8 Essential Trading Tools to Help You Make the Most of Your Trades July 6, 2020

Trading is filled with immense opportunities and can be a very lucrative career. However, succeeding in this field can be challenging as even the most seasoned day traders would find it hard to stay on top of their game. This begs the following question: how does one succeed in trading? Here are 8 essential trading tools to help you make the most of your trades:

Spot opportunities with real-time information

There are various tools to help you identify trade ideas and assess market trends such as the Ticker Streamer and Market Streamer.

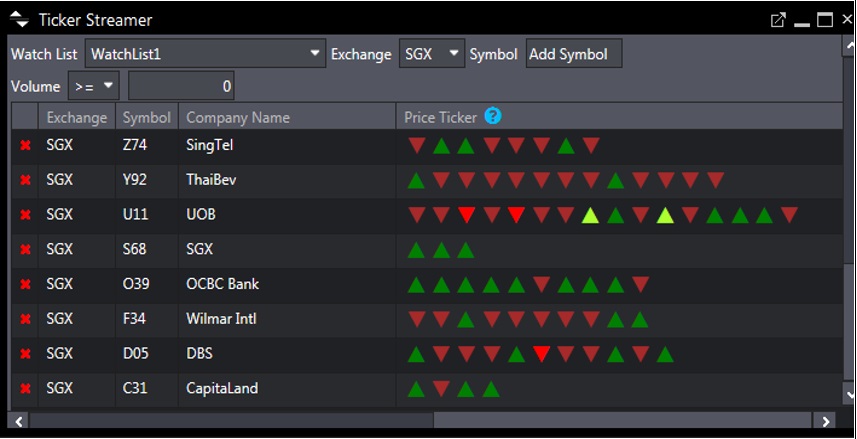

1. Ticker Streamer

The Ticker Streamer provides a broad overview of the active counters on your watchlist, allowing you to track intraday market movements at a glance. The red and green triangles, which represent completed trades on the market, acts as a visual representation of the real-time price movements of the counters when the market is open.

Check out how it works here: https://bit.ly/3lmkjXI

Tip: Click on ‘?’ icon to load the price ticker legend for quick reference

Tip: Click on ‘?’ icon to load the price ticker legend for quick reference

2. Market Streamer

On the other hand, the Market Streamer tool can be used to discover counters that are traded at a specific price and volume you have indicated. With this tool, you can monitor live Time & Sales transactions and intraday high/low across the SGX exchange to identify trading opportunities.

Check out how it works here: https://bit.ly/3lmkjXI

Tip: Apply the price and volume filter to narrow down the counters of your interest

Tip: Apply the price and volume filter to narrow down the counters of your interest

Trade with precision using advanced trading tools and features

For all we know, trading tools may just be the most important ingredient to a trader’s success. To conduct their daily trading activities, traders often rely on technical analysis tools such as charts and indicators to analyse stock performance and make better-informed decisions.

Here are some tools that you should be utilising to get every advantage possible:

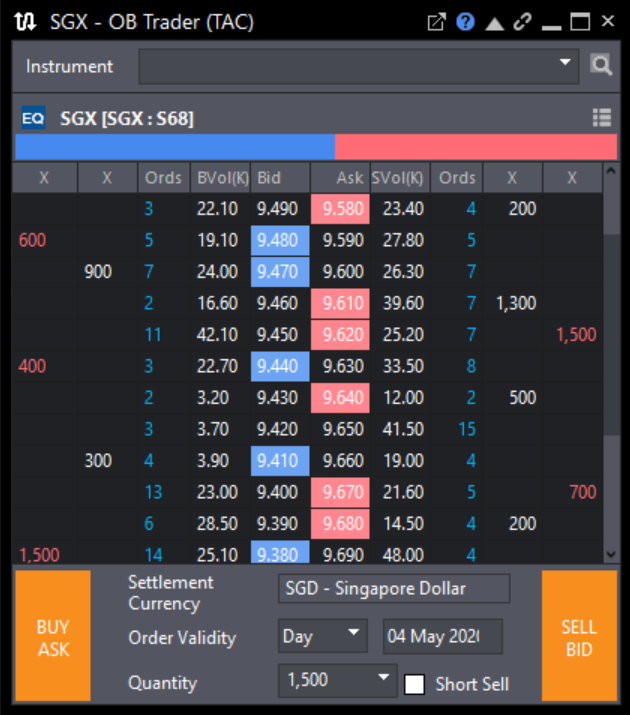

3. OB Trader: One-Click Trading

An active trader makes multiple trades per day and every second matters to them given that a delay in trade could result in losses. Recognising that speed is key when it comes to trading, the OB Trader tool will certainly strike a chord with intraday traders. This tool is a quick one-step process that allows you to execute trades with a single click, enabling traders to enter and modify limit and stop limit orders in quick successions.

