New to Singapore fixed income securities? Below is a rough overview on what exactly are Singapore Government Securities Bonds and Treasury Bills to get you up to speed. So what exactly are SGS bonds and T-bills?

Singapore Government Securities (SGS) Bonds

SGS bonds are an avenue which investors may look at for diversifying their investment portfolio. In general, bonds are a much safer alternative as compared to equities as they ensure investors will be able to get regular cash flows from the coupon payments. Also, these bonds are issued by the Government of Singapore.

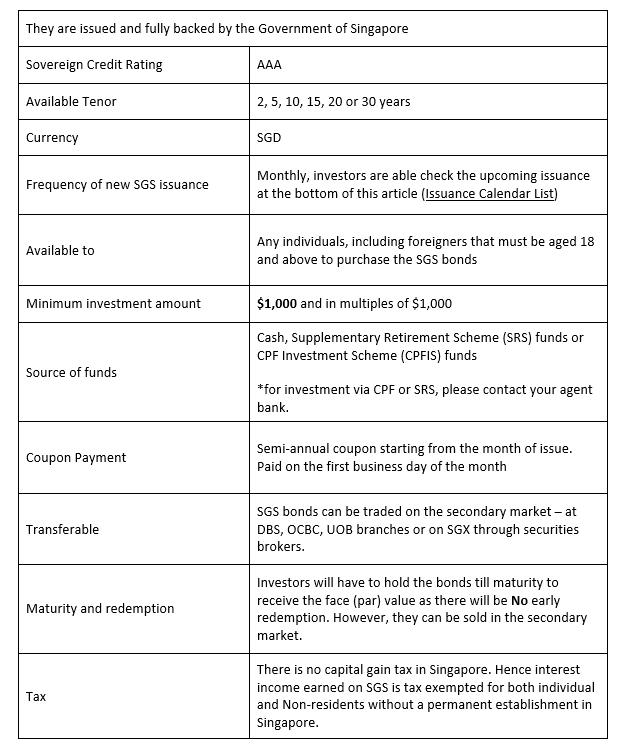

Here is a quick overview on SGS bonds:

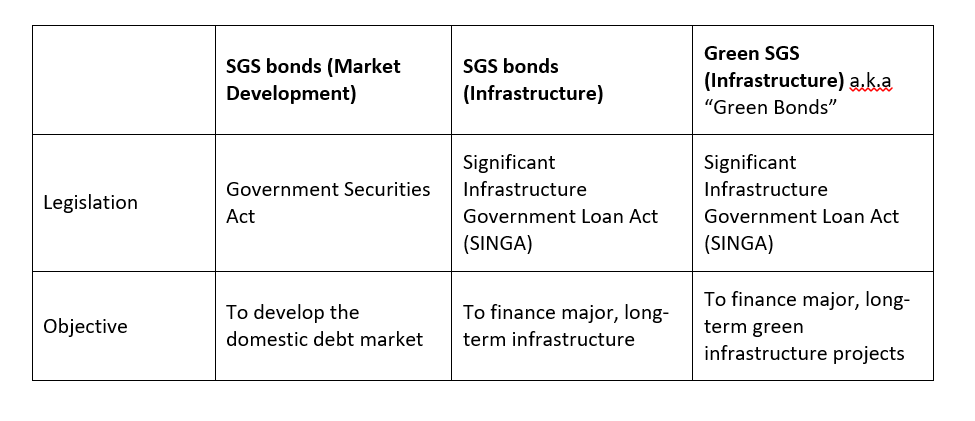

Types of SGS bonds:

(See related article regarding Green SGS: Singapore’s Green Bond Framework: Focus on financing a sustainable future)

SGS bonds are rather low risk as they are backed by the Singapore Government and the government has the strongest credit rating given by international credit rating agencies. Still, low risk does not equate to no risk as all investment carry some form of risk. One key aspect that investors should take note of is the lack in flexibility as compared to Singapore Savings Bonds (SSB). SSB holders are able to redeem their principal at any given month. There is no early redemption option for SGS bonds holders. In the event SGS bondholders require the capital amount, they would need to trade them on a secondary market. However this would put them in a position where they might be subjected to potential capital losses if they were to sell their bonds below par value ($100). Hence the liquidity factor should be something that investors should consider before investing in the SGS bonds.

Another alternative that investors may look into could be Treasury Bills (T-bills). T-bills have a relatively shorter maturity of 6 or 12 months.

Treasury bill (T-bills)

