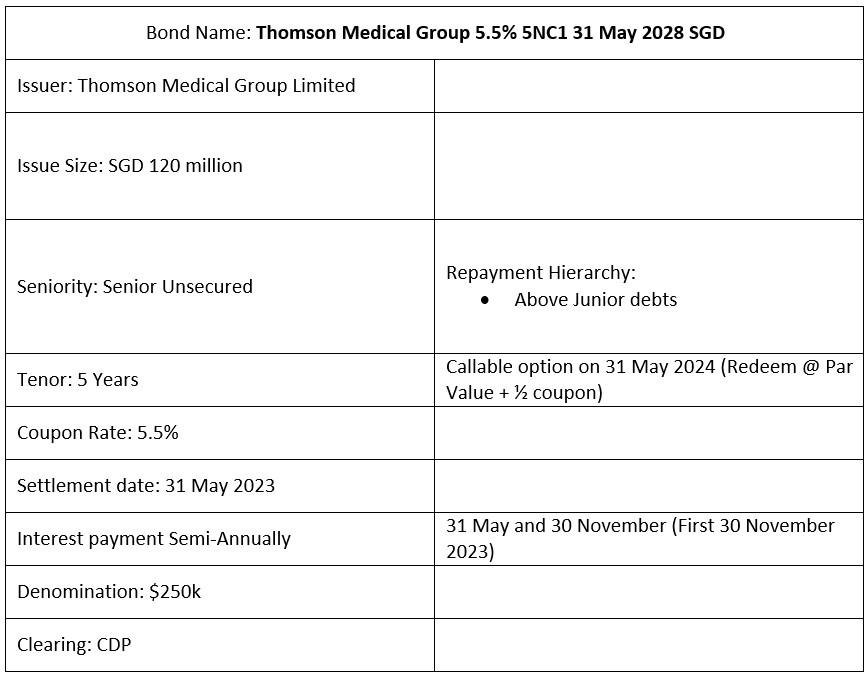

Thomson Medical Group recently announced the issuance of its 5NC1 senior unsecured bonds at a final price guidance of 5.5%. These bonds carry a tenor of 5 years with an attached one-time callable option by the issuer at the end of year 1 (31 May 2024). Upon call redemption, the bonds will be redeemed in full at par + half coupon (2.75%). These bonds are ranked Senior, and in terms of debt repayment they will be paid out before those of its junior debts. The coupon payments for these bonds are paid out semi-annually and are scheduled on 31 May and 30 November each year, with the first coupon payment being paid out on 30 November 2023. This bond is non-rated and the proceeds from this issuance will be deployed for general corporate purposes, refinancing of borrowings, potential acquisition, strategic expansions, general working capital, capex expenditure, and other investments of the Group.

Company Overview

Thomson Medical Group is one of the largest healthcare services providers in the South-East Asia region with operations in both Singapore and Malaysia. The group consists of 3 businesses namely: Thomson Medical Centre – TMC (100% ownership), TMC Life Sciences Berhad (approx. 70% ownership), and Vantagebay Healthcare City (100% ownership). Thomson Medical Group is listed on the main board of the Singapore Exchange (SGX: A50) with a market capital of $1.639 billion as at 24th May 2023. Thomson Medical Group is non-rated.

Thomson Medical Pte Ltd

One of Singapore’s largest private providers of healthcare services for women and children

TMC Life Sciences Berhad

A multi-disciplinary healthcare company listed on the Main Market of Bursa Malaysia Securities Berhad since 2005

Vantagebay Healthcare City

Currently still in its planning stage but is to become a unique and purpose-built integrated hub for healthcare, education, and wellness in Johor Bahru’s City Centre

1H2023 Financials

In 1H2023, the Group’s revenue was recorded at $184 million as compared to the previous 1H2022 which was $145.3 million a 26% increase Y.o.Y. Revenue from the Specialized Services segment grew the most at 41% followed by Hospital Services at 14.6% respectively. The growth in revenue was mainly driven by the increase in patient volume and an increase in average bill size due to higher-intensity cases. The Group’s public-private partnerships such as managing vaccination centres and Transitional Care Facilities had also played a part in Singapore’s revenue contribution. In conjunction, EBITDA has also followed suit and increased by 40.6% Y.o.Y from $39.4 million to $55.4 million during 1H2023. In terms of the geographical breakdown of its revenue, Singapore is still the main contributor at 75.6% while the remaining 24.4% comes from Malaysia. Despite that, Malaysia’s revenue has also seen an improvement with it rising by 23% which was attributable to the phased opening of the new wing at Thomson Hospital Kota Damansara (THKD) from 3Q2022. However, the increase in revenue was offset by an increase in manpower cost due to an increase in headcount, higher utility costs and development of the new wing at THKD. These costs have increased by 26.7% and 10.7% YoY respectively. Additionally, the expansion of TKHD which includes a brand-new Cancer & Theranostics Centre, Nuclear Medicine Centre, Eye Health Centre, Preventive Health and Family Medical Centre, and an increase in bed count from 205 to 535 beds will enable it to meet future healthcare demands.

The Group recorded a net decrease in cash and cash equivalent during 1H2023 of $5.9 million. This decrease was due to the purchases of property and equipment, payments of loans interest, leases liabilities, and dividend payments to shareholders of the company. But this decrease was partially offset by the increase in net cash flow from its operations of $52.8 million. Despite the net decrease in cash and cash equivalent, the Group’s cash and short-term deposits stood at $153.4 million which is sufficient to meet its short-term liabilities of $120.5 million. In terms of the Group’s net gearing ratio, it is currently at 0.8 times and it is expected to increase post-issuance according to its management. The company noted that it will make continuous efforts to reduce net gearing moving forward.

The 1-year callable structure which provides an additional half a coupon upon redemption on this particular bond, the yield to call for these bonds would be approx. 8.18% based on Bloomberg. This is a spread of 465bps as compared to the Singapore 1-year Treasury bill which is hovering around the 3.6% range.

For investors who are looking to lock in at 5.5% for a 5-year period with a possibility of early redemption at a premium call price of 102.75, this new issuance would be an attractive mix to be included within a portfolio.

As the initial offering has closed for subscription, investors who are interested in these notes will have to head onto the bond’s secondary market on our POEMS platform to get hold of them. These notes can be transacted in a minimum lot size of SGD$250K.

Bond Overview