What do you fear most when you’re buying a bond? Is it how low the yield is? Is it how long it takes to get your principal back? Or is it whether or not you will get back their principal when their bond matures? Bondholders are most concerned with receiving their principal and coupon as promised. That’s why stories of company defaults are so talked about because no one wishes to lose their investment, let alone their entire investment. And that’s why investors choose bonds in the first place, for the promise of principal repayment and regular coupons. Assessing bond safety is priority for bond investors.

Contrary to equity investors, who tend to be more concerned with higher dividend yield, many bond investors tend to avoid high yielding bonds. Based on our observations, the perfect bond to our investors yield between 3% to 5%, while bonds with higher yields, such as around 10% yields, are largely avoided. What drives this tendency of avoidance of higher yields? It’s the perception of safety that the yield signals, where lower yields mean more safety, higher yields mean more risk.

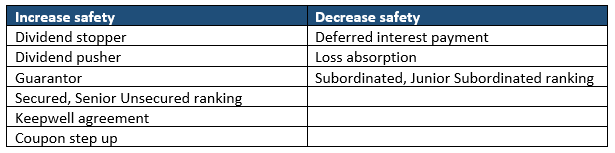

Well, yields are not the only thing that help determine the safety of bonds. Bond covenants play a big part in increasing (or decreasing) the safety of bonds for bond investors. What are some of these covenants?

Dividend stopper and pusher

If the bond issuer pays dividends on a regular basis, the dividend stopper and pusher covenants provide a safety net for bondholder coupons. The dividend stopper covenant stipulates that if the bond issuer wishes to stop or defer bond coupon payments, it also has to stop dividend payments to shareholders. For dividend paying issuers, such as REITs, that are mandated to payout rental income, bonds with dividend stopper covenants provide a strong safety net for bondholders.

Dividend stopper covenants work similarly to dividend pushers, but in the opposite direction. In the event that the bond issuer has already stopped or deferred bond coupon payments and wishes to restart paying dividends to shareholders, bond coupons will have to be paid as well.

Guarantor

Having a guarantor for your bond helps in the event that the issuer faces financial difficulty, especially if the guarantor is financially stronger. The guarantor will guarantee bond coupon and principal payments, so long as it is financially able to.

Bond seniority

There are different ranks to bonds that determine who gets first rights to repayment in the event of a default. Bonds ranked higher in seniority are safer as they get repaid first, while subordinated bonds get paid after seniors. The ranking levels from highest ranking to lower ranking are as follows: secured, senior secured, senior unsecured, and junior subordinated.

Keepwell agreements

If a bond has a keepwell agreement, the parent company has an agreement with the bond issuer to maintain the solvency and financially back of the issuer for the duration of the agreement. The parent company will assist the issuer if it encounters troubles in cash flow and access to financing to continue operations.

Coupon step up

This covenant applies to callable bonds in which issuers are not obligated to redeem/call the bond at a stipulated call date. The coupon step-up covenant helps to incentivise issuers to redeem the callable bond by way of increasing the bond’s coupon rate if the bond is not called. This reduces non-call risk and helps to offset a coupon reset downwards if the bond has a coupon reset clause and interest rates are low.

Loss absorption

Loss absorption clauses are usually found on bonds issued by banks to protect the banks in times of financial crises. The clause allows the issuer to write-down the principal amount and/or cancel interest payments and accrued interest in the event the clause is triggered. In such an event, the bondholder’s bond will be written off.

What is the perfect bond to you?

I would imagine every investor likes a bond that pays a high yield with zero risk, however there is always a compromise between return and risk, with safer usually yielding lower and riskier bonds yielding higher. Fortunately, finding a safe bond with attractive returns is possible, and usually entails more work of analysing credit profiles of the issuer as well as comparing bond prices in the market. Stay tuned for more articles on these.