5 Interesting US IPOs to Look Out for in 2022 March 15, 2022

An Initial Public Offering (IPO) is the process of a private company going public through the sale of its shares on a stock exchange1.

In 2021, excluding Special Purpose Acquisition Companies (SPACs), there were a total of 2,097 IPOs2 in the US.

The IPOs in 2021 raised US$402 billion in the US, which is 81% higher than the amount raised in 2020.

Tesla’s (TSLA.US) rival, Rivian Automotive Inc (RIVN.US) raised USD $ 12 billion which is the largest market debut since Alibaba Group Holding (BABA.US) in 2014.

Have you ever wondered why investing in IPOs is so attractive?

The main reason for the attractiveness of an IPO can be attributed to the returns investors achieve on listing day.

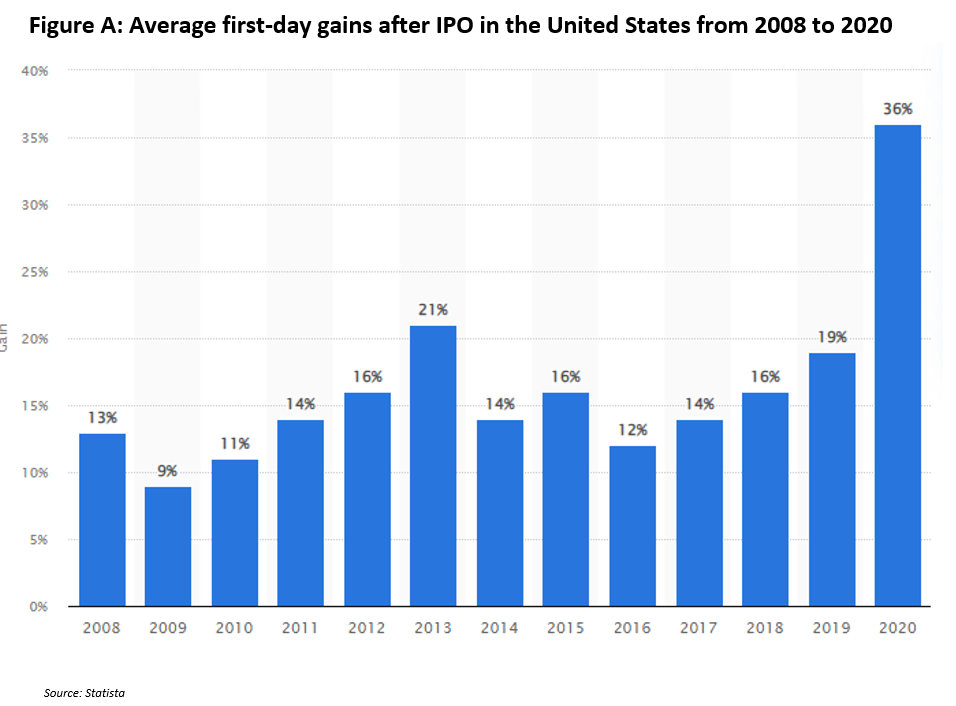

From 2008 – 2020, an average IPO investor managed to get a return of 9% to 36% just on the first day (Figure A).

Thanks to an IPOs’ ability to generate double-digit returns in a single day, investing in one seems like a “get rich quick” scheme. However, investors need to note that like all investments, IPOs are risky too.

There were many IPOs that soured on debut. For example, Super League Gaming (SLGG.US) produced a negative return of 22.7% on its debut (Figure B).

Similarly, with Smile Direct Club (SDC.US), investors lost 18.9% on the first day (Figure C).

