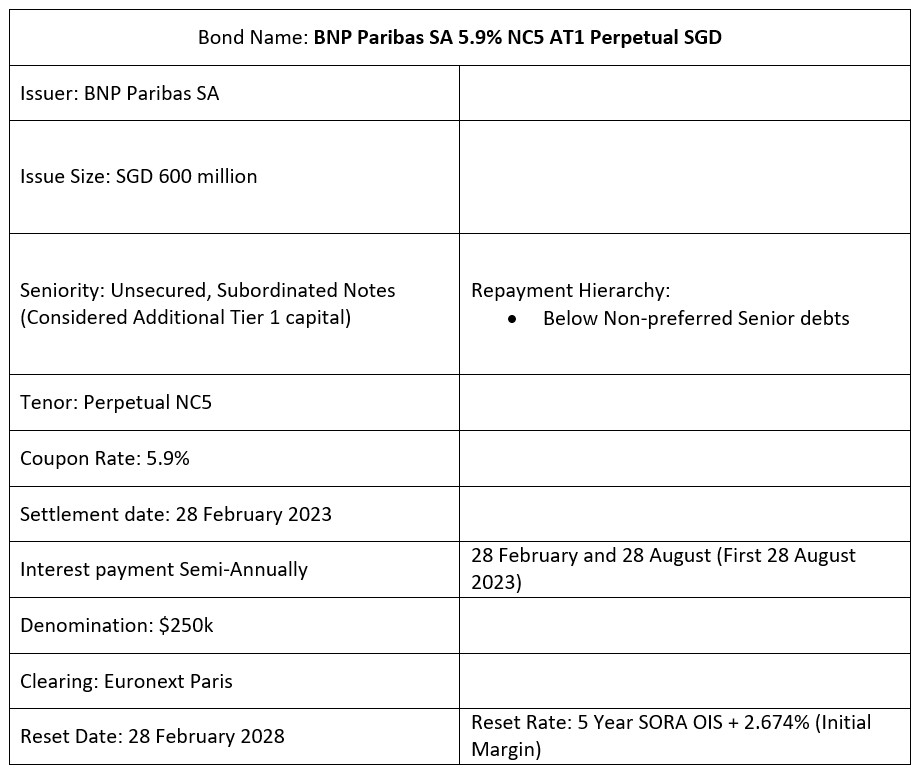

BNP Paribas SA recently announced the issuance of its non-call 5 years perpetual bonds at a final price guidance of 5.9%. The bonds will be treated as additional tier 1 capital for the issuer and will be callable from 28 February 2028. If the notes are not recalled then, the perpetual will then be reset at the prevailing 5-year SORA-OIS plus the initial margin of 2.674%. Coupon payments for these bonds are paid out semi-annually and are scheduled on every (28 February) and (28 August) each year, with the first coupon payment being disbursed on 28 August 2023.

However, do note that these bonds come with a write-down trigger where in the event if BNP Paribas SA’s CET1 ratio falls below 5.125%, the prevailing outstanding amount of the notes will be written down. Some or all of the principal amount of the notes may, at the issuer’s discretion, be reinstated, up to the original principal amount, if a positive group net income is recorded, subject to compliance with the Relevant Rules (including the Maximum Distributable Amount). The expected rating for this issuance is BBB-/BBB (S&P/Fitch).

Company Overview

BNP Paribas SA is a French international banking group and features in the list of largest banks in Europe published by S&P Global Market Intelligence as of April 2022, with total assets amounting to €2.55 trillion. It is headquartered in Paris. The bank comprises 3 main operating divisions which are Corporate & Institutional Banking (CIB); Commercial, Personal Banking & Services (CPBS); and the Investment & Protection Service (IPS). BNP Paribas SA has a long term debt credit rating of A+/AA-/Aa3 by (S&P/Fitch/Moody’s).

FY2022 Financials

For the full year 2022, BNP Paribas recorded a 9% YoY rise in revenue from €46.2bn in FY2021 to €50.4bn in FY2022. The growth was support by revenue growth in all of its divisions with Corporate and Institutional Banking growing by 15.7%; Commercial, Personal Banking & Services by 9.3%; and Investment & Protection Services by 3%. Corporate and Institutional Banking were driven by good performance in its global markets and securities services. The Investment & Protection Services increase was due to its increase in its Private Banking. Both core sectors managed to grow despite unfavourable market conditions. The Commercial, Personal Banking & Services growth was due to its increase in net interest income and its fees.

As for BNP’s CET 1 ratio, it improved from 12% in the previous year to 12.3% in FY2022. BNP is also expecting an improvement in its CET 1 ratio by approximately 170bps after the closing of the Bank of the West sales in February 2023, and an increase in its leverage ratio of approximately 40bps. Currently, BNP’s leverage ratio is at 4.4% while having a liquidity coverage ratio of 129%.

As the initial offering has closed for subscription, investors who are interested in these notes will have to head onto the bond’s secondary market in our POEMS platform to get hold of them. These notes can be transacted in a minimum lot size of SGD$250K.

Bond Overview