**Do note that application and redemption of SSB can only be done via the banks**

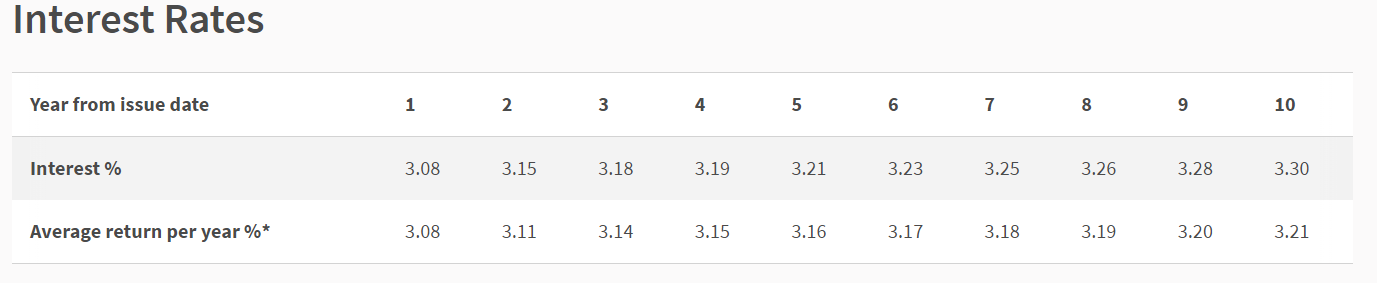

With the ongoing interest rate hikes, recent issued bonds rates have also increase in tandem with the latest Singapore Saving Bonds (SSB) issuance on Monday (3 Oct 2022) having its first year yield at an all-time high of 3.08% and its 10-year average yield of 3.21%.

SGNOV22 – GX22110A (November Issuance rates)