POEMS Pro OB Trader is a powerful execution tool that simplifies your order entry and reduces order submission time. With one click withdrawal functional, the OB Trader tool protects your risk exposure during adverse market condition by allowing you to do a quick withdrawal of all outstanding Buy/Sell orders in the queue.

Check out how it works here: https://bit.ly/3bVuEGQ

Tip: Single left click on the “X’ Columns to withdraw all Bid/Ask Queued orders

Tip: Single left click on the “X’ Columns to withdraw all Bid/Ask Queued orders

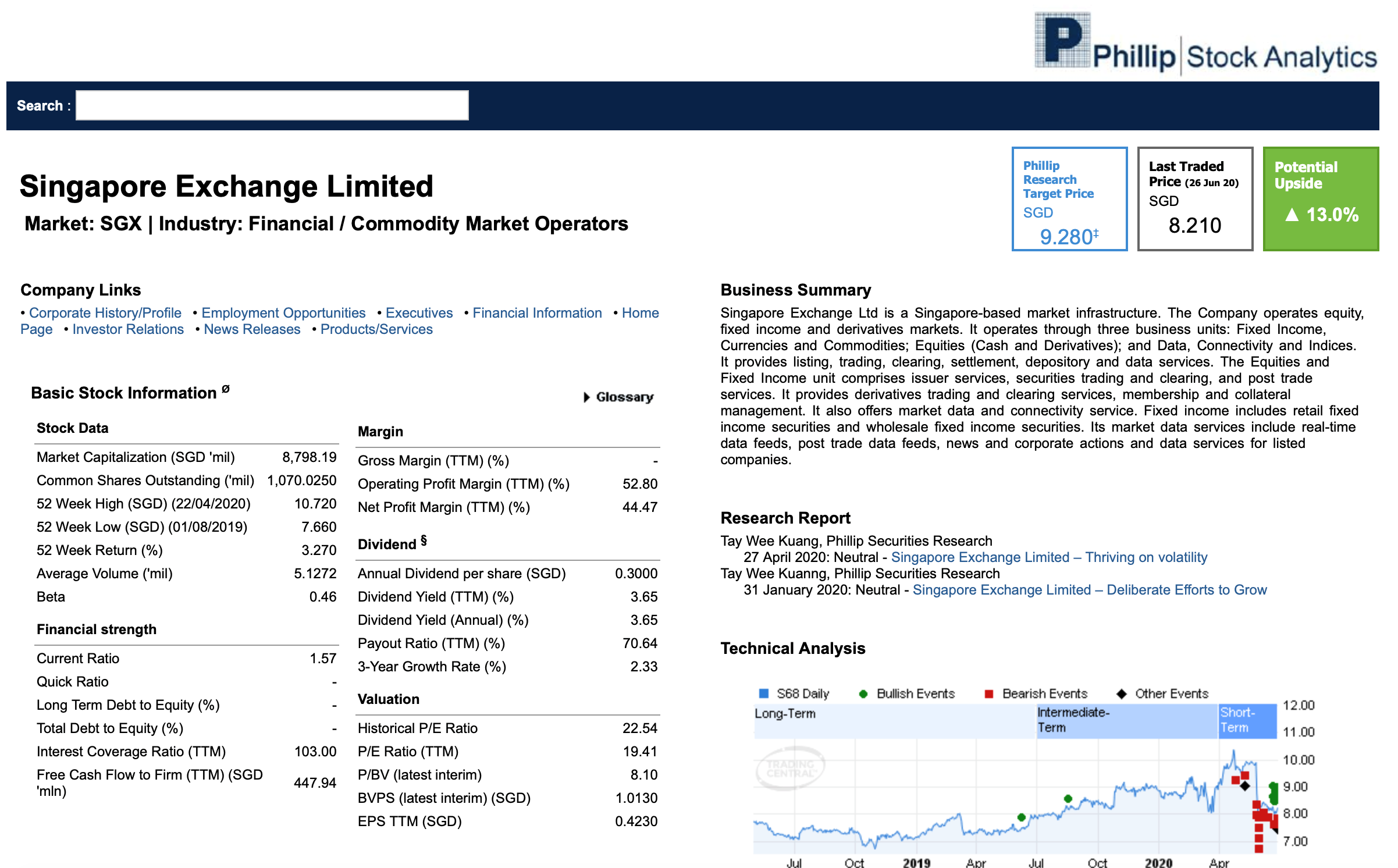

4. Stock Analytics

Stock Analytics allows traders to gain insights into listed companies’ business, valuations and operating performance. While there are plenty of stock analytic tools you can access, quality information may not be available on most.

