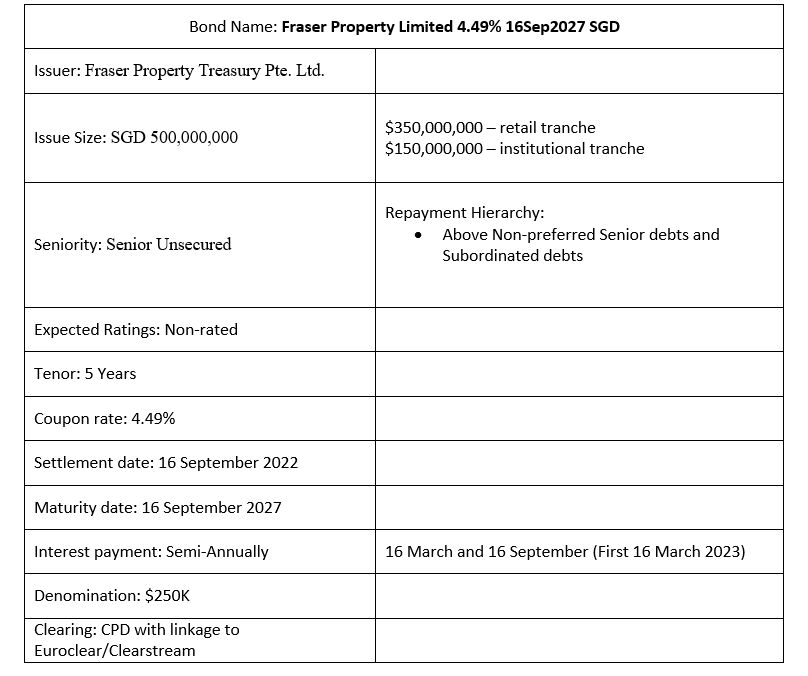

Fraser Property Limited has just announced the issuance of its 5-year Senior Unsecured bonds at a final price guidance of 4.49%. As these are green bonds, the proceeds from this note issuance will be used to finance or refinance, in whole or in part, eligible projects as described in Fraser Property Treasury Pte. Ltd. (FPTPL) Green Finance Framework. These projects are mainly: Green commercial and residential buildings and green building portfolios for its REITs segment. The bonds comes with a 5-year tenor that will mature on the 16 September 2027 and a semi-annual coupon payment scheduled every 16 March and 16 September each year, with the first interest payment being made on 16 March 2023.

Company background

Fraser Property Limited (FPL) is a multinational developer-owner-operator of real-estate products and services across the property value chain. Headquartered in Singapore, it is listed on the Main Board of SGX-ST with a ticker (TQ5). The group has approximately $40.7bn in total assets as at 31 March 2022.

The group operates across five asset classes namely: residential, retail, commercial & business parks, industrial & logistics and hospitality across Southeast Asia, Australia, Europe and China.

Frasers Property’s financial in 1H2022 (ending 31st March 2022)

As there are no financial updates on its 3Q2022 business prospects, we will look at its 1H2022 financial results. In its 1H2022 results, Fraser Property reported revenue of $1.68bn. This is 7.5% higher YoY as compared with $1.56bn in 1H2021. The transfer from properties held for sale to investment properties in the previous period led to a higher contribution from the industrial business due to the recognition of a gain on the change in use of a portfolio of industrial properties. With the exclusion of the impact from the gain from the change in use of the industrial properties transferred, profit before interest and tax (PBIT) increased by 9.9% YoY from $478.9m in 1H2021 to $526.1m in 1H2022. Attributable profit also saw stellar growth of 603.1% YoY from $22.5m in 1H2021 to $158.2m in 1H2022.

In its 3Q2022 business update, Revenue per Average Room (RevPAR) in Europe benefitted from stronger domestic travel in the UK, particularly in the Malmaison Hotel de Vin portfolio, which increased 209.2% YoY from $55.7 to $172.2 with the accelerating pace in reservations across Europe, the Middle East, and Africa (EMEA) region for the summer season. RevPAR in Asia Pacific, excluding North Asia, was also in tandem with a 28.4% increase YoY from $101.1 to $129.8. This was reflected by the positive impact from the lifting of border restrictions and the stronger pick-up in corporate long stays in Singapore as the city transitioned to the endemic mode with the easing of restrictions.

The pipeline for FPL remains robust with a total of 16 developments (Australia 15, Europe 1) covering a total of 476,000 sqm, and with a gross development value (GDV) of $1.3bn. An amount of $2.3bn of unrecognized revenue for its residential projects was also recorded in 3Q2022.

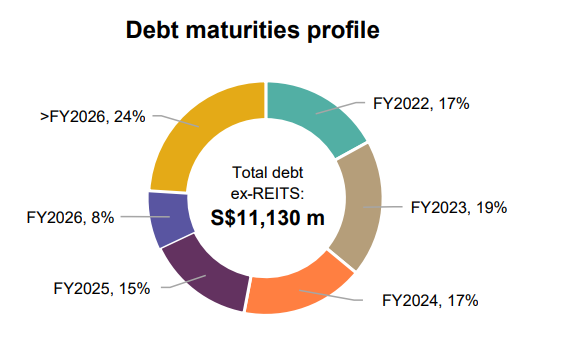

In terms of FPL’s credit outlook, its net gearing ratio has improved by 3.2% from 73.7% in 4Q2021 to 70.5% in 3Q2022. This was partially due to the divestment of FPL’s stake in the Asia Retail Fund (ARF) and Fraser Commercial Trust (FCT); the FPL rights issue; and the divestment of its stake in the Cross Street Exchange. Net interest coverage is at 3 times while its debt maturity profile is also spaced out evenly across the years, indicating that FPL is proactively managing its capital to mitigate situations where it will have to roll over debts if a period is overly concentrated with maturing loans.

Source: FPL

Things to Note:

Fraser Properties Treasury Pte Ltd 3.95% Perpetual (SGD)

- Issue size: $350,000,000

- Coupon payment: Semi Annually

- The issuer has the option to recall the bonds at the end of year 5 and every 5 years thereafter. If the bonds are not redeemed in the 5th year, they will be reset at the prevailing SGD 5Yr SOR + initial spread (2.245% )+ 1% Step Up Margin on 5th October 2027

- On 29th August 2022, the company have announced that it’s wholly-owned subsidiary, the Issuer, to redeem all of the Perpetual Securities on 5 October 2022

Overall, with a healthy cash flow visibility in its development pipeline alongside the improvement in its net gearing ratio, FPL, on the whole, remains resilient and investors may consider investing in its notes.

Bond Overview