Changi Airport Group (Singapore) Private Limited (CAG) is the owner and operator of Changi Airport and Seletar Airport in Singapore. The group also operates and is a 51% owner of Tom Jobim International Airport in Rio de Janeiro through its wholly-owned subsidiary Changi Airports International Private Limited. In addition, CAG holds a 51% stake in Jewel Changi Airport. The group is wholly-owned by the Minister for Finance.

CAG’s revenue consists of regulated and non-regulated revenues. In FY19/20, 50% of the group’s revenue was from regulated revenue; mainly fees for use of runways, taxiways, aprons and terminal facilities. The remaining non-regulated revenues are largely generated from the leasing of retail space under concession arrangements, the rental of office and warehouse space, and car parking facilities. Changi Airport was contributed approximately 85% of the group’s total revenue in FY19/20.

Credit metrics as at 31 March 2021:

- Debt to asset: 0.18x

- EBITDA interest coverage for FY19/20: 5.5x

- Rating: AAA by Moody’s

Commentary

Liquidity to last till full recovery. CAG stands along side other major airlines with the view of 3-5 years to full recovery in the aviation industry. CAG has S$1.9bn in cash and S$2bn in credit facilities for the next 4 years. Cash burn is expected to be S$600-800mn a year. As such, liquidity looks ample to last for the next 2-3 years. Expansion projects including the third runway, Terminal 2 expansion, as well as the Changi East Project (Terminal 5), which was delayed until June 2022, will be supported by the Singapore government.

Passenger traffic mainly a health issue. Passenger numbers are low mainly due to border closures. CAG is still seeing healthy cargo volumes, which reflect healthy underlying fundamentals of the economy. Historically, cargo volumes are a good predictor of passenger numbers. CAG sees passenger demand still evident.

Reopening in the works. Singapore’s COVID-19 situation is faring well in global terms. Once vaccination levels reach herd immunity, wider reopening to international travel can be expected to countries with similar low infection rates. As of now, Singapore’s minister of transport has submitted travel bubble applications for Taiwan, Australia, New Zealand, Brunei and China. In addition, regulators are considering waiving quarantine measures for inbound passengers who are vaccinated. Testing procedures are also being enhanced, with possible use of breath analysers. Breath analysers have a 95% accuracy and cost 10% price of a PCR test. Results can be obtained in 2 minuted instead of 6hrs for the PCR test, and users need only breathe into it for 10 seconds.

Heavy institutional holdings on CAG’s bond. The new CAG bond’s order book was over S$1.4bn compared to the issue size of S$500mn. Bulk of the investors were from institutions at 61% of the order book, while 36% came from the public sector and banks, and the remaining 3% from private banking and retail. We view this order book composition as credit positive, comprising of more real money holders, offering better price stability.

Bond valuation

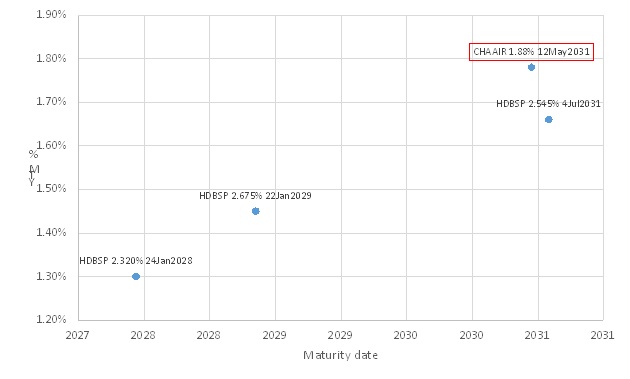

Changi Airport Group recently issued their first bond, a 10-year senior unsecured bond with a 1.88% coupon rate and maturity date on 12 May 2031. The bond, CHAAIR 1.88% 12May2031 Corp (SGD), trades at a yield to maturity of 1.78% with an ask price of 100.95. A comparable issuer would be the Housing and Development Board (HDB). HDB is a statutory board and quasi-sovereign entity heavily supported by Singapore’s Ministry of Finance. Its issuer rating, as well as its bonds, are given the highest rating of AAA stable by Fitch. Similarly, Changi Airport Group’s issuer rating is the highest at AAA by Moody’s.

We find Changi Airport Group’s bond trading attractively against the HDB curve. As such, we prefer the CHAAIR 1.88% 12May2031 Corp (SGD), which offers a yield pick up of 0.12% to the HDB 2.545% 4Jul2031 Qsov (SGD) paying 1.66%.

Figure 1: Changi Airport Group’s bond trades attractively versus the Housing and Development Board curve.

Source: Bloomberg, POEMS