- New perpetual bond issues likely as issuers seek to manage gearing levels amidst growing need for funding.

- Perpetual bond structures may be more accommodating to dampen investor adversity to non-call risk. We provide an overview of various perpetual bond structures and how they help mitigate non-calls.

What is non-call risk

As a review, perpetual bonds have no maturity dates, only call dates. This means that issuers are not obligated to redeem the bond at the call date, but may extend the bond beyond the call date at their discretion. Many perpetuals, if not called, will have their coupons reset based on the current interest rate environment, potentially leaving bondholders with a lower coupon rate for a longer time. The risk of issuers not redeeming the bond at call date is defined as ‘non-call risk’.

New perpetual bond issuance still likely

Despite recent events of perpetual bonds increasing investor adversity to their non-call risk, we believe that issuers will still look to issue perpetual bonds as a source of funding. While funding costs will be higher than issuing non-perps, perpetual bonds are still considered a viable source of funding as they are treated as equity on issuer balance sheets and help manage or improve gearing ratios in times of growing need for funding.

Bond structure matters

For issuers to mitigate investor worry about non-call risk, we can expect new perpetual bond issues to have structures that are more accommodating. We will touch on the various structures that perpetual bonds can have that help reduce non-call risk.

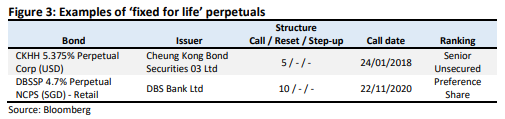

Structure 1: Step-up coupon on first call date

Perpetual bonds with step-up clauses at their first call date help reduce non-call risk by penalizing issuers with a coupon rate increase if they do not call. For example, CELSP 3.9%, in Figure 1, has a 500bps step-up on the first call date of 19 October 2020. If CITIC Envirotech Ltd, the issuer, decides not to redeem the bond at the first call date, the coupon rate will be increased by 5% (in addition to a coupon reset based on the prevailing interest rate environment). The coupon step-up will likely incentivise CITIC to call, or be subjected to higher interest expense, thus helping reducing non-call risk.

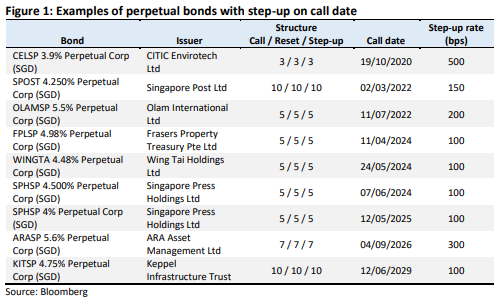

Structure 2: Step-up coupon/Reset date after first call date

This structure is somewhat weaker than step-up on first call date structure because the step-up only kicks in some time after the first call date, thus the issuer incurs no step-up coupon for not redeeming the bond at the earliest call date. For example, the HPLSP 4.65% in Figure 2 has its first call date on 5 May 2022, but step-up coupon of 1% only on 5 May 2027. Thus the step-up does little to reduce non-call risk on the first call date.

Some of these perpetuals have reset dates after the call date as well. This helps to delay a reset to lower coupon rates till some time after the first call date. Should a non-call not reward the issuer with a lower coupon rate, theoretically the less likely there will be a non-call. An example would be the SCISP 3.7% with first call date 22 June 2020 and reset date 22 June 2022. Should the reset date be on the first call date, the bond would likely reset to a lower coupon, a good deal for Sembcorp Industries, but a bad deal for bondholders.

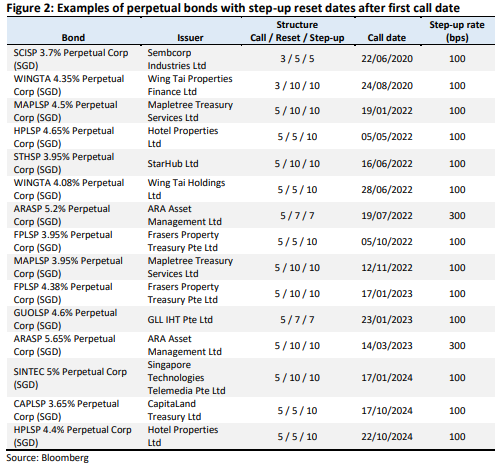

Structure 3: ‘Fixed for life’ perpetuals

This rare structure keeps perpetuals coupon rates fixed without any reset. This is a particularly useful feature in a low or declining interest rate environment, preventing coupon rates from resetting to lower rates. Non-call is then less attractive for issuers in such circumstances. This structure, however, works against bondholders when interest rates are high or rising, preventing coupon rates from resetting higher. ‘Fixed for life’ bonds are usually senior in ranking.