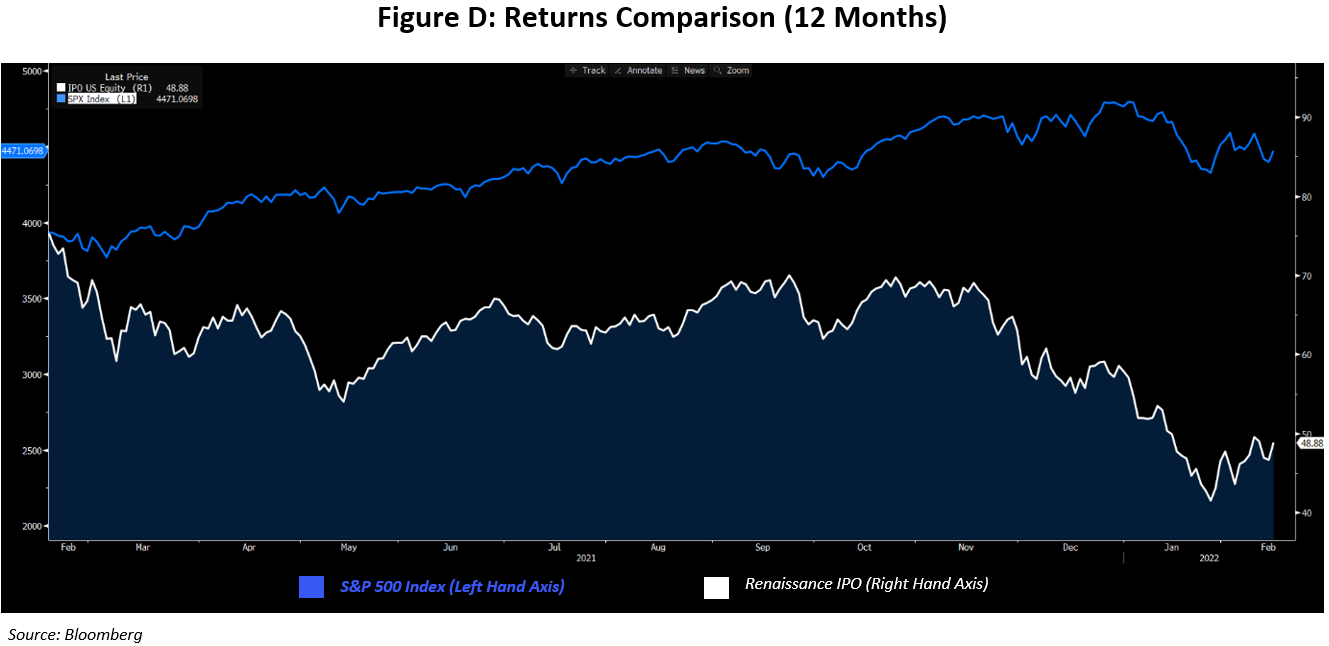

Looking at returns of the last 12 months, investors would have been better off investing in the S&P 500 index.

IPO.US follows the performance of freshly listed US IPOs and it is down around 35.2% while the S&P 500 index is up at about 12% (Figure D).