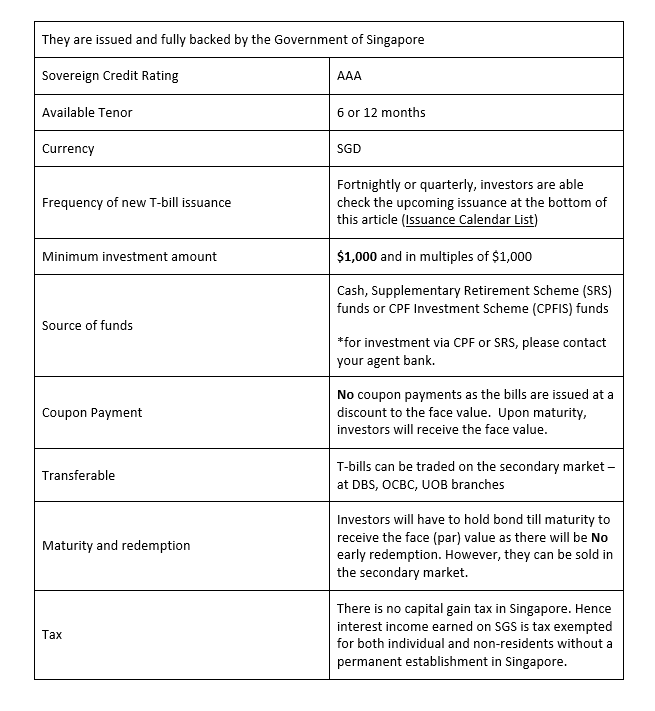

Similar to SGS bonds, T-bills are also a relatively safe investment alternative as they are also issued and fully backed by the Singapore government. However, what separates T-bills and SGS is the short tenor, and also T-bills do not make coupon payment. But they are issued at a discount to the face (par) value initially and upon maturity they are redeemed at par value.

Here is a quick overview on T-bills:

What are the yields for SGS bond and T-bills?

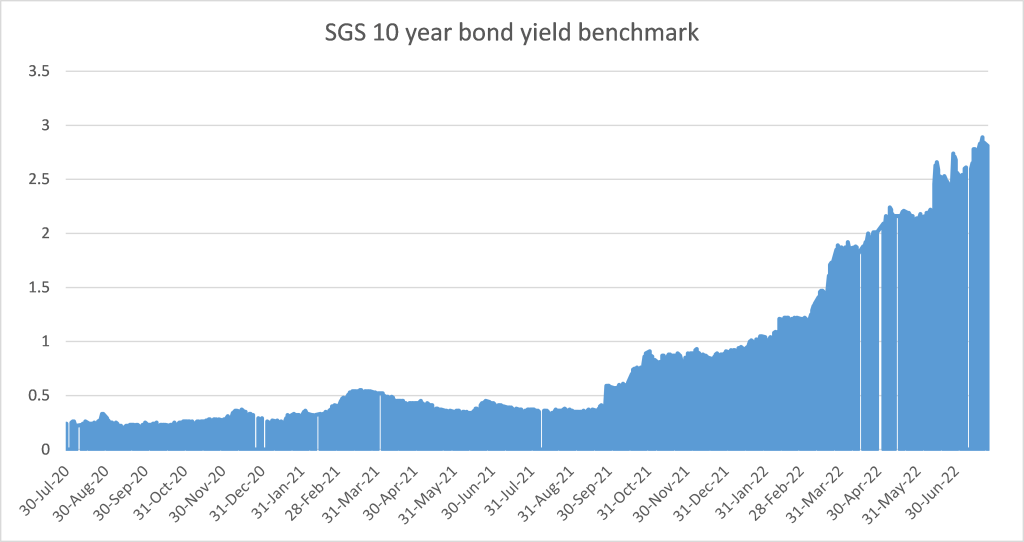

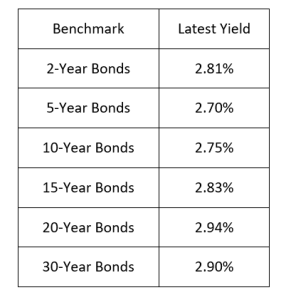

This year’s aggressive rate hikes by the US Federal Reserve in an attempt to tame rising inflation has pushed the 10-year SGS bond yield benchmark to 2.75% as of 26th July 2022. This is 1.42% higher than 1.33% on 26th July 2021. This is a much higher rate than our current Singapore CPF Ordinary Account rate of 2.5%. Thus investors might see this as an opportunity to gain a higher rate of return.

Source: MAS, Phillip Bond Desk

The benchmark for the SGS bond yields as of 27th July 2022

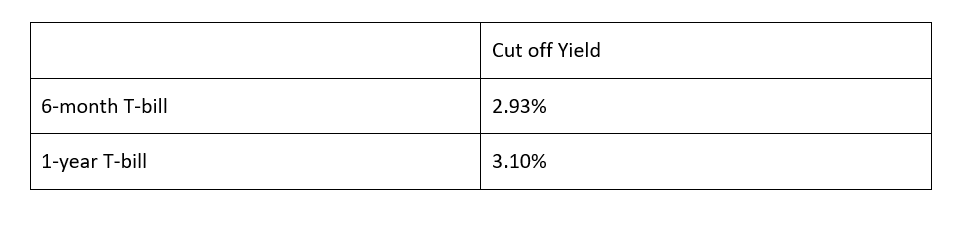

The Cut off yield for the T-bill yields as of 21th July 2022

No certainty on yield during subscription

Purchases of SGS bonds and T-bills are put through an auction and there are allotment limits due to demand. Investors have to make a bid for the purchase of the fixed income instrument. Thus, the yield will be affected by market forces (demand and supply) at the point of subscription.

Upcoming Issuance

For upcoming new issuance of either SGS bonds, T-bills or even SSB. Investors are able to view the issuance calendar list from here: Issuance Calendar list

Overview

Before an investor decides on whether to go for SGS bonds, T-bills or SSB bonds he will have to decide his investment time horizon and also if he would prefer flexibility or to have a higher rate by locking in for a longer tenor. However, though the rates may seem attractive currently do also note that one should not place all his eggs in one basket as investor should also set aside emergency funds for rainy days.