SPACS: How should retail investors view the opportunity? January 26, 2022

Three special purpose acquisition companies (SPACs) will be on the SGX.

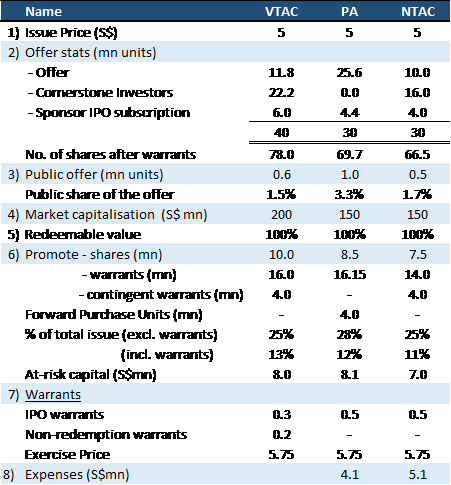

The IPO offers are an attractive free lunch for investors. SPAC shares are 100% redeemable at S$5 offer price with free warrants thrown in with the shares. The public or retail offer is only 1.5 – 3.3% of the total issued shares.

We are cautious on SPACs post-IPO until valuations and ownership structures of the target companies are determined.

SPACS, or special purpose acquisition companies, is one of the terms that has now become part of the investor vocabulary in Singapore.

And with Vertex Technology Acquisition Corporation (VTAC), a SPAC established by Vertex Venture Holdings (Vertex Holdings), starting trading on the Singapore Exchange (SGX) on Jan 20, 2022, after being listed, interest in SPACS in Singapore is bound to grow exponentially.

Vertex is just the first of the SPACS to list on the SGX, after the Singapore Exchange in September allowed the listing of this type of initial public offering.

The other SPACs to list on the SGX in the near future are Pegasus Asia, or PA, and Novo Tellus Alpha Acquisition, NTAA, (pending).

SPACs, which offer an alternative to traditional IPOs, have been around in various forms for many decades. But it is only during the past two years that they have taken off in the United States, according to Max H. Bazerman and Paresh Patel in an article on SPACS in the Harvard Business Review.1

In 2019, 59 were created, with $13 billion invested; and in 2020, 247 were created, with $80 billion invested. In the first quarter alone of 2021, 295 were created, with $96 billion invested.

In 2020, the Harvard Business Review article said, SPACs accounted for more than 50% of new publicly listed US companies.

So, who are the main players in a SPAC? There are three main players in a SPAC – sponsors, investors and targets.

Who are sponsors? Sponsors initiate the SPAC process by investing risk capital in the form of non-refundable payments to bankers, lawyers, and accountants to cover operating expenses.

But if the sponsors fail to create a combination within the specified time frame, the SPAC must be dissolved and all funds returned to the original investors.

Then there are investors. The vast majority of investments in SPACs to date have come from institutional investors. And investors receive two classes of securities: shares and warrants that allow them to buy shares in the future at a specified price.

As for targets, most SPAC targets are start-up firms that have been through the venture capital process.

So, how should retail investors look at SPACS? According to Paul Chew, the head of research at Phillip Securities Research, a member of PhillipCapital Group, SPACs are “a free lunch for the few”.2

And his reasons for this:

- Non-IPO investors are at a disadvantage. IPO investors in SPACs are essentially buying zero coupon capital-guaranteed bonds with free warrants (or convertible bonds). Put in simple terms, they can get back all their IPO subscription money (i.e. S$5 per unit) and yet enjoy free warrants. The opportunity cost for this is theoretically interest income foregone on a 2-year fixed deposit. Investors buying into the SPACs post-IPOs will be immediately disadvantaged even if they purchase at the initial issue price of S$5. The free warrants lower the cost for IPO investors.

- Wait for the acquisition: We would prefer to wait until details of the target company are disclosed before deciding on investing in a SPAC. Investors must monitor both the valuations and shareholding structures. Valuations for the target company may be priced to perfection, or at best fairly valued. The target company will likely be issued shares in the SPAC in exchange for the acquisition. This may create a large share overhang if there is an insufficient lock-up period.

Comparison between the 3 SPACs to trade on SGX

- VTAC’s structure stands out. Among the three SPACs, the VTAC structure stands out:i. Larger in size. VTAC has raised a larger cash sum of S$200mn. The other two SPACs are S$150mn each. A larger cash hoard should enable the SPAC to acquire a much larger and hopefully more attractive technology target company since scale is a competitive advantage.

ii. Fewer warrants. VTAC units come with a 0.3 warrants each. The remaining 0.2 warrants are issued to shareholders that vote for the acquisition. The other two SPACs provide 0.5 warrant each, a much larger “free ride”.

iii. Time and price-based vesting of promote shares. 49% of the sponsor promote shares can be exercised only 12 months after the acquisition. The remaining 51% of the promote shares vest only (or can be disposed of) at S$6 (17%*), $7 (17%) and $8 (17%). Both SPACs time the vesting of promote shares. PA has lower price vesting at S$5.75 (25%) and S$6.50 (25%). NTAA has no price vesting.

*refer to proportion of total promote shares

Salient points of the three SPACs

- At the point of listing, the SPACs will issue units. Each unit is entitled to one share and 0.3 warrants (VTAC) or 0.5 warrants (PA/NTAA). The warrants are detachable and can be sold separately.

- Sponsor promote (or founder) shares are the virtually free equity given to the sponsor as compensation for completing the acquisitions.

- Investors can redeem the $5 per share for cash if the acquisition (or business combination) is completed or after 24 months. Ironically, they can vote for the acquisition and still redeem their shares.

- At-risk capital is used to fund the operations, offering expenses and other costs of the SPACs. The capital is raised via private placement warrants to the sponsor. These warrants are each priced at S$0.50 (VTAC/NTAA) and S$0.2 (PA). It is not entirely clear how the warrants were priced, but the S$0.50 is a good reference price for trading.

In conclusion, we believe that the life of a SPAC can be broadly separated into two stages.

At the IPO stage, we view the SPAC as a capital guaranteed bond, 100% backed by cash. And the warrants are a freebie for IPO investors.

However, post-IPO, investors are buying blindfolded. This is because the target is unknown, the valuations are unknown and vendor’s shares are unknown. As a result of this, we believe that only a small premium is warranted.

Summary of the three SPACs:

Reference:

- [1] https://hbr.org/2021/07/spacs-what-you-need-to-know

- [2]https://www.stocksbnb.com/reports/phillip-singapore-strategy-free-lunch-for-the-few/

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.

About the author

Elston Soares

Elston Soares is an editor with the Phillip Securities Research team.

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap

Japan’s Economic Resurgence: Unveiling the Tailwinds Behind Nikkei 225’s Record Leap  How to soar higher with Positive Carry!

How to soar higher with Positive Carry! ![[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close](https://www.poems.com.sg/wp-content/uploads/2024/03/Valerie-Lim-LI-X-SMART-Park-Article-300x157.jpg) [Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close

[Smart Park] Buy Insurance, Get Rich Quick? Not Exactly, But This Comes Close  Deciphering the Updates: Understanding the latest CPF Changes

Deciphering the Updates: Understanding the latest CPF Changes