- Astrea 7 is the latest issuance under the Astrea bond series.

- The bonds are secured by cashflows from private-equity funds. Credit rating for the Class A-1, A-2 and B bonds are to be investment grade.

- 50% of the Class B bonds (USD) or US$100mn are made available to retail investors for subscription via ATM.

- Retail investors for Class B bonds should note the bonds are denominated in USD and it is expose to foreign currency risks.

Background

Astrea 7 is the seventh issuance in the Astrea product line and offers three classes of investment grade bonds which amount to US$755mn. It is issued by Astrea 7 Pte. Ltd., a subsidiary of Astrea Capital 7 Pte. Ltd. (Sponsor). Astrea Capital is an indirect wholly-owned subsidiary of Azalea Management Pte. Ltd., which is indirectly wholly-owned by Temasek Holdings. These bonds are asset-backed securities that will be supported by the cashflows from a US$1.9bn portfolio invested across 38 private-equity funds. The Astrea 7 portfolio comprises buyout funds (77.1%) and growth equity funds (22.9%).

Highlights

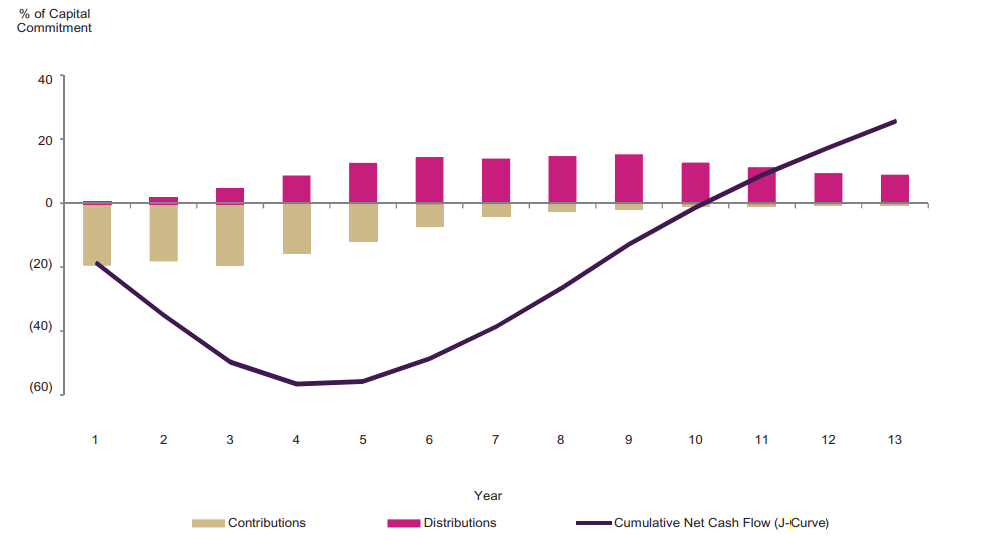

- Risk management: The Astrea 7 PE portfolio has a weighted average age of approximately 5.3 years and is diversified across a total of 38 funds with 982 underlying investee companies managed by 29 GPs. The portfolio is considered to be mature and cash-generative as PE funds typically turn cashflow positive after 5 years due to divestments outpacing capital calls in the later years of a fund’s life. (Figure 1)

Figure 1: The Private Equity J-Curve

Source: Astrea

As mentioned above, 77.1% of the fund’s NAV is made up of buyout funds with the remaining 22.9% made up of growth equity funds. Historically, the buyout strategy has displayed more robust performance compared to other PE strategies which is illustrated in (Figure 2). The strategy provides fund managers with greater control over investee companies, allowing managers to make operational improvements and remain responsive to the global macroeconomic environment. Some reputable fund managers in this portfolio include Warburg Pincus (8.5% of NAV), KKR (6.6% of NAV) and Permira (6.5% of NAV). The portfolio is also highly diversifed, as with the largest investee company making up only 1.5% of the total portfolio’s NAV out of 982 companies. The bonds are also expected to obtain investment-grade ratings by Fitch and S&P.

- Structural Safeguards: Astrea 7 possesses multiple safeguards for their investors, similar to Astrea VI. In addition to the mandated reserve accounts for both Class A bonds seen in the previous years, there is also an additional mandated reserve account for Class B as Class B bonds are now offered to retail investors. These reserves are set in place to ensure that cash flows from the funds are being held for the redemption of the bonds at their scheduled call dates. A maximum LTV ratio of 50% will be maintained for the fund so long as any bonds remain outstanding. If exceeded, cash generated from the funds will be diverted into the reserve accounts until the reserve accounts cap has been met (in the order of Class A reserves then Class B reserves). Lastly, DBS Bank will be providing a credit facility in the event of cash shortfalls which can be used to cover the bond interest payments, certain expenses and fees (e.g management fee and interest expense) and capital calls.

- Overcollateralization and alignment of interest: The funding structure of this portfolio is overcollateralized with an LTV ratio of 39.6%. In other words, the portfolio value is more than double the amount of the debt issued. In terms of repayment for the bondholders, Astrea 7 follows a priority of payment feature (Figure 3) where bondholders are ranked above the sponsor. The sponsor also holds all of the equity in the fund, providing a strong alignment of interest with its bondholders.With the significant demand seen for previous Astrea bonds, given Astrea VI’s aggregate offering was more than 6x subscribed, Astrea V at 6x and Astrea IV at more than 5x, similar or higher levels of participation is expected as retail investors can now invest into the Astrea 7 Class B bonds.