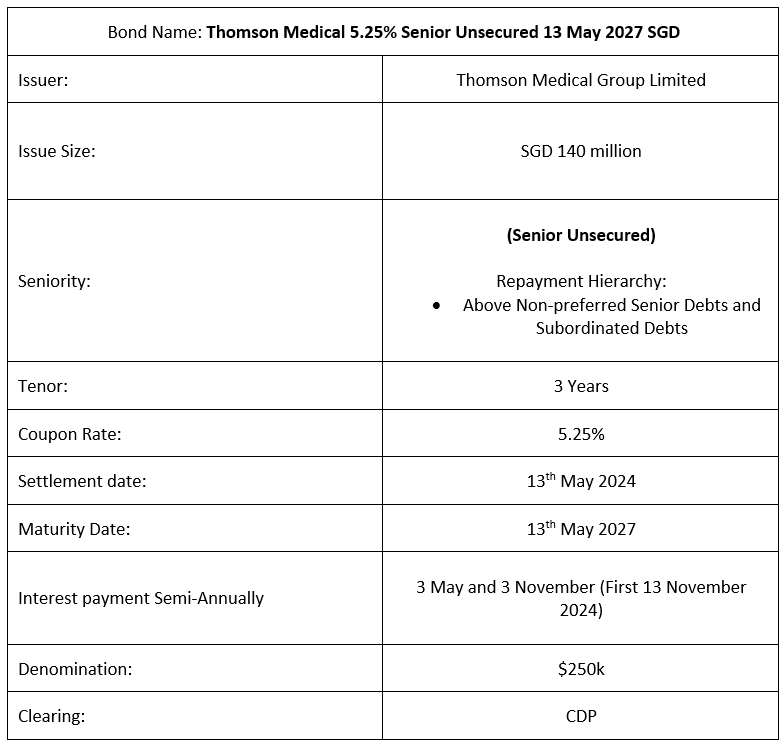

Thomson Medical recently announced the issuance of its Senior Unsecured notes at final price guidance of 5.25% with a 3-year maturity period. These bonds come with a semi-annual coupon payment scheduled on the 13th of May and the 13th of November each year, with the first coupon payment commencing on the 13th of November, 2024. This new issuance is non-rated and falls under its SGD 1 billion Multicurrency Debt Issuance Programme. After the deduction of expenses used for the issuance, the proceeds from this issuance will be used to refinance existing borrowings (including partial repayment of the acquisition loan for the Group’s acquisition of Far East Medical Vietnam Limited) and general working capital of the Group.

Company Overview

Thomson Medical Group (TMG) is a regional healthcare group specializing in healthcare services for women and children in Singapore. The group also operates 737 licensed beds across Singapore, Malaysia, and Vietnam (newly acquired – FV hospital). Thomson Medical Group is listed on the mainboard of the Singapore Exchange (SGX:A50), and as of 6th May 2024, TMG has a total market cap of $1.348bn.

1H2024 Results

TMG reflected a lower revenue (-8.6% YoY) in 1H2024 from $184m to $168.1m attributable to the rolling off from the one-off government COVID-related project (vaccination centres and transitional care facilities) in Singapore previously. TMG’s adjusted EBITDA has also fallen by (-20.3% YoY from $55.5m to $44.2m) as operating expenses came in higher due to one-time transaction costs and FX losses incurred concerning the acquisition in Vietnam. However, despite the decrease in revenue. If we were to look at the proforma statements, we would take into consideration the income from its newly acquired Vietnam hospital and the recent increase in bed count for its KL hospital from 205 to 300. TMG’s revenue improved by +21.2% YoY while Adjusted EBITDA only slid slightly by -0.4% YoY).

In terms of its credit view, investors may be a little apprehensive as the group’s Proforma Net Debt to EBITDA remains on the higher end at 7.5 times. Still, its management has mentioned that its debt ratio is currently elevated due to the borrowings for its business expansion, but this will be lowered moving forward. The net gearing ratio was also slightly bumped up from 107% in 1H2023 to 148% in 1H2024, attributable to the recent debt pick-up for the acquisition.

Looking Ahead

TMG is targeting to increase its bed count in Thomson Hospital Kota Damansara (Kuala Lumpur) from the current 350 to 400 by the end of 2024 and 500 in 2025, catering to higher patient volumes. Additionally, the current renovation on the ground floor of Singapore’s Thomson Hospital (slated to be completed at the end of April), once completed, should minimize the disruption to the business. The group also plans to add a new wing to their FV hospital in Vietnam to raise its floorspace and offer a wider service range (such as IVF services) within Malaysia and Vietnam to further boost medical tourism.

Thomson Medical 5NC1 5.5%

This bond was previously issued to fund the Vietnamese acquisition. It included a 1-year non-callable period with the understanding that management would redeem it if the deal fell through. Since the acquisition was successful, the bond will not be called early and will function as a standard 5-year bond.

Bond Overview