- Home

- Lion-OCBC APAC Financials ETF

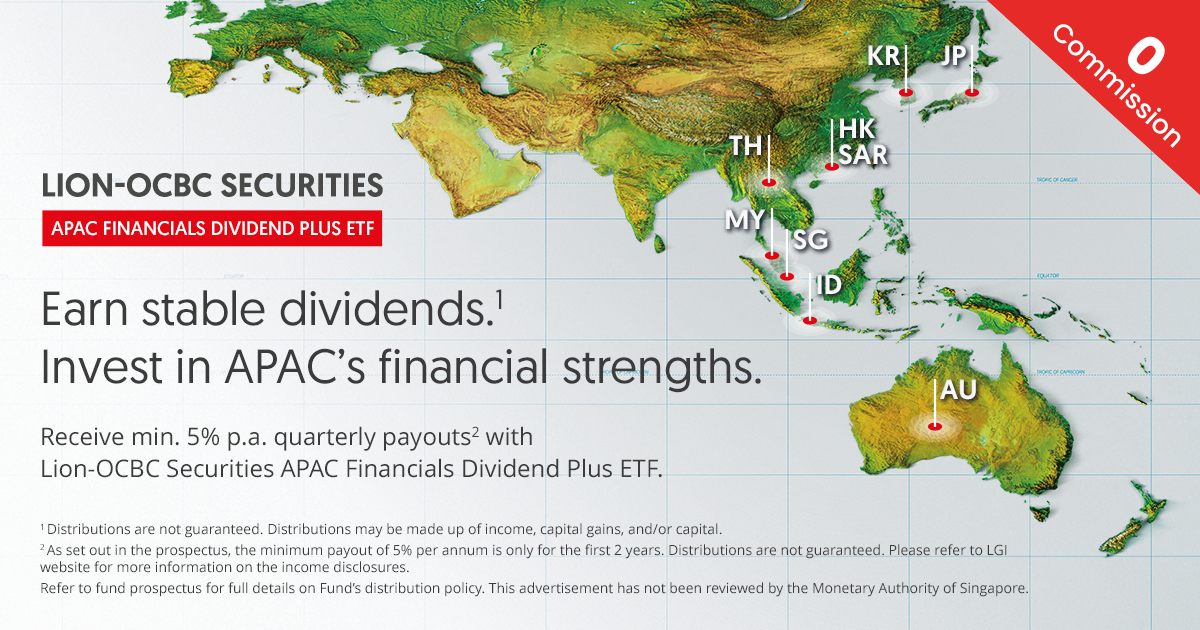

Lion-OCBC Securities APAC Financials Dividend Plus ETF

- Login to your POEMS 2.0 account > Acct Mgt > Online Forms > IPO Subscription – Irrevocable Form

- Select the IPO that you wish to subscribe to

- Read and agree to the prospectus, terms and conditions before subscribing to the financial product

- Application closes on 2 May 2024, Thursday at 5pm

- Ensure sufficient cash is present in your POEMS account to complete the application process (inclusive of subscription amount, transfer fee and GST) by the settlement date on 2 May 2024, Thursday at 5pm

| Subscription Period | 11 April – 2 May 2024 |

| Listing Date | 13 May 2024 |

| Subscription price | S$ 1.00 |

| Minimum Quantity | 1,000 units |

| Commission Fees | Zero Commission |

| Transfer Fees | S$ 10.00 (Subject to GST) for Cash Management Account. Other Phillip Investment Account Types will not be subject to transfer fee charge |

| Settlement Currency | S$ |

| Trading Currency | S$, US$ |

| Allotment | Full Allotment |

| ETF Name | Lion-OCBC Securities APAC Financials Dividend Plus ETF |

| Underlying Index | iEdge APAC Financials Dividend Plus Index |

| Issue Price | S$ 1.00 per unit |

| Target Listing Date | 13 May 2024 |

| Initial Offer Period (IOP) | 11 April 2024 to 2 May 2024 |

| Base Currency | S$ |

| Trading Currency | S$ and U$ |

| SGX Code | YLD (S$) and YLU (US$) |

| Bloomberg Ticker | FINSGD SP (SG$) and FINUSD SP (US$) |

| Trading Board Lot Size | 1 unit |

| Management Fee | 0.50% per annum |

| Dividend Policy^ | First 2 years: Quarterly distribution (min 5% pa of the Issue Price) in every March, June, September and December. First distribution expected in September 2024. Year 3 onwards: Intend to declare quarterly distributions of around 5% pa of the SGD Class NAV less the expenses of the Class in every March, June, September and December. |

| Replication Strategy | Direct Replication or Representative Sampling |

| Classification Status | Excluded Investment Product |

Promotion

Receive up to S$500 Cash Credit to Your POEMS Account when you subscribe to the Lion-OCBC Securities APAC Financials Dividend Plus ETF

- Clients will receive $20 cash credit for every $10,000 subscription into Lion-OCBC Securities APAC Financials Dividend Plus ETF

About the ETF

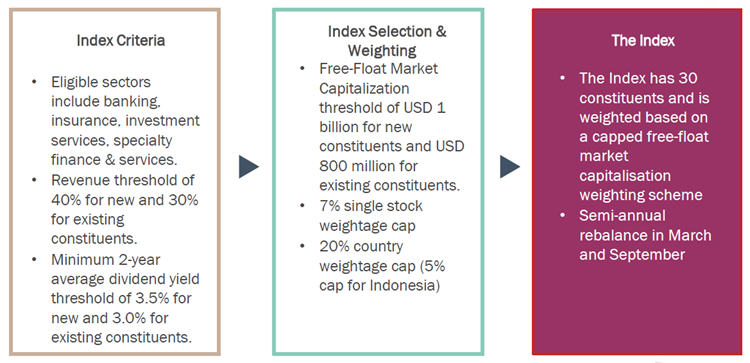

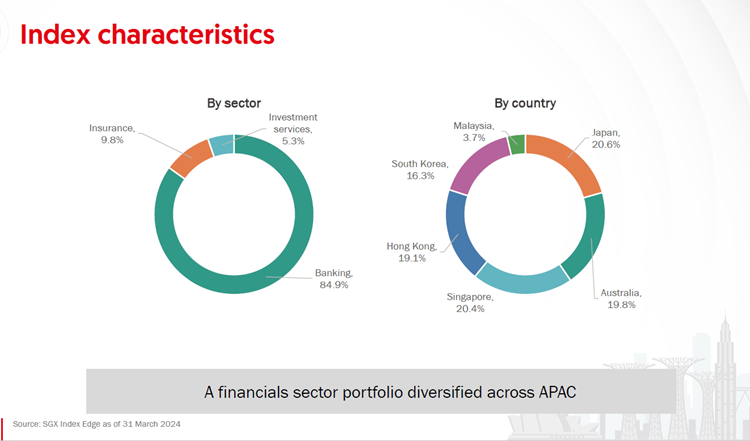

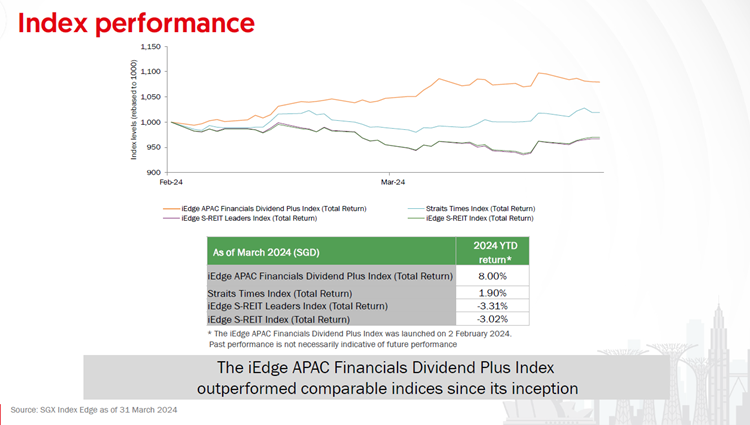

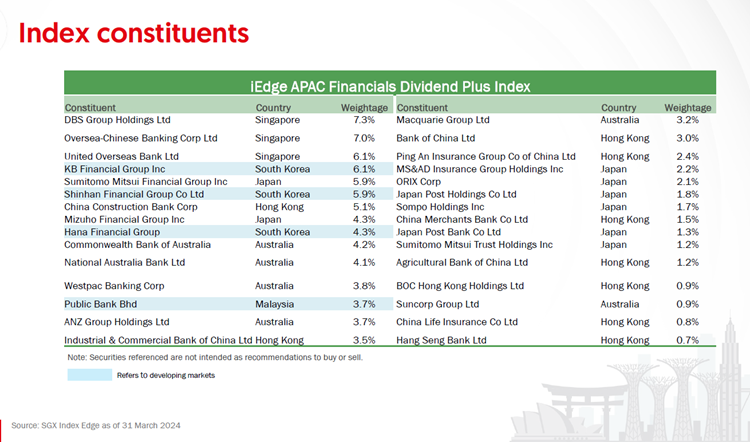

- The iEdge APAC Financials Dividend Plus Index aims to track the 30 largest and most tradable companies listed in Asia Pacific and is designed to provide access to stable dividend payout attributes and growth in the financial sector

- The index universe includes financial institutions listed in Australia, Hong Kong, Japan, Singapore, Korea, Indonesia, Malaysia and Thailand

For more information about the ETF, please check on the Pitch Book and Brochure below.

Overview: Lion-OCBC Securities APAC Financials Dividend Plus ETF

Check out more information of the ETF via the “Pitch Book” and “Brochure” below.

Why the Financial Sector?

- It continues to prosper through the centuries

- It is an essential capital provider for economies worldwide

- It provides products/services for the growth, storage or transaction of money and assets

- Beyond Banks, there are Investment Management, Insurance, Brokerages & Exchanges

Why APAC Financials?

^,*,# – Please refer to Pitch Book page 23

- Financial services are among the world’s most profitable sectors, generating US$ 12.5 trillion revenue globally in 2022

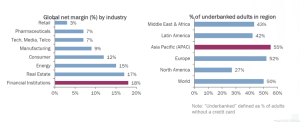

- 55% of adults in the Asia Pacific are underbanked (aduls without a credit card), which represents the largest proportion across regions

- APAC banks can further grow further by serving the underbanked in developing in Asia

- The APAC financials sector is a diversified mix of developed (e.g. Australia, HK, Japan, SG) and developing markets (e.g. Indonesia, Malaysia, Thailand)

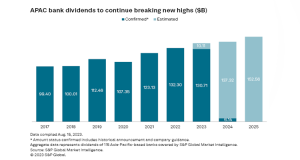

- APAC banks typically pay high dividends, laying the foundation for stable dividend income

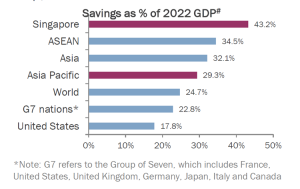

- Based on % of 2022 GDP, APAC savings rate is higher than the world average savings rate of 24.7%

- Within Asia Pacific, ASEAN and Singapore are the key drivers behind high savings rates

- Out of the world’s top 30 banks by market cap, 13 are APAC banks

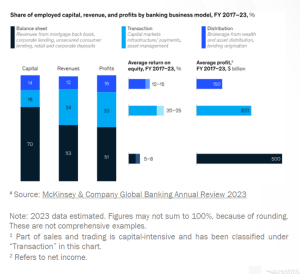

- Capital-light models use less balance sheet but yield higher ROE and net income

- In 2017-23, transactions used 16% of capital but generated 33% of profits#

- Financial institutions are embracing digital transformation (e.g., AI, data analytics) to be capital-light.

- According to the DBS Annual Report 2022, “Digital customers are consistently more valuable with an increasing share of income, sustained higher income per customer, better efficiency and higher returns.”

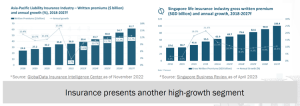

- The life insurance industry in Asia-Pacific (APAC) was the world’s largest in 2021, with five Asian countries featuring among the top 10 global markets by written premiums

- From 2021-26, China, India, Hong Kong and Singapore are expected to maintain a Compound Annual Growth Rate (CAGR^) of 5% to 10%*. Singapore’s life insurance industry# is expected to exceed S$100.4 billion in 2027

- From 2021-26, emerging markets in APAC such as Indonesia, Thailand and Malaysia are expected to grow at CAGR of 5% to 22%# respectively

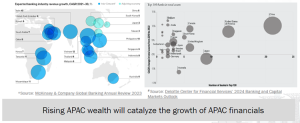

- Banks grouped along the Indian Ocean crescent* (stretching from Singapore, India to East Africa) are home to half of the world’s best-performing banks

- In the next decade, more APAC banks are expected to join the top global 100 banks#

- Global wealth is expected to surpass US$500 trillion in 2024#, nearly five times the global GDP. The biggest wealth source is from APAC (~40%)

Webinar Recording

Terms and Conditions

- The subscription period for Lion-OCBC Securities APAC Financials Dividend Plus ETF (“ETF”) is from 11 April 2024, Thursday at 9am to 2 May 2024, Thursday at 5pm

- The online subscription will close on 2 May 2024 at 5pm. No new applications, amendments, or withdrawals are allowed after this deadline.

- Eligible Accounts to subscribe for the ETF must be Cash Plus, Margin (M), Custodian (C), Prepaid Custodian (CC), Cash Management (KC) and Share Financing (V) Accounts. Cash Trading Accounts (T) are not eligible to participate in this subscription.

- An additional transfer fee charge of S$10 (subject to GST) per application for Cash Management Accounts will be applicable.

- Only one application is allowed per Account.

- Each ETF unit is priced at S$1 and the minimum order quantity is 1,000 units, with an incremental order size of 1,000 units.

- There are zero commission fees.

- The total amount payable is denominated in S$. The settlement currency will be in S$.

- Sufficient funds (including transfer fee and GST) must be present in the Customer’s Account by 2 May 2024 at 5pm

- Applications will be rejected if the Account does not have or reflect sufficient funds after 2 May 2024 at 5pm.

- ETF units will be credited to the clients’ CDP or clients’ sub-account with Phillip Securities Pte Ltd by 13 May 2024.

- Customers will receive the full allotment of the number of ETF units that they subscribe to.

- Customers can start trading the ETF units when the ETF is listed on SGX on 13 May 2024 at 9am.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.

- Customers will receive S$20 cash credit for every S$10,000 subscription into Lion-OCBC Securities APAC Financials Dividend Plus ETF, and successful subscribers to fulfill 1 month holding period after the listing date.

- The Campaign period is from 11 April 2024, Thursday at 9am to 2 May 2024, Thursday at 5pm.

- The Cash Credit is capped at S$500 per POEMS account.

- The Cash Credit will be credited to your Account in one month after the listing date.

- Notwithstanding anything herein contained, PSPL reserves the right at any time in its absolute discretion to (i) amend, add and/or delete any time of these Terms & Conditions without prior notification (including eligibility and qualifying terms and criteria), and all participants shall be bound by such amendments, additions and/or deletions when effected, or (ii) vary, withdraw, or cancel any items or the promotion without having to disclose a reason thereof and without any compensation or payment whatsoever. PSPL’s decision on all matters relating to the promotion shall be final and binding on all participants.

- In the event of a dispute over the client’s eligibility to participate in this Promotion, PSPL’s decision will be final. PSPL shall not be obliged to give any reason on any matter concerning the Promotion and no correspondence or claims will be entertained.

- By taking part in this promotion, the customer acknowledges that he/she has read and consented to these Terms & Conditions.