Platform fee |

This fee is charged by the trading platform and can range from 0% - 3% of your holdings.

Enjoy 0% platform fee on POEMS. |

Understanding the risks involved in unit trusts

Investing in unit trusts, like all investment vehicles, comes with its set of risks that could lead to fluctuations in the value of your investments. Below are some of the risks that investors might face:

| Market risk |

Economic downturns, political instability, or global events like pandemics are all examples of events that could lead to potential investment losses. |

| Currency risk |

Fund managers invest across geographies and currencies. Hence, the weakening of an underlying currency relative to the investor’s currency can reduce the value of the investment when converted back. |

| Interest rate risk |

When interest rates rise, the value of bonds typically drops, and the opposite applies when interest rates drop. These can affect the NAV of fund s exposed to bond and fixed-income instruments. |

| Managerial risk |

While fund managers strive to achieve the best possible performance, poor investment choices or strategies still occur. Researching the underlying fund manager’s track record and investment philosophy is important for investors to feel more at ease with parking their funds with a fund manager. |

Conclusion

Unit trusts are a convenient and diversified way for investors to gain access to financial markets. They provide an avenue for individuals to partake in a broad range of investments backed by the expertise of professional fund managers. However, as with any investment, due diligence, a clear understanding of one's financial goals, and an awareness of the associated costs and risks are paramount. For those looking to navigate the investment landscape, unit trusts offer a compelling starting point or addition to a well-rounded investment portfolio.

Trade unit trusts on POEMS! Open an account here: https://www.poems.com.sg/open-an-account/Where did the dragon go? A summary on the China market in 2023.

China's economy in 2023 showed resilience in the face of multiple challenges. GDP growth remained above 5%, driven by domestic consumption and government efforts to stabilize key sectors like property and manufacturing. However, the growth was slower than the historic highs China had previously experienced, likely contributing to the underperformance of the stock market. Several factors contributed to this moderated growth. Read more in the infographic below.

Sign up for the China & Asia: Market Outlook for Q1 2024 event here: http://tinyurl.com/2cast5d7

Phillip Capital Management – Outlook 2021, CIO, Jeffrey Lee

Jeffery Lee, CIO of Phillip Capital Management Outlook for 2021. In it he has 3 Salient points:

• Bright Outlook Ahead

• Opportunities Amidst Crisis

• Identifying superior growth

To find out more, please read the

full article.

Phillip Capital Management – 1H2020 Review of Phillip Singapore Real Estate Income Fund [INSIGHTS RELEASE]

Phillip Capital Management (S) Ltd recently published an article titled “1H2020 Review of Phillip Singapore Real Estate Income Fund”.

In the article, we shared our insights on the actively managed Phillip Singapore Real Estate Income Fund that invests primarily in S-REITs, based on its performance in 1H2020 and further discussed about how the Fund is adjusting to the changes in the operating environment for S-REITs in light of the Covid-19 situation.

To find out more, please read the

full article.

As societies grapple with escalating obesity rates and their associated health risks, the demand for effective weight management solutions has never been more urgent. Amid this backdrop, a revolutionary advancement is reshaping the landscape: a new class of weight loss drugs developed by pharmaceutical giants. These drugs, which double as treatments for both diabetes and obesity, are not just breakthroughs in medical science—they represent a beacon of hope for millions. Beyond the significant health implications, these innovations open substantial investment opportunities.

This article delves into the pioneering approaches spearheaded by Novo Nordisk and Eli Lilly, exploring how they could herald a new era in managing and potentially reversing obesity trends, while also offering lucrative prospects for savvy investors to capitalise on the expanding market. These drugs, used to treat both diabetes and obesity, include:

As societies grapple with escalating obesity rates and their associated health risks, the demand for effective weight management solutions has never been more urgent. Amid this backdrop, a revolutionary advancement is reshaping the landscape: a new class of weight loss drugs developed by pharmaceutical giants. These drugs, which double as treatments for both diabetes and obesity, are not just breakthroughs in medical science—they represent a beacon of hope for millions. Beyond the significant health implications, these innovations open substantial investment opportunities.

This article delves into the pioneering approaches spearheaded by Novo Nordisk and Eli Lilly, exploring how they could herald a new era in managing and potentially reversing obesity trends, while also offering lucrative prospects for savvy investors to capitalise on the expanding market. These drugs, used to treat both diabetes and obesity, include:

Both Ozempic and Wegovy are developed by Novo Nordisk, a Danish multinational pharmaceutical company. The success of both drugs had a dramatic impact on the business fortunes as well as the stock market performance of Novo Nordisk. At time of writing, Novo Nordisk stock price has risen over 150% over the last 2 years.