Stocks analysis should be consolidated on a single trading platform and be designed for easy retrieval of comprehensive data. POEMS Stock Analytics provides financial key figures and ratios, news updates and analyst ratings within a single page on POEMS Pro, eliminating the need to scour through the information highway. With this tool, you can now access timely research reports from our in-house investment analysts for the latest insights and analysis of listed companies.

Tip: Detach the module and drag it to your secondary screen to view it alongside other trading modules!

Tip: Detach the module and drag it to your secondary screen to view it alongside other trading modules!

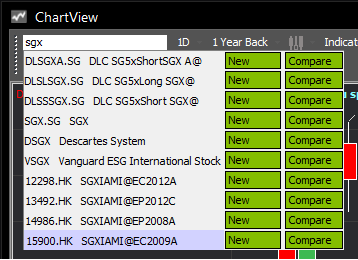

5. Charting Tool: Chart View

Another essential tool that all traders rely heavily on is the charting tool. Stock charts enable traders to examine market technical trends in identifying trade opportunities. The extensive technical insights that come with the charts play a crucial role in allowing a trader to deep dive and perform technical analysis.

POEMS ChartView is an intuitive charting tool unique to POEMS Pro. This tool provides extensive technical insights that are designed to ensure high performance, intuitive and fully-customisable charting solution. With more than 40 indicators available on ChartView including Ichimoku Kinko, Chalkin Oscillator and Barros Swing, traders can conduct more detailed analysis and identify trends to aid their trading decisions.

Tip: POEMS Pro chart customization is limitless; you can launch ChartView in multiple tabs and load up to 6 chart windows in tab.

Tip: POEMS Pro chart customization is limitless; you can launch ChartView in multiple tabs and load up to 6 chart windows in tab.

Click “New” to open the counter in a new chart or click “Compare” to plot it against your existing counter.

Limit trading risks by applying appropriate stops and limits

Risk is always prevalent when it comes to trading and managing it is a trader’s biggest challenge. The good news is, there are many tools that you could tap on to mitigate risks.

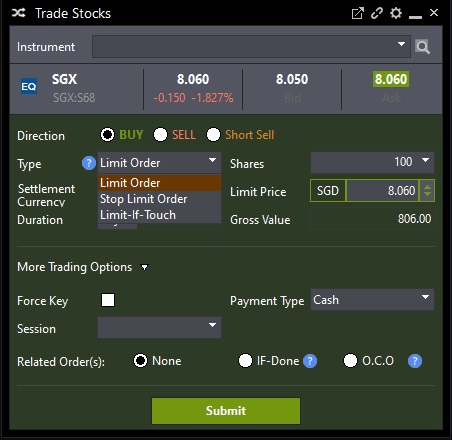

When dealing in a sea of uncertainty, a simple, yet powerful way to help you trade with precision is advanced order types. This tool allows you to program orders such as applying appropriate stops and limits for every trade you make and monitor market movements more effectively.

1) Stop Limit Order allows the investor to enter a new position or exit an outstanding position when the price surpasses a particular price level. It also allows one to minimise losses on an existing long or short position. This order type is currently supported for orders on SGX, AMEX, NASDAQ and NYSE on POEMS 2.0, POEMS Mobile 2.0 and POEMS Pro.

2) Limit-if-Touched Order provides investors the flexibility to buy and sell at specific price levels without having to constantly monitor market movements. It is particularly useful in fast-moving markets, when investors may not be able to react in time to take advantage of buying or selling opportunities. This order type is currently supported for orders on SGX, AMEX, NASDAQ and NYSE on POEMS Pro, and on SGX on POEMS 2.0 and POEMS Mobile 2.0.

3) One-Cancels-The-Other (OCO) Order allows the submission of two orders simultaneously to either take profit or cut loss. If one part of the order is executed, the other is automatically cancelled. OCO orders are generally used by traders for volatile stocks that trade in a wide price range. This order type is currently supported for orders on SGX on POEMS Pro.