Source: MAS

Source: MAS

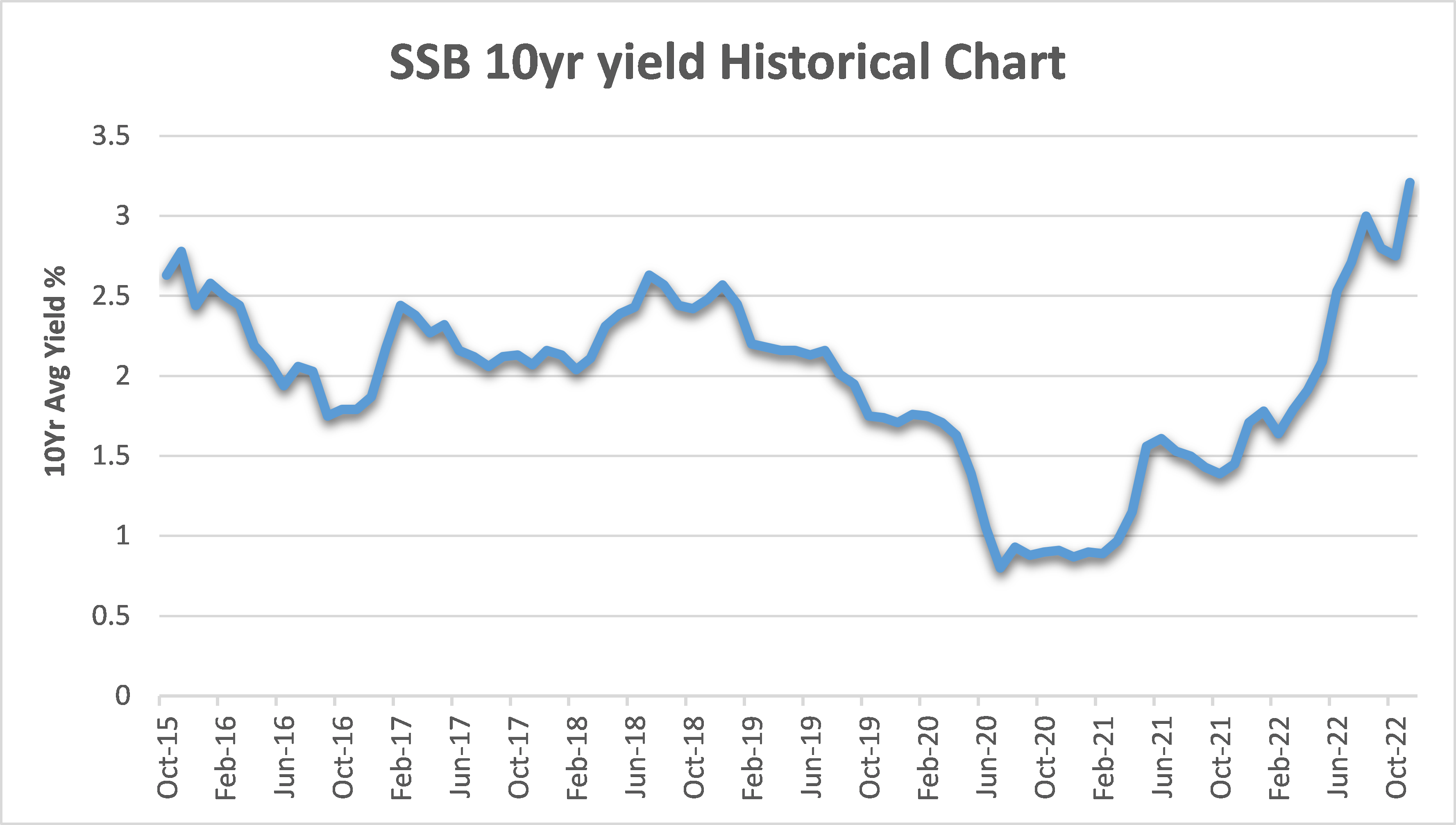

This is the highest yield that was announced since 2015 where the November issuance was at 2.78%.

Singapore Savings Bonds Historical Yield

Source: MAS, Phillip Bond Desk

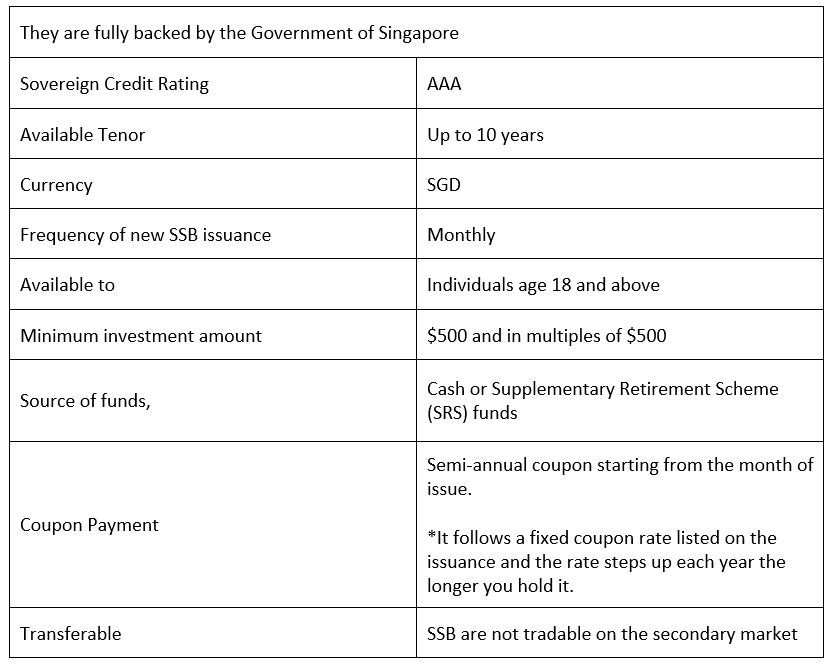

So what exactly are Singapore Saving Bonds (SSB)?

Well just like Singapore Government Securities (SGS) bonds and Treasury Bills (T-bills). SSB is a government security that is issued and fully backed by the Government of Singapore. It gives individual investors an alternative savings option apart from the usual fixed deposits that banks offer, and it is almost close being risk free while offering the flexibility to redeem your principal in full as compared to fixed deposit, SGS bonds or T-bills.