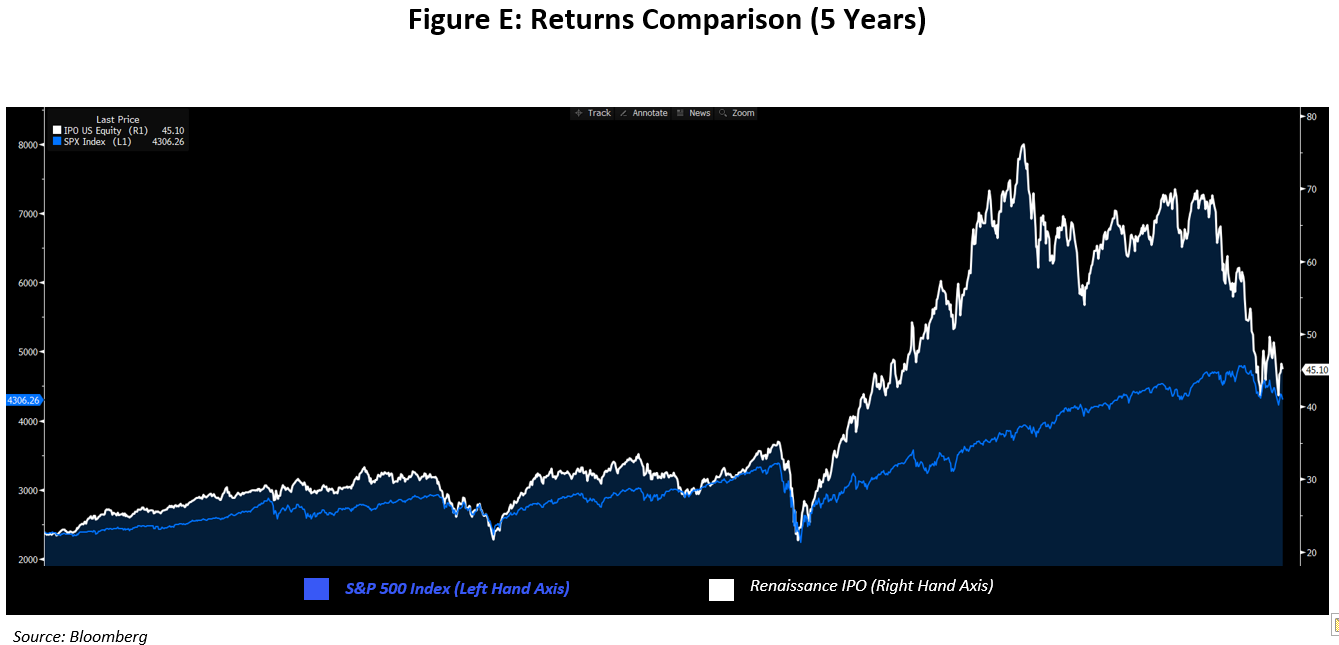

However, there is a different conclusion when comparing the returns for the last 5 years (Figure E). Here, the S&P 500 index is up at 81.3%, while IPO.US is at 98.9%.

IPO.US used to follow the S&P500 index rather closely, but the relationship broke during the COVID-19 pandemic. The sudden change in behaviour can be attributed to 2 reasons. The first is due to the decades-long build-up of unicorns and Venture capital funding3. And the second is due to the increasing involvement of retail investors in the market.

Investors who invested when the valuation of IPOs were at their peak, would have lost a significant amount. Further, the IPOs in 2021 fell 14% on average six months post-IPO4. Hence, investing in an IPO is not as fool proof as one thinks.

Now that we shared the potential and pitfalls of investing in IPOs, here are the top 5 upcoming IPOs of 2022 in no particular order.

1. Discord

Discord is a free voice, video, and text chat app that is used by millions of people ages 13+ to talk and hang out with their communities and friends5. The COVID-19 pandemic has helped Discord expand its user base. Previously, users of Discord were mainly gamers, but now Discord is used in sports, dating and even investing6.

With the explosion in its user base, Discord attracted acquisition offers from the likes of Microsoft and Twitter. Discord rejected them despite the offers valuing Discord at between US$15 billion and US$18 billion7. The turning down of the offers, suggests that Discord is in favour of an IPO. The IPO could be as soon as early 20228.

In its latest round of funding, Discord managed to raise US$500 million, taking its valuation to US$15 billion9.

2. Impossible Food

Impossible Food was founded in 2011 with the aim of using plants to make meat, dairy and fish10. Impossible’s most noticeable rival in the industry is Beyond Meat (BYND.US) which is valued at around US$3 billion.

Meat and dairy substitutes are gaining traction as consumers become more conscious of the environmental footprint of food11. With this growing trend, plant-based food could make up 7.7% of the global protein market, which is around US$162 billion.

The management aims for a public listing which can value them at US$10 billion12. Impossible had planned to go public 12 months from April 2021 which is rather soon.

With the latest funding of US$ 500 million in November 202113, Impossible is valued at US$ 7 billion14.

3. Reddit

Reddit is an American social news aggregation, web content rating, and discussion website15. For those who not aware, Reddit is the home of r/WallStreetBets that created the term meme stocks. The meme stock saga helped Reddit to become better known.

Reddit was started in 2005 and remains unprofitable16 which is common with many public listed companies like Roblox Corporation (RBLX.US)17. But this may change in the future as the management is building its advertising model to attract big brands18.

Reddit did a confidential filing in December 2021 which does not require a prospectus until later in the process for an IPO19. The company has yet to decide on the number of shares for issue. However, it is eyeing a listing valuation of around US$ 15 billion.

Based on its latest funding led by Fidelity Investments, Reddit is valued at more than US$ 10 billion20.

4. Stripe

Stripe is dual-headquartered company (San Francisco and Dublin21) that helps businesses accept and send payments online with its application programming interface (API)22. Its customers include Google (GOOGL.US), Amazon (AMZN.US) and Shopify (SHOP.US)23. Stripe has stakes in multiple FinTech start-ups like payroll start-up Check24 and corporate card start-up Ramp25. The investments help Stripe gain market share in the online payment world.

With regard to Stripe’s IPO, the founders think that Stripe is still early in its journey and they are happy with remaining private26. Thus, based on the comments by Stripe’s founders, they may not go public soon. However, people familiar with the matter said that Stripe is in early discussions with investment banks to go public and a listing is possible as soon as this year27.

Stripe raised US$ 600 million in March 2021 and is valued at US$ 95 billion28. With a valuation of US$ 95 billion, Stripe is the most valuable private FinTech company.

5. Instacart

Instacart offers users pick-up and delivery services for groceries29. Its marketplace features more than 300 local grocers and retailers. Instacart is backed by well-known firms like Sequoia Capital and Fidelity management.

Thanks to strong backing, Instacart has sufficient cash flow and is not in a rush to list. It was supposed to list in 2021 but delayed this to concentrate on growth and to fend off competitors like Amazon (AMZN.US), DoorDash (DASH.US) and Uber (UBER.US)30. One of the areas which Instacart is expanding into is digital advertising31.

With funding in March 2021, Instacart is valued at US$ 39 billion32.

Should I invest in an IPO?

Ultimately, investing in IPOs is similar to all other forms of investments, where adequate due diligence is required. Also, even a fundamentally strong company is not spared from black swan events. Thus, taking macro key events into consideration could help you take a more holistic decision.

Want to get daily updates on market events? You can join our Telegram Channel here.

Open a POEMS account to start trading or chat with one of our licensed representatives to find out more.

Explore a myriad of useful features including Trading View chartings to conduct technical analysis, stock analytics from our in-house research analysts, and more available for you anytime and anywhere to elevate you as a better trader.

Reference:

- [1] Initial Public Offering (IPO) Definition – Investopedia

- [2] Analysis: Record IPO binge in 2021 leaves investors hung over.” 24 Dec. 2021

- [3] IPOs are on track for a record year as companies cash in on sky-high stock prices.

- [4] Record IPO rush of 2021 led to historically dismal returns for investors with no relief in sight.

- [5] What is Discord | A Guide for Parents and Educators.

- [6] Discord is rapidly expanding beyond gaming, attracting suitors like ….” 8 May. 2021

- [7] Chat App Discord Ends Takeover Talks With Microsoft.” 20 Apr. 2021

- [8] Discord IPO Could Come in Early 2022: Information for Investors.” 18 Jan. 2022

- [9] Discord Valued at $15 Billion After New Funding Round – Bloomberg.” 15 Sept. 2021

- [10] What is Impossible Foods?

- [11] Plant-based food sales are expected to increase fivefold by 2030.” 11 Aug. 2021

- [12] Exclusive: Impossible Foods in talks to list on the stock market.” 8 Apr. 2021

- [13] Impossible Foods raises $500 mln in funding round led by Mirae.” 23 Nov. 2021

- [14] Temasek-backed Impossible Foods looks to raise US$500m at US ….” 29 Oct. 2021

- [15] Reddit: Homepage

- [16] Become an FT subscriber to read: Tech start-ups – Financial Times.

- [17] Roblox shares dive 21% after earnings miss – Asia Newsday.” 16 Feb. 2022

- [18] Reddit revamps ad strategy to woo big brands | Financial Times.” 2 Oct. 2019

- [19] Reddit prepares for stock market listing | Financial Times.” 15 Dec. 2021

- [20] Reddit is valued at more than $10 billion in latest funding round..” 12 Aug. 2021

- [21] Our mission is to increase the GDP of the internet – Stripe

- [22] Stripe: Online payment processing for internet businesses

- [23] Our customers | Stripe

- [24] Stripe leads $75m funding for US payroll start-up Check – Silicon ….” 18 Feb. 2022

- [25] Stripe deepens investment in US corporate card start-up Ramp.” 24 Aug. 2021

- [26] Stripe ‘Happy’ to Stay Private After Reaching $95 Billion Value.” 23 Nov. 2021

- [27] Stripe Is Discussing Public Listing for 2022 with Bankers.” 10 Sept. 2021

- [28] Stripe valued at $95 billion in $600 million funding round – CNBC.” 14 Mar. 2021

- [29] Instacart Help Center – How Instacart works

- [30] Instacart pushing off IPO to work on growth – report (Private:ICART).” 16 Nov. 2021

- [31] Instacart Goes Deeper Into Digital Advertising as Grocery Delivery ….” 6 Sept. 2021

- [32] Instacart’s valuation doubles to $39 billion – CNBC.” 2 Mar. 2021

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Chan Zi Quan

Dealer

Zi Quan is a US Equity Dealer in the Global Markets Team and specializes in the US and Canadian markets. He is an avid crypto fan and is adept in macro analysis.

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth

Grab Holdings Achieves First Full Year of Net Profit with Strong Revenue Growth  Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition

Lendlease Global Commercial REIT Strengthens Retail Portfolio with PLQ Mall Acquisition  United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability

United Hampshire US REIT Delivers Strong Performance Amid Portfolio Stability  CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile

CDL Hospitality Trusts: Lease-Based Cash Flows Support Improving Leverage Profile