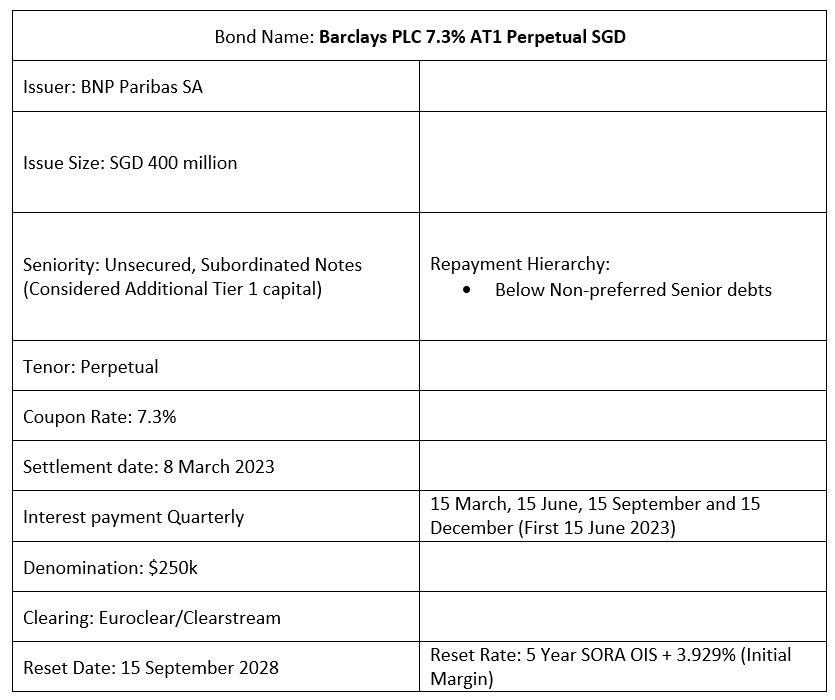

Barclays PLC recently announced the issuance of its additional tier 1 perpetual notes at a final price guidance of 7.3%. The bonds will be callable on 15 June 2028 and every 5th anniversary date thereafter. In the event the notes are not recalled by 15 September 2028, the bonds will then be reset at the prevailing Mid-Market Swap Rate (5-year SORA-OIS) plus the initial margin of 3.929%. Coupon payments for these bonds are paid out quarterly and are scheduled on every (15 March), (15 June), (15 September) and (15 December) each year, with the first coupon payment commencing on 15 June 2023.

As these bonds constitute as additional tier 1 capital for the bank, do note that these bonds come with a capital adequacy trigger. If Barclays’ CET 1 ratio falls below 7%, an automatic conversion of the securities will occur on the conversion date at a price of SGD 2.66.The expected rating for this issuance is Ba2/BBB- (Moody’s/Fitch).

Company Overview

Barclays is one of the major banks in the UK with total asset amounting to approx. £1.51 trillion as recorded in FY2022. Barclays mainly operates in two divisions namely Barclays UK (provides consumer banking services), Barclays International (provides corporate and investment banking services coupled with consumer cards and payment businesses) and they are supported by their service company Barclays Execution Services. The bank is headquartered in London, England and is primarily listed on the London Stock Exchange (ticker: BARC). It also has a secondary listing on the New York Stock Exchange (ticker: BCS) and is a constituent of the FSTE 100 Index. The Bank has a credit rating of BBB/A/Baa2 (S&P/Fitch/Moody’s).

FY2022 Financials

In FY2022, Barclays reported an improvement in its total income by 13.7% YoY from £21.9bn in the prior year to £24.9bn in FY2022. This was supported by income momentum across its operating divisions. Within its Barclays International division, its Corporate and Investment Bank (CIB) income increased by 8% YoY as improved margins, growth in deposits and fees have uplifted the performance in Transaction banking by approx. +52% YoY. Increase income from both its Global Markets and Fixed Income, Commodity and Currency (FICC) market have also played a positive role in the contribution of income. However, the group’s total operating expenses increased by 14.1% YoY from £14.6bn previously to £17.7bn in FY2022. This increase was mainly due to higher litigation and conduct charges. Net Interest Income (NII) has improved by 27.7% YoY while Net Interest Margin (NIM) has also improved by 61bps from the previous year. This was primarily driven by rising interest environment in the UK. Last not least, in FY2022 Barclays also reported its leverage ratio to be at 5.3%, Liquidity Coverage Ratio at 165% and CET 1 ratio to be 13.9% which is a decrease of 1.2% YoY. This was due to the increase in Risk Weighted Assets (RWA) and a decrease in CET 1 capital. However, despite a reduction in CET 1 ratio, it is still within the bank’s target of 13-14%.

As the initial offering has closed for subscription, investors who are interested in these notes will have to head onto the bond’s secondary market in our POEMS platform to get hold of them. These notes can be transacted in a minimum lot size of SGD$250K.

Bond Overview