Here is a quick overview on SSB bonds:

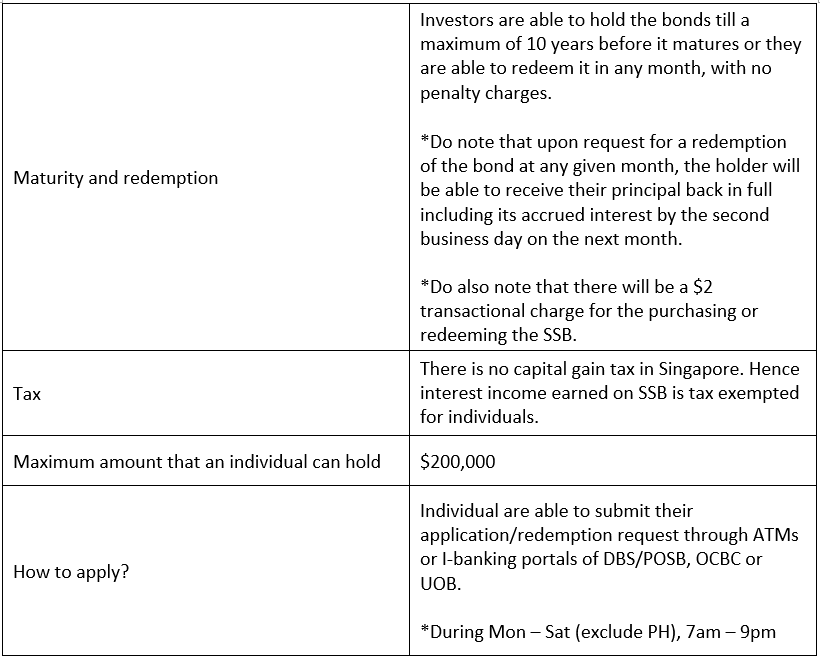

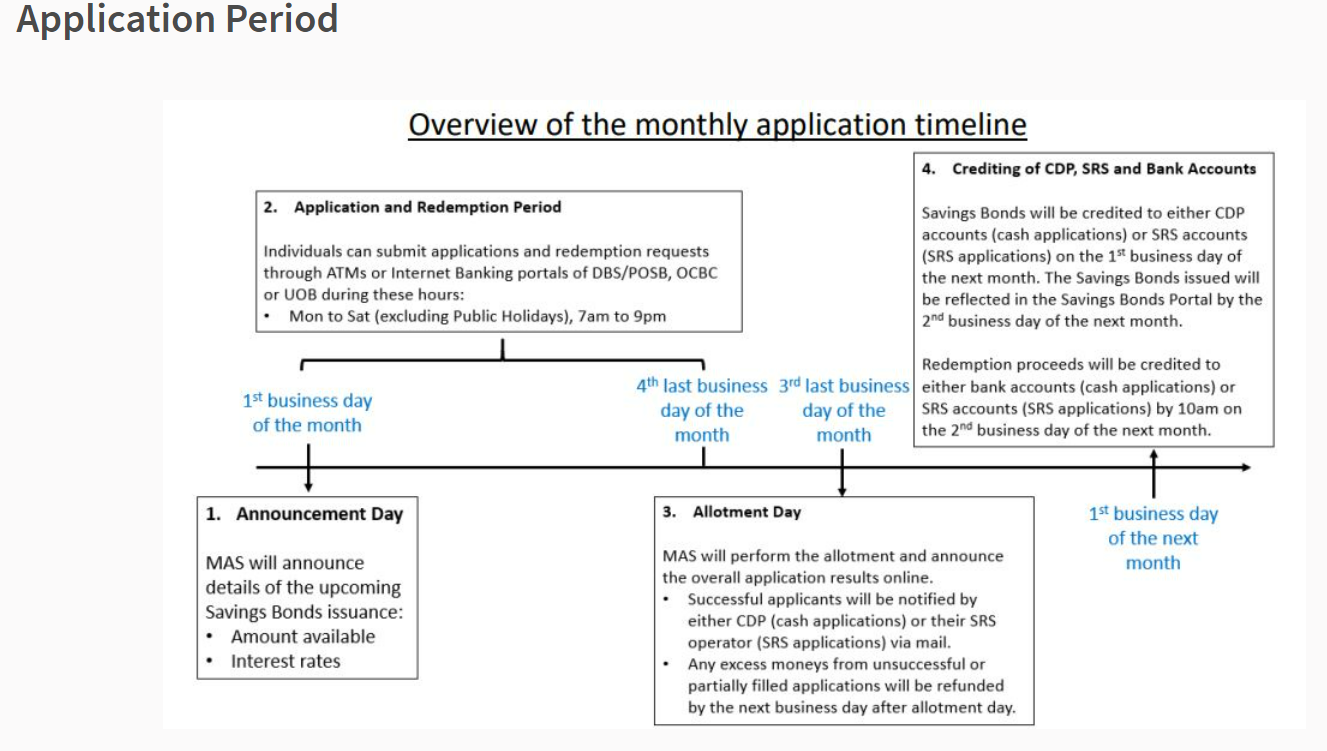

Below is an overview on the application timeline and how does one apply for SSB

Source: MAS

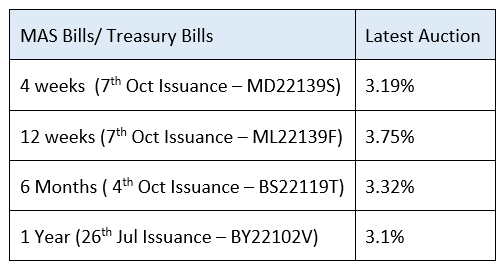

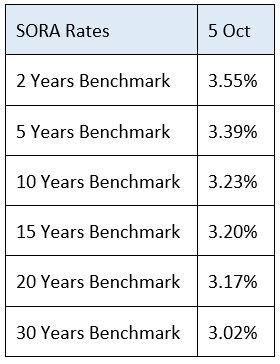

In terms of benchmarking & comparison

Here are some recent sovereign issuance and their respective rates to have a rough benchmark:

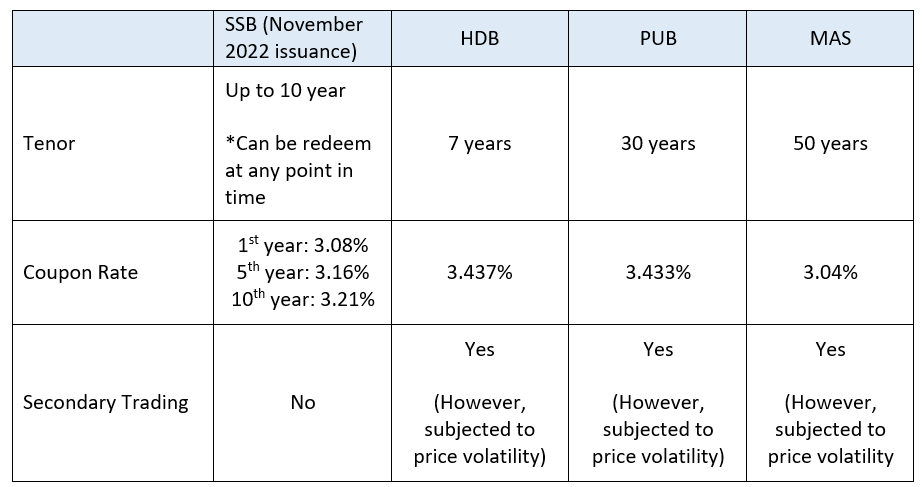

Comparing SSB against some recent statutory board issuance:

Singapore CPF Ordinary Account (OA) is paying out a rate of 2.5% while the SSB first year payout is at 3.08%. From the tables above, the November SSB issuance also appears to be rather attractive as compared to the different statutory board. Hence this could be something that may peak the interest of investors with smaller risk appetite.

Conclusion

Investors who wish to lock in this rate for a longer period of time may consider parking some of their funds in this latest issuance of SSB to capture the all-time high interest rates. It not only provides stability but also flexibility for investors who may wish to shift their fund allocations in the near future. However, with the latest FOMC meeting signaling that the rate hikes are probably not slowing down any time soon, investors can perhaps allocate a portion of it to this issuance while waiting for December’s issuance in hopes for higher rates.