Zepbound and Mounjaro by Eli Lilly have boosted their financials, with the American pharmaceutical company seeing a 26% increase in revenue in Q1 2024. Lilly's chair and CEO attributed the year-over-year revenue growth to strong sales of the two drugs. Similar to Novo Nordisk, Eli Lilly’s stock price has risen more than 200% over the last 2 years.

Beyond investing solely in the companies’ stocks, less volatile instruments like unit trusts offer decent exposure to the pharma firms.

AllianceBernstein’s AB SICAV I - International Health Care Portfolio fund has an exposure of 8.59% and 8.30% to Eli Lilly and Novo Nordisk respectively, with an annualised 7.79% per annum since inception for the A USD class at time of writing.

The BlackRock World Healthscience Fund, a strong contender, has an exposure of 7.41% and 7.16% to Eli Lilly and Novo Nordisk respectively. The performance of the fund since inception in 2001 has also been a respectable annualised 8.50% per annum for the A2 Singapore Hedged Class.

Both Ozempic and Wegovy are developed by Novo Nordisk, a Danish multinational pharmaceutical company. The success of both drugs had a dramatic impact on the business fortunes as well as the stock market performance of Novo Nordisk. At time of writing, Novo Nordisk stock price has risen over 150% over the last 2 years.

Zepbound and Mounjaro by Eli Lilly have boosted their financials, with the American pharmaceutical company seeing a 26% increase in revenue in Q1 2024. Lilly's chair and CEO attributed the year-over-year revenue growth to strong sales of the two drugs. Similar to Novo Nordisk, Eli Lilly’s stock price has risen more than 200% over the last 2 years.

Beyond investing solely in the companies’ stocks, less volatile instruments like unit trusts offer decent exposure to the pharma firms.

AllianceBernstein’s AB SICAV I - International Health Care Portfolio fund has an exposure of 8.59% and 8.30% to Eli Lilly and Novo Nordisk respectively, with an annualised 7.79% per annum since inception for the A USD class at time of writing.

The BlackRock World Healthscience Fund, a strong contender, has an exposure of 7.41% and 7.16% to Eli Lilly and Novo Nordisk respectively. The performance of the fund since inception in 2001 has also been a respectable annualised 8.50% per annum for the A2 Singapore Hedged Class.

Whether you should adopt a more active or passive approach depends on what you’re investing in and your knowledge about the markets. For example, given their smoother flow of capital, developed markets might be well-served by passively managed options. On the other hand, active management could give your portfolio an edge in emerging markets where efficiently picking stocks may have a more significant impact.

Whether you should adopt a more active or passive approach depends on what you’re investing in and your knowledge about the markets. For example, given their smoother flow of capital, developed markets might be well-served by passively managed options. On the other hand, active management could give your portfolio an edge in emerging markets where efficiently picking stocks may have a more significant impact.

Winshern Ho

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/TTPWinshernHo

Winshern Ho

Wealth Manager

Phillip Securities Pte Ltd (A member of PhillipCapital)

https://bit.ly/TTPWinshernHo Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from 'AAA' to 'BBB-' (S&P and Fitch) or 'Baa3' (Moody's) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

Credit Rating: Credit ratings for a fixed income unit trust is an indicator of the credit worthiness of the overall portfolio of securities within the fund. Ratings or individual fixed income securities are assigned by independent rating agencies such as Moody’s, Standards & Poor’s and Fitch Ratings. Ratings from 'AAA' to 'BBB-' (S&P and Fitch) or 'Baa3' (Moody's) denote securities considered to have a lower risk of default and thus are considered investment grade. Ratings lower than what was stated earlier denote that the security is non-investment grade. The fund manager will then issue an average rating for the overall portfolio.

Duration: Duration for fixed income unit trust is the estimation of how much the price of a bond or a portfolio of bonds is likely to fluctuate in response to an interest rate change. It is expressed as a function of years. The longer the duration, the more likely the price of the unit trust will change when interest rates change.

When you are working, you'll find yourself in one of these three categories:

When you are working, you'll find yourself in one of these three categories:

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund's underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

The diagram above outlines the various types of funds along with their associated risk levels. This provides a clearer picture of the level of risk involved for each type of fund, allowing you to make informed investment decisions aligned with your risk appetite. However, look into each fund's underlying holdings to get a better sense of what you’re investing in.

An effective strategy to manage risk would be to construct a portfolio of different funds with an overall risk rating that you would be comfortable with in the long run. This topic will be explored in greater detail in an upcoming article.

Investing in unit trusts, like all investment vehicles, comes with its set of risks that could lead to fluctuations in the value of your investments. Below are some of the risks that investors might face:

Investing in unit trusts, like all investment vehicles, comes with its set of risks that could lead to fluctuations in the value of your investments. Below are some of the risks that investors might face: