3 Reasons to Start Your Equities CFD Journey with POEMS June 30, 2020

According to a survey done by e-commerce company, Picodi in 2019, the majority of Singaporeans prefer travelling abroad as opposed to a staycation. An average Singaporean spends around S$1,086 / USD $797 per person on a vacation. The amount that an average Singaporean spends on travel and vacation is amongst the top ten in the world![1]

However, as a result of the COVID-19 pandemic, there is a high probability that we will not be unable to travel or even have a staycation in the foreseeable future.

Instead of globetrotting, have you ever thought of letting your portfolio ‘travel’ the globe on your behalf?

In this article, we will be taking a look at why you should be going global with Contracts for Differences (CFDs).

Reason 1: Global Opportunities

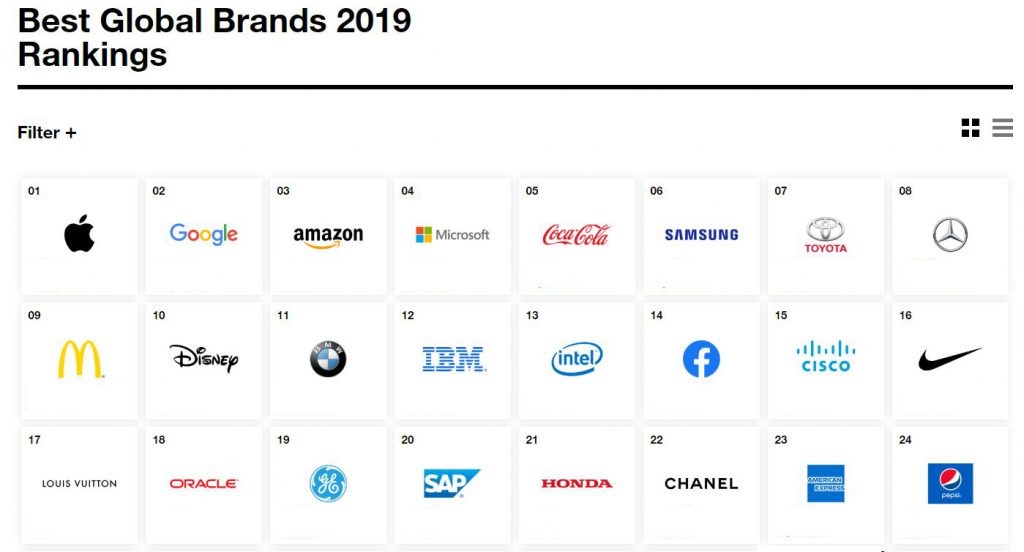

Figure 1: Adapted from Interbrand, Best Global Brands 2019 [2]

Wall Street Legend Peter Lynch has a very basic investment tenet, “Buy what you understand.” Lynch believes that individual investors have an advantage over Wall Street as they have an advantage of the first hand observation.

Dear Readers, let’s experiment with this:

While being cooped up at home during this lockdown period, look around you. Observe the appliances and products you use, if something attracts you as a consumer, why can’t it pique your interest as an investment?

Fun Fact: Many of Peter Lynch’s great investment ideas were discovered while walking through the grocery store or chatting casually with friends and family.

Take an electronic device which many of us cannot live without, the smart phone. Many of us use iPhones (AAPL-US) or our XiaoMi (1810-HK) to surf Facebook (FB-US) for news and updates. When we crave entertainment, we use our smartphones to catch up on the latest k-dramas and blockbusters through Netflix (NFLX-US). This lockdown period, many of us resort to playing video games (Tencent Holdings (0700-HK)), to socialise with our friends and family and maintain relationships. Whilst working from home, we could be using computers from Lenovo (0992-HK) and Hewlett Packard Enterprises (HPE-US). of us may also turn to online shopping viaTaoBao (BABA-US) or Amazon (AMZN-US) to continue shopping despite being homebound. To make electronic payments, we use services such as Visa (V-US) or MasterCard (MA-US).

Whether we realise it or not, we as consumers are constantly interacting with these foreign publicly traded companies through their products and services on a daily basis! Trading opportunities present themselves when these businesses expand their reach and influence.

Reason 2: Geographic Diversification

Most of us are aware of the importance of asset allocation and diversification. Diversification is a core risk management technique that helps to reduce risk by allocating investments among a variety of assets within a portfolio. Diversification can also be practiced through asset, sector and geographic allocations.

In trading, a fundamental tenet is that you do not want to put all your eggs in one basket. If we are trading stocks in a specific market, any adverse economic, geopolitical or market events specific to that market could significantly affect our trading.

For instance, in 2018, Singapore implemented property cooling measures (ABSD and LTV). On the following day, property and banking stocks in Singapore came under heavy selling pressure as investors reacted negatively to unexpected news of cooling measures. With market events that are specific to your market, your trade could be impacted significantly as compared to a geographically diversified portfolio.

Trading in different markets could help you reduce your risk and reliance on a single market for return. With access to over 8 markets (Singapore, US, HK and more), we offer a wide range of global markets for you to trade in!

Reason 3: Market Liquidity

When we are trading, we must take note of liquidity in the market. A liquid investment implies that there is sufficient trading interest in the market to allow traders to enter and exit positions without experiencing a drastic change in the asset price. In simple terms, it is a measure of how many buyers and sellers are present and the ease of transactions taking place.

A liquid market is generally associated with less risk as there is usually someone willing to take the other side of a given position. This means that a seller is able to find a buyer without having to cut the price of the asset to sell it and the buyer does not need to pay a liquidity premium to buy the asset he/she wants.

Here is a list of some of the largest and most liquid stock market exchanges around the world.

- New York Stock Exchange, United States

- NASDAQ, United States

- Tokyo Stock Exchange, Japan

- Hong Kong Stock Exchange, Hong Kong

We offer Equities CFD that reflect the various exchange quotes. Given that different foreign markets have different operating hours, there are always trading opportunities round-the-clock! There are also free live prices^ for Singapore, Japan, Malaysia and United States stock markets, and you can trade with ease as you can reach out to our 24/5 trading support when needed!

^Open to individuals who qualify as Non-Professional Investors

Conclusion

Trading some of these foreign shares can be quite expensive and you may not have sufficient capital. Through CFDs, you are only required to place an initial margin to open a trade. Hence, you would not be restricted by your capital. However, leverage is a double edged sword which can amplify your returns and losses. Therefore, it is paramount that you always utilise stop-loss orders when you are trading.

Another key feature of CFDs is that these instruments allow you to trade the market both directions, long and short. Short selling is an investment or trading strategy that speculates on the decline in a stock. To understand more, you can read up on the article on short selling, take a look at our recent webinars or view our Top 10 Reasons to Short Sell CFDs with POEMS. For CFDs traders, you will not be restricted by the bull or bear market. If you are expecting the recent bull run to be a mere dead cat bounce, CFDs can be a handy tool for you.

We sincerely hope that you have found value in this article. If you’re interested to trade Equities CFD, we have a brand new promotion running from 1 July 2020 – 30 September 2020, “Trade Around the World with Equities CFD” where you can receive up to S$88* CFD Trade Rebates!

Begin your CFD Trading Journey with us!

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Mr Mike Ong

CFD Dealer

Mike is a member of Phillip Securities’ largest dealing team that specialises in Equities, ETFs, CFDs & Bonds. The team manages >50,000 client accounts. He evaluates stocks using fundamentals and believes in investing long-term for passive income. He is currently the chief editor of the HQ education series that aim to equip clients with tools & skillsets to make better investing and trading decisions.