4) Immediate-or-Cancel (IOC) Order is an order to buy or sell a stock that must be executed immediately. This order allows for partial filling and any portion of the order that cannot be filled immediately will be cancelled. This order type is currently supported for orders on SGX on POEMS Pro.

5) Good-Till-Date Order is a type of order that is active until its specified date, unless it has already been fulfilled or cancelled. If they haven’t been executed, all orders are cancelled at the end of the trading day on the date specified on the order, so GTD orders are used to cover longer periods of time. This order type is currently supported for orders on SGX, HKSE, AMEX, NASDAQ and NYSE on POEMS Pro, and on SGX on POEMS 2.0 and POEMS Mobile 2.0.

Manage your trade and adjust your strategy

Managing your trades well and understanding your current position are necessary to catch the opportunities available at the right time and devise a good trading strategy. Here are two tools that you can help you do so:

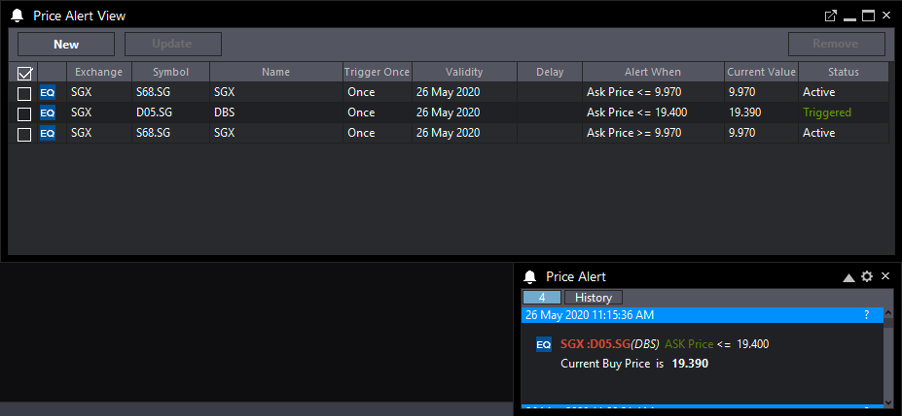

7. Price Alerts

As an active trader, keeping track of multiple trades can be confusing and difficult. A handy tool to help you monitor stock prices would be price alerts. Eliminating the need to constantly monitor stock prices throughout the day, the tool is designed to send alerts automatically according to your pre-set specifications.

POEMS Price Alert allows you to choose from a variety of condition settings such as low or high price targets, percentage change targets or even volume targets. With price alerts, you can set your desired price and receive an alert once your counter(s) reaches the predetermined condition(s). There is no need to worry about missing out on opportunities and market movements with our free automated price alerts. Sit back, relax, and let our price alert feature monitor the markets for you.

Tip: Set a sound price alert and be alerted with sound when your counters hit your target price! (Click on the gear icon to set it!)

Tip: Set a sound price alert and be alerted with sound when your counters hit your target price! (Click on the gear icon to set it!)

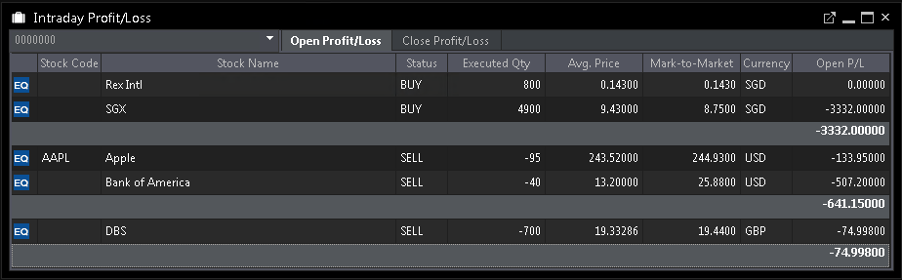

8. Intraday P&L

To determine if your trading plan is working well, it all boils down to your profit and loss. This is a general practice that every trader should employ to analyse their trading performance and make adjustments to their trading strategies.

To help you keep track of your intraday profit and loss, POEMS Pro provides an intra-day P&L tool that discloses your intraday gross trading profit and loss. Traders can now leverage this instrument to get an overview of their trade performance of the day and track the amount of money made or lost for the day, removing the need to comb through their transaction history.

Bonus tip!

Bonus tip!

