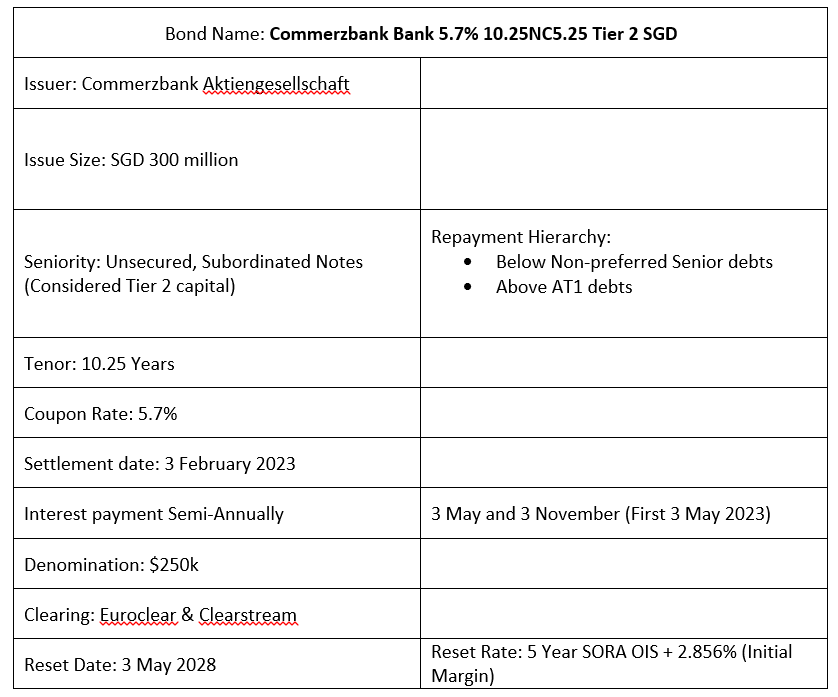

Commerzbank AG recently announced the issuance of its 10.25NC5.25 Tier 2 subordinated notes at 5.7%. These bonds carry a maturity date of 10.25 years at 3 May 2033 and the bank may only call back the bonds after 5.25 years on 3 May 2028. If the bonds are not called back at the callable date, it will then be reset at the prevailing 5-year SORA-OIS plus the initial margin of 2.856%. As these notes constitute a Tier 2 instrument for the bank, in the event of any insolvency, dissolution or liquidation of the issuer, the issuer may write down the obligation of these notes, convert them into equities of the issuer, amend the terms and conditions or cancel the notes. These bonds come with a semi-annual coupon payment scheduled on every (3 May) and (3 November) each year, with the first coupon payment being paid out on 3 May 2023. The expected rating for this issuance is Baa3 (Moody’s).

Company Overview

Commerzbank Aktiengesellschaft (Commerzbank AG) is one of the major banks in Germany and is headquartered in Frankfurt am Main. The bank has international presence, with operations across almost 40 countries and is represented in all major financial centers, such as London, New York, Tokyo and Singapore. However, the focus of the bank’s international activities is on Europe and it is listed on the Frankfurt Stock Exchange (FRA ticker: CBK). The two primary segments for Commerzbank are primarily – Private and Small Business Customers (PSBC) and Corporate Clients (CC). Commerzbank has a credit rating’s A2/BBB+ (Moody’s/S&P).

3Q2022 Financials

In 3Q2022, Commerzbank recorded an increase of approx. 45% Y.o.Y in its operating profit (from €1.042bn in 3Q2021 to €1.571bn in 3Q2022), while net profit improved significantly from €9mn in 3Q2021 to €963mn in 3Q2022. Rising interest rates couple with strong customer business were the main drivers for the increase even though the operating results were weighed down by the mandated credit holiday in Poland (cost for the bank €270mn).

Commerzbank Net Interest Income (NII) also displayed notable growth from €1.211bn to €1.617bn in 3Q2022 (41% YoY) as mBank – a subsidiary of Commerzbank continued to grow along with the increase of the Polish reference rate which currently stands at 6.75%. In terms of its Net Commission Income (NCI), it has fallen 2.5% Y.o.Y from €871mn in 3Q2022 to €849mn in 3Q2022. This was due to a slight weigh down from its Private and Small-Business Customers (PSBC) sector in Germany due to lower market values of securities held by customers. Commerzbank’s CET 1 ratio stood at 13.8% (up from 13.7% Q.o.Q). This gives the bank a buffer of 435bps to its required level of 9.44%.

The bank’s exposure in Russia may be a point of concern for investors. The bank has significantly reduced their net exposure in Russia by 51% since 18 Feb 2022 (Total net exposure from €1.866bn to €913mn in 3Q2022).

To conclude, investors who are open to a European banks bond may consider adding this bond to their bond portfolio mix because these bonds are embedded with a callable feature after 5.25 years. In the presence of a non-call after 3 May 2028, the notes will then be reset at an attractive rate of the prevailing 5 years SORA + 2.856 initial margin. As the initial offering has closed for subscription, investors who are interested in these notes will have to head onto the bond’s secondary market in our POEMS platform to get hold of them. These notes can be transacted in a minimum lot size of S$250K.

Bond Overview