A commercial paper is a short-term debt instrument that typically pays a higher yield than an equivalent government bond. And while they’re able to default, this is an unlikely scenario, thus offering investors an alternative for higher yielding short-term fixed income investments. Issuance of commercial papers in Singapore has not been high, however recent launches of new programmes could signal a new trend.

What is a commercial paper?

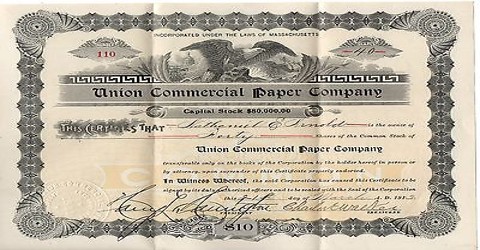

Commercial papers are short-term, unsecured debt obligations that pay a fixed rate of interest. They’re typically issued by financial institutions or large corporations focused on covering short-term financial obligations such as payroll, accounts payable, inventories, as well as meeting other short-term liabilities. Commercial papers are categorised as money market instruments with maturities no longer than 270 days. This is beneficial to issuers as they’re cheaper and more convenient to issue than capital market instruments such as bonds.

Lot sizes in Singapore are typically in sizes of S$250k, targeted at accredited investors. Secondary trading is available, but may be thin as there’s less need for holders to sell when maturities are very short.

Commercial papers offer higher yields than government bonds

Given their unsecured nature, commercial papers are backed solely by the financial strength of their corporate issuer. As such, they usually pay a higher rate of interest than guaranteed instruments. While commercial paper yields are low on an absolute basis due to their short maturities and investment grade issuers, they typically pay higher yields than government bonds in Singapore, making them an attractive alternative short-term fixed income investment. Commercial papers are often highly sought-after by companies looking for returns on cash held on their balance sheet.

Low risk of default

Unlike secured or guaranteed instruments, commercial papers can default due to their unsecured nature. However, we see this as highly unlikely given their short maturity, investment grade issuers, and the common practice of securing insurance for the debt. The practice of buying backup loan commitments as a form of insurance for commercial paper became commonplace in the market after high profile defaults of AAA-rated companies in the past.

Uptick in establishments of commercial paper programmes in Singapore

Several large Singapore-based corporations with investment grade credit profiles have established commercial paper programmes. These include Temasek, which established a US$5 billion euro-commercial paper programme some 10 years ago. Recently we’re seeing an uptick in activity in the commercial paper market, with CGS-CIMB issuing a S$150 million commercial paper in May 2021. This was followed by Keppel Corp establishing a US$1 billion euro-commercial paper programme in June 2021. The increased activity could signal more interest to come in the space.

Summary

Commercial papers have recently gained some traction in Singapore as an alternative fixed income instrument for short-term yield. While institutional investors such as investment firms, banks, and mutual funds have historically been the chief buyers in this market, it is becoming increasingly available to retail investors who seek low risk short-term yield investments.