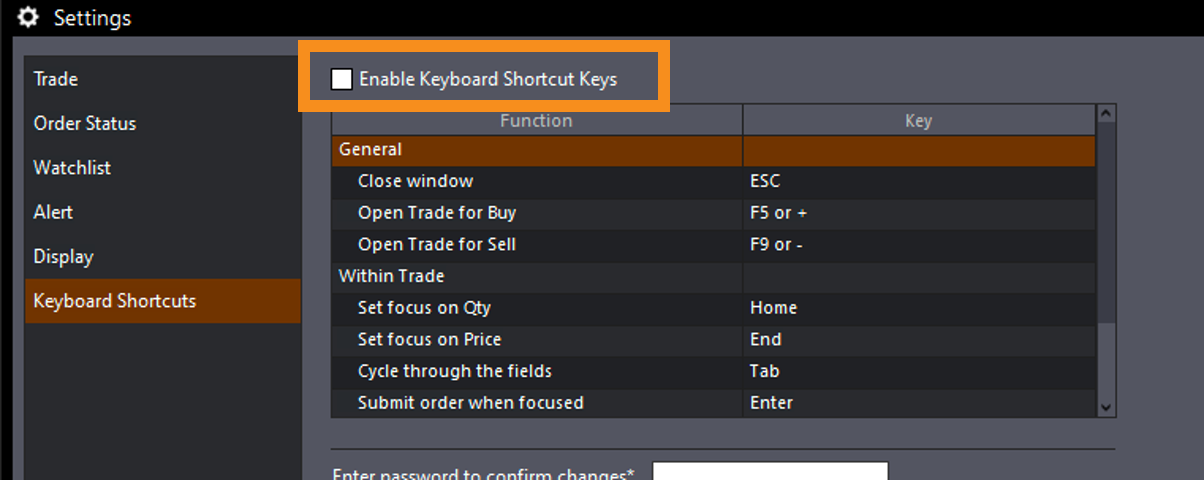

You can enable keyboard shortcuts to help you be more efficient at doing certain tasks on POEMS Pro! Simply go to Settings to enable it!

In a nutshell, day trading can be difficult to master as there are bound to be risks and challenges that require a well-thought-out plan, opportunities and prudence. However, on the bright side, with the right trading tools, you can greatly improve your chances of beating the odds. Designed by traders for traders, POEMS Pro is an uncomplicated yet advanced trading platform specially curated to assist you in your trading activities.

Disclaimer

These commentaries are intended for general circulation. It does not have regard to the specific investment objectives, financial situation and particular needs of any person who may receive this document. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of any person acting based on this information. Opinions expressed in these commentaries are subject to change without notice. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income from them may fall as well as rise. Past performance figures as well as any projection or forecast used in these commentaries are not necessarily indicative of future or likely performance. Phillip Securities Pte Ltd (PSPL), its directors, connected persons or employees may from time to time have an interest in the financial instruments mentioned in these commentaries. Investors may wish to seek advice from a financial adviser before investing. In the event that investors choose not to seek advice from a financial adviser, they should consider whether the investment is suitable for them.

The information contained in these commentaries has been obtained from public sources which PSPL has no reason to believe are unreliable and any analysis, forecasts, projections, expectations and opinions (collectively the “Research”) contained in these commentaries are based on such information and are expressions of belief only. PSPL has not verified this information and no representation or warranty, express or implied, is made that such information or Research is accurate, complete or verified or should be relied upon as such. Any such information or Research contained in these commentaries are subject to change, and PSPL shall not have any responsibility to maintain the information or Research made available or to supply any corrections, updates or releases in connection therewith. In no event will PSPL be liable for any special, indirect, incidental or consequential damages which may be incurred from the use of the information or Research made available, even if it has been advised of the possibility of such damages. The companies and their employees mentioned in these commentaries cannot be held liable for any errors, inaccuracies and/or omissions howsoever caused. Any opinion or advice herein is made on a general basis and is subject to change without notice. The information provided in these commentaries may contain optimistic statements regarding future events or future financial performance of countries, markets or companies. You must make your own financial assessment of the relevance, accuracy and adequacy of the information provided in these commentaries.

Views and any strategies described in these commentaries may not be suitable for all investors. Opinions expressed herein may differ from the opinions expressed by other units of PSPL or its connected persons and associates. Any reference to or discussion of investment products or commodities in these commentaries is purely for illustrative purposes only and must not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the investment products or commodities mentioned.