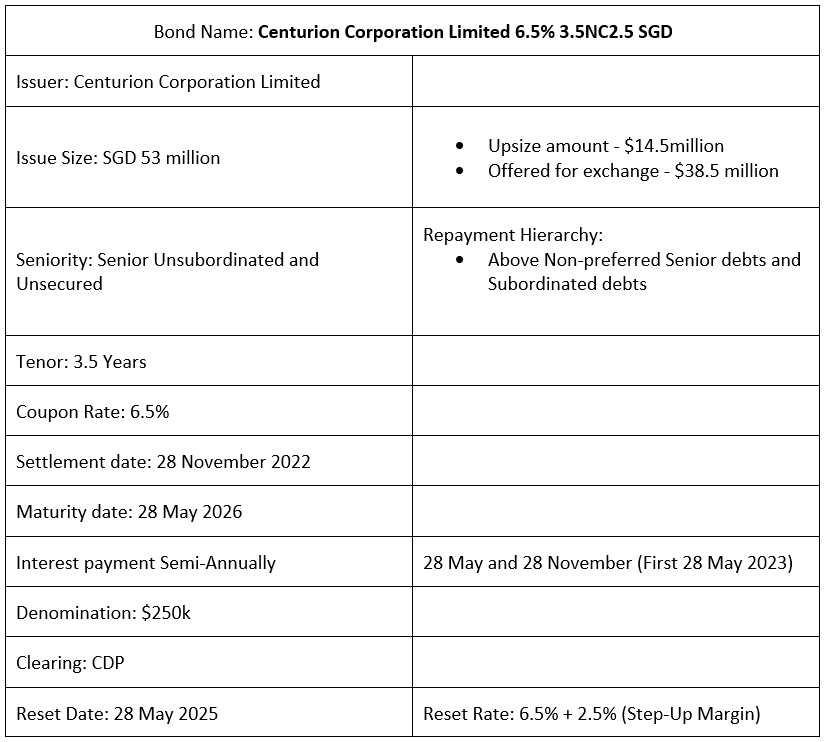

Centurion Corporation Limited recently just announced the issuance of its 3.5NC2.5 unsecured bonds at a final price guidance of 6.5%. This is Series 006 of their SGD750 million multicurrency debt issuance programme. The net proceeds arising from this issuance will be first used by the issuers towards the redeeming of the outstanding Series 005 Notes and any excess thereafter will be used to pay the interest payment for Series 005 falling on 12 April 2023. The bonds can be redeemed only after 2.5 years and carry a maturity date of 3.5 years at 28 May 2026. If the bonds are not called on 28 May 2025 (2.5 years), these bonds will be reset at the final price guidance + a step up margin of 2.5%. These bonds also come with a semi-annual coupon payment scheduled on every 28 May and 28 November each year, with the first coupon payment being paid out on 28 May 2023.

Company Background

Centurion Corporation Limited is one of Singapore’s largest specialised accommodation owner-operators, with assets in workers and student accommodation across six countries globally (Singapore, Malaysia, United Kingdom, United States, Australia and South Korea). Centurion Corporation is headquartered in Singapore and listed on both the Singapore Exchange (ticker: OU8) and the main board of the Hong Kong Stock Exchange (ticker: 6090). As of 3Q2022, Centurion Corporation has Assets Under Management (AUM) of $1.9billion.

Financial

In its 3Q2022 business update, not much financial data was provided but Centurion’s revenue increased by 26% YoY (from $35.3million in 3Q2021 to $44.3million in 3Q2022). This increase was due to a higher contribution from improved performance in Singapore’s Purpose-Built Workers Accommodation (PBWA) assets as Singapore’s borders reopened. This in turn increased the arrivals of dormitory-bound work permit (WP) holders from the Construction, Marine Shipyard and Process sectors, which have recovered to pre-Covid numbers (approx. 369,000 in June 2022 vs approx. 370,000 in December 2019). Its UK and Australia Purpose-Built Student Accommodation (PBSA) portfolio has also benefitted as international students returned. The average financial occupancy (percentage of the total gross leasable area which the tenant is obligated to pay rent for) for its UK sector has recovered from 68% for 9M2021 to 90% for 9M2022, while the student accommodation in Australia has also rebounded from 26% for 9M2021 to 68% for 9M2022.

For the credit aspect, Centurion acquires its operating assets and assets under development primarily from bank borrowing with regular principal repayments. Therefore, the net gearing ratio for Centurion stood at 45% in 3Q2022, improving slightly from 46% in 1H2022 and the company’s average debt maturity is 6 years. Centurion has a total borrowing of approx. $700million, but in 1H2022 net current liabilities contributed to $50.6million. As at 3Q2022, the firm had approx. $181million cash and undrawn committed facilities to meet this current obligation.

Overall, with travel gradually recovering, Centurion’s accommodation will experience a rebound moving forward through the return of migrant workers and international students, driving further demand. The firm is also actively looking for opportunities to expand its portfolio as well as asset enhancement to tap into key purpose-built student accommodation markets, which will then provide more income visibility and stability for the company. Investors with a slightly larger risk appetite and who are looking for a shorter duration bond may consider adding this into their bond portfolio mix as investors may look at it as a bond that is paying a 6.5% for 2.5 years, and if the notes are not redeemed by 2.5 years, there will be a step up of an additional 2.5% which takes the coupon rate up to 8%. Since the initially offering has closed for subscription, investors who are interested in these notes will have to head onto the bond’s secondary market in our POEMS platform to get hold of them from sellers. These notes can be transacted in a minimum lot size